Investing in your retirement early is one significant way to help ensure financial stability as you age, especially when it comes to understanding various retirement options. Getting started may feel overwhelming—luckily we’re here to help. To help you better understand your retirement plan, we’re breaking down the difference between 401(k) and 403(b) accounts, and how they can impact your financial life.

In chapter 7, we’ll be going over the similarities and differences between 401(k) and 403b, how each works, and various other ways you can grow your retirement savings. The main difference between a 401(k) and a 403(b) is the company who’s offering them.

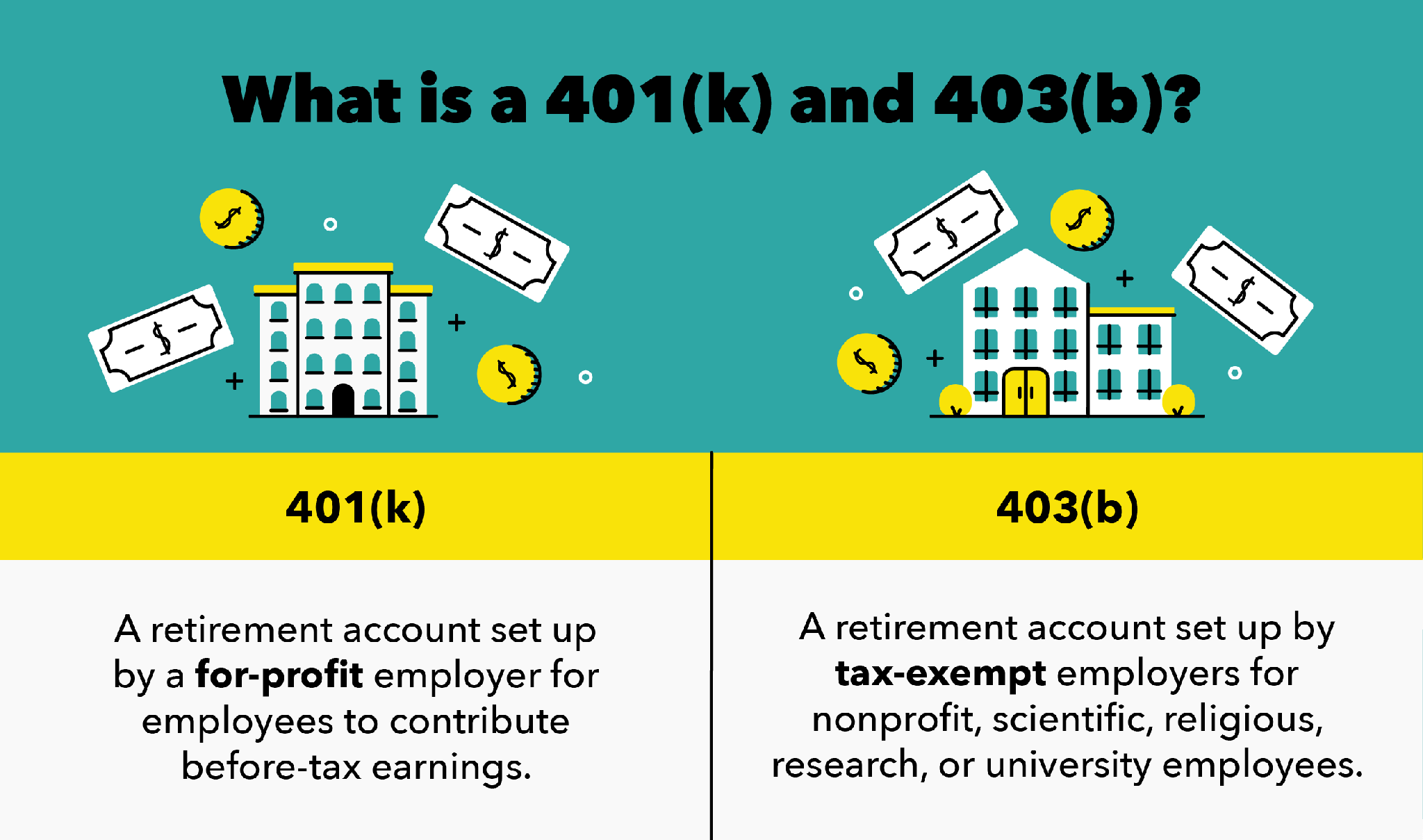

401(k) accounts are offered by for-profit companies and 403(b) accounts are offered by nonprofit, scientific, religious, research, or university companies.

You may already know the value in adjusting your budget to make saving for a rainy day a priority. But are you also prioritizing your retirement savings? If you’re just getting started in the workforce and looking for ways to invest in yourself, 401(k) and 403(b) plans are great options to know about. To understand the similarities and differences between plans in depth, skip to the sections below or keep reading for an in-depth explanation.

- How a 401(k) Works

- How a 403(b) Works

- The Differences Between 401(k) and 403(b)

- The Similarities Between 401(k) and 403(b)

- Is a 401(k) or 403b better for Retirement Planning?

- 5 Ways to Grow Your Retirement Savings

- Key Takeaways: What is a 401(k) vs. 403b?

- Take Advantage of Your Employer Retirement Plan

So far in our retirement series, we’ve gone through a lot of the retirement basics, like the best ways to save for retirement, how much you should save from your paycheck, how to make a retirement budget, and the difference between an IRA vs. 401(k). If you want to learn more about 401(k) basics, you should go back and read Chapter 5 first before proceeding with this chapter.

How a 401(k) Works

A 401(k) is a retirement account set up by for-profit employers for employees to contribute before-tax earnings. Employer-sponsored 401(k) accounts give employees the opportunity to build retirement savings in different forms including:

- Company stocks

- Before-tax earnings

- Exchange-traded funds (ETFs)

Your contributions to a 401(k) plan and any earrings from the investment are also tax-deferred.

Each company’s retirement plans may vary on benefits like employee matching, stock options, and more. In addition, you’re able to choose how much you’d like to contribute on a monthly basis.

Keep in mind, both 401(k) and 403(b) plans have a yearly contribution limit of $20,500 with your employer matches. Plus, most retirement funds have required minimum distributions (RMDs) by the time you turn 72. This essentially means you have to take a minimum amount of money out each month whether you want to or not. If you’re going to take up an employer match, just make sure you avoid the investing mistake of counting your employer’s match in your total contribution amount.

In most cases, employers will offer 401(k) matching to encourage consistent contributions. For example, your employer match may be 50 cents of every dollar you contribute up to six percent of your salary. For example, with this employer match on a $40,000 salary, you would contribute $200 and your employer would contribute an additional $100 each month. This pattern would continue until your annual contributions hit $2,400 and your employer contributes $1,200.

Employee matching is essentially free money. You’re monetarily rewarded for your retirement payments, which means you can significantly grow your earnings in the long-term, thanks to compounding interest. Be sure to pay attention to vesting periods when setting up your employer match.

Vesting periods are an agreed amount of time you need to work at a company before you receive your 401(k) benefits. For example, some companies may require you to work for their team for a year before earning retirement benefits. Other employers may offer retirement benefits starting the day you start working with them.

To make sure you’re on track with your 401(k) plan, it’s important to be aware of the average 401(k) balance by age, which essentially tells you how much you should have in your 401(k) account at different ages.

How a 403(b) Works

A 403(b) is a retirement account made by employers for tax-exempt, charitable nonprofit, scientific, religious, research, or university employees. Organizations that qualify for 403(b) accounts include:

- School boards

- Public schools

- Churches

- Hospitals

- And more

This type of account is also known as a tax-sheltered annuity plan—they allow pre-tax income to be invested until taken out.

Employers that offer 403(b) retirement plans may offer a pool of provider options that undergo nondiscrimination testing. This allows employers that qualify for this account to shop around for plans that offer the best benefits and don’t discriminate in favor of highly compensated employees (HCEs). For instance, some 403(b) accounts may charge more administrative fees than others.

Employers are able to offer employee matching on 403(b) accounts if they decide to. To cut costs for nonprofit companies, 403(b) retirement plans generally cost less than 401(k) accounts. Costs associated with starting up these accounts may not affect you, but it may affect your employer.

The Differences Between 401(k) and 403(b)

So, what is the difference between 401(k) and 403b?

Both a 401(k) and 403(b) are similar in the way they operate and they’re both beneficial investment accounts to have, but they do have a few differences. Here are the biggest contrasts to be aware of:

- Eligibility: 401(k) retirement plans are issued by for-profit employers and the self-employed, 403(b) retirement plans are for tax-exempt, non-profit, scientific, religious, research, or university employees. As well as Hospitals and Charities.

- Investment options: 401(k)s offer more investment opportunities than 403(b)s. 401(k) accounts may include mutual funds, annuities, stocks, and bonds, while 403(b) accounts only offer annuities and mutual funds. Each employer varies in retirement benefits—reach out to a trusted financial advisor if you have questions about your account.

- Employer expenses: 401(k) accounts are generally more expensive than 403(b) accounts. For-profit 401(k) accounts may pay sales charges, management fees, recordkeeping, and other additional expenses. 403(b) plans may have lower administrative costs to avoid adding a burden for non-profit establishments. These costs vary depending on the employer.

- Nondiscrimination testing: This form of testing ensures that 403(b) retirement plans are not offered in favor of highly compensated employees (HCEs). However, 401(k) plans do not require this test.

The Similarities Between 401(k) and 403(b)

Aside from the differences between a 403b vs 401(k) account, both accounts are set up to aid employees in retirement savings. Here’s how:

- Contribution limits: Both accounts cap your annual contributions at $20,500. In the event you contribute over this limit, your earnings will be distributed back to you by April 15th. If you’re under your retirement contributions by the time you’re 50 years old, you’re allowed to make catch-up contributions. This means that, if you’re eligible, you can contribute $6,500 more than the yearly contribution limit.

- Withdrawal eligibility: You must be at least 59.5 years old before withdrawing your retirement savings. In the case of an emergency, you may be eligible for early withdrawal. However, you may be charged penalties, taxes, and fees for doing so.

- Employer matching: Both retirement account options allow employers to match your contributions, but are not required to. When starting your retirement fund, ask your HR representative about potential benefits and employer matching.

- Early withdrawal penalties: If you choose to withdraw your retirement savings early, you may be penalized. In most cases, you need a valid reason to withdraw your funds early. Eligible reasons may include outstanding debt, bankruptcy, foreclosure, or medical bills. In addition, you may be charged a 10 percent penalty fee, taxes, and other fees. During a downturned economy, as we’ve seen with the COVID-19 pandemic, fees may be waived.

Is a 401(k) or 403b better for Retirement Planning?

Neither a 401(k) or a 401b are necessarily better for retirement planning. It ultimately just depends on the type of employer you have. It’s important to have some type of retirement investment account as part of your financial plan, so you should just use whichever is available to you.

5 Ways to Grow Your Retirement Savings

Contributing to a 401(k) or 403(b) can help grow your investments while taking on fairly minimal risk. You’re able to grow your non-taxed income to put towards your future goals. The more you contribute, the more you may have by the time you retire.

Here are a few tips to get ahead of the game and invest in your financial future.

1. Create a Retirement Account Early

It’s never too late to start a retirement account. If you’re currently employed, but haven’t set up your retirement account, reach out to your HR representative. Ask about retirement plan options and their benefits. When employers offer retirement matches, consider contributing as much as you can to meet their match.

If you’re not sure how much you need to save for retirement, you can use our free online financial calculators, like our free retirement calculator. This is important information to know so you can start making the right moves to save enough money.

2. Set up Monthly Automatic Contributions

Save time and energy by setting up automatic contributions. You may feel less interested in contributing to your retirement as your payday approaches. Taking time to set up a retirement fund and budgeting for this change may be holding you back.

To meet your retirement goals, consider setting up automatic payments through your employer as a way to pay yourself first. This is a good way to grow your retirement savings and maximize your savings rate. After a while, you may not even notice the slight budget adjustment.

3. Leverage Employer Matching

Employer matching is essentially free money. Many employers will match contributions one-for-one based on a percentage of your gross pay and how much you’re contributing. Some employer plans will also contribute a percentage of your gross pay, even if you don’t contribute. This encourages employees to consistently put money towards their retirement savings. Not only are you able to earn extra money each month, but this “free money” will grow with interest over time. If you can, consider trying to match your employer’s contribution percentage, if not more.

4. Avoid Early Withdrawal

Credit card balances, student loans, and mortgages can be stressful. Instead of withdrawing early from your retirement fund to pay for these, consider other debt payoff methods. If you’re eligible to withdraw from your retirement early, you may face penalty fees, taxes, and administrative expenses. This may hinder your savings potential or push back your desired retirement date.

5. Contribute Your Future Raises and Bonuses

If you’re saving less than $20,500 to your retirement fund this year, you may want to consider contributing more. If you earn a bonus or a raise, stick to your current budget and consider increasing your contributions. Ask your employer to increase your retirement payments right before you receive a bonus or raise. The more you contribute, the more interest you’ll accrue over time.

Whether your retirement funds are established through a 401(k) or a 403(b), these accounts offer you the chance to build your financial portfolio. Consistently funding your retirement account may better your financial plan and set you at ease. As your contributions age, so do your interest earnings. You’ll be able to make money on your pre-taxed income and set your future self up for financial success. Get started by checking in on your budget and carving out a specific amount to put towards your retirement each month.

Key Takeaways: What is a 401(k) vs. 403b?

- A 401(k) is a retirement account set up by for-profit employers for employees to contribute before-tax earnings.

- A 403(b) is a retirement account made by employers for tax-exempt, charitable nonprofit, scientific, religious, research, or university employees.

- 401(k) vs 403b plans differ by:

- Eligibility

- Investment options

- Employer expenses

- Nondiscrimination testing

- There are various ways you can grow your retirement savings, such as:

- Create a retirement account early

- Set up Monthly Automatic Contributions

- Leverage Employer Matching

- Avoid Early Withdrawal

- Contribute Your Future Raises and Bonuses

Take Advantage of Your Employer Retirement Plan

Regardless of what your lifestyle will be in retirement or where you will retire, it’s crucial to have enough money saved up. And one of the best ways to ensure that is by taking advantage of your employer retirement plan, whether that be a 401(k) or a 403b investment account.

So now that we’ve answered “what is a 403b vs 401(k)?”, you should have a better idea of which plan is right for you. The next chapter in our series is Chapter 8, which covers Social Security retirement benefits.

Sources: Department of Labor | Investor.gov | IRS 1, 2, 3

This is for informational purposes only and should not be construed as legal, investment, credit repair, debt management, or tax advice. You should seek the assistance of a professional for tax and investment advice.

Third-party links are provided as a convenience and for informational purposes only. Intuit accepts no responsibility for the accuracy, legality, or content on these sites.

Comments

Post a Comment

We will appreciate it, if you leave a comment.