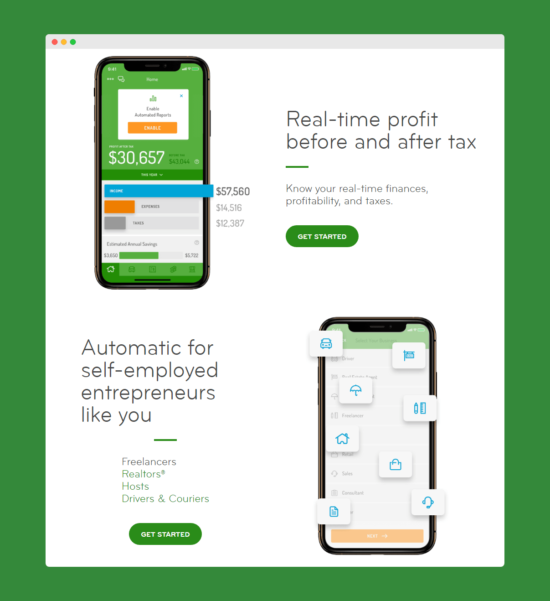

A great way to track work-related mileage is through Hurdlr. It’s an app designed to make life easier for freelancers, independent contractors, and other professions that need help tracking income, expenses, and mileage.

A great way to track work-related mileage is through Hurdlr. It’s an app designed to make life easier for freelancers, independent contractors, and other professions that need help tracking income, expenses, and mileage.

By using Hurdlr, you’ll also be able to estimate your tax burden and track tax deductions throughout the year.

How You Use Hurdlr for Taxes

Ideally, you’ll use one specific bank account for your business expenses and income. Once you’ve linked your account, Hurdlr is able to track income and expenses easily.

You can also link Hurdlr to services like PayPal, Square, Stripe, Freshbooks, and others to stay completely synced.

How Does Hurdlr Track Mileage?

There’s a mileage tracking function that runs in the background and tracks mileage automatically. It can even integrate with Uber’s app. There’s no need to manually track your mileage anymore.

Hurdlr tracks everything efficiently and automatically. It keeps track of deductions, reimbursements, and so much more. You have access to tons of financial reports with Hurdlr too.

You will always be organized and ready when it’s time to tackle your taxes with their Tax Estimator.

Who can Benefit from Using Hurdlr?

Hurdlr is perfect for people with side hustles or those who are self-employed. It’s an easy and inexpensive way for people to track mileage along with their income and expenses.

Hurdlr is a great option for:

- Uber drivers and Lyft drivers

- Freelancers and entrepreneurs

- Independent contractors

- Real estate agents

- Drivers

- DoorDash and Instacart couriers

- Airbnb, HomeAway, and VRBO hosts

Hurdlr can integrate with many of the other tools and apps used by people who are self-employed. Real estate agents can use it to track commissions.

It provides enough accounting and finance tracking functions without overcomplicating anything.

Learn more about tracking your mileage with Hurdlr here.

How Much Does Hurdlr Cost?

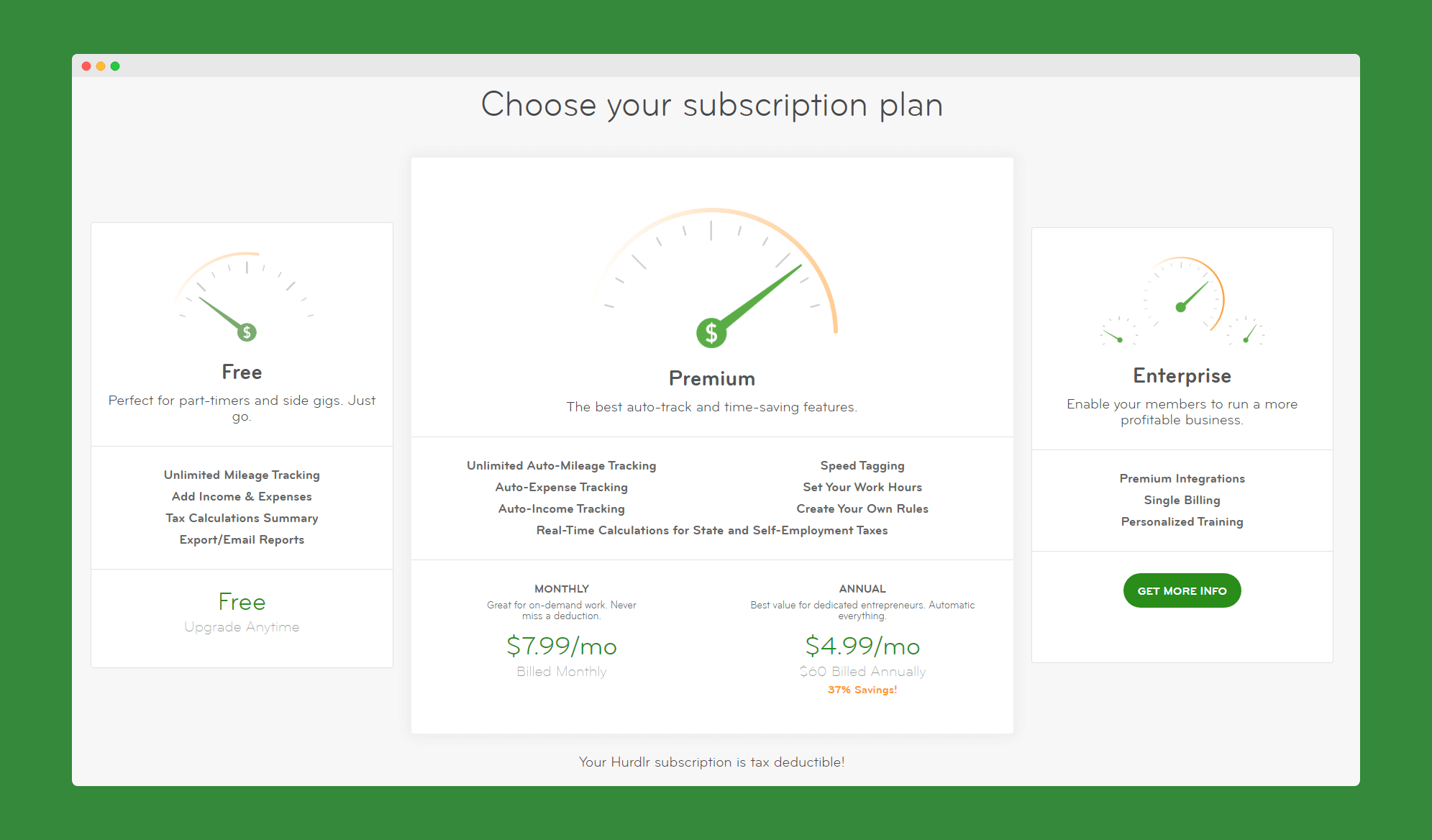

Hurdlr offers four levels of service and pricing for customers:

Free: This is perfect for people who work part-time or have side hustles. You get access to unlimited mileage tracking, tax calculation summaries, and the ability to add income and expenses. You can also export or email reports from Hurdlr under this plan. Sign up for Hurdlr’s free plan.

Note: On this plan, you will have to manually start and stop the mileage tracker. If you’d prefer it to track your driving automatically, you’ll want to upgrade to the Premium plan.

Premium: This plan costs users $10/month or $8.34/month if billed annually. You also get unlimited auto-mileage tracking, but you also get other services like:

- Auto-Expense Tracking

- Auto-Income Tracking

- Speed Tagging

- The ability to set your work hours

- Real-Time Calculations for State and Self-Employment Taxes

Pro: This plan costs users $16.67/month billed annually. You get everything with Premium, plus:

- Annual Tax Filing

- Invoicing

- Invite Your Accountant

- Advanced Reports

Enterprise: This plan is designed for businesses to use. It allows access to all of the tracking tools to your entire company. There’s also personalized training offered with Enterprise to share with your team. For pricing, you need to contact Hurdlr directly.

Hurdlr users have been finding over $5,600 in tax deductions on average.

Tracking mileage through Hurdlr could quickly increase your Mileage Tax Deduction. If you aren’t doing a good job of tracking your mileage then you are probably leaving money on the table.

At $5 a month, you’d only need to track an extra 25 miles per month, approximately—depending on your tax rate.

If you think you might be missing that by trying to track manually, then Hurdlr will pay for itself! To say nothing of the time you’ll save by being able to skip this task.

The post Hurdlr Review: Automatically Track Your Business Mileage appeared first on Part-Time Money®.

from Part-Time Money® https://ift.tt/91yGta3

Comments

Post a Comment

We will appreciate it, if you leave a comment.