Household Budget Template & Free Tools

Need a budgeting template that can help you plan your household expenses?

We have you covered!

In this post, we’ll show you how to create your household budget using the budget template below, so you can make informed financial decisions for you and your family.

Here are the two core budgeting methods we’ll review in this post:

- Budgeting Using the Household Budget Template: Download the free home budget template which uses the same categories as the Mint app.

- Budget Using the Mint Mobile App: Learn how to automate the household budget template with the Mint app so you can save time.

Sign up for Mint to automate your household budget!

With a quick set up, you can create and manage your home budget for free with Mint.

Budgeting Using the Household Budget Template

Our household budget template is a simple way to create a budget for your home using a simple Excel spreadsheet. With a home budget worksheet, you can learn the basics of budgeting and start to get your household finances in order. To use the template click the “Download” button below.

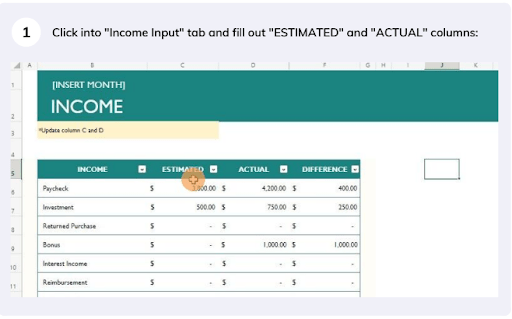

Step 1:

You can get started by clicking the “Income Inputs” tab at the bottom of the spreadsheet, which will bring up a list of income categories. Once you see this page, fill out the “ESTIMATED” and “ACTUAL” columns.

Here you’ll be able to add how much you earn from your various income sources including your paycheck, investments, reimbursements, and more.

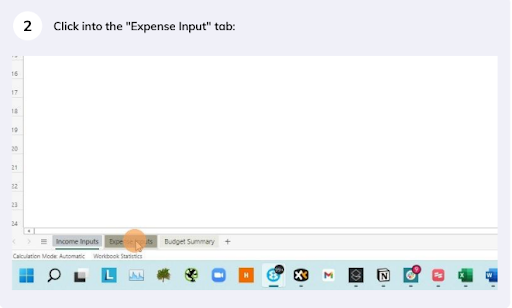

Step 2:

Next, you’ll need to navigate to the “Expense Inputs” tab that’s located just to the right of “Income Inputs”.

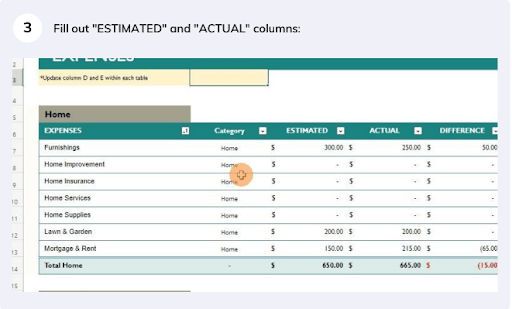

Step 3:

In the “Expense Inputs” tab, fill out the “ESTIMATED” and “ACTUAL” columns just like you did for your income. You’ll find categories including basic home expenses like your mortgage payment, furnishing, and home insurance as well as utilities and child-related expenses.

Note that the categories included in our household budget worksheet are the same as those used in the Mint app. That way you can switch over to an automated budget easily if you want.

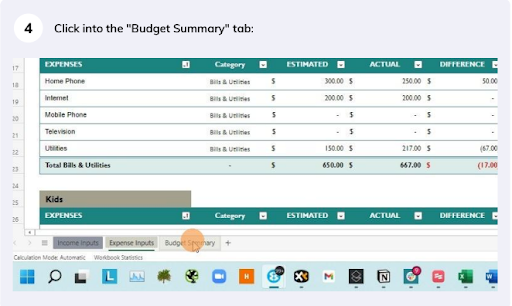

Step 4:

Click the “Budget Summary” tab when you’ve finished adding your expenses. The “Budget Summary” will give you a comprehensive view of your current finances.

Step 5:

The “Budget Summary” tab will automatically populate the data you’ve previously entered. In the “Budget Summary”, you’ll be able to see your expenses vs. income, an expense breakdown by category, and more.

Budgeting Using the Mint Mobile App

You can also use the Mint app instead of the downloadable template to streamline the process. Follow the simple steps below to set up and automate your monthly budget.

Step 1: Create Your Budget

Click “Monthly”. If this is your first time setting up a budget you’ll see a message to “Create a budget”, click the button to get started.

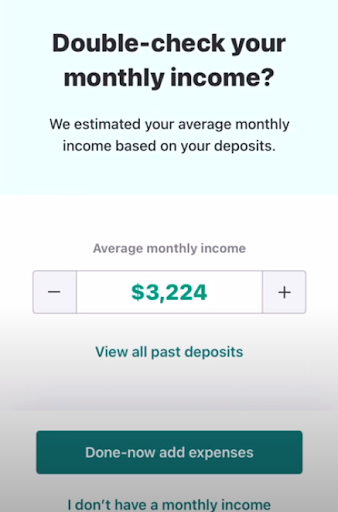

Step 2: Add Your Income

Click “Tell us your monthly income” which will take you to a page where you input your monthly income. If you have your bank accounts connected to the Mint app, this will auto-populate.

Once finished, click “Done–now add expenses”.

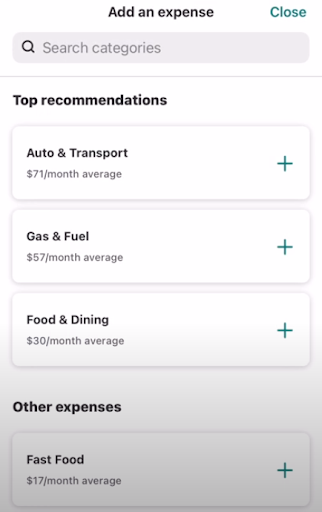

Step 3: Add Your Expenses

Click “Add an expense”. The page will populate with common categories, or you can search for something specific in the bar at the top. There are a wide variety of expenses to choose from.

If you want to mimic the excel template within the Mint app instead, you can use the specific home budget categories we used, which are outlined below.

| Grouping | Category |

| Home | Furnishings |

| Home | Home Improvement |

| Home | Home Insurance |

| Home | Home Services |

| Home | Home Supplies |

| Home | Lawn & Garden |

| Home | Mortgage & Rent |

| Bills & Utilities | Home Phone |

| Bills & Utilities | Internet |

| Bills & Utilities | Mobile Phone |

| Bills & Utilities | Television |

| Bills & Utilities | Utilities |

| Kids | Allowance |

| Kids | Baby Supplies |

| Kids | Babysitter & Daycare |

| Kids | Child Support |

| Kids | Kids Activities |

| Kids | Toys |

| Auto & Transport | Auto Insurance |

| Auto & Transport | Auto Payment |

| Auto & Transport | Gas & Fuel |

| Personal Care | Dentist |

| Personal Care | Doctor |

| Personal Care | Gym |

| Personal Care | Health Insurance |

| Food & Dining | Groceries |

| Food & Dining | Coffee Shops |

| Food & Dining | Fast Food |

| Food & Dining | Restaurants |

| Food & Dining | Alcohol |

| Investments | Deposit |

| Investments | Withdrawal |

| Investments | Dividends & Cap Gains |

| Investments | Buy |

| Investments | Sell |

| Entertainment | Amusement |

| Entertainment | Movies & DVDs |

Select a category for each expense you need to input and add an estimate for how much you spend monthly toward that item. Repeat this process for each expense.

After all expenses are added, click “Continue” in the bottom right corner.

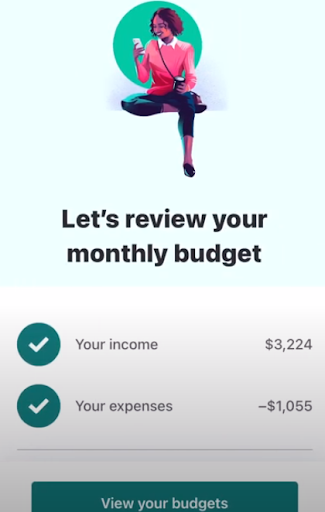

Step 4: Return to the Dashboard

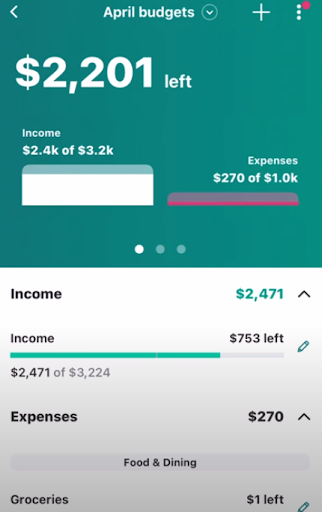

Click “View your budgets” to return to the budget dashboard. Here you’ll see the overview of your budget in one convenient place.

Step 5: Confirm That Everything is Correct

As you scroll through your dashboard, make sure you’ve set everything up correctly with the right numbers for your expenses and income. This will help you ensure your budget is as accurate as possible.

You can ensure the values you’ve input into Mint are accurate by checking them against the actual bills for each expense and income documentation like your paystubs.

Additionally, if anything is categorized incorrectly, you can easily make updates.

Make your household budget for free with Mint.

Get the Mint app to start automating your home budget in a few easy steps.

Household Budgeting Tips & FAQs

What are Some of the Top Household Budgeting Tips?

Here are some budgeting tips to consider when using a monthly household budget template:

- Pay off debt: The sooner you can get out of debt, the easier it will be to save money and work toward our other financial goals. Consider including debt repayment in your household budget.

- Focus on important categories: Before you consider entertainment, you may want to ensure your budget accounts for all the essentials, such as bills, home maintenance, food, and paying off debt.

- Budget together: Complete your household budget worksheet with your partner. Your household budget doesn’t just affect you, so it can be beneficial to ensure everyone has a say in the budget.

What Are the Basic Elements of a Household Budget?

The basic elements of a household budget are income and expenses. Your income is the money you have to work with each month, while your expenses determine how much of that money you have left over. Leftover money can be put toward savings, used to pay off debt, or used to make big purchases you’ve been planning for.

What Is the Best Way to Set Up a Household Budget?

The best way to set up a household budget is to use an app like Mint or a simple household budget template. Using tools that help you quickly create a budget means you save time without compromising the usefulness of your budget.

With Mint, you can automatically track and categorize spending to make budgeting even easier.

What Items Should Be Included in a Monthly Household Budget?

A list of household expenses in the template should include things like home-related costs, grocery, gas, entertainment, and any other expenses you can expect to pay on a regular basis. You should also include any forms of income you have, including everything from money from side jobs to income you receive from the government.

What Are the Characteristics of a Successful Household Budget?

A successful household budget is one that takes everything into account and paints a clear picture of your finances. If you forget sources of income or expenses, your budget isn’t going to be completely accurate. When you’re making a household budget, you might want to look at your recent account statements to see what kind of purchases you’re making on a monthly basis.

The post Household Budget Template & Free Tools [Step-by-Step Home Budgeting Tutorial] appeared first on MintLife Blog.

from MintLife Blog https://ift.tt/RHYXMah

Comments

Post a Comment

We will appreciate it, if you leave a comment.