Golden years require some gold.

Are you saving for retirement? You should be, even if your golden years are more than half your lifetime away. The sooner you begin, the less you’ll need to save each month.

Too many people have no idea how much they’ll need to live comfortably through retirement. According to the 20th Annual Transamerica Retirement Survey, only 27 percent of workers have a written financial strategy for retirement.

It’s never too late to start saving, and it’s also never too early. But you’ll need a budget to show how far you’ve come and where you’re headed. Learning how to start saving for retirement is important for everyone. There are plenty of ways you can save for retirement—401(k) accounts, IRA accounts, savings accounts, and so forth.

In Chapter 3 of our retirement series, we’ll go over how to save for retirement, the best way to save for retirement, when to start saving for retirement, and more. You can use the list below to jump to a section you’re curious about, or you can read through for a more thorough understanding of saving for retirement. Take a look!

- Step One: Calculate How Much Retirement Savings You’ll Need

- Step Two: Create a Budget to Save for Retirement

- Step Three: Consider Investments to Supplement Retirement Savings

- Expenses to Make Sure You Account for in Your Retirement Budget

- Retirement Budget Example

- Additional Tips for Saving Money for Retirement

- Key Takeaways on Saving for Retirement

In the previous chapters we discussed how much you need to save for retirement, and how much you need to save from each paycheck. To brush up on these topics, go back and read those chapters. Otherwise, keep reading to learn about how to make a retirement budget that works for you.

Step One: Calculate How Much Retirement Savings You’ll Need

Your living expenses might not be the same at retirement. Maybe your home will be paid off by then, but the cost of living will certainly be higher. If you want to travel, you’ll need more savings. Calculating retirement funds takes a lot of consideration. The safest approach is to err on the generous side since having more than you need can never be a bad thing.

When it comes to making a budget for retirement, it’s a good idea to start by differentiating your wants and needs. Sure, a Masserati and beachfront property sounds like a great way to enjoy your sunset years, but will you have enough money to pay for utilities, property taxes, and food? To figure out how much retirement savings you’ll need, you need to think about where you’ll retire and what your lifestyle will be.

The Department of Labor estimates that you need roughly 70 to 90 percent of your pre retirement income to live comfortably in retirement. Budgeting for retirement can help you determine how much money you need to have saved in order to live comfortably and maybe even splurge on something new, like a vacation to Europe or a pontoon boat for the lake.

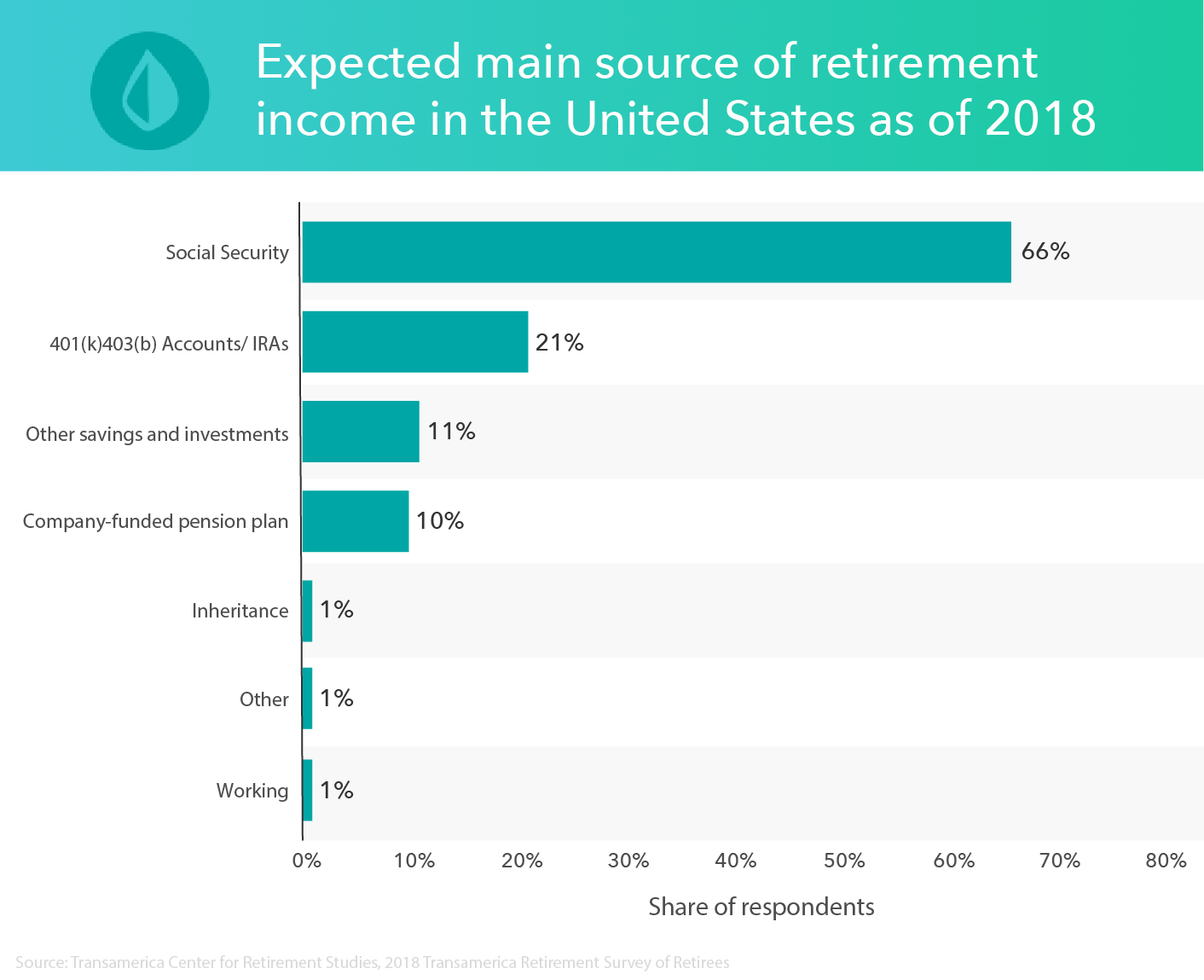

Start your retirement fund by determining your retirement savings goals. Retirement savings calculators, such as the free one from Mint, do most of the work for you. It includes fields to include the amount you are scheduled to receive in Social Security benefits and investments. Fill in the blanks, and the calculator shows their estimated amount that you’ll need to have in your retirement savings. Financial calculators can also help you figure out how much you need to budget in order to reach your financial goals, like retirement.

Other ways to determine your retirement savings goals include:

- Consulting with a financial advisor

- Filling out a budgeting worksheet

- Enlisting the help of an online budgeting tool, like the Mint app.

But regardless of what you do, it’s imperative to make a financial plan that outlines your retirement goals and how you are going to achieve them.

You can also try out the pay yourself first method, which is a savings strategy where you put a portion of every paycheck before you put more towards any expenses. This strategy can help you prioritize saving for your financial goals, like retirement.

Different Retirement Accounts

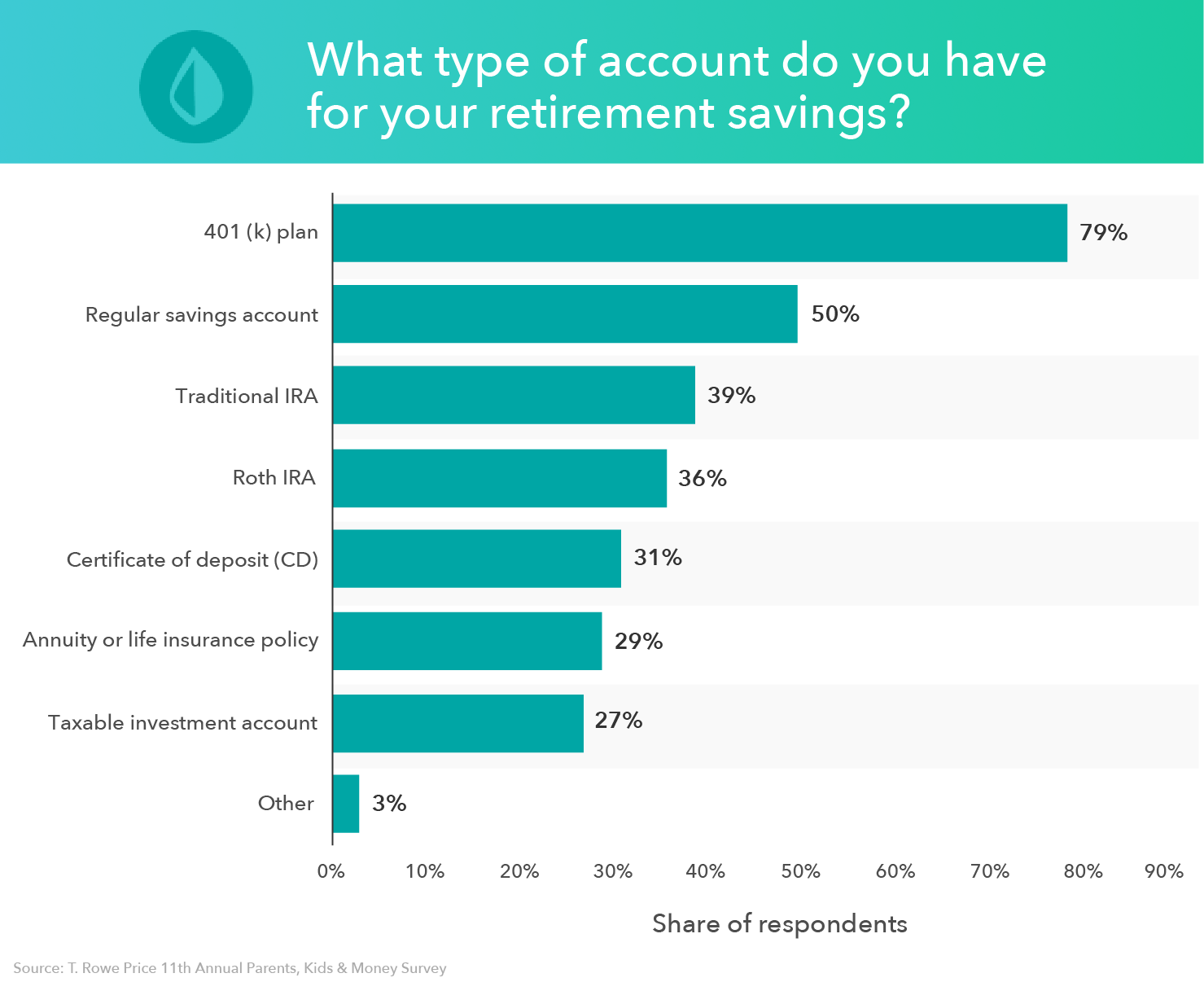

As you calculate how much retirement savings you’ll need, it’s essential to know your options on where to save your money.

Many retirement accounts place limits on how much you can save up each year, but there are a few different retirement accounts where you can contribute more of your salary annually.

- 401(k): A 401(k) is a retirement account that’s set up by an employer that allows workers to contribute a portion of their wages to the account. Earnings made through a 401(k) account aren’t taxed until they are withdrawn in retirement. Some employers also offer a 401(k) match, where they will match all, or a portion of your contributions. You can learn more about 401(k) accounts on Mint.

To get the most out of your 401(k) plan, invest up to the match and aim to reach the contribution limit—as long as you can do so comfortably. The annual contribution limit in 2022 is $20,500.. If you’re 50 years or older, you’re granted a catch-up contribution of $6,000, meaning you can contribute $25,000 to your 401(k). Your goal should be to meet the average 401(k) balance by age so you can make sure you’re on track with your savings. You should also avoid 401(k) early withdrawal, even if you have debt to pay, as it can cause you to lose thousands of dollars in potential growth.

- Traditional IRA: A traditional IRA is a retirement account that allows you to make contributions that will be deducted from your taxes during that year. Once you withdraw money from your traditional IRA during retirement, you will have to pay income taxes.

Each year, you can contribute up to $6,000 to your Traditional IRA, and $7,000 if you’re 50 years old or older. To get the most out of your retirement savings, aim to reach the contribution limit.

- Roth IRA: A Roth IRA and Traditional IRA are very similar. The main difference is that with a Roth IRA, your contributions aren’t deductible during the tax year you make the contribution. However, this means that when you withdraw funds from your Roth IRA in retirement, they won’t be taxed.

As with a Traditional IRA, the contribution limit for 2022 is $6,000 and $7,000 if you’re aged 50 or older. Aim to contribute $6,000 to get the most out of your retirement.

Contributing a large percent of your annual salary towards retirement savings may seem like a daunting task at first, but you may be closer than you think.

If you contribute 5 percent of your salary to your 401(k) and your employer provides a 5 percent match, you’re already at 10 percent. And if you’ve reached the contribution limit for your traditional or Roth IRA and still haven’t reached your goal, you can go back to your 401(k) and contribute the rest there, as long as you don’t exceed $20,500. If you have an old 401(k) account, you can also get an IRA rollover and put those funds into an IRA account while maintaining the tax-deferred status of your investments.

401(k) accounts and IRAs are considered tax-deferred savings plans, which allows you to postpone paying taxes on the money in your account until you withdraw it, which typically won’t happen until retirement. A 401(k) and IRA are both good investment accounts to save money for retirement.

But whether you invest in a 401(k) account or an IRA, It’s important to understand your savings rate when preparing for retirement so that you can save up more money on a monthly basis. The more money you save in these accounts now, the more you’ll have later, thanks to the benefits from compound interest.

How Much Money You Should Have Saved by Age

The most pressing question many people have is when to start saving for retirement. Remember, as we previously said, it’s never too late or too early to plan for retirement. The best way to save for retirement, however, is to begin early. This means you won’t have to contribute as much money later on in life.

For many people, their contributions gradually increase as they age. However, how much you’re able to put away each year likely depends on the other financial factors in your life at the time. Read Chapter 9 to learn more about saving for retirement by age and determine whether you’re on track.

Step Two: Create a Budget to Save for Retirement

Retirement calculators usually produce an enormous dollar amount. Replacing 80 percent of a modest yearly salary might require a million dollars in savings or much more if there are no other anticipated sources of income. That’s a lot of savings, but spreading it out over many years means your monthly contribution won’t be as much.

A retirement calculator can assist you with saving for retirement. To create a budget to save for retirement, keep these factors in mind:

- Fixed expenses: These are recurring expenses that don’t change. Examples of fixed expenses include rent, monthly bills for services like cable, gym memberships, and cell phones, along with insurance and taxes. Knowing the fixed expenses you’ll have during retirement will allow you to calculate how much money you’ll need to get by.

- Leisure: Retirement is a time for you to pursue your passions and hobbies. Whether it’s traveling the world or picking up golf, set aside an estimate for how much money you’ll need for fun and hobbies.

- Medical costs: Unfortunately, with old age comes an increased probability of health concerns. If you retire before 65 when you’re eligible for Medicare, you may have to pay for your health insurance. Make sure you create an emergency fund for medical expenses in case any health concerns pop up.

Once you have all of your expenses tallied up, you’ll be able to determine how much money you’ll need for retirement.

Now’s the time to find extra money in your budget to devote to retirement, but sometimes there doesn’t seem to be anything left after the bills are paid. That’s where budget software, such as Mint.com, can help.

By opening an account and entering all of your financial information, Mint can help you find money and suggest ways to allocate it to savings. For example, an overview of your expenses and income might reveal an imbalance that you can correct.

Mint can expose spending patterns that you weren’t aware of, and show you how they add up monthly. Mint can also make suggestions if you’re spending too much in interest based on another lender or credit card that offers a lower rate. Every penny you find can turn into valuable retirement savings.

Now is the best time to get on track.

Step Three: Consider Investments to Supplement Retirement Savings

As the old saying goes, your money should work for you. Putting money in a cookie jar leaves exactly the amount saved. In an interest-bearing savings account, there could be slightly more over time. If you really want to watch your money grow, think about investing.

Investments always carry risk, but some are much riskier than others. When you are young, those chances are easier to take. There are still years ahead to recover from stock market drops and other losses. As you grow closer to retirement, you might consider switching to less risky investments to keep your money safer. If you want to begin investing, make sure you do thorough research about what kind of investments are best for you.

Expenses to Make Sure You Account for in Your Retirement Budget

There are a variety of costs that you need to make sure you account for in your retirement budget above and beyond your typical living expenses, such as:

- Taxes: You need to account for the possibility of your property taxes increasing in your retirement budget so that you can have enough money saved up.

- Emergencies: This includes instances like home repairs, healthcare emergencies, and other unexpected costs.

- Grandkids: You might not think to include your grandkids in your retirement budget, but between birthdays and holidays, as well as spending quality time, caring for your grandkids can get expensive so it’s important to include these expenses in your budget.

- Long-term care: We’re living longer than ever before, which means there’s even more expenses to account for. While it might be hard to think about your life in your 80s and 90s, long-term care is definitely something to think about when it comes to saving money for retirement.

- Bucket-list goals: If you have an extensive list of things you want to accomplish in your golden years, you need to account for those costs. And even if you don’t, you may take on an expensive hobby, so you’re better off having money saved up for your bucket-list goals.

Retirement Budget Example

For some more clarity about what a retirement budget might look like, you can check out the following retirement budget example:

- Retirement income sources:

- Social security income

- Company pensions

- Rental income

- Investment income

- Annuity income

- Other retirement plans

- Housing expenses:

- Mortgage or rent

- Real estate taxes

- Maintenance and repair

- Home insurance

- Living expenses:

- Food and groceries

- Transportation

- Auto insurance

- Entertainment

- Insurance

- Utilities

- Clothing

Once you’ve calculated all of these costs, you have to find your discretionary income, which is your income that’s left over after you pay taxes and take care of your living expenses. You can calculate your discretionary income by subtracting taxes and all of your essential monthly expenses from your total income. Any leftover discretionary income can be used to pay for extra expenditures and unexpected costs.

Additional Tips for Saving Money for Retirement

Contributing money to employer-sponsored 401(k) plans and IRAs aren’t the only options you have for saving money for retirement. Aside from investing your money, you can make a few lifestyle changes to increase your nest egg. Dol.gov offers an excellent publication on planning for retirement with worksheets and information on budgeting for retirement and tracking down expenses.

Additional steps you can take to save money for retirement include:

- Tracking your spending: With a budgeting app like Mint, you can track your spending to see where your money is going. Avoid spending money on non-essential items, such as going out to a fancy dinner every night or subscribing to every streaming service offered online. You’ll be surprised how much you can save by eliminating impulse buys and expensive services.

- Taking advantage of your health savings account (HSA): If your employer offers a high deductible health plan (HDHP) that comes with an HSA, you may consider contributing up to the contribution limit. Why? HSAs can cover your current and future medical costs, and funds go straight from payroll to your account. HSA contributions are also pre-tax and tax-deductible, meaning when you make a withdrawal for a qualified expense, you won’t be taxed.

- Paying off your debts: Being in debt can cost you a lot of money. Not only is the principal balance something to worry about, but the interest you accumulate can be harmful, too. Paying off your debts as soon as possible, such as credit card debt, your mortgage, student loans, and auto loans will allow you to put more money towards retirement rather than compounding interest.

Key Takeaways on Saving for Retirement

- Many Americans aren’t fully prepared for retirement and don’t have enough money saved up to live comfortably after they retire.

- One of the best ways to save for retirement is by taking advantage of the many savings accounts out there, such as 401(k) accounts and IRA accounts.

- For traditional retirement accounts, your taxable income will be reduced based on the amount of your contributions, giving you a nice tax break. Roth accounts, on the other hand, will collect taxes on your contributions when you make them but will allow you to withdraw money tax-free in retirement.

- Budgeting for retirement in advance can help you stay on track for your savings goals.

- Investing in stocks and diversifying your portfolio is a great way to supplement your retirement savings.

- Tracking your spending, taking advantage of your health savings account, and paying off your debts are additional ways you can save for retirement.

Retirement is meant to be enjoyed. Learning how to save money for retirement can help you live your retirement years to the fullest. The best way to get the most out of your retirement savings is by planning ahead and committing to those plans over the long haul.

Mint offers budget products that help make budgeting and saving simple, so you can be sure you’re always on top of the game. Sign up for a free account today and see how Mint can help your retirement plans.

With a good idea in mind of how to go about creating a retirement budget, you’re prepared to move onto Chapter 4 of our retirement series, which covers the best ways to save for retirement.

Sources: Transamerica Institute | Department of Labor | IRS 1, 2

This is for informational purposes only and should not be construed as legal, investment, credit repair, debt management, or tax advice. You should seek the assistance of a professional for tax and investment advice.

Third-party links are provided as a convenience and for informational purposes only. Intuit accepts no responsibility for the accuracy, legality, or content on these sites.

Comments

Post a Comment

We will appreciate it, if you leave a comment.