Gering ratios are helpful metrics in the assessment of the business debt. These ratios highlight if the financing structure of the business is stable and leverage remains under control. Again, it’s an excellent tool for lenders to assess if the business/financial risk aligns with the risk appetite. Further, the price setting of the loan and other terms are also dependent on the same.

Detailed understanding

The main aspects of the business include profitability, liquidity, activity, and gearing. All of these aspects are important and dependent on each other. A good business manager has the competence to manage all of these aspects and ensure the efficient run of the business.

Gearing is about the financing structure of the business. Mainly, there are two components of the financing structure; equity & debt. If the proportion of the debt is higher, the business is considered to have more risk. On the other hand, if equity is higher, the business is considered more stable.

Another perspective of gearing assessment is the ability of the business to cover interest it pays period to period. Further, the business with a higher debt proportion is exposed to higher economic fluctuations. For instance, an increase in the interest cost will lead to adverse impacts on the business profitability and liquidity (cash flow).

In addition to this, the gearing status is used by lenders and the management of the business. The lenders use gearing status,

- To decide if a loan should be sanctioned to a specific business (assessment is made to ensure the financial risk of the business is in line with the lender’s risk appetite).

- To set the price/cost of the loan. (Higher financial leverage leads to higher risk and higher cost/price).

The management uses gearing structure/status to plan for the cash flow, financial planning, and liquidity. Hence, these ratios help management in the execution of their responsibilities.

There are different mathematical and logical ways to set the metrics for the gearing assessment. These metrics include debt to equity ratio, time interest earned, equity ratio, and debt ratio. Let’s understand the working mechanism and the interpretations to get the most from these analytics.

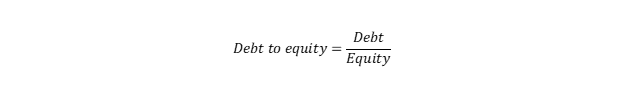

1) Debt to equity

This ratio compares debt proportion with equity, and it helps to highlight the extent of debt about equity. If the debt is more, the lender may be reluctant to disburse the funds because of higher risk. Although, in case of liquidation, they stand first in the queue to claim charges over assets.

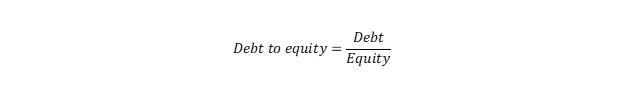

This ratio is also helpful for the management as a clear picture of related finance sources can be identified; this also helps in controlling/keeping eyes and maintaining the financing structure. The formula for this ratio is as follow,

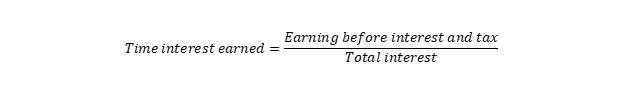

2) Time interest earned

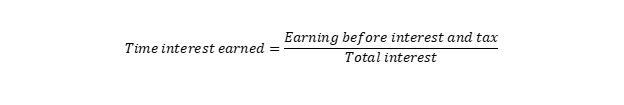

This metric connectively analyzes profitability and gearing aspects. It’s important to note that higher gearing may be compensated by higher business profitability. This is because a higher rate of return can easily cover the cost of capital. Time interest earned works on the same philosophy; if the time interest earned is higher, it suggests higher profitability and positive side of the business and vice versa. The formula for this ratio is as follow,

Mathematical interpretation indicates that there is an inverse relationship between the cost of interest and the matric.

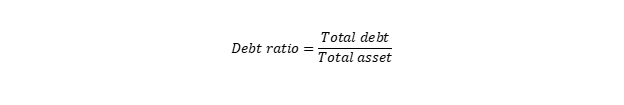

3) Debt ratio

The debt ratio compares the total debt of the business with the total assets. It helps to understand if the loan obtained has been used to finance the purchase of assets.

In other words, the business’s financial statement may indicate higher gearing, yet it may not be indicative of adverse financial conditions due to higher volume of assets. So, we need to analyze where proceeds of the loan have been consumed.

For instance, if the debt ratio is lower, it indicates that debt proceeds have been used to finance the purchase of the assets. In addition to this, it’s a sign for the lenders that the business has sufficient assets to meet liabilities in liquidation.

Sometimes, the business obtains a loan to finance the losses and maintain working capital. Similarly, the businesses sometimes finance growth/expansion with the loan obtained. So, lenders can include a restrictive clause in the loan agreement to protect their interest by using this matric.

The following formula is used to calculate the debt ratio of the business.

A lower debt ratio is desirable from the lender’s perspective of the business.

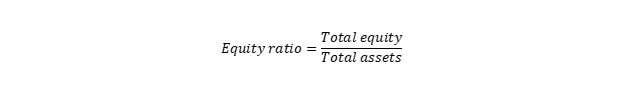

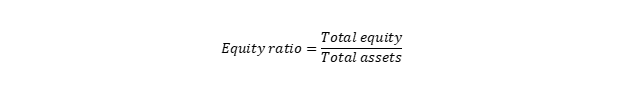

4) Equity ratio

The equity ratio is helpful matric in assessing the proportion of the assets that have been financed by equity. A higher equity ratio indicates that business has better solvency in long term and is considered more stable.

Analytics of equity ratio adds more value when analyzed with market trends because sector-wise financing differs in terms of source of finance. Further, retained earnings are also included in the equity section to reflect business performance.

The business performance is measured in terms of profit/loss and impacts on the equity ratio. So, the equity ratio can change from time to time due to the bottom figures of the income statement. Hence, there is a need to monitor this ratio from time to time.

It’s also important to note that if there is a loss in the business, it leads to a decrease in overall equity and a decrease in equity ratio. Similarly, disposal and the acquisition of the assets can lead to changes in the equity ratio.

Example to understand the gearing concept

Suppose the debt and equity in the financing structure of the business amount to $20,000 and $15,000 respectively. The provided equity balance is opening and the profit for the current year amounts to $2,000—further, the total assets of the business amount to $35,000.

The cost of interest for the business amounts to 16% per annum. Let’s interpret the gearing status of the business with the calculation of related gearing ratios like debt to equity, time interest earned, debt ratio, and the equity ratio.

Debt to equity

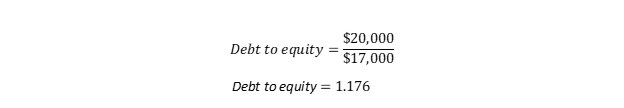

The closing amount of the debt is $20,000. However, we need to add current year profit amounting to $2,000 in the opening capital. So, closing capital will be $17,000 ($15,000+$2,000). Let’s put the figures in the given formula.

The debt portion of the financing structure is more than equity, and it means the financing structure is a little risky with perspective to an investor.

Time interest earned

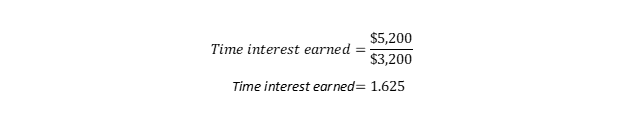

The business’s net profit amounts to $2,000, and the interest cost is $3,200 (20,000*0.16). To get earnings before interest and tax, we need to add back the interest cost in the net profit, $5,200 ($2,000+3,200) is the total amount for the earnings before interest and tax.

Let’s solve the given formula,

Connective analysis of the profitability and gearing suggests that the business’s profit is sufficient to cover the interest cost. However, the business does not have significant profitability. So, investors should think before investing as the line gap is small between the impact of gearing and the conversion to loss. In simple words, partial increase in interest rate can convert profit to a loss for the year.

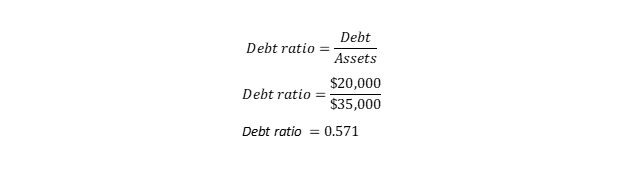

Debt ratio

The calculation suggests that the business has used loan proceeds to finance the purchase of the assets. So, it’s a good sign for the lenders because they will be able to recover their dues easily in case of business default.

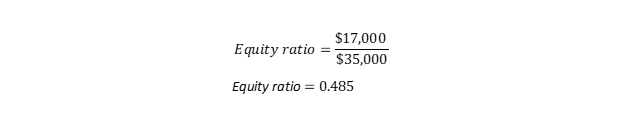

4) Equity ratio

Closing equity of the business amounts to $17,000, and total assets amount to $35,000. Let’s put these figures in the above formula.

Again, the business’s total assets exceed the total equity, which means the business has financed the purchase of assets with equity. So, the business indicates better financing and investing environment with long term solvency.

Conclusion

The gearing ratio is an essential financial metric that helps to assess the financial risk of the business. If gearing ratios indicate more debt in the financing structure, it suggests that the business is more exposed to the environmental risk of fluctuation.

However, if the business has better profitability, higher gearing is acceptable. This situation can be better assessed by calculating a ratio called time interest. Similarly, if the business raises loans and purchases assets, it’s not a bad deal, and the business can be attractive from an investment point of view.

Frequently asked questions

Why is gearing assessment important in financial analysis?

Gearing assessment is important in financial analysis because it mainly impacts both profitability and liquidity. For instance, if the business has to incur a higher interest cost, profitability is compromised. Similarly, payment of interest and repayment of capital can lead to inefficiency in cash flow management.

What are the three types of ratios used in financial analysis?

Three types of ratios used in the financial analysis include profitability, liquidity, and gearing.

Is gearing is bad for the business?

Overall, gearing is considered bad for the business from the perspective of financial analysis. However, it’s not always the case. For instance, if the business has obtained a loan to finance the project with a higher rate of return, the gearing is good.

Further, the cost of debt is lower than equity due to tax advantage. Hence, gearing is not always bad. However, a complete assessment needs to be made based on an overall financial statement and relevant business conditions.

The post Gearing Ratio: Formula, Calculation, And more appeared first on CFAJournal.

from Finance – CFAJournal https://ift.tt/2Z6a9Ur

Comments

Post a Comment

We will appreciate it, if you leave a comment.