If you’re looking to get tax benefits on your retirement savings, an IRA and 401k are both potentially beneficial choices as you won’t pay taxes on your investment growth. The main difference between an IRA vs. 401k is that a 401k must be set up by an employer and is a pre-tax investment, whereas an IRA is set up by an individual with after-tax dollars.

In the previous chapters of our retirement series, we covered the basics of how to save for retirement, like how much you need saved, how much you should save from each paycheck, how to make a retirement budget, and what a 401k is. But in Chapter 6, we’ll be going over the difference between IRA and 401k and how to choose which is best for you.

When it comes to saving for retirement, smart financial planning is a must. Below, we’ll walk you through how IRAs and 401ks work, plus the pros and cons of each.

- Is an IRA a 401k?

- IRAs

- 401ks

- Comparing IRAs and 401ks

- Can You Combine a 401k and IRA?

- Key Takeaways: Differences Between an IRA and 401k

- Retirement Accounts Are Essential for Planning for the Future

Is an IRA a 401k?

You may be wondering: Is an IRA the same as a 401k?

While both IRAs and 401ks provide income for retirement, they are different types of retirement accounts. A 401k is an employer retirement account and an IRA is an individual retirement account.

IRAs

An individual retirement account (IRA) is a tax-deferred retirement savings account set up by an individual rather than an employer. There are several types of IRAs to choose from and many allow account holders to own multiple assets within the account, such as stocks, bonds, real estate, and CDs.

Traditional IRA

A traditional IRA gives you a tax deduction upfront on your contributions and earned interest. You won’t be required to pay taxes on your investment gains until you withdraw your investment, and the amount you pay in taxes will be based upon the distribution age requirements.

Roth IRA

A Roth IRA doesn’t allow you to deduct your contributions. However, since your account is funded with after-tax dollars, you won’t pay taxes on your investments or gains when you withdraw in the future, as long as you meet the age distribution requirements and have held your account for over five years. You’ll also earn compounding interest with a Roth IRA plan, which means your earnings will grow over time just by being in your account.

SEP IRA

If you’re self-employed or own a small business, then a simplified employee pension (SEP) IRA may be a good fit for you. This retirement account offers tax breaks for self-employed individuals and business owners to save for the future.

401ks

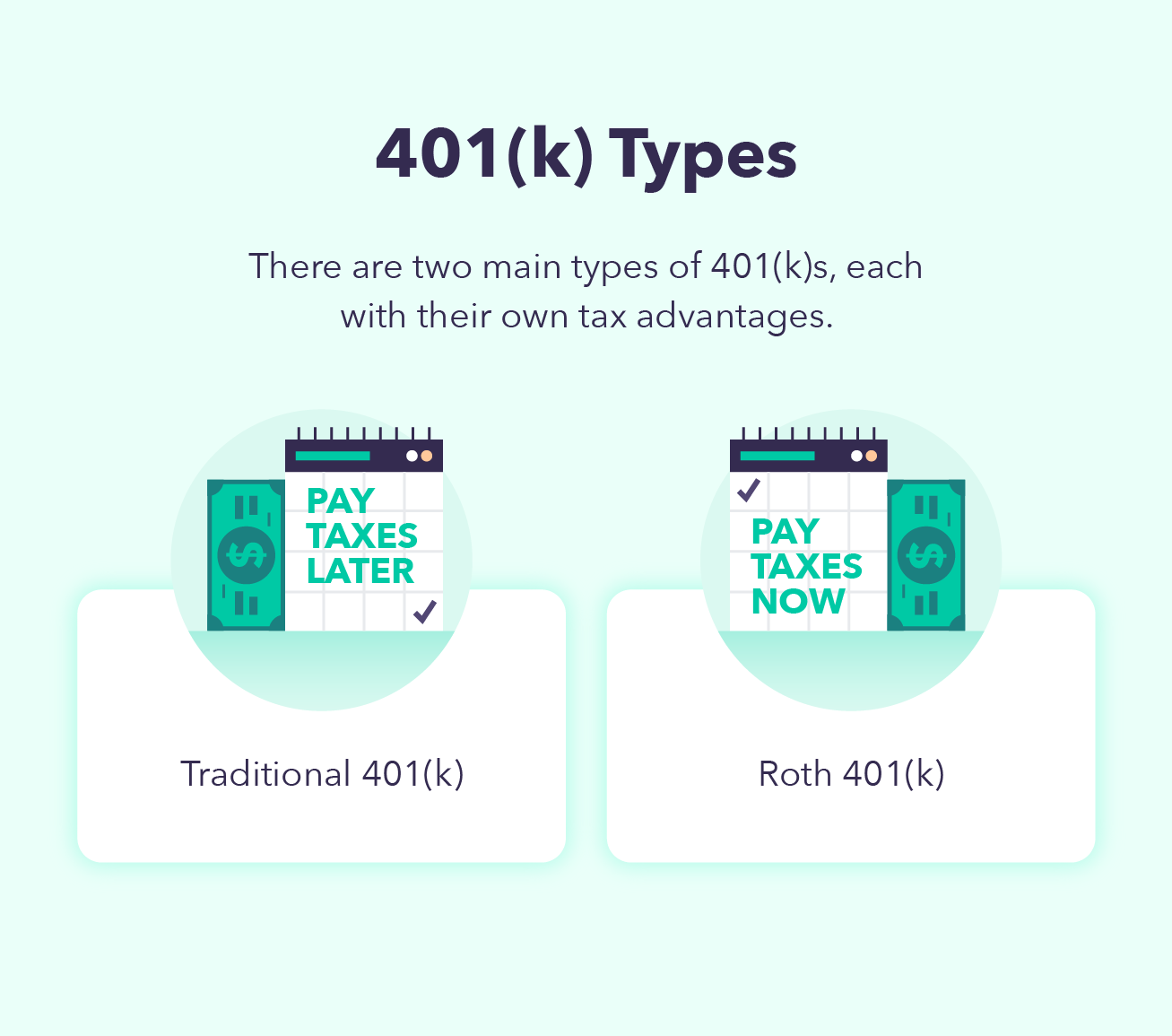

A 401k is a tax-deferred retirement savings account that is set up by an employer. Because this is a company-controlled investment, you have a smaller investment selection than you would with an IRA. In a traditional 401k you’ll invest pre-tax dollars, meaning you can reduce your taxable income as you invest, but you’ll pay taxes on your contributions when you withdraw them.

Typically, you should also avoid cashing out your 401k prior to retirement because there are side effects of early withdrawal. The best way to get the most out of your 401k is to keep your money in the account for as long as possible.

Tax-deferred 401k

A tax-deferred 401k allows you to save taxes today and save for retirement. Workers set aside a portion of their pay before federal and state income taxes are withheld, which allows them to lower their taxable income and pay less income tax.

Roth 401k

In a Roth 401k, your funds are removed after taxes, meaning you are paying taxes as you contribute and won’t have to pay taxes when you withdraw your investment.

Comparing IRAs and 401ks

If you’re having trouble deciding between an IRA or 401k, we have good news for you: you can have both! So what are the differences between an IRA vs. 401k?

A 401k typically offers an employer match, meaning you invest more money than you contribute. All of the investments in your 401k are pre-tax investments, meaning that when you withdraw your contributions, you’ll owe taxes on them. Because your 401k is maintained by your employer, you have less of a say in your investments.

While IRA benefits and restrictions can vary, this individual retirement account typically holds after-tax investments, so you will pay no taxes on your money if you withdraw it after age 59 and a half. You’ll have access to a much larger investment selection with your IRA and can grow investments on stocks, bonds, real estate, and CDs.

So, what are the differences between a Roth IRA and a 401k? Let’s break down the differences between a Roth IRA and tax-deferred 401k:

Roth IRA

- How it works: Employer-sponsored and holds pre-tax investments that lower your taxable income.

- Are the contributions taxed?: Yes

- Contribution limits: Contribute up to $6,000 per year (those ages 50 and older can contribute $7,000)

- Are there penalties?: Yes. You’ll be penalized if you withdraw before age 59 ½.

- Are you required to make withdrawals at a certain age?: No, you are not required to withdraw money at a certain age.

- Pros:

- Access to a large investment selection

- Contributions can be withdrawn anytime

- Cons:

- Lower contribution limits

- No immediate tax benefit for contributing

401k

- How it works: Holds after-tax investments and doesn’t require tax payments if you withdraw after age 59 ½.

- Are the contributions taxed?: No

- Contribution limits: Contribute up to $20,500 per year (those ages 50 and older can contribute $27,000)

- Are there penalties?: Yes. You’ll be penalized if you withdraw before age 59 ½.

- Are you required to make withdrawals at a certain age?: Yes. After age 70 ½ you’re required to withdraw a certain amount.

- Pros:

- High annual contribution limit

- Eligibility is not limited by income

- Cons:

- Employer controls plan and investment costs

- Distributions are taxed

It’s important to know the difference between Roth IRA and 401k so that you can make an informed decision of which is right for you. You should also consider making a financial plan that outlines which type of retirement investment accounts you’ll use so that you can stay on top of your savings.

If you need help with retirement planning, you can use a retirement calculator, which will show you exactly how much you need to save to make your retirement dreams come true.

Can You Combine a 401k and IRA?

Both 401ks and IRAs are essential investment accounts you should consider to prepare for retirement. And while you don’t need to have both, it’s definitely an option.

In fact, many people choose to combine a 401k and an IRA so they can keep better track of their savings and make sure their investments are working. However, if you’re just starting to invest, it might be a better idea to start with one so you can get an idea of how it works before you take on both.

Investing can get intimidating, so be sure to read up on retirement investment terms before you open an account.

What Is Best for You?

If you’re still wondering which retirement savings account is best for you, we’ve got you covered with these frequently asked questions and answers.

Should I take advantage of my company’s 401k?

If your company offers a 401k with a company match, you may want to consider setting up your 401k and contribute the match amount if you can afford it. Why? It’s free money that your employer is giving you for retirement, so you may as well take advantage of it.

Just make sure you avoid the common investing mistake of counting your employer’s match towards your maximum contribution.

What if I have leftover funds to invest after the 401k match?

Once you’ve met your company’s 401k match, you can start taking a look at IRA options to diversify your investment portfolio. Having multiple retirement savings accounts isn’t for everyone, though. If the thought of having two is overwhelming, you can stick to the 401k and contribute more than your company match, although there are 401k contribution limits.

How do I decide which IRA to open?

If you do decide to diversify your investments, you’ll need to decide which IRA you’d like to open. Remember that your Roth IRA will be after-tax dollars, so you won’t pay any taxes when you withdraw your investment and gains in retirement.

Since your traditional IRA functions more similarly to a 401k, you can reduce your taxable income today, but you’ll pay taxes on your investment and gains in the future.

Is it beneficial to have an IRA and a 401k?

While having both an IRA and a 401k might seem overwhelming, it can be very beneficial. Having both retirement accounts can help you maximize both your savings and your tax advantages. It can be a great way to diversify your investment portfolio as well as grow your earnings.

Key Takeaways: Differences Between an IRA and 401k

- A 401k is an employer retirement account and an IRA is an individual retirement account.

- A traditional IRA gives you a tax deduction upfront on your contributions and earned interest.

- A Roth IRA doesn’t allow you to deduct your contributions.

- A tax-deferred 401k allows you to save taxes today and save for retirement.

- You can combine a 401k and IRA.

- In a Roth 401k, your funds are removed after taxes, meaning you are paying taxes as you contribute.

- If your company offers a 401k with a company match, you should set up your 401k and contribute the match amount.

Retirement Accounts Are Essential for Planning for the Future

In addition to having retirement accounts, having a high savings rate–which is essentially how much money you save each month compared to your gross income–can also be highly beneficial.

Retirement accounts are essential for financial success and so that you can have a solid amount of money saved up when you retire. With a better understanding of an IRA vs. 401k, you can move onto Chapter 7, where we’ll cover the differences between a 401 vs. 403b.

This is for informational purposes only and should not be construed as legal, investment, credit repair, debt management, or tax advice. You should seek the assistance of a professional for tax and investment advice.

Third-party links are provided as a convenience and for informational purposes only. Intuit accepts no responsibility for the accuracy, legality, or content on these sites.

Comments

Post a Comment

We will appreciate it, if you leave a comment.