Though they all may just look like a piece of plastic, not all credit cards are the same. For example, there are secured credit cards and unsecured credit cards. But how are they different beneath the surface and how do you choose a secured vs. unsecured credit card?

So what’s the difference between a secured and unsecured credit card? In this post, we’ll help you find out. Keep reading to learn more about the pros and cons of each and how to choose between them.

What Is a Secured Credit Card and How Does It Work?

A secured credit card is a credit card that requires a cash deposit—or security deposit—as collateral to open the account. Once you’ve deposited the required cash, you can use a secured credit card anywhere a traditional unsecured credit card is accepted.

If you have a low credit score or no credit history, you’ll probably start off with a secured credit card. Similar to an unsecured credit card, you’ll be billed monthly for how much you spend in a time period. If you don’t pay your bill in full, you’ll incur interest charges on your remaining balance.

Oftentimes, your cash deposit will be your credit limit, so if you deposit $300, you’ll have a $300 credit limit to spend. Unlike a prepaid debit card, using a secured credit card can help you establish or rebuild credit if you cannot get approved for an unsecured credit card.

What Is an Unsecured Credit Card and How Does It Work?

An unsecured credit card is a credit card that doesn’t require any collateral to open it. Unsecured credit cards are the most common type of credit card and provide you with credit based on your credit history, ability to pay, and other application information.

Because you aren’t providing the card issuer with any collateral, the interest rate you pay will depend on your credit history. Much like a secured credit card, you can also use an unsecured credit card to build credit.

If you want a credit card with low interest rates and attractive rewards programs, an unsecured credit card is right for you. Like a secured credit card, you’ll be billed monthly and will incur interest on your unpaid balance.

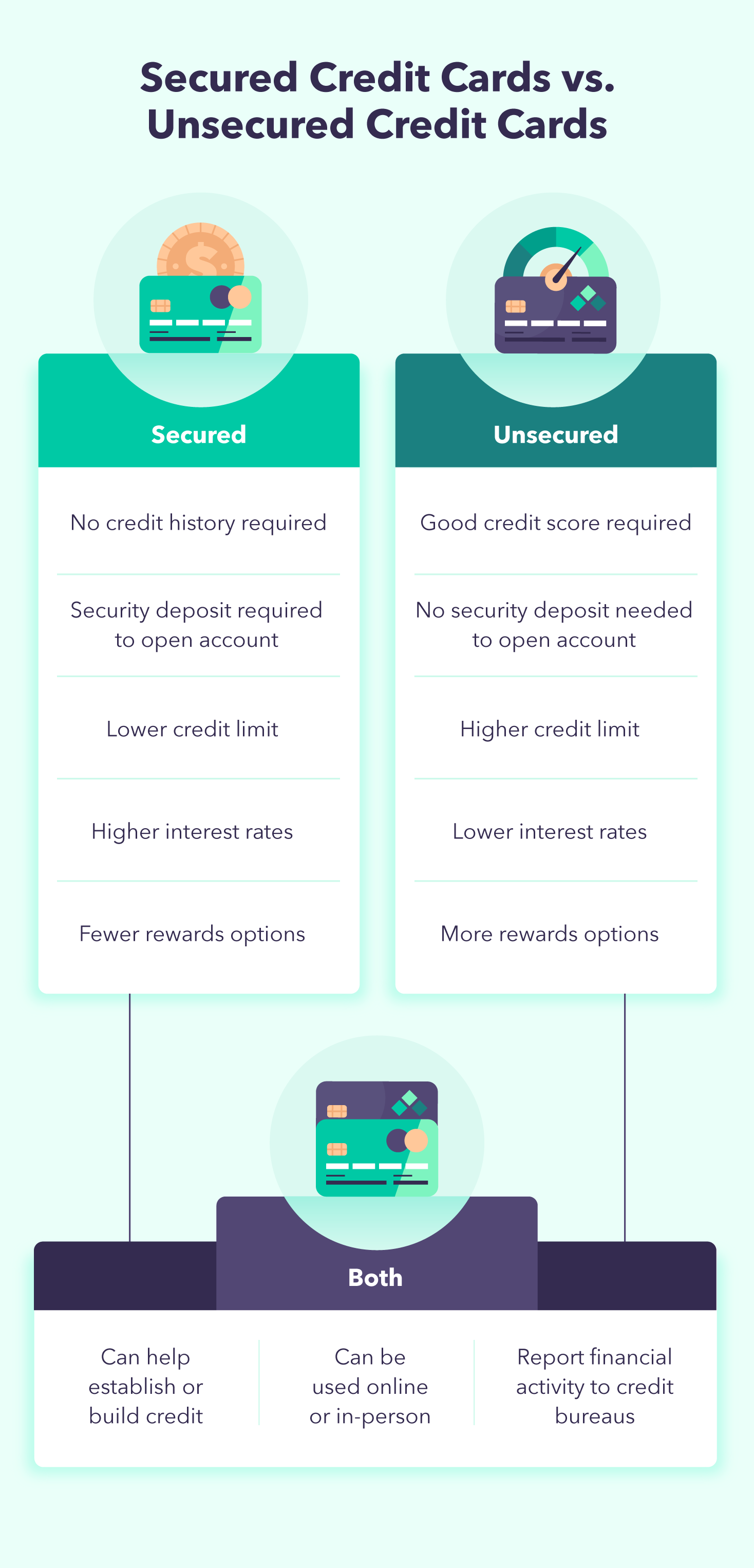

Secured Credit Cards vs. Unsecured Credit Cards: Key Differences

Beyond collateral and interest rates, there are more considerations to weigh when choosing whether an unsecured vs. secured credit card is right for you. Let’s dive into the key differences.

Application Approvals

While your approval is never guaranteed, getting approved for a secured credit card is often easier. This is because secured credit cards are available to those with little to no credit history, whereas many unsecured credit card companies may require you to have a credit score of 670 or higher to qualify.

With so many different credit cards to choose from, it is essential to remember that each one will have its own policies and requirements for approval.

Deposit Requirements

When applying for an unsecured credit card, no deposit is required. On the other hand, secured credit cards require a cash deposit to help back up your credit limit and protect the card issuer. This is one of the most significant differences between secured credit cards vs. unsecured credit cards.

The minimum deposit requirement for a secured credit card is typically around $200 and can range to upwards of $3,000. While your deposit is usually equal to your credit limit, certain cards may require you to make a greater deposit than your credit limit.

APRs and Fees

When selecting a credit card, you’ll notice that different cards will have different annual percentage rates (APR). The APR is how much it costs to borrow money for your credit card.

If you’re applying for an unsecured credit card, your APR will vary depending on your credit score. For example, the APR on an unsecured card may range from 15.99 percent to 24.99 percent. If you have a higher credit score, you’ll get a lower APR.

Unlike an unsecured credit card, a secured credit card may offer cardholders a fixed interest rate. Because of this, your APR may be closer to 25 percent, which is significantly higher than the average advertised APR of 19.62 percent.

In addition, whether you choose a secured or unsecured credit card, you may need to pay an annual fee. While not every card has a yearly fee, prices can range from $35 to over $500. This fee will show up on your credit card statement once per year and can vary based on your card’s benefits and rewards.

Rewards

One of the many reasons people use credit cards is for their rewards. Common credit card rewards include:

- Cash back

- Travel miles

- Points

While some secured credit cards offer rewards such as cash back, unsecured credit cards tend to provide more options when it comes to rewards.

Credit Reporting

All unsecured credit cards report your account activity to at least one of the main credit bureaus every month. The main credit bureaus include:

- Experian

- Equifax

- TransUnion

The difference in secured and unsecured credit cards is that not every secured credit card reports your activity to the credit bureaus. If establishing or rebuilding credit is your top priority, choose a card that reports your account activity to at least one of the three major credit bureaus. Your secured credit card can help you establish and rebuild your credit when you use it responsibly.

Building Credit with Secured vs. Unsecured Credit Cards

Whether you’re using a secured or an unsecured credit card, how you build credit is essentially the same. To help increase your credit score, try:

- Asking to increase your credit limit.

- Paying off your monthly bill in full.

- Making your payments on time.

To help determine your credit score, your credit card issuer will report your financial activity to credit bureaus.

Some of the primary information reported includes your:

- Personal identifying information

- Account balances

- Payment history

- Credit utilization

Whether you use a secured or unsecured credit card, you can build credit as long as your card issuer reports your financial activity to the credit bureaus. However, if you can’t gain approval for an unsecured credit card, then a secured credit card may be the best next step for establishing or building credit.

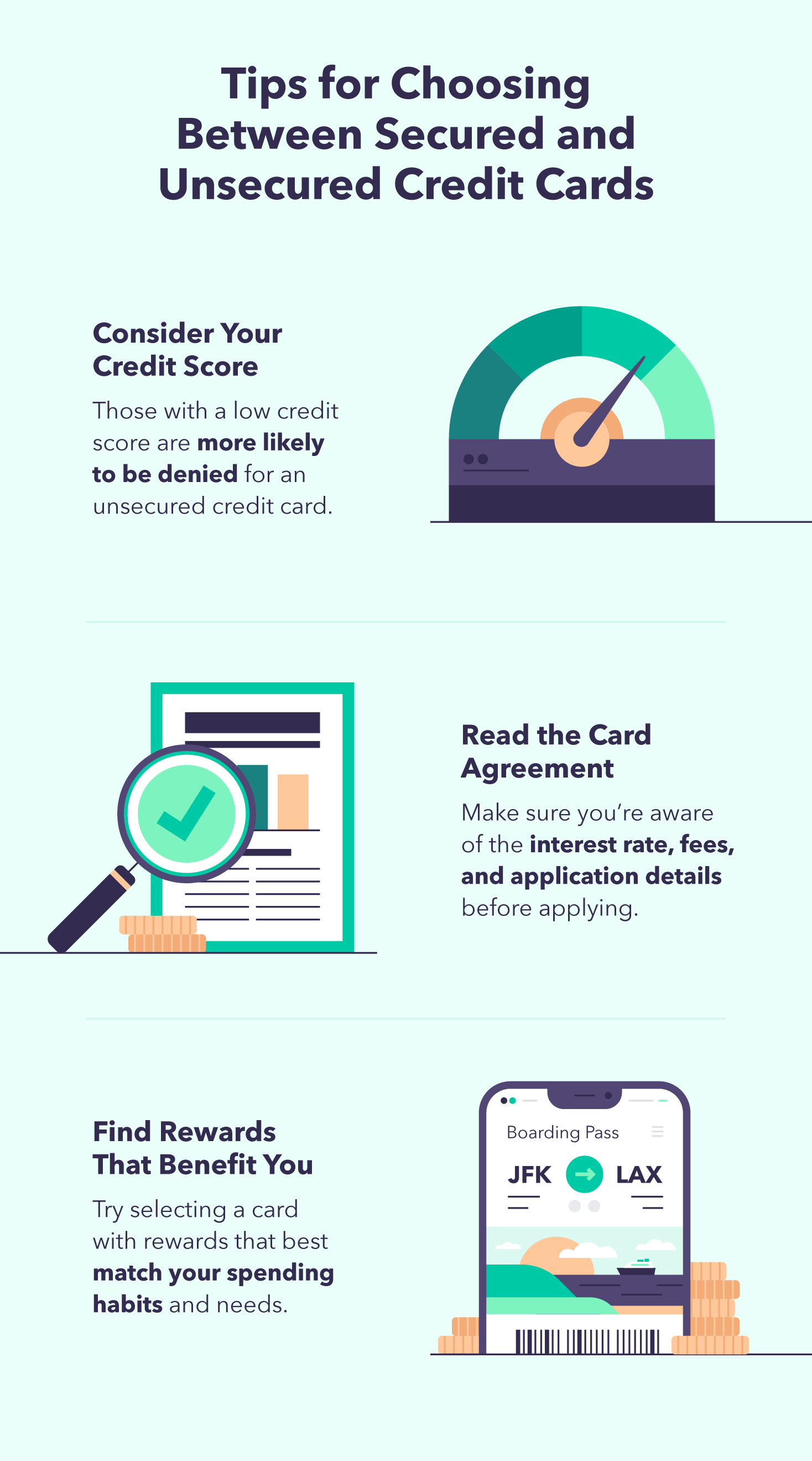

How to Choose Between a Secured and Unsecured Credit Card

After learning the differences between a secured and unsecured credit card, you’re probably wondering how to choose between the two. If you’re new to credit cards, need to establish a credit history, or rebuild a bad credit score, a secured credit card may be best for you.

On the other hand, if you have an established credit history and a good credit score, sticking with an unsecured credit card is a great way to access lower interest rates, a higher credit limit, and better rewards. In addition, you’ll get more reward opportunities for unsecured credit cards that best fits your credit and spending needs.

Whether this is your first time getting a credit card or you’ve been using them for years, it is important to stay on top of your finances. After choosing between a secured vs. unsecured credit card, thoroughly understanding your credit card agreement and making timely payments is essential.

Sign up for MintSecured vs. Unsecured Credit Card FAQs

Still unsure which option is best for you? Find the answers to some common questions when comparing a secured vs. unsecured credit card.

While secured credit cards have a lower barrier to entry than most unsecured credit cards, no option is necessarily better or worse for your credit score. Because of this, it comes down to personal choice and whether you can meet the minimum deposit requirement for a secured credit card or have a high enough credit score for an unsecured card.

The main difference between secured and unsecured credit cards is the cash deposit you have to make upfront. In addition, you’ll most likely pay a higher interest rate than if you choose an unsecured card. On top of that, your spending limit will be much lower and depends on the amount of money you deposit when signing up.

Someone may choose to use a secured credit card if they have bad credit or no credit at all. Unlike an unsecured credit card, secured credit cards are offered to those with little to no credit history and give them the opportunity to establish or rebuild their credit.

The key difference between a secured credit card and a prepaid debit card is that you’re using money borrowed from the issuer rather than your own money when you use a secured credit card. This allows you to build credit, something you can’t do with a prepaid debit card.

You’ll get your security deposit back as long as you close your account with your balance fully paid off. You may also get your deposit back if you upgrade to an unsecured credit card from the same issuer.

Also, it’s important to note that every credit card is different. To be safe, check your card’s specific terms and conditions to learn more about getting your deposit back.

While it may be quicker for you to get approved for a secured credit card, it will not help you build credit any faster than an unsecured credit card. To help improve your credit quickly, try to pay off your credit card debt in full and on time every month.

The post Secured vs. Unsecured Credit Cards Explained: Which Is Right For You? appeared first on MintLife Blog.

from MintLife Blog https://ift.tt/DR7Ailg

Comments

Post a Comment

We will appreciate it, if you leave a comment.