As a business owner, receiving my 1099s each year puts me in the mood to start preparing my taxes. But what if the income on the 1099 misc does not match income received?

What Should You Do with an Incorrect 1099?

In short, if you receive an incorrect 1099, reach out to your client and try to correct it. If this doesn’t work, contact the IRS at (800) 829-1040 for instructions. You may have to include a letter with your tax return stating why there is a discrepancy.

In this article, I’ll answer some more questions regarding 1099s. Including what to do if it’s incorrect, it is duplicated, or missing.

An Example: 1099 Misc Does Not Match Income Received

Now for a helpful example…

Last year, my friend Jason did some independent contractor work for a venture capital-backed company in Houston, about four or five hours away from his home in the Dallas-Fort Worth metroplex.

He would travel and stay in Houston on the weekdays and return home on weekends.

Jason paid for his expenses out of pocket. The company agreed to reimburse him for his travel expenses, including:

- gas

- hotel

- meals

- incidental company purchases

Two months in, unfortunately, investors backed out of the project. He lost a couple thousand in actual dollars spent, not to mention several thousand more for non-payment of mileage, company purchases, and wages payable.

Jason only received one check for $1,000 to help offset some of the expenses he had already incurred.

Jason walked to his mailbox months later, surprised by a 1099-Misc Form from the Houston company—however, he had not received any income, only partial reimbursement for his expenses.

The amount listed on the 1099 form was six hundred and some-odd dollars and change.

Not only did he receive an unexpected 1099 form, but the amount was random and didn’t even match the dollar amount he received.

Related: What is the Minimum Income to File Taxes?

How My Friend Fixed an Incorrect 1099 Misc Form?

Jason wasn’t sure what to do with his situation. If you find yourself in a similar situation, there are some steps to take to correct the mistake:

1. Open Your Mail and Take Action Immediately

You won’t know any mistakes on your 1099 form unless you open your mail and verify every detail.

Also, if you sit on it for a while and don’t do anything, you risk not getting the issue fixed in time.

There’s also the chance the IRS notices the discrepancy and wants to take a closer look at your taxes.

2. Reach Out to the 1099 Issuer

If there is a discrepancy on your 1099-MISC form, take steps to contact the issuer immediately to correct the issue.

If they did make a mistake and confirm it on their end, they would need to send an amended 1099-MISC form to the IRS.

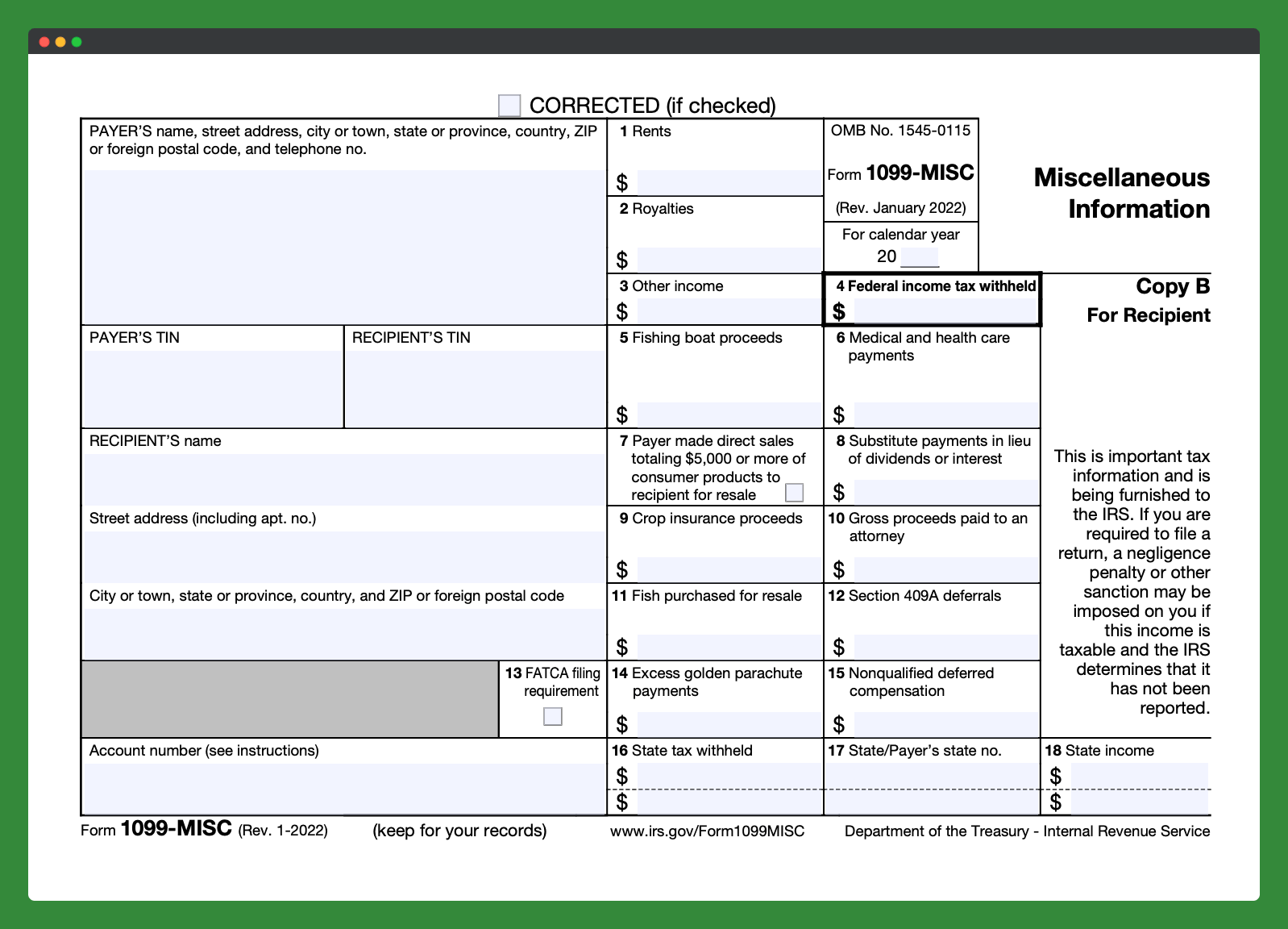

The form has a checkbox at the top to mark if it’s an amendment.

3. Don’t Neglect Your 1099 Form

Not worrying about your incorrect 1099-MISC form would be a big mistake.

You get a copy of your 1099. So does the IRS.

The IRS will look at those, all of your personal information, and your income, and make sure everything matches up.

If not, you will have to account for any mistakes at some point.

4. What if the Company Will Not Correct the Mistake?

You still have options if you run into a situation where the company doesn’t agree with you or isn’t willing to take the time to fix the problem.

Jason’s former employee refused to cooperate. He requested the form be changed three separate times but was unsuccessful.

Jason called the IRS helpline: (800) 829-1040. They told him to:

- claim his income

- deduct his expenses

- include a note explaining why the particular 1099 form was wrong and what the correct figures were for income and deductions

Jason went ahead and claimed $1,000 of income and offset the rest as expenses while explaining why there was a discrepancy.

More Questions About Incorrect 1099s

What if You Receive a 1099-MISC Form for Less Than $600 Work?

Sometimes businesses send out 1099s regardless of how much they pay independent contractors.

Instead of running the risk of missing someone or having to take time to separate who needs one and who doesn’t, companies often fill them out for everyone.

This is similar to receiving one from your bank for $8 worth of interest for your savings account.

It’s not a big deal to get 1099 for work less than $600. Claim all of your income, and you are set.

What if Your 1099 Form Includes Expenses and Income?

A company that employs you may include payment for items you don’t consider income, such as reimbursement for expenses.

For example, you were paid $10,000 to remodel a kitchen and were reimbursed $5,000 for materials. When 1099 arrives, the amount is for the entire $15,000 rather than the $10,000 you received as actual income.

How do you fix this?

Report $10,000 as income, and take all the deductions you are entitled to.

In this case, your expenses are $5,000 in materials. With this method, all will even out, and no correction is needed.

Again, you may want to include a description of all inbound and outbound incomes and expenses if there are any questions.

What if You Receive Double 1099 Forms?

There are times you might receive two 1099 forms for the same work.

One would be from the business that paid you, and the other could be from a payment service, like PayPal, or pay with a credit card.

Companies are not required to send a 1099 form to you (or the IRS) in those cases because electronic payment providers handle it.

This would be the case even if you were paid more than $600 over the year. You will likely receive a 1099-K from PayPal or credit card companies.

Why would you receive two, then?

Like receiving one for less than $600 worth of work, companies want to protect themselves. There are no penalties for sending 1099 forms when not needed.

Businesses face penalties for failing to send one when required. If this does happen to you, be sure to keep detailed records of your income.

You want to turn in both 1099 forms with your taxes, but you don’t want to count that income twice.

What if You Did Not Receive a 1099 Form at All?

In the case of electronic payments, companies are only required to send you a 1099-K when there are 200 total transactions, or they pay you $20,000 or more.

You might not get a 1099 at all. That’s ok.

Whether you receive one or not, you should claim all of your income.

Related: The Best Accounting Software for Small Business

What is a 1099 Form?

Let’s quickly define what 1099 is and why you received one in the first place.

There is a series of 1099 forms through the IRS, which they refer to as information returns. 1099 forms are used when a person receives money outside of their normal wages from their employer.

You should receive a 1099 form when you receive interest from a bank or dividend income.

A 1099-MISC form, which Jason received, is used by the IRS to report wages paid to non-employees, like independent contractors and freelancers.

Companies must send you a 1099-MISC form if they paid you $600 or more in a calendar year. They also send a copy of the 1099-MISC form to the IRS directly.

The Importance of Keeping Good Tax Records

One thing which can help Jason and other freelancers and independent contractors is to keep detailed records.

Record all of your income. Don’t forget to track all of your expenses as well.

Stay organized. Keep detailed documentation.

If there is a mistake on your 1099 form, you will have the information to fix the issue through the 1099 issuer or the IRS.

Regardless if you do your taxes or someone else does, it is important to be on top of things like 1099 forms.

Make sure you turn in everything you need to ensure that your information is accurate and that the IRS doesn’t have to come calling with questions about your income.

Have you ever received an incorrect 1009? How did you end up fixing it?

The post What to Do if Your 1099 is Incorrect [Fast Fix for 2023] appeared first on Part-Time Money®.

from Part-Time Money® https://ift.tt/mkuEbs4

Comments

Post a Comment

We will appreciate it, if you leave a comment.