One way to improve your credit score is to be added as an authorized user on another person’s credit account(s). But what if you don’t have another person with good credit to be added as an authorized user?

That’s where Tradeline Supply Company comes into the picture. It is a service that enables you to purchase authorized user access on accounts of individuals with good credit. It can temporarily increase your credit score to help you get approved for a loan elsewhere.

In this Tradeline Supply Company Review, I’ll explain how it works, the pros and cons, and let you know who should consider Tradeline.

Table of Contents

- What Is a Trade Line?

- What Is Tradeline Supply Company?

- How Tradeline Supply Company Works

- Tradeline for Buyers

- Tradeline for Sellers

- Tradeline Supply Company Pricing

- Alternatives to Tradeline Supply Company

- How to Sign Up with Tradeline Supply Company

- Pros & Cons

- Tradeline Supply FAQs

- The Bottom Line on Tradeline Supply Company

What Is a Trade Line?

A trade line is the activity record of any credit product reported to the major credit agencies. When you obtain new credit, like a credit card or a car loan, the lender provides your account and payment information to the credit bureau. Each account is considered a trade line.

For example, if you currently have a mortgage, car loan, and one credit card, three trade lines are reporting on your credit report.

Your trade line history makes up part of your credit score. Trade lines open for several years contribute to a higher credit score, while brand-new accounts have little impact.

Borrowers without longstanding trade lines can purchase them from companies like Tradeline Supply to boost their credit scores temporarily.

What Is Tradeline Supply Company?

Tradeline Supply Company acts as an online marketplace for credit trade lines. It’s a platform where individuals with good credit can sell an authorization to one or more credit lines to an individual looking for a boost in their credit score.

Tradeline Supply Company, LLC is based in San Diego, California, and was launched in 2017. The company has an “A” rating from the Better Business Bureau, the second highest rating.

How Tradeline Supply Company Works

You can benefit from Tradeline Supply Company in two ways: as a buyer or a seller. As a buyer, you can purchase access to one or more trade lines with the expectation of getting a boost in your credit score. As a seller, you can make money by selling that access to a borrower in need.

Trade line buyers can choose from hundreds of credit lines based on criteria like credit limit or the date the line opened. You can select lines that best match your credit needs.

For example, suppose you have compromised your score because of high credit utilization. In that case, you can choose one or more tradelines with low credit utilization in the hopes that your ratios will improve.

If your credit history is too recent, you can purchase longstanding credit lines to boost your score. Of course, you’ll be looking for credit lines with excellent histories to improve your payment history.

Trade line sellers with excellent credit profiles can earn a steady income by providing buyers with temporary authorized user status on their trade lines. And because the status is temporary, you can sell the same trade line repeatedly for even more income.

Tradeline for Buyers

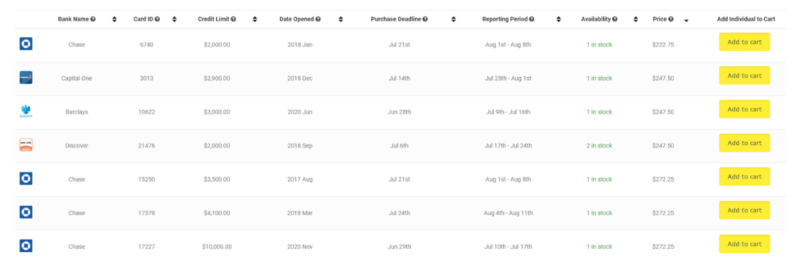

When you visit the Tradeline Supply Company website, they will present you with a list of credit accounts and the relevant information for each.

Tradeline provides you with the bank’s name, the specific credit limit, and the date the seller opened the credit line. The seller will also include a purchase deadline, the reporting period of the trade line, the availability, and the price you can buy it for.

You can purchase as many trade lines as you like simply by clicking the yellow “Add to Cart” button on the right-hand column of each trade line offered.

As you’ll see when you go to the website, Tradeline Supply Company will allow you to select hundreds of different tradelines. This wide selection will give you an excellent opportunity to purchase the lines you believe will benefit your credit profile.

Tradeline for Sellers

Tradeline Supply Company provides an easy way for those with good credit and desirable tradelines to sell temporary access to the lines to buyers. Add your tradeline to their website, and it will be available for purchase.

Tradeline offers sellers direct deposit, real-time order history, email and text message order notifications, and round-the-clock access to the marketplace. It’s an opportunity for tradeline sellers to earn additional income regularly and passively.

Tradeline Supply Company offers sellers an opportunity to get a quote on how much a tradeline is worth. Simply enter your name, email address, telephone number, and Tradeline Supply Company.

Tradeline Supply Company Pricing

There is no cost to use the Tradeline Supply Company service or website. But you will pay a fee for each trade line, which can run anywhere from 200 hundred dollars to well over $1,000.

How much you will pay will depend on the features and quality of each trade line, as well as how many lines you believe you need to purchase.

According to the company website, you can purchase access to a $45,000 credit limit that’s been open for ten years. That would positively impact your credit score more than a trade line with a lower credit limit.

Tradeline Supply prices a $3,000 credit line, open for three years, at around $275.

Learn more about Tradeline Supply

Alternatives to Tradeline Supply Company

Tradeline Supply can help you boost your credit score, but good credit comes at a cost. Alternatively, you may want to consider cheaper options for building credit, such as a secured credit card or credit builder loan. Let’s take a look at these two Tradeline Supply alternatives.

Secured Credit Cards

With a secured credit card, the borrower must provide security upfront in the form of a cash deposit equal to the credit limit amount. The nice thing is that most secured credit cards come with low credit limits, so you may only need $100 or $200. Once you activate your card and start using it, the credit bureaus track your payment history, just like any other credit product.

It may take longer for a secured credit card to boost your score, but it’s a less expensive option than Tradeline Supply. Take the Capital One Platinum Secured Credit Card, for example. The card has no annual fee; you must place a refundable security deposit between $49 and $200. As long as you pay the balance owed in full each month, you won’t pay any interest. As soon as your credit score is high enough, you should be able to qualify for a regular credit card and have the security deposit returned to you.

Credit Builder Loans

You may also consider getting a credit builder loan to improve your credit score. Credit builder services allow you to build credit without going into debt. Here’s how it works. With a traditional loan, you receive the total loan amount in advance and then make payments over a specified period until you repay the loan.

A credit builder loan works in reverse. You make payments to a loan, and the credit builder company reports them to the credit bureau. You only receive the funds after you have paid the loan in full. It’s kind of like a prepaid loan. Because the credit bureau is recording your payments, your credit score improves. You do have to be careful, as many credit builder loans have high fees and interest. Make sure you know exactly how much you are paying in the end. For more information, check out our Best Credit Builder Loans article.

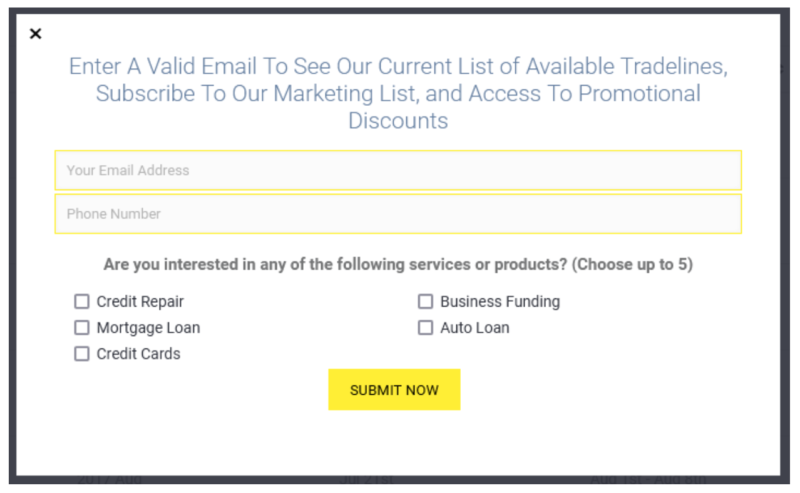

How to Sign Up with Tradeline Supply Company

To sign up with Tradeline Supply Company, enter your email address and phone number, then indicate the specific service or product you’re interested in.

Nest, you must create a unique password for your account. Tradeline will then ask you to verify your identity. You can provide a color copy of your driver’s license and your Social Security card, though they will accept a color copy of your passport or a state-issued ID card in lieu of a driver’s license.

There is no fee to sign up, and you’ll gain access to the most current list of available trade lines by providing your email address and phone number.

Tradeline Supply Company allows you to save money by buying multiple tradelines. As the screenshot below indicates, you can save 10% on a second trade line purchase, 20% on a third, and 30% on your fourth (or higher) purchase.

You’ll need to use either a wire check or an eCheck from your bank account to pay for your order. Tradeline Supply Company does not accept credit cards.

Learn more about Tradeline Supply

Pros & Cons

Tradeline offers a unique product that has the potential to benefit buyers and sellers. But that doesn’t mean you aren’t taking a risk, and it’s certainly not for everyone. Here’s my list of Tradeline Supple pros and cons:

Pros:

- Tradeline buyers can purchase authorized user status that will improve their credit scores.

- Opportunity to select from hundreds of tradelines

- The website is free to use.

- Tradeline Supply Company offers discounts on the purchase of multiple tradelines.

- As a tradeline seller, you’ll sell temporary authorized user access and earn a potentially steady second income.

Cons:

- Purchasing tradelines to improve your credit score can create legal issues – see the first FAQ below.

- No guarantee that purchasing a tradeline will improve your credit score.

- The purchase of a trade line is a temporary transaction

- Purchasing a trade line doesn’t help you develop good financial habits

- Depending on the type and number of tradelines you need to purchase, you could spend hundreds or thousands of dollars.

Tradeline Supply FAQs

Buying and selling trade lines has become a recognized practice. But it’s also considered a legal gray zone.

Experian describes it: “Buying tradelines may be viewed as deceptive by lenders and credit reporting agencies, and could even put you in danger of committing bank fraud.”

Tradeline Supply Company disputes the notion that buying trade lines can be viewed as committing bank fraud. They cite sources from the U.S. Congress, the Federal Reserve Board, and the federal trade commission, indicating buying trade lines is legal. However, they don’t provide links to the specific statements by any of those government agencies, proving the point.

If you consider buying or selling a trade line, you should be aware of this possibility and prepared to deal with whatever the consequences may be.

The company website indicates the following guarantees:

• If you buy any tradeline by the purchase deadline, we guarantee that it will post on your credit report on the next “Reporting Period,” which is listed for each Tradeline.

• On all tradelines purchased, they guarantee that you will remain on the card as an authorized user for two monthly reporting cycles.

• Guarantee that the tradelines post to at least two (out of three) credit bureaus.

• They guarantee that all tradelines will have a perfect payment history with no late payments ever reported.

• They guarantee that the utilization ratio will always be 15% or lower.

The above notwithstanding, the company does not guarantee any positive results on your credit score from purchasing any trade lines, nor do they guarantee that the results produced will enable you to secure the loans are other benefits you hope to gain.

You should also be aware that while they offer live customer service, company agents cannot provide specific guidance on how much the purchase of any tradeline will affect your credit score.

Unfortunately, that is a possibility. And it can happen under one of two scenarios.

First, purchasing a trade line could lower your credit score if the line is not the right fit for your credit profile. For example, if lack of credit history is a significant reason for your low credit score, purchasing a line that’s only one or two years old may not help your score and could drop by a few points.

But the second possibility could have an even greater impact. Since you are purchasing the ability to be included as an authorized user on a credit line, the quality of the credit reference depends entirely on how well the primary owner manages that account.

If you purchase a trade line, and the owner makes a late payment after the fact, it could cause your credit score to drop.

Learn more about Tradeline Supply

The Bottom Line on Tradeline Supply Company

My best advice on purchasing trade lines is to tread lightly. This activity falls into a legal grey area. Consumers may take advantage of authorized user status from family members, but it isn’t always successful.

As stated in the FAQs, the quality of any trade line depends entirely on how the primary owner handles it. If the owner borrows on the credit line or makes a late payment, your credit score could drop quickly. There’s also evidence the credit bureaus don’t give the same weight to authorized user accounts as to primary accounts.

Also, know that you’ll be paying a hefty price for this service. You’ll need to evaluate whether the benefit you’ll receive will be worth the money you pay upfront.

Finally, purchasing trade lines to improve your credit score is only a temporary solution. The only way to improve your credit score long-term is to build it from the ground up. That means taking loans and credit lines in your name, paying them on time, and managing them properly.

Purchasing authorized user status through Tradeline may help you get approved for a loan or credit card. But it won’t lead to a permanently higher credit score. Only you can make that happen, which will require time and effort.

The post Tradeline Supply Company Review: A Good Way to Build Credit? appeared first on Best Wallet Hacks.

from Best Wallet Hacks https://ift.tt/HGF5sUI

Comments

Post a Comment

We will appreciate it, if you leave a comment.