I use Avail to manage my two rental units. Here’s my full review…

Rental properties are a great passive income source. Not many will disagree with that. Leasing out units is a fairly low-effort side hustle that can scale as you wish.

If you’re after passive income, like me, chances are you’ve considered investing in real estate.

But not everyone pushes through. Oftentimes, the issue people have with owning rental property is property management.

And we’ve all heard the horror stories of tenants not paying rent, damaging your property, or the difficulties of finding tenants to begin with.

These hassles are enough for budding investors to give up on real estate altogether.

The platform “Avail” (Avail.co) offers a solution. Their goal is to level the playing field by helping individual landlords mirror the property management capabilities of large investors.

But is listing your property with them worth your time, or are there better alternatives?

I think Avail is the best property management software for the upstart/small landlord…perfect for your first property. With it you can list your property, screen tenants, collect rent, and analyze your rental property business. All for free or $5/mo/unit for their premium features.

Let’s explore more in our full review of Avail.

What is Avail?

Avail is an all-in-one property management solution for individual landlords.

They were acquired by Realtor.com in the past few years and they cover the entire property management cycle, including listing, screening, leasing, payments, and maintenance.

We’ll cover each step in more detail and see how Avail’s features stack up.

The Property Management Cycle

As a real estate investor, the grind doesn’t end after buying a property. That holds true for any type of investor.

Real estate flippers turn around to sell, value investors do a rehab on the property before renting it out, others like buying turnkey, and some do a combination of various strategies.

Each rental property will go through the following steps if you intend to be a landlord.

Step 1. Listing the Property on Avail.co

When the property is ready to be rented out, landlords will obviously need a way to advertise it to potential tenants. But what isn’t so clear are the various ways to market the property.

We can lump them into three buckets: (1) Large listing sites, (2) Having your own website, and (3) Referrals from your network of investors.

All three buckets are available on Avail. This flexibility is a huge reason why Avail excels at listing properties.

Avail’s partner listing sites are a mix of large and small websites nationwide, including Zillow, Trulia, Hotpads, Apartments.com, and many more.

Next, say you’re keen on having a dedicated website for your property.

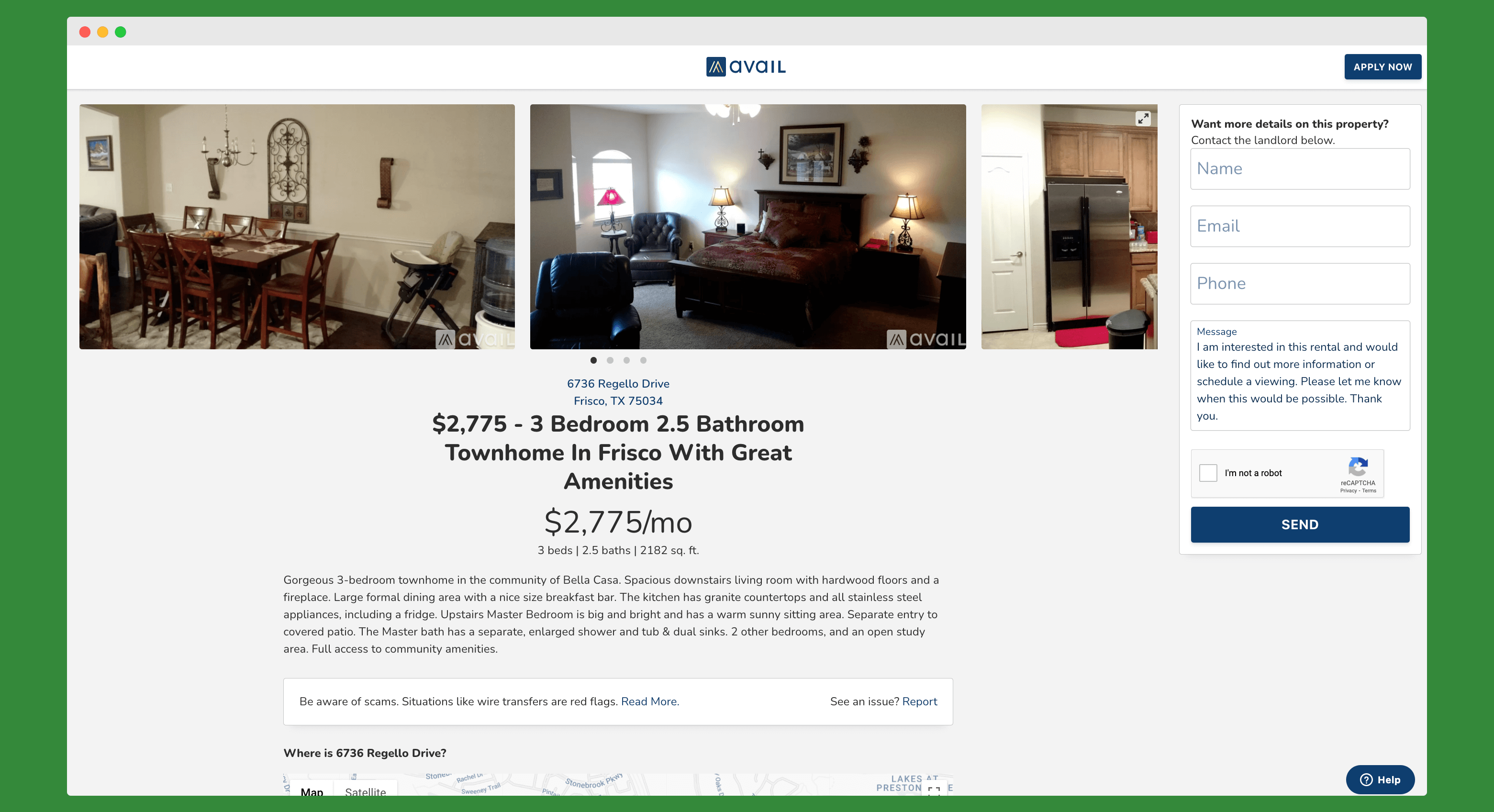

If your property has its own landing page, that can differentiate it from comparable options. And differentiation is often the key to standing out in a market of marginally distinct rental units. Here’s one of my landing pages:

The third tenant source is your network of investors. This is likely the least probable source.

However, don’t underestimate the quality (i.e., length of stay, ability to pay, willingness to pay) of referrals that come this way.

You will want to establish your network of investors anyway, and Avail can help by connecting you to other landlords via their online community.

Step 2. Screening and Onboarding Tenants Using Avail

The screening and onboarding features are an underrated yet essential feature of Avail.

Many aspiring landlords make the mistake of accepting every tenant. But the quickest way to end your career as a real estate investor is to take on bad tenants.

Not only can they damage your property, but they can force your hand, and eviction processes can be expensive. Not to mention the trauma that comes from dealing with toxic tenants.

Avail helps you screen prospects with tenant-initiated credit reports and background investigations. These checks include the prospect’s criminal history, prior evictions, and income documentation and verification.

Step 3. Rent Collection and Lease Enforcement with Avail

Making sure your tenants pay rent on time is another aspect Avail excels in.

You can set rent reminders and notifications (with tenant messaging), receive direct-deposit online payments, and have auto-generated payment receipts.

These automation capabilities massively make the lives of new landlords easier. In terms of efficiency, Avail’s paid plan has added features that we’ll cover below.

Avail’s customizability is top-notch, with a digital leasing tool that lets you draft, send, and receive electronic leases.

Landlords can upload their own lease clauses, either an amended version of the template made by Avail or a totally new one. With their templates, you can get state-specific rental agreements or tailor-made clauses.

I have my own lease I’ve been using for a while, but I’ll be using Avail’s lease agreement template to compare.

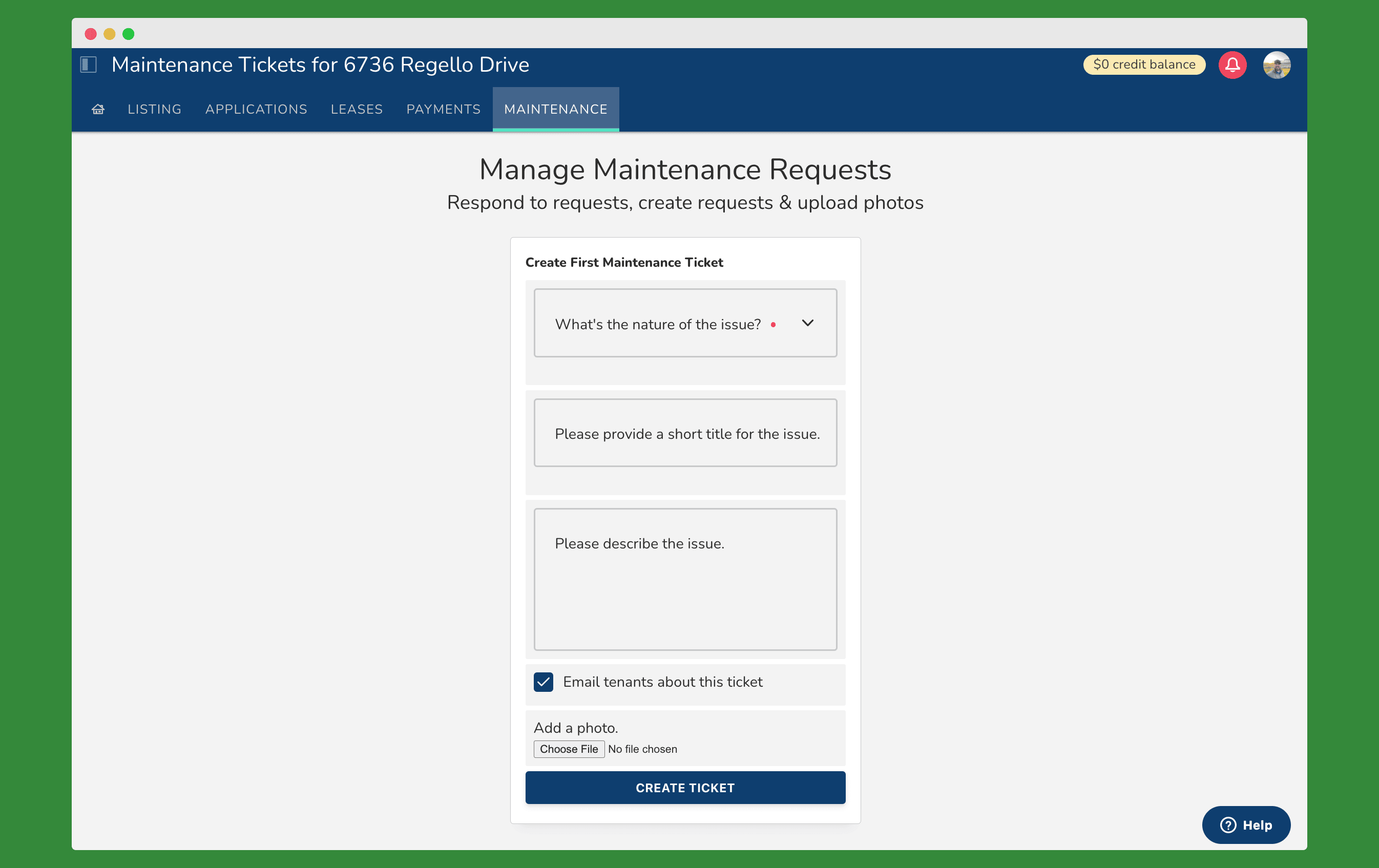

Step 4. Ongoing Maintenance Request Management Through Avail

Justified or not, many tenants will notify you about all kinds of things. Dealing with complaints can be really stressful, too.

Fortunately, Avail’s maintenance reporting features somewhat mitigates this stress.

The app streamlines the process with online maintenance tickets where tenants can upload photos of the issue, exchange messages with the person in charge, and keep a record of updates.

Other Important Considerations

But Avail is much more than just an intermediary platform between landlords and tenants.

For instance, their education section provides helpful content for aspiring investors, covering topics like rental property renovations, maintenance, and rent collection. They also have a fantastic forum.

In a nutshell, if it’s a part of the rental cycle, it seems the team at Avail intends to have a solution for it. Avail is also a dynamic platform that listens to users’ feedback.

Avail Reporting and Analysis

For more advanced users, the platform helps you calculate the cap rate, cash-on-cash return, GRM, and IRR of your next rental property. See if your planned purchase makes sense with their free rental property calculator tool.

Avail also recently released a rental property accounting feature to make bookkeeping for landlords easier.

Customer Feedback on Avail

One vital point that’s not reflected in snapshot reviews of Avail is how they constantly update their platform. In fact, if you look at past reviews, some of the app’s disadvantages no longer apply or are at least less relevant today.

For instance, the rental property accounting features they’ve recently added used to be a weakness of the platform. It remains to be seen if execution is good. But this goes to show how Avail actively listens to its users.

I think this is an underrated feature of Avail or any app for that matter. In reality, we only know if a platform works for us after some hands-on experience.

Avail’s assurance through their fantastic customer feedback makes new landlords less anxious about diving into the platform — users know their feedback will be accounted for.

Avail Pricing: Free vs. Unlimited Plus

The platform has a free offering where landlords can post an incredibly generous unlimited number of units. Their Unlimited Plus offering, though, is decently priced at just $5/unit per month.

To help you decide, here are some of the additional features of Unlimited Plus:

- ACH fees are waived for tenants, and this is displayed as “waived by landlord.” For free users of Avail, ACH fees are charged to tenants.

- FastPay for next-day payments is activated. This is an upgrade from the standard 3-day process on deposits via ACH.

- You can integrate custom questions on tenant applications, personalizing them based on the specific needs of your unit. Full customization of clauses before sending them to the tenant to sign is also available.

- Unlimited Plus users can upload more pictures, which automatically syncs across other listing websites. Paying users can also have a unique website or landing page for the property.

- If you’re undecided, there’s little reason not to try the free tier either. The free plan includes syndicated listings to Avail’s partners, credit and criminal screening, state-specific leases, online payments, and maintenance tracking.

The Unlimited (free plan) and Unlimited Plus features are summarized here.

Is Avail Right for You?

Avail is often marketed as a solution for smaller, individual investors.

On the other hand, Apartments.com and Buildium are touted as the superior alternatives to property managers or landlords with a significant number of units.

These two alternatives have optimized their reporting capabilities to suit the needs of medium- to large-scale property managers. Here’s how they stack up:

| Rent Collection | $2.50 ACH Fee 3.5% Fee for Credit or Debit Card |

Free ACH 2.75% Fee for Credit Card |

$1.00 EFT Payments 2.95% Fee for Credit Card |

| Deposit Time | 3 Days | 4-5 Days ACH 3 Days Express |

1-2 Days |

| Restrict Partial Payments | Yes | End of Lease | Yes |

| Multiple Deposit Accounts | Yes | Yes | Yes, for an Extra Fee |

| Auto Late Fees | Fixed or % | Fixed | Fixed |

| Background Check | $30 ($22.50 if bundled) | $29.00 + tax | Included |

| Credit Check | $30 ($22.50 if bundled) | $29.00 + tax | Part of Screening (Above) |

| Digital Lease | Part of Paid Plans | No | Available |

| Renter's Insurance | Available | Available | Available |

| Best For | New Landlords | Multi-Unit Landlords | Full-Time Landlords |

| Free Account | Free Account | Free Trial |

Due to its pricing, customizability, and excellent customer service, Avail is my preferred recommendation for newcomers and current investors who’ve yet to try an all-in-one property management tool.

But that’s also not saying Avail isn’t a good option for larger property managers. With a complete ensemble of property management features, it’s easy to recommend Avail.

Ultimately, property management should be as unobtrusive as possible. I would argue the goal is to achieve financial freedom, not become full-time property managers.

Your time is much better spent looking for deals rather than managing your properties. And to this end, Avail is a set-and-forget property management solution, making it a fantastic option for real estate investors.

The post Avail Review 2022 | Best for New Landlords? appeared first on Part-Time Money®.

from Part-Time Money® https://ift.tt/Xcyd2HU

Comments

Post a Comment

We will appreciate it, if you leave a comment.