College Budget Template & Free Tools [Step-by-Step Tutorial]

Looking for a budgeting template to help you plan college expenses?

You’re in the right spot!

In this post, we’ll walk you through how to build a college budget using the budgeting template below to help you take control of your finances.

If you’re a fan of automation. You can also set up the exact same student budget and automatically track your finances over time using the Mint app.

Automatically track your spending over time with the Mint mobile app, or use our college student budget template to input your income and expenses each month. Either way, using a budget can help you start working toward your financial goals.

We’ll cover two ways to go about making your college budget:

- Budgeting Using the College Budget Template: Download the Excel spreadsheet–which has the same categories as the Mint app–and fill out your income and expenses.

- Budget Using the Mint Mobile App: Build your college budget with ease with the Mint app which allows you to automate the steps you’d do manually for the template.

Sign up for Mint for free to automate your college budget.

With the Mint app, you enter your budget info once and it does the rest!

Budgeting Using the College Budget Template

The college expenses worksheet is an Excel spreadsheet you can download for free. The template uses the same categories as the Mint app, but you’ll have to manually input your income and expenses.

With a college student budget worksheet, you can add your income and expenses to get a better look at your financial situation. To get started, download the college planning spreadsheet below. Here are the steps you’ll follow to complete the budget template:

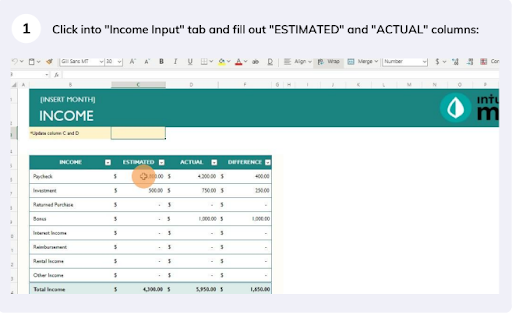

Step 1:

First, select the “Income Inputs” tab at the bottom-left of the page. You’ll see a table that lists the different types of income you may receive. Fill out the “ESTIMATED” and “ACTUAL” columns, which will then automatically populate the “DIFFERENCE” column.

If one of the income sources doesn’t apply to you, leave the value as “-” as a stand-in for $0.

Step 2:

Next, you’ll need to click the “Expense Inputs” tab, which should be just to the right of the “Income Inputs” tab that you’re already on.

Step 3:

Once you’re on the “Expense Inputs” page, fill out the “ESTIMATED” and “ACTUAL” columns just like you did before. You’ll see that each type of expense is broken down into greater detail in each respective table.

If one of the expenses doesn’t apply to you, leave the value as “-” as a stand-in for $0.

Step 4:

Now that you’ve added your income and expenses, click on the “Budget Summary” tab where you’ll be able to see a breakdown of your budget.

Step 5:

The “Budget Summary” tab is automatically populated with this information once you complete the “Income Inputs” and “Expense Inputs” tabs. In addition to the budget breakdown, you’ll be able to see a comparison of your total income and expenses as well as an expense breakdown spending category.

The “Budget Summary” can be used to help you make decisions about your finances.

Budgeting Using the Mint Mobile App

As we mentioned, the Mint app is an easy way to automate your budget to save you time each month. Using the mobile app also lets you get actionable insights that can help you make more informed financial decisions.

Follow the steps below to create a budget in the Mint app. You can also watch this short video:

Note: This video has been created with a fake demo account.

If you don’t have Mint yet, you’ll need to download the app to sign up.

Step 1: Create Your Budget

To create a budget, click “Monthly”. If it’s your first time setting up a budget in Mint, a message that says “Create a budget” will pop up. Click the button to get started.

Step 2: Add Your Income

To add your income, click “Tell us your monthly income”. This will take you to the next page, where you’ll input your monthly income. Sources of income might include earnings from your part time job or even financial aid distributions.

Note that if you already have bank accounts connected to your Mint account, this information will auto-populate.

Once all of your income sources have been added, click “Done–now add expenses”.

Step 3: Add Your Expenses

To get started, click “Add an expense”. On this page, you will see a list of recommended categories you can choose from, or you can search a specific expense category within the app using the bar at the top of the page. Once you input the amount for the expense, click “Add to budget”. You’ll repeat this process for each expense.

You’ll see there are a wide variety of categories to choose from, but If you want to mimic the Excel template within the Mint app, you can use the specific categories outlined below.

| Grouping | Category |

| Auto & Transport | Auto Insurance |

| Auto & Transport | Auto Payment |

| Auto & Transport | Gas & Fuel |

| Auto & Transport | Parking |

| Auto & Transport | Public Transportation |

| Auto & Transport | Ride Share |

| Auto & Transport | Service & Parts |

| Bills & Utilities | Home Phone |

| Bills & Utilities | Internet |

| Bills & Utilities | Mobile Phone |

| Bills & Utilities | Television |

| Bills & Utilities | Utilities |

| Education | Books & Supplies |

| Education | Student Loan |

| Education | Tuition |

| Personal Care | Dentist |

| Personal Care | Doctor |

| Personal Care | Gym |

| Personal Care | Health Insurance |

| Food & Dining | Groceries |

| Food & Dining | Alcohol & Bars |

| Food & Dining | Coffee Shops |

| Food & Dining | Fast Food |

| Food & Dining | Food Delivery |

| Home | Home Supplies |

| Home | Mortgage & Rent |

| Entertainment | Amusement |

| Entertainment | Movies & DVDs |

Watch this short video for a demonstration of adding and editing categories:

Step 4: Return to the Dashboard

To return to the budget dashboard, click “View your budgets”. This will bring you to the page where you can see an overview of your budget.

Step 5: Confirm That Everything is Correct

You’ll want to double-check all of the values and categories you’ve added to your budget. Mistakes on your budget can impact your financial stability, so this step is especially important.

To ensure everything is correct, you can verify the values you’ve input into Mint against your bills for each expense. For income, you can double-check your pay stub and other documentation. All values should match.

If anything is categorized incorrectly, you can update them as needed. Note that Mint will categorize anything it doesn’t know how to allocate as “Everything Else”. You may need to add custom categories to accommodate those expenses.

Managing your college budget is easy with Mint.

You can automate your monthly budget for free with Mint after one easy set up.

College Budgeting Tips & FAQs

Why Should College Students Budget?

Budgeting is an important part of making sure you have enough money to get by and maybe even have enough to start saving for the future. While you might be a student right now, the choices you make impact your financial future, so using a budget can help you start forming good financial habits.

You might use your budget to start investing, paying off debt, or prioritize other financial goals. Whether you use the college budget template or the Mint app, learning to budget is a useful skill that can serve you well for the rest of your life.

What Are Some Basic Expenses College Students Should Budget for?

Some of the expenses college students may want to budget for include:

- Rent

- Food

- School supplies

- Utilities

- Transportation

Using a college budget template can help you figure out what you’re spending and where you can cut back as needed.

Do College Students Need an Emergency Fund?

Sticking to a budget can help ensure you can afford everything you need, but if you can afford to, you may want to consider starting an emergency fund.

A college student emergency fund can help you deal with unexpected expenses and other financial problems you may run into–like an unexpected increase in rent, car repairs, or laptop replacement–which is why the U.S. Department of Education’s Office of Federal Student Aid recommends it.

How Do You Determine Your College Budget?

To figure out your college budget, you’ll need to look at your monthly income versus your monthly expenses. Reducing spending in certain areas gives you more money to work with, so you can cut back in some areas if you don’t have enough of your budget allocated for food or bills. While spreadsheets work, the Mint app automates your monthly budget, making it a simple, time-saving solution for college budgeting.

What Are Some Key College Budgeting Tips?

- Prepare for anything: You never know when you’re going to need a significant amount of cash to pay for a new textbook or medical bills. Even though you might not have a lot of money to spare, you may want to try to create an emergency fund so you’re prepared for anything.

- Set long-term goals: Build your budget with the future in mind. Set long-term financial goals and find ways to achieve those goals through budgeting. Your goal might be to pay off your credit cards now so you can focus on student loans after graduation or to start an investment account so you can start your retirement fund early.

- Get creative with spending: As a college student, you can save a lot of money by using coupons and splitting costs with roommates, like by sharing your subscriptions.

The post College Budget Template & Free Tools [Step-by-Step Tutorial] appeared first on MintLife Blog.

from MintLife Blog https://ift.tt/aAoUWuR

Comments

Post a Comment

We will appreciate it, if you leave a comment.