Many personal finance apps specialize in specific tasks like saving money, earning a high-interest rate, paying bills, and potentially earning spending rewards. Finding one platform offering both banking and investing accounts can be challenging.

That’s not the case with Albert. Albert can help you save, invest, and receive hands-on financial guidance with a single app. This Albert app review dives into the various features that can help improve your finances, potentially for free.

Table of Contents

What Is Albert?

Albert is a personal finance app for Android or iOS devices powered by Sutton Bank, a member of FDIC. You can open an FDIC-insured savings account (up to $250,000 in coverage) and a SIPC-insured brokerage account ($500,000 coverage limit).

While Albert isn’t a banking app, you may consider it as a supplement to your existing checking account as you can enjoy more features.

Some of the available services include:

- Savings account

- Rewards debit card

- Investing account

- Budgeting tools

- On-demand, personalized money advice

You can open an account if you’re at least 18 years old, a U.S. resident or citizen, and have an existing bank account.

This external bank account is necessary to qualify for amenities such as cash advances, automated savings, and opening an investing account.

Unfortunately, this service doesn’t provide kids debit cards, so it won’t be the best finance app for your entire family.

Albert Pricing

There is a free and premium version of Albert. The free version lets you enjoy the following features:

- Banking account

- Cash rewards debit card

- Cash advances (2-3 days delivery speed)

- Recurring savings

There are no minimum balance requirements or monthly maintenance fees to use the app’s banking and savings tools. You can also avoid cash advance fees on balances below $100 through Albert Instant. However, a $4.99 fee may apply for instant advances between $100 and $250.

The service also accepts optional tips if you wish to make a one-time donation.

Albert Genius

Becoming a paid Genius subscriber gets you access to fee-free ATMs, advanced budgeting and savings tools, Albert Investing, and personalized financial advice.

An Albert Genius subscription costs between $6 and $16 per month. You pay what you decide is fair. Purchasing a yearly membership can give you a discount that deposits into your Albert Cash account.

Best Albert Features

Albert Cash

Albert Cash is similar to a free online checking account. There are zero balance requirements or maintenance fees.

You will receive a physical and virtual debit card to help you make purchases, and you could earn a $150 bonus from Albert when you receive a qualifying direct deposit and use your Albert debit card.

Your online spending account includes these perks:

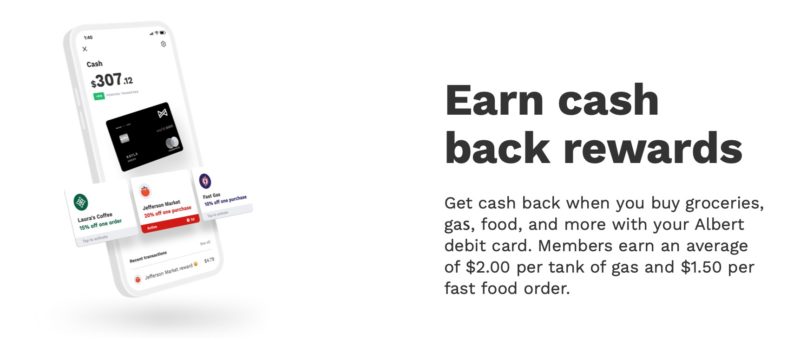

- Earn up to 20% cash back on debit card purchases

- Receive direct deposits up to two days sooner

- Up to $250,000 in FDIC insurance from partner banks (i.e., Coastal Community Bank and Wells Fargo, N.A.)

A Genius subscription is necessary if you want to access the 55,000+ fee-free AllPoint ATMs for cash withdrawals, and fees can still apply for non-network ATM withdrawals.

Along with offering a free spending account, Albert can analyze your linked accounts and categorize your expenses to look for spending trends. In addition, real-time alerts can notify you of your latest transactions and current account balance to avoid going into an overdraft.

The service can also monitor your linked accounts for overdraft fees, late fees, and other hidden charges that can be easy to overlook.

Albert Savings

You may also consider joining Albert just for its automated savings tool, which is similar to Digit. Albert Savings can help you effortlessly schedule recurring withdrawals with a fixed dollar amount from your spending account to build a small nest egg.

Your saving frequencies can include:

- Weekly (each Monday)

- Twice-monthly (on the 1st and 15th)

- Monthly (the first business day each month)

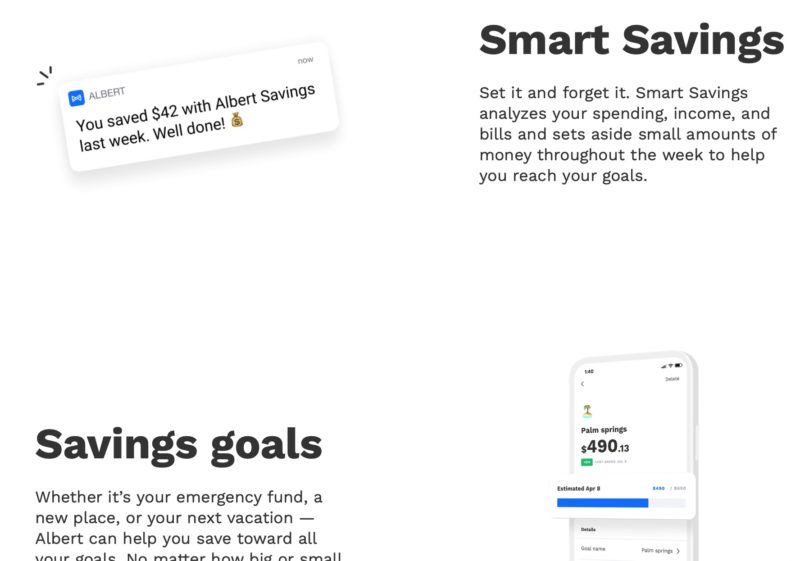

Premium subscribers can enroll in the Smart Savings plan, which analyzes their linked account daily. Then, the app initiates a “safe withdrawal amount” between $5 and $100 per week (up to three transactions per week).

All saving deposits deposit into your designated savings goal and receive a monthly savings bonus, similar to earning interest.

The annual savings bonus is 0.25% for Genius members and 0.10% for free members (May 2, 2022).

This savings rate isn’t as high as a high-yield savings account. Still, it can be an attractive incentive to save more money each month.

Albert Savings vs. Digit

There are several similarities between Albert and Digit.

For example, Digit can analyze your spending to automate savings but only costs $5 per month ($6 for Albert Smart Savings). You also get a bank account, debit card with fee-free ATMs, and an investing account. Digit offers tax-advantaged retirement accounts (Albert only offers taxable brokerage accounts).

Albert might cost a tad more per month than Digit, but your debit card earns cash back. You can also ask financial questions and may also provide more budgeting insights to optimize your spending plan.

Both services have a 30-day risk-free trial period.

If your finances are tight, Albert can be the better option as you can schedule recurring deposits of a fixed dollar amount with the free plan. It’s not quite the same as Smart Savings, but you still earn saving rewards.

Cash Advances

The Albert Instant feature provides up to $250 in cash advances when you receive qualifying direct deposits in a connected bank account. Your advance limit can be lower if you earn a smaller income.

You can request up to three cash advances per pay period. Then, when payday arrives, Albert deducts the advance amount from your direct deposit before it reaches your account.

If you choose the standard delivery speed, there are no fees, and you will receive your cash advances within three business days.

Instant cash advances don’t have any upfront fees, but a repayment fee of $4.99 applies.

No cash advance incurs interest charges. You also won’t pay late fees if you can’t repay the total advance amount on the scheduled repayment date.

Albert Investing

Genius subscribers can also open a taxable non-retirement investing account.

You can self-manage your account by investing in stocks and ETFs. The investment options can include index funds, ESG investments, and sector ETFs for a customized portfolio.

A more appealing option can be the automated Portfolios by Genius features. You can choose an aggressive, moderate, or conservative risk tolerance, and the platform holds corresponding funds.

The app lets you invest for different financial goals to help customize your asset allocation.

It’s possible to schedule recurring investments or manual contributions.

There are no trading fees, and the minimum investment is $1.

This platform can be an excellent option to invest your first $1,000 with an easy-to-use platform. You can ask the financial experts basic investing questions that other investing apps may not answer.

However, experienced investors may prefer a different online brokerage with advanced research tools and stock screeners.

Albert Genius

Activating Genius is necessary if you want full access to the Albert app. A monthly subscription can cost as little as $6 per month, competitive with similar personal finance services.

Genius members can invest and also get fee-free ATM withdrawals. Here are some of the other premium features worthy of the spotlight.

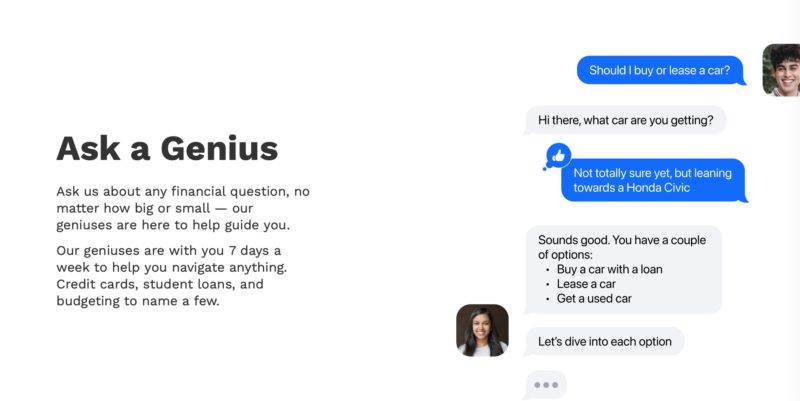

Personalized Money Advice

The most valuable benefit can be receiving personalized money advice from financial experts. Many questions focus on these money topics:

- Budgeting

- Insurance

- Investing

- Life events

- Paying off debt

- Saving

- Student loans

- Travel miles

You can text your questions to the Genius hotline and chat back and forth. This service is cheaper than paying for one-time advice packages. The experts can also analyze your linked accounts to provide hands-on help depending on the question.

Budgeting Tools

You can make a spending plan after Albert analyzes your income and expenses. The app can help you prioritize your core expenses like debt payments, utilities, and groceries.

Then, you can allocate additional funds for non-essential expenses, giving, and putting money into your savings account.

Bill Reduction

The service can recommend subscriptions to cancel or reduce to lower your monthly spending if you don’t have the time (or desire) to renegotiate your bills, Albert partners with Billshark to do the dirty work. A one-time fee applies for each successful bill reduction or cancellation.

Insurance

Albert can also help you save money by finding cheaper insurance premiums for these products:

- Car insurance

- Renters insurance

- Homeowners insurance

- Term life insurance

Performing an annual insurance review can ensure you’re paying the best price for your coverage. In addition, use this time to determine whether you have enough insurance.

Smart Savings

Once again, you may be able to reach your savings goals sooner by enabling Smart Savings with the Albert Save feature. The app analyzes your account balance and transactions to withdraw a safe amount up to three times per week.

This customized savings amount varies by week but can be more than a fixed recurring amount that you may think is enough.

You also earn the enhanced saving bonus (0.25% instead of 0.10%).

Albert Pros and Cons

Pros

- The number of free and premium savings tools

- Spending and investment accounts in the same app

- Financial experts provide personalized advice

- Cash advances up to $250

Cons

- Monthly fee charged for some key features

- No phone support

- No tax-advantaged retirement account

Albert Alternatives

These financial apps offer many overlapping features, but their unique strengths can make them a better fit, depending on what you’re looking for.

Here are a few alternatives to Albert and what they offer:

Digit

Consider Digit if you want a personalized savings and budgeting app. You also get a spending account, debit card, and investing account for $5 per month. To learn more, read our full Digit review here.

Cash App

The Cash App can be valuable if you want free online checking, rewards debit cards, and commission-free investments. You can also quickly send money to friends and receive direct deposits. However, this app doesn’t provide budgeting tools and automated savings goals like Albert. Check out our full Cash App Review for more details.

Acorns

Acorns is a micro-investing app that lets you round up purchases from a linked debit card or credit card. You can also receive bonus cash by shopping at participating retailers. In addition, you can invest in automated ETF portfolios similar to Albert.

Your monthly fee is either $3 (Individual) or $5 (Family). Both plans offer a taxable investing account and an online banking account.

However, pick the Family plan if you want retirement and custodial investing accounts. This upper tier also provides multiple checking accounts and exclusive offers. Read our Acorns App review to learn more.

Truebill

Truebill offers free and premium budgeting and savings tools. The free version provides a starter budget, spending insights, and a savings account.

A Truebill Premium subscription costs between $3 and $12 per month and includes customized budgeting, complimentary bill negotiation, and personalized savings goals. The app can recommend a specific amount to save each month, similar to Albert Savings. These tools and more help make Truebill one of the best budgeting apps available today.

Current

Current offers free online banking for parents and teens with several attractive features. First, it’s possible to earn a competitive interest rate on Savings Pods. You can also receive cash back at over 14,000 retailers and withdraw money at AllPoint ATMs.

You can also be eligible for up to $250 in overdraft protection. Unfortunately, this platform doesn’t offer in-depth budgeting tools, automated savings, or investment accounts like Albert. Learn more in our Current review.

FAQs

No, Albert is only available for individuals at least 18 years old. There are no household plans, and each person must open an individual account.

The core Albert features are free, including a cash account, recurring savings, rewards debit card, and cash advances. However, you must upgrade to Albert Genius ($6-$16 monthly) to invest, use the Smart Savings tools, and text financial experts.

Genius subscriptions ($6/month or more) are the primary way Albert makes money. They can also earn a small commission when you use your Albert debit card, repay an instant cash advance, or sign up for a recommended insurance policy.

Premium members can send personalized questions by text to financial experts. There is also an online knowledge library for all users. Unfortunately, the service doesn’t offer phone support.

Final Thoughts on Albert

Albert can be an effective solution if you need help with budgeting and investing. Its hands-on tools can also help you effortlessly save money towards your financial goals and get answers to your money questions.

The premium Genius version will give you the best experience. However, the free version can also be worthwhile to access unique features like fee-free cash advances and debit card rewards.

The post Albert App Review: An All-in-One Banking and Investing App? appeared first on Best Wallet Hacks.

from Best Wallet Hacks https://ift.tt/fn9S5mN

Comments

Post a Comment

We will appreciate it, if you leave a comment.