We’ve done the research, and these are the only 5% CD rates available today. Don’t waste time with low-interest CDs.

It’s true. There are 5% CD rates. These haven’t been around for long, but they’re here. You can even lock in 5% for 27 months. I might buy one myself to participate.

Can You Get 5% Interest on a CD?

Yes. Here are the current CD rates at or above 5%. If these CDs don’t work, we’ve made other suggestions below for places to save your money.

Can You Get 6% on a CD?

Not at this time. CD rates are rising. But we’re not quite at 6% yet. I will update this page if and when rates get to 6%. Won’t that be something?!

Even though we’re only at 5% interest rates, that’s still an incredible opportunity to save your money in a secure account.

Where Else to Get High Interest

These 5% CDs are some of the highest rates you’ll see in a savings product. For instance, there are some high yield savings accounts paying close to this rate.

And there are a few savings alternatives that you could consider. But by in large, these rates above are the best from a FDIC Insured product.

How CD Rates are Changing

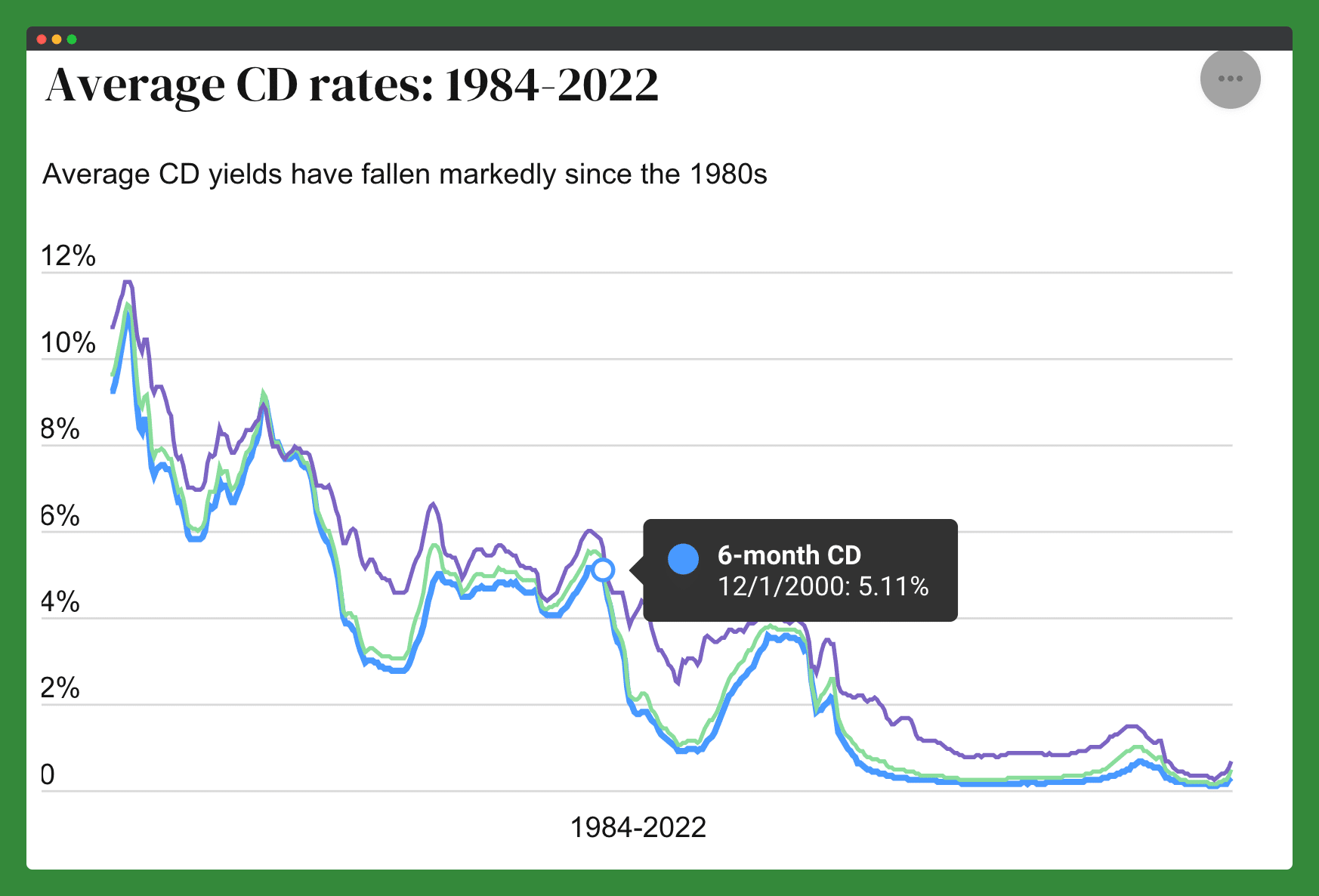

Right now, CD rates are rising. Last month rates topped out at 4%. So rates are moving up quickly. And historically, we haven’t seen 5% rates on CDs in over 20 years. The year 2000 was the last time.

While I like seeing savings and CD rates rising, I know it’s because inflation is out of control, and the Federal Reserve is raising its rates to try to squash it.

Tips for Finding the Best CD Rates

Shop around: Compare rates offered by different banks and credit unions. Online comparison tools can make this process easier, but it is also essential to check with local banks and credit unions.

Consider term length: CD rates vary depending on the term length or the length of time the deposit is held. Longer terms generally offer higher rates but also lock up your money for a longer period.

Check minimum deposit requirements: Some banks and credit unions require a minimum deposit to open a CD account. Make sure you can meet these requirements before you apply.

Compare penalties for early withdrawal: CDs typically have penalties for withdrawing the deposit before the term ends. Compare these penalties among different institutions and ensure you understand the terms before investing.

Consider online banks: Online banks often offer better CD rates than traditional brick-and-mortar banks.

Negotiate with your bank: If you have a good relationship with your bank, you may be able to negotiate a better rate.

Keep an eye on interest rate trends: Interest rates fluctuate, and it is vital to be aware of the trend to help you decide when to invest in a CD.

Consider laddering CDs: laddering CDs can help you take advantage of different interest rate environments by breaking up your investment into CDs with different maturity dates. This allows you to access your money sooner and take advantage of rising rates.

The post 5% CD Rates: Too Good to Be True? appeared first on Part-Time Money®.

from Part-Time Money® https://ift.tt/qhK7EPy

Comments

Post a Comment

We will appreciate it, if you leave a comment.