Investment funds that track the S&P 500 index make up the core holdings in many investment portfolios, and Fidelity’s S&P 500 Index Fund (FXIAX) and Vanguard’s S&P 500 ETF (VOO) are two of the most popular. Of the two, which fund should you choose for your portfolio?

The choice isn’t an easy one because the funds are nearly identical. Each one tracks the performance of the S&P 500 index and is part of a major investment fund family, offering incredibly low expense ratios. Meanwhile, the performance differences between the two are practically invisible.

Either fund is an excellent choice to represent the S&P 500 portion of your portfolio. Even so, breaking down both funds will help you identify small differences that might make one more attractive than the other.

Table of Contents

Fidelity S&P 500 Fund vs Vanguard S&P 500 Fund

As stated in the introduction, both the Fidelity S&P 500 Index Fund (FXIAX) and the Vanguard S&P 500 ETF (VOO) are index funds that track the performance of the S&P 500 index. But while the VOO is an exchange-traded fund (ETF), the FXIAX is a mutual fund.

Generally speaking, mutual funds are actively traded funds in which the fund manager attempts to outperform the general market by trading securities, often frequently. That leads to higher management expense ratios (MERs) since buying and selling shares involve fees. Therefore, ETFs are generally preferable to mutual funds due to their lower operating expenses.

But this is not the case with FXIAX. Even though it’s a mutual fund, it has very low expense ratios. In fact, the MER for FXIAX is lower than it is for VOO.

Note: While S&P 500 index funds are well diversified across the general US stock market, they are limited to the American market only. If you want to add international companies to your portfolio, you’ll need funds specializing in that market sector.

In addition, if you want more concentration on specific business sectors, like technology, healthcare, or energy, you’ll need to take positions in funds that specialize in those industries. The S&P 500 is mostly a general investment fund that avoids specialization and any one sector.

FXIAX vs. VOO: A Head-to-Head Comparison

The table below compares the basic features of FXIAX and VOO. Not surprisingly, there are more similarities than differences between the two funds.

| Fund / Feature | FXIAX | VOO |

| Asset Class | Domestic Stock – General | Domestic Stock – General |

| Category | Large Blend | Large Blend |

| When Launched | 2/17/1988 | 09/07/2010 |

| Expense Ratio | 0.015% | 0.03% |

| Market Price (as of 12/14/2022) | $141.94 | $367.12 |

| 52-week High / Low Price | $166.37 / $124.13 | $439.25 / $327.68 |

| Total Net Assets | $372.75 billion | $789.6 billion |

| Number of Stocks | 505 | 503 |

| Dividend Distribution | Quarterly | Quarterly |

| Dividend Yield (Trailing) | 1.55% | 1.56% |

Let’s now take a closer look at the two funds to see where there may be any differences, however slight they may be.

Holdings

FXIAX

The industry distribution of the FXIAX is as follows: information technology (26.24%), healthcare (15.30%), financials (11.37%), consumer discretionary (10.85%), and industrials (8.25%).

The ten largest holdings in the FXIAX fund, which represent 26.4% of total net assets, include:

- Apple Inc.

- Microsoft Corp

- Amazon.com Inc.

- Tesla Inc.

- Alphabet Inc CL A (GOOGL)

- Berkshire Hathaway Inc.

- UnitedHealth Group Inc.

- Alphabet Inc CL C (GOOG)

- Exxon Mobil Corp

- Johnson & Johnson

VOO

The industry distribution of the VOO is as follows: information technology (26.4%), healthcare (15.2%), financials (11.60%), consumer discretionary (10.40%), and industrials (8.40%).

The ten largest holdings in the VOO fund, which represent 25.1% of total net assets, include:

- Apple Inc.

- Microsoft Corp.

- Amazon.com Inc.

- Alphabet Inc. CL A (GOOGL)

- Berkshire Hathaway Inc.

- Alphabet Inc. CL C (GOOG)

- Tesla Inc.

- UnitedHealth Group Inc.

- Johnson & Johnson

- Exxon Mobil Corp.

Notice that while there are slight differences in the rank of each company in each portfolio, as well as small differences in the sector percentages held in each, these funds have essentially the same composition.

Perhaps the biggest difference between the two is that while the VOO holds 503 stocks – matching the S&P 500 index – the FXIAX includes 505.

Performance

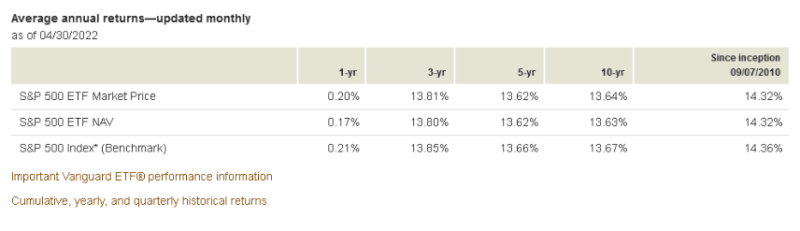

Below are screenshots of the 1-year, 3-year, 5-year, 10-year, and since inception performances of both funds (through November 30, 2022), according to Fidelity and Vanguard.

FXIAX:

VOO:

Now let’s look at the performances side-by-side to better compare the returns on each.

| Fund / Performance Period | FXIAX (Thru 11/30/2022) | VOO (Thru 11/30/2022) |

| 1-Year | -9.23% | -9.38 |

| 3-Year | 10.89% | 10.81% |

| 5-Year | 10.96% | 10.92% |

| 10-Year | 13.32% | 13.29% |

| Since Inception (inception date) | 10.46% (since 2/17/1988) | 13.56% (since 09/07/2010) |

Once again, the performance between the two funds is very nearly identical. But while VOO has a slightly better one-year performance, FXIAX outperformed VOO over the three-, five-, and 10-year timeframes. This could be more significant than VOO’s superior one-year performance because funds represent a longer-term investment. By that count, FXIAX looks to be the better-performing fund.

The better long-term performance can be partially explained by the lower expense ratio of FXIAX. It’s 0.015% per year, vs. 0.03% for the VOO. Though that small difference in the expense ratios may seem insignificant, it can add up over time, especially when your investment time horizon stretches over several decades.

VOO does stand out as the better performer since inception, and by a wide margin – more than 3% per year. But that difference is mainly explained by the more recent start date of the fund. Since the VOO began in 2010 – shortly after the 2008 Financial Meltdown – it avoided that market’s negative impact. The FXIAX, by contrast, experienced the total weight of that bear market – in addition to the 2000 – 2002 Dot-com bust.

Related Post: VOO vs. SPY

FXIAX vs. VOO: Is One Better than the Other?

As you can see from the side-by-side comparison, the difference between the FXIAX and the VOO is minimal. Both are index funds tracking the same index and performing well against that index. Either will represent a worthy allocation of the S&P 500 index.

FXIAX shows a consistent pattern of slightly higher returns over the longer term, or at least through the most recent ten years. But VOO has been weathering the 2022 downturn a little better, which can’t be ignored either.

Is There a FAIAX Performance Advantage?

What should we make of the better performance of the FXIAX fund over three and 10-year periods? Someone who invests based mostly on the numbers might declare the slightly better performance of the FXIAX – especially in light of its lower annual expense ratio – to be the obvious choice. After all, even though the difference is minimal, it does add up as the years’ pass.

But as is usually the case, that slightly better performance and lower expense ratio isn’t the whole story.

The distinction that FXIAX is a mutual fund and VOO is an ETF is more critical than it seems on the surface.

It all has to do with investment brokerage commission fee structures. The best online brokers today offer commission-free buying and selling of ETFs. The same is not true for mutual funds. Most brokers charge between $10 and $50 per trade on mutual funds.

That may not matter much if you’re purchasing a substantial position in a mutual fund like FXIAX. But in smaller amounts, it can be significant. For example, a $30 purchase commission equals 3% of a $1,000 mutual fund investment. That fee will not apply to an ETF.

The situation becomes even more pronounced if you intend to trade funds, even infrequently. If you do, ETFs – like VOO – are the clear winner. Depending on the platform, you’ll pay no commissions to buy and no commissions to sell.

Final Thoughts

I can think of one workaround that places FXIAX on more equal footing with VOO.

Fidelity Investments is not only the provider of the FXIAX (and many other funds) but is also a popular investment brokerage firm. If you purchase FXIAX or any Fidelity-sponsored mutual fund, you can trade the fund commission-free by opening a brokerage account with that firm.

In that case, the FXIAX fund may be an equal choice.

The post FXIAX vs. VOO: Which Fund Should You Choose? appeared first on Best Wallet Hacks.

from Best Wallet Hacks https://ift.tt/CsFGivc

Comments

Post a Comment

We will appreciate it, if you leave a comment.