At one time the concept of owning digital money probably sounded strange and unattainable, but after the rise of popularity in cryptocurrency in recent years, many have chosen to own and invest in this type of currency. If you’re curious about cryptocurrency trading for beginners, you might be asking yourself, “What is a cryptocurrency exchange?”

What Is a Cryptocurrency Exchange?

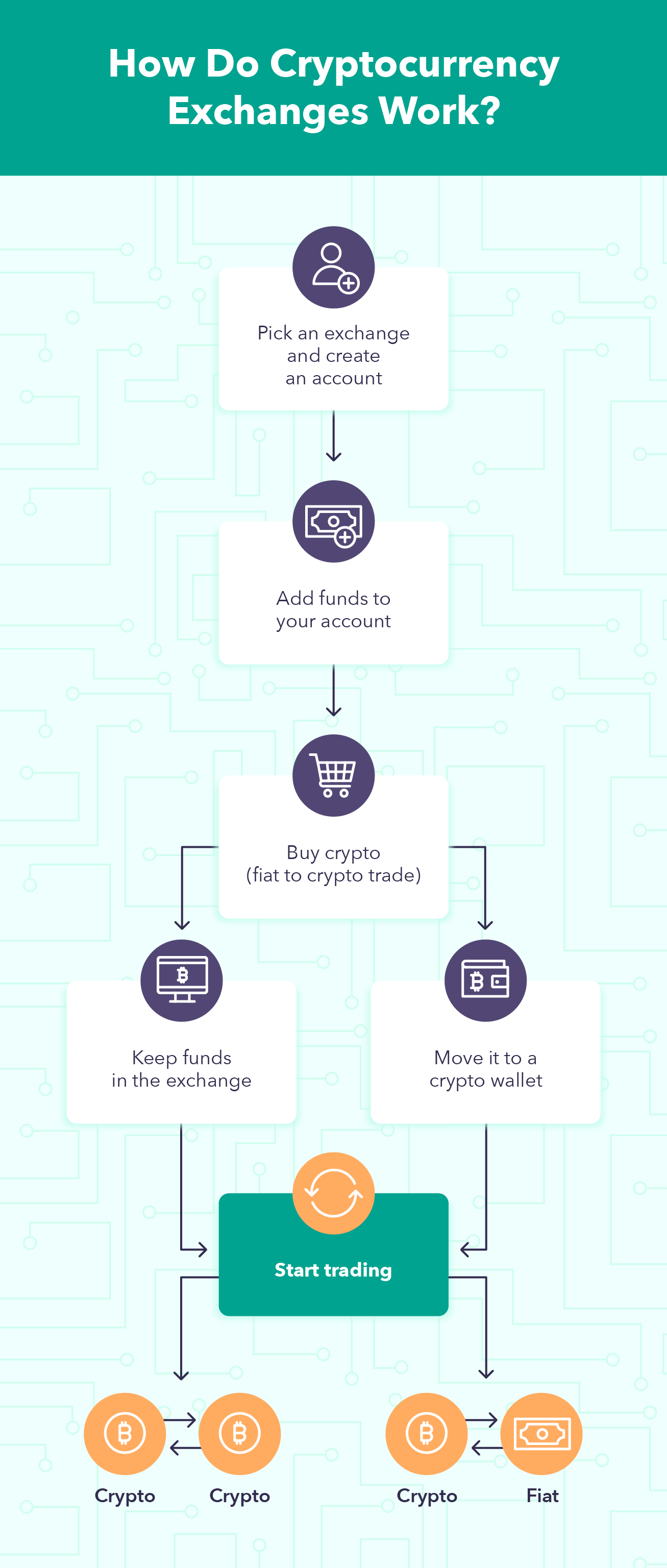

If you’re wondering where to buy cryptocurrency, using a cryptocurrency exchange platform is likely where you’ll start your investment journey. Cryptocurrency exchanges are online platforms used to buy and sell cryptocurrency. These platforms are intermediaries between the buyer and seller, allowing users to trade cryptocurrencies using fiat money or altcoins.

Many investors opt to use cryptocurrency exchanges due to their relatively low trading fees. However, keep in mind that some platforms might not be beginner-friendly, tending to overwhelm users, particularly those who are not familiar with trading stocks. For that reason, it’s important to understand the differences between each exchange platform to find the one that works best for you.

Types of Cryptocurrency Exchanges

If you’re eager to buy your first cryptocurrency, an important step before doing so is to understand the types of crypto exchanges:

Centralized

Centralized crypto exchange is the most common type of exchange platform and uses a third party — a middleman — to help conduct transactions. The middleman acts as a bank so people trust them with their money, and offer security and monitoring. Some investors find this concept misleading since cryptocurrencies are considered decentralized with no need for a central authority.

Decentralized

Unlike centralized cryptocurrency exchanges, there isn’t a middleman for decentralized exchanges — instead, they use blockchain technology or distributed ledgers. In this less common type of exchange, the currency isn’t held by a third party, and transactions are done peer-to-peer using smart contracts.

Notable Crypto Exchanges

There are over 6,500 cryptocurrencies existing today, which means there is a large market for crypto exchanges, reaching over 300 platforms. Before picking the best cryptocurrency trading platform based on your needs, it’s important to do your own research, since there are plenty of options available. Here are some recommended crypto exchange platforms:

Binance

Founded in 2017 and considered the best crypto trading platform by many investors, Binance offers a list with hundreds of currencies to pick from, with the bonus of having its own wallet.

Trading fees:

- 0.1 percent spot trading fee

- 0.5 percent instant buy/sell fee

Pros

|

Cons

|

Coinbase

With over 50 cryptocurrencies to trade, some consider Coinbase the best platform to buy cryptocurrency. And with strong security and transparency, Coinbase makes it easier for users to buy and sell crypto. This is a great platform for crypto-only traders who also want to earn staking rewards.

Trading fees:

- Coinbase: from 99 cents to $2.99

- Coinbase Pro: up to 0.5 percent

Pros

|

Cons

|

Gemini

Gemini offers over 40 cryptocurrencies and is a good platform for beginners as well as avid traders. Although it has a simple interface, Gemini also offers upgrade features and tools for advanced trading. Launched in 2015, the platform is transparent about its security measures and stores the cryptocurrencies in an offline cold storage system.

Trading fees:

- 0.5 percent convenience fee

- 99 cents to $2.99 transaction fee and 1.49 percent for trades over $200

Pros

|

Cons

|

Kraken

One of the oldest platforms, founded in 2011, Kraken is also considered one of the best cryptocurrency exchanges. With over 60 cryptocurrencies and high cybersecurity ratings, Kraken also has relatively cheap trading fees and is great for more experienced traders.

Trading fees:

- Up to 0.26 percent

Pros

|

Cons

|

KuCoin

Offering more than 300 different cryptocurrencies, KuCoin is also one of the largest cryptocurrency exchanges. With a simple platform, KuCoin makes trading pretty straightforward, which can be great for beginners, with additional features that also make it ideal for more experienced users.

Trading fees:

- 0.1 percent spot trading fee

- 0.5 percent instant buy/sell fee

Pros

|

Cons

|

Bittrex

Bittrex is a great platform for anyone looking for a large variety of cryptos — it offers over 190 of them. Founded in 2014, Bittrex believes security is key to a good exchange platform. It’s also user-friendly, making it a good platform for beginners.

Trading fees:

- 0.25 percent flat trading fee

Pros

|

Cons

|

What to Look For When Picking a Cryptocurrency Exchange

Ultimately, everyone has their own view of the best place to buy cryptocurrency. Whether you’ve made a decision or you’re still deciding between a couple of options, it’s important to know what to look for when choosing a cryptocurrency exchange before committing to it.

Is It Accessible?

No matter where you are in the world, you should consider which cryptocurrency exchanges are available in your country as well as the state regulations. Looking at the platform website or terms of service can help you find out if it’s accessible to you.

What Coins Are Offered?

It may come as a surprise that many cryptocurrency exchanges don’t offer all of the cryptocurrencies out there. New coins with smaller market caps might be limited to certain platforms. It’s a good idea to figure out what cryptocurrencies you plan on buying beforehand, and then pick an exchange that offers them.

Are There Any Fees?

Although some people lean toward the option with lower fees, it’s important to understand what those fees are for and how they are charged. Sometimes a higher fee will provide you with more security and make the process of exchanging cryptos easier. You may come to find out that paying a higher fee might give you a better overall experience than a platform with a lower fee.

Is It Secure?

One of the biggest reasons for choosing to use cryptocurrency is its security, so picking a secure platform is just as important to keep your money safe. Some platforms will protect your digital currency with insurance policies in case of fraud or hacking. Take into consideration other security features when picking an exchange as well, such as a two-factor authentication system. If you choose not to go for one of the larger exchanges, keep in mind that newer or smaller exchanges might not have the best security measures.

Does It Have Liquidity?

One characteristic of crypto exchanges that can be overlooked is whether they have liquidity. You want to make sure you’re able to sell your cryptocurrency whenever you want and at the best price. This requires the exchange to have enough trade volume, and often the more popular crypto exchanges will have higher liquidity.

What Are the Storage Options?

Whether you’re a beginner or have dipped your toes in crypto investing before, it’s important to take into account the storage options available for that platform. Although there are conflicting options between keeping your cryptos in your wallet or storing them in the platform, as a beginner, picking an exchange that allows you to keep them within the online account is a good option. Just make sure you’re allowed to take them off the exchange if you later decide you want to move them to your wallet.

Does It Provide Tax Information?

Just like investing in stocks, whenever you make capital gains while trading cryptocurrencies, you have to report it in your taxes. Some platforms provide you with Form 1099-B, which tracks your gains and losses, making it easier to file taxes later on. Since taxes can be tricky, especially for beginners, finding a platform that provides you with that information can make filing taxes less stressful.

Are There Any Extra Tools?

With so many crypto exchanges to pick from, they’ll also differ in what kinds of extra tools or benefits they will offer you. Take into consideration how the platform works and how it looks, as well as if it’s easy to use and if it connects to your personal investment tracking app, such as the Mint app.

Bottom Line: Crypto Investing Begins With Educating Yourself

If you started reading this guide wondering, “What is a cryptocurrency exchange?” Hopefully you now understand what you should be looking for when choosing a platform. But it doesn’t stop there — investing in cryptocurrency can be a learning experience that requires a lot of research. The market is always changing and the learning never stops, so making sure you keep track of your finances can be a great way to have a positive trading experience.

Sources: Investopedia | Time | BitDegree

The post What Is a Cryptocurrency Exchange? A Beginner’s Guide for 2022 appeared first on MintLife Blog.

from MintLife Blog https://ift.tt/3vo5j0p

Comments

Post a Comment

We will appreciate it, if you leave a comment.