Do all these savings account interest rate increases have your head spinning about where to stash your cash?

It’s great that we’re finally earning interest on our money again. But rates are changing quickly. It’s hard to know where to save.

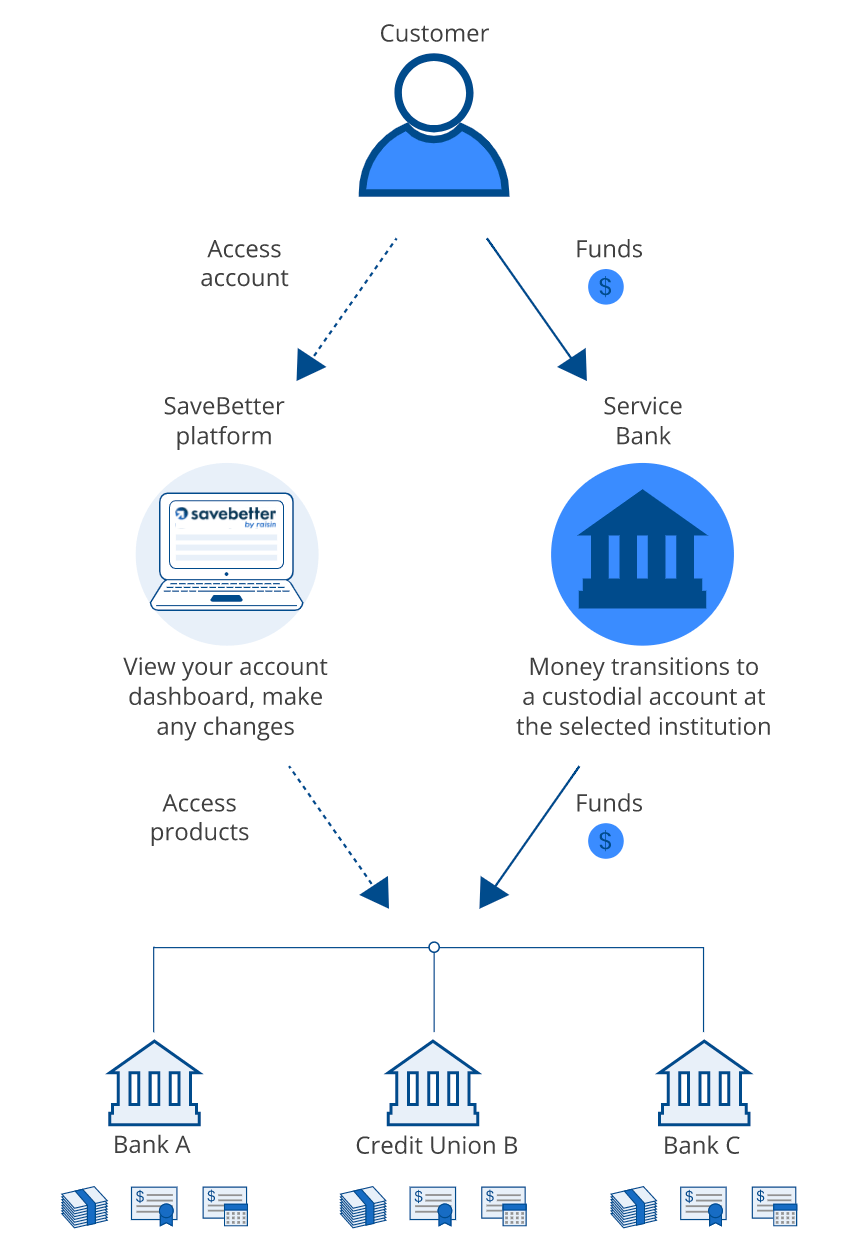

That’s where the revolutionary savings platform from Raisin, called SaveBetter, comes in. They act as a custodian of your savings and put them into the high-paying savings account of your choice.

That’s where the revolutionary savings platform from Raisin, called SaveBetter, comes in. They act as a custodian of your savings and put them into the high-paying savings account of your choice.

Don’t worry. I’ll explain more. I’ve been trying SaveBetter, and I’ll share all I know in this comprehensive review.

What is SaveBetter?

SaveBetter is a savings platform. Not a bank. They partner with different banks and credit unions and their respective savings products (accounts, money markets, and CDs) and allow you to save into these products through their platform.

They act as a custodial account for your savings, allowing you to tap into multiple savings products under one account.

That’s the point of the service. Get the best savings rates without having to jump around to different banks all the time.

SaveBetter was created by Raisin (formerly Deposit Solutions). I know the President and marketing team at Raisin, and I’ve done business with them via FinCon.

Is SaveBetter Legit?

It’s a unique platform. But yes, it’s legit. I have an account with SaveBetter, and my money is earning interest now.

Several financial experts have reviewed the tool, most notably Rob Berger (trusted Youtuber, attorney, and friend). Rob loves SaveBetter and vouches for it.

Like I said above, I know a few SaveBetter/Raisin team members and can vouch for them.

If you’re concerned about the FDIC-Insurance thing, that’s understandable. But SaveBetter is a custodian for your funds (they have the custodial account at the bank or credit union), and the FDIC-Insurance is transferable to you.

Here are their exact words on the topic:

“Although SaveBetter customers’ deposits are pooled in omnibus accounts, there is no impact on the eligible deposit insurance coverage you receive from the financial institution holding your savings. This is because the government entities providing federal deposit insurance — the FDIC for banks and NCUA for credit unions — permit pass-through coverage. So your money that’s pooled in a custodial account still has the coverage it would have were it held in an individual account in your name.”

How SaveBetter Works

SaveBetter shows you several savings options (savings accounts, CDs, and money market funds) and allows you to sign up for the products via the SaveBetter portal. You never have to go to the partner banks / credit union.

Once your account (or accounts) are established, you can see them all in the SaveBetter dashboard. Move money around, transfer it out, whatever you want.

Banks and credit unions that SaveBetter works with at the time of this article:

- Western Alliance Bank

- The State Exchange Bank

- American First Credit Union

- mph.bank

- Blue Federal Credit Union

- Third Coast Bank

- The Atlantic

- Great Lakes Credit Union

- Liberty Savings Bank

- Ponce Bank

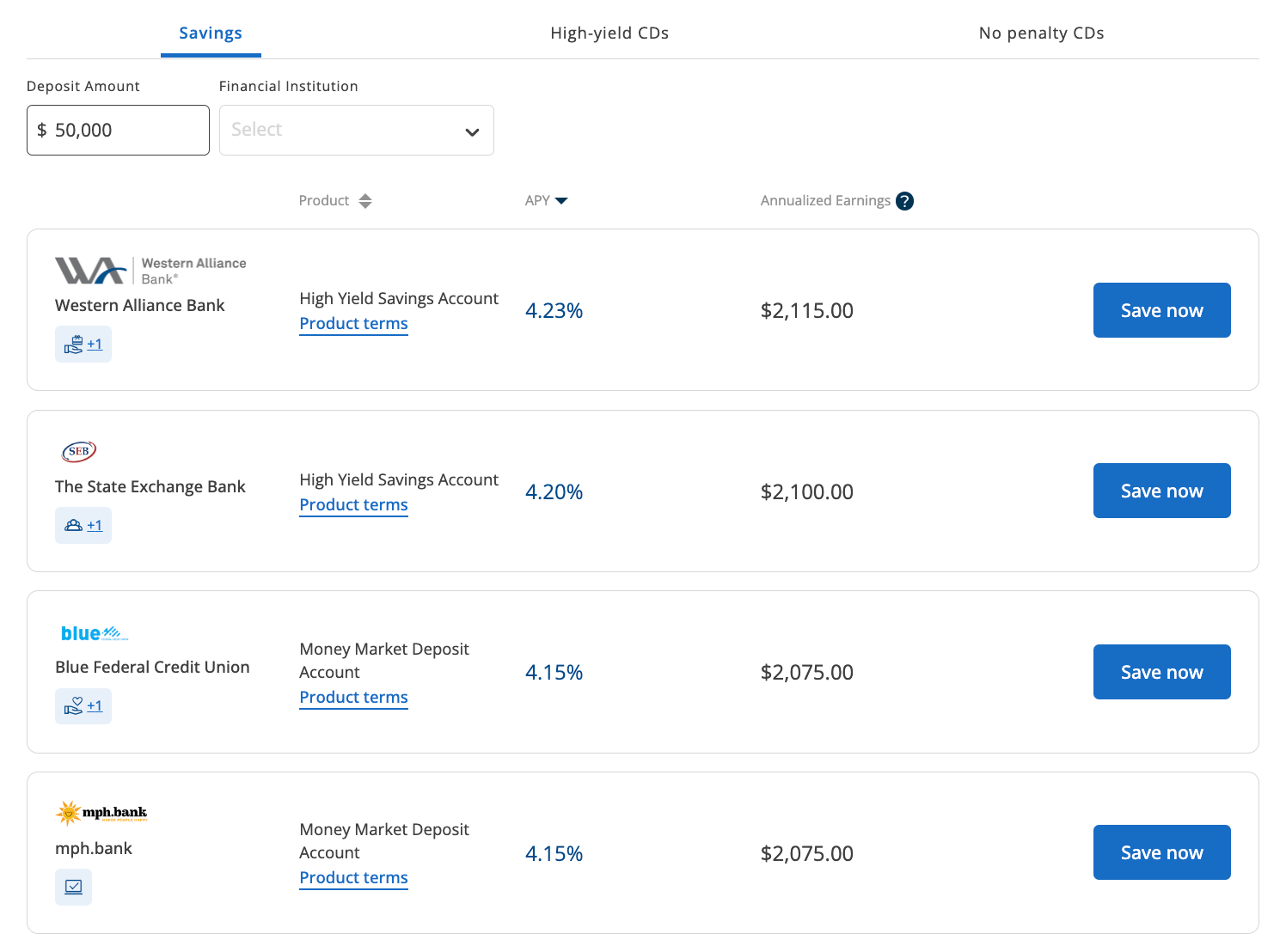

What SaveBetter Offers

SaveBetter offers high-interest savings accounts, money market funds, and CDs. They have traditional CDs and “no penalty” CDs.

Partner banks and credit unions create these products. SaveBetter allows you to tap into them all from one dashboard.

Does SaveBetter Offer Business Accounts?

There are no explicit business accounts with SaveBetter. However, nothing stops a small business from using SaveBetter as a business savings sweep account.

Traditional business savings accounts are pretty bad. SaveBetter wouldn’t be a bad option for business savings.

What Does SaveBetter Charge in Fees?

They don’t charge fees to you. They charge a fee to the banks and credit unions on their platform. The partner banks and credit unions also do not charge a fee. It’s a free service to you.

How Much Can I Earn from SaveBetter?

SaveBetter has the highest savings rates available today. At the time of this piece, those interest rates are above 4%. Use the calculator below to determine how much interest you would earn in a year with a SaveBetter account:

This calculator allows you to see the amount of interest that you will earn over the course of a year.

Steps:

- Enter the principal (the amount of money in the savings account) and

- enter the APY (the annual percentage yield) in the appropriate input fields, and

- click the “Calculate” button

The result is displayed in the “Interest” field below the button. Try it!

Pros and Cons of SaveBetter

Pros

- Highest savings rate available today

- Everything under one platform/login

- Simple interface and fast signup

- FDIC-Insured

- Unique offering

Cons

- Limited banking solutions

- New fintech

- No 3rd party app links (e.g., Personal Capital)

- No trust or IRA accounts

Should You Use SaveBetter?

SaveBetter is an excellent fit for you if you always like to have your savings earning the best interest rate but you’re tired of jumping around signing up with new accounts.

SaveBetter is also great for aspirational savers. Maybe you’re just getting started saving, and you want a secure an “offsite” place to store your separate savings. SaveBetter would make a great partner in your efforts.

SaveBetter is not for you if you’re looking for a one-stop banking solution with checking, cards, etc.

Saving made simpler: Access multiple high-yield savings products from one account. FDIC-Insured. $1 Minimum Balance.

FAQs

How do I know that my money is safe with SaveBetter?

All accounts at SaveBetter have insurance from either FDIC or NCUA (for credit unions), which protects your money up to $250,000.

Are there any minimum balance requirements to open an account with SaveBetter?

Most, if not all, accounts opened through SaveBetter can be done so with a $1 minimum balance.

Is there a limit to how much I can deposit into my SaveBetter account?

No, but you may want to spread your deposits across multiple products if you put more than $250,000 into SaveBetter.

Can I access my account and make transactions with my account on holidays or weekends?

Yes

What is the process for depositing and withdrawing money from my SaveBetter account?

You connect an external bank account and transfer the money. It takes 2-3 business days.

Are there any penalties for withdrawing money early from a CD account through SaveBetter?

Yes, on certain CDs, there is an early withdrawal penalty. Each bank will determine the penalty. However, SaveBetter does offer several no-penalty CDs.

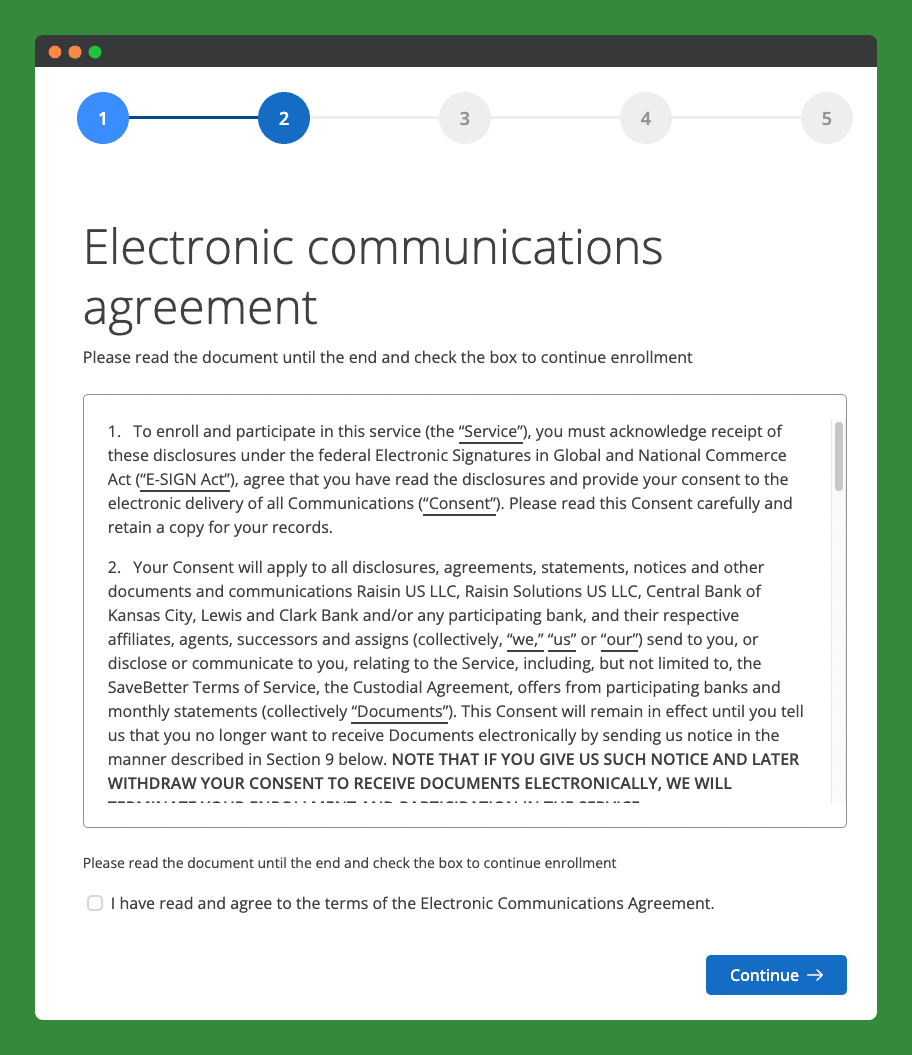

Is there any paperwork required to open a SaveBetter account?

No physical paperwork, no. The entire signup process is done online and in minutes. It involves providing basic information, agreeing to terms, and connecting with an external bank.

Can I open multiple accounts under one SaveBetter account?

Yes, you can have multiple bank or credit union savings accounts or CDs under one SaveBetter account. You can also open a joint SaveBetter account.

Can I use SaveBetter account to pay bills or for other transactions?

There is no bill pay with SaveBetter. You can transfer money in and out of your SaveBetter account at any time into an external bank account and pay your bills from there.

Are there other benefits to using SaveBetter rather than opening an account directly with a bank or credit union?

The significant benefit is simplicity—one account to manage your savings.

How do I contact SaveBetter customer service?

SaveBetter can be reached by email at service@savebetter.com, via live chat on SaveBetter.com, or by calling (844) 994-EARN (3276).

Does SaveBetter offer a signup bonus?

Last Summer they offered a $125 signup bonus depending on how much you deposited. But that promotion has ended.

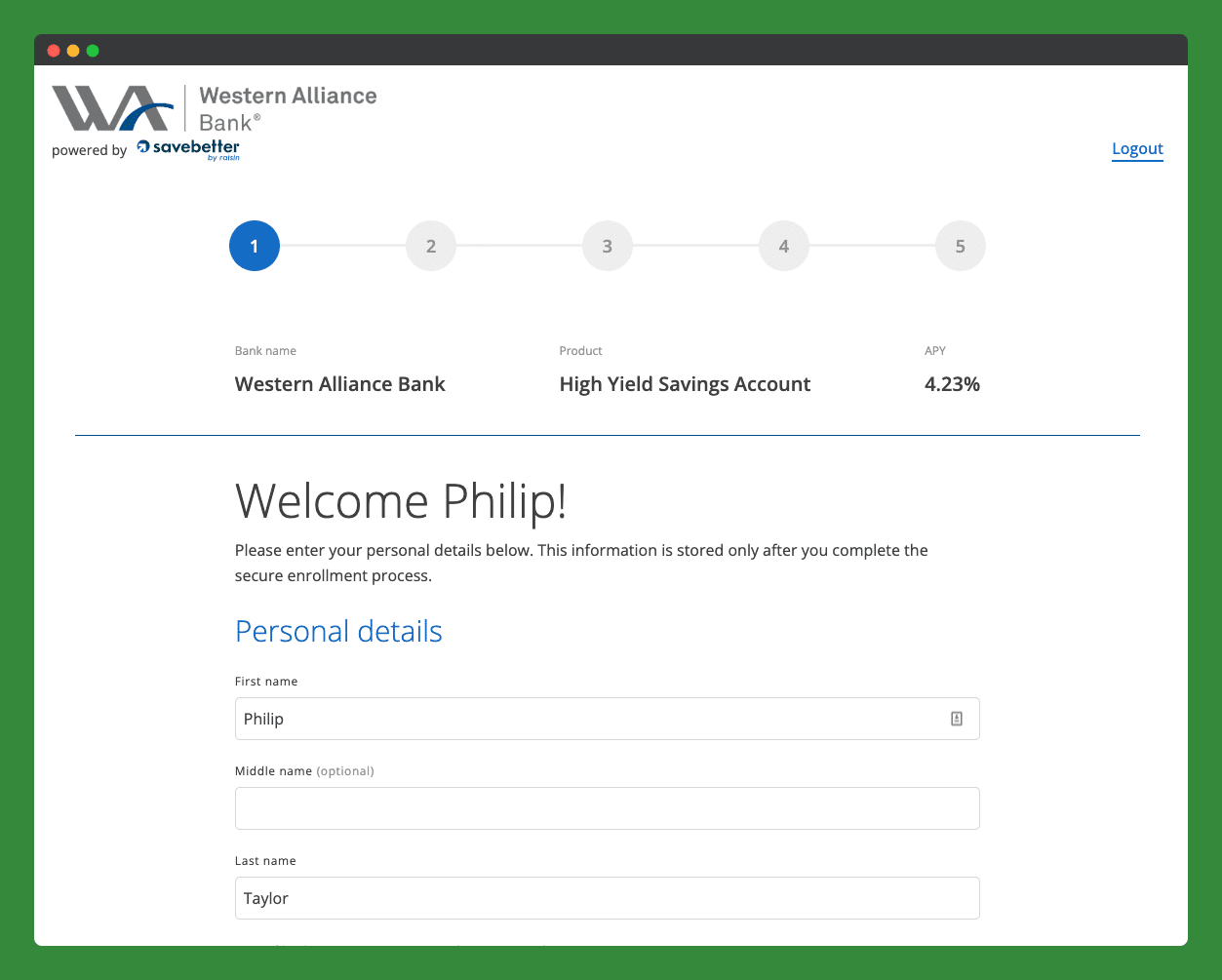

Steps to Sign Up with SaveBetter [in 5 minutes]

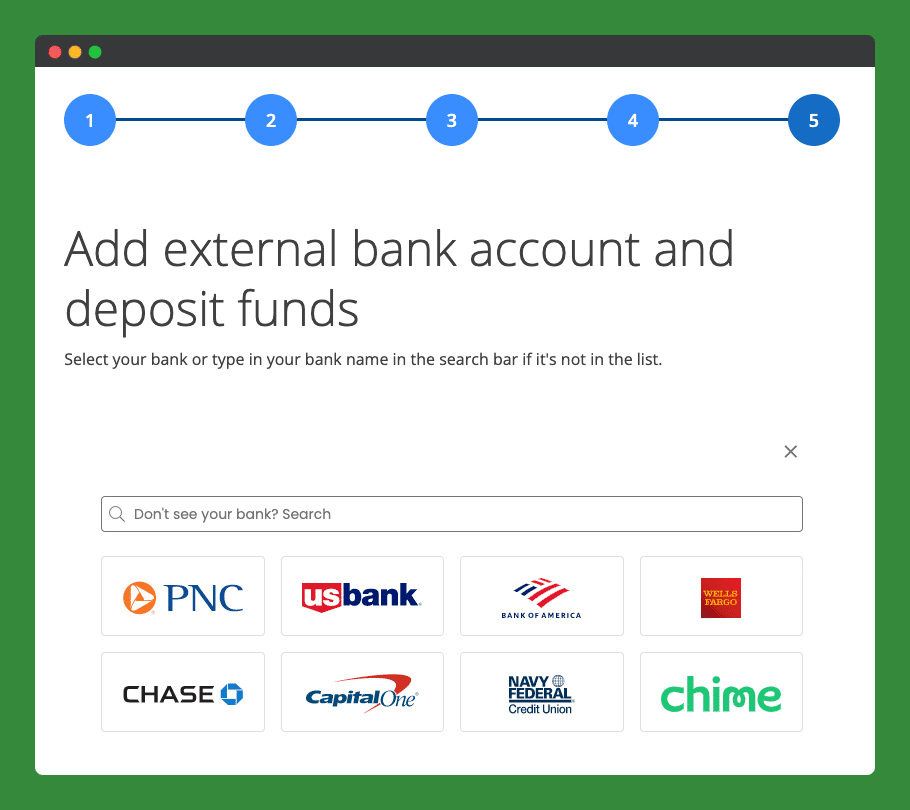

I signed up with SaveBetter and captured all the screenshots to show you what it’s like.

Step 1: Head to SaveBetter.com and pick a product (savings, CD, etc.)

Step 2: Complete the basic bio, including your Social Security number.

Step 3: Sign an electronic agreement, several terms of service, and tax certification.

Step 4: Connect an external bank account and deposit at least $1.

Step 5: Repeat the process for any more products you would like.

Ready to give SaveBetter a try? Head to SaveBetter.com and learn more.

Saving made simpler: Access multiple high-yield savings products from one account. FDIC-Insured. $1 Minimum Balance.

The post SaveBetter Review: Is it Legit? appeared first on Part-Time Money®.

from Part-Time Money® https://ift.tt/kysPSWj

Comments

Post a Comment

We will appreciate it, if you leave a comment.