Every year, I give this list a mini-refresh. Sometimes I add an item.

These are moves that are important but not urgent. Requesting a credit line increase is not something that will change your financial life… but it can make it easier.

When you find yourself with some downtime after the New Year and you want to make some small “spring cleaning” types of moves in your finances, check out the list below for some ideas.

Bookmark it. Email it to yourself in the future. Save it for later.

Here are the spring cleaning money moves I recommend for 2023:

- Go paperless

- Review your Recurring Expenses

- Request a credit line increase

- Simplify your finances

- Update your financial documents

- Rebalance your investment portfolios

- Check your credit report for errors

- Shred old financial documents

- Price shop major fixed expenses

- Opt out of data collection sites

- BONUS TIP: Check MissingMoney.com

You can do way more than what's on this list, it is by no means exhaustive, but these are the ones that offer the most impact for your time.

Go paperless

If you still have companies sending you paper bills or statements, convert to paperless. If you have taken the steps to automate your payments (if not, what's holding you back?), these statements are completely irrelevant. They just cost you the time to dispose of them.

Last year, I went on a kick to reduce the amount of useless mail we get. This meant going completely paperless (with the exception of car insurance, where we need insurance cards with updated dates) and canceling as many catalogs as possible. For canceling catalogs, we use CatalogChoice.

Lastly, I unsubscribe to email newsletters that aren't serving me anymore. It keeps my email inbox just a little bit cleaner, which is like mopping up the beach.

Review Your Recurring Expenses

Recurring expenses, ones that hit your credit card or bank account each month, are great for businesses but silently drain your bank account. This is especially true lately with all the streaming services you're probably subscribed to.

We are subscribed to Disney+, Netflix, Spotify (and Hulu), Peloton… just to name a few. Fortunately, we use them all and quite frequently (according to a recent Time Journal exercise) so they're “justified.”

But check your budget for these types of recurring expenses that you aren't using anymore, or as much, and consider canceling them.

Here's a hack to help you along: You can always subscribe to them again.

I have a friend who rotates through streaming services to binge his favorite shows. He subscribes to HBO when there's a series he wants to watch. Cancels it and subscribes to Paramount+ or Disney+, then cancels when he's done. He can't watch more than one show at a time anyway, so he just rotates through them.

Request a credit line increase

Credit utilization (credit used divided by total credit available) is an important factor in your credit score, which is one of the most important numbers in your life once you reach adulthood. The difference of a few points can mean thousands of dollars in interest payments so you want it as high as possible.

The easiest way to lower your credit utilization is to not use your credit – not a good long term solution. It's like not using a hammer because you don't want to wear it out!

The second easiest way is to increase your total credit available and the quickest way to do that is by asking your credit cards for a credit limit increase.

How do I do this? Read my step by step instructions to increasing your credit limit, with screenshots of popular issuers and “what to watch out fors.” This approach has helped me increase my credit limit into the six figures.

This task literally takes just a few minutes. If you do nothing else, do this one. (while you logged in, you can go paperless too!)

This task literally takes just a few minutes. If you do nothing else, do this one. (while you logged in, you can go paperless too!)

Simplify your finances

Simple is better! It always is and always will be.

Your finances shouldn't be complicated but over time, we accumulate things in our finances like we do in our house. We just don't think to declutter our money because we don't “see” it every day. How many credit cards do you have? How many bank accounts do you have? If you were like me, you had a whole bunch. We moved a couple times, opened new accounts, and accumulated more that we needed without really knowing it.

How do I do this? It's not hard, especially if you just did your taxes and now have all the tax forms from these various financial institutions.

The first step is to create a financial network map, which will detail all your accounts and how they're related. Then, it's the simple matter of finding the overlap and closing those accounts.

You don't have to clean it all up all at once! Just close one of the unnecessary bank accounts today. It'll take you a few minutes to call them up, verify who you are, and shut it down. If you don't know if you need it, check out our post on a Rock Solid Financial Foundation to see if the account is something we consider crucial.

One easy one is to rollover any old 401(k)s. If you have several, just do one. If you need help (it's easy but just in case), a service like Capitalize can help you.

Just like decluttering a room, you don't need to do it all at once (no matter what Marie Kondo says!) but take that first step.

Here are more tips on how to simplify yoru personal finance!

Update your financial documents

We keep a few documents that explain our entire financial situation – I call it our “Finances At A Glance.” It has our Money Field Manual, Net Worth Record, and a Financial Network Map. As our systems change, those documents need to be updated too (Net Worth is updated monthly).

If you simplify something in your system, remember to update the documents too. Those documents are meant to help someone understand how our money is set up and if it's out of date, that can be a problem if we are incapacitated or dead.

How do I do this? Just update them! If you don't have these documents, it's very easy to set up (our are just word documents). If you want a head start, you can always get an “In-Case-of-Emergency” binder of templates to help you know what key things to collect.

Rebalance your investment portfolios

I subscribe to the set it and forget it model of investing, unless it has to do with my “fun” dividend growth portfolio, and so all of those investments are in index funds at Vanguard.

When I established the fund, I had target allocations in mind. Let's say I had 120 minus my age as my target percentage in equities (stocks). Over the course of the year, my portfolio will change since investments will rise and fall at different rates. I want to bring those percentages back in line with my target – this is known as rebalancing. Sometimes stocks do better than bonds, sometimes bonds to better than stocks, I want to get them back to the correct ratio I set at the beginning of the year.

How do I do this? If all of your investments are in one place, that broker should have tools to help you figure out your current allocations. If your investments are in different places, you'll want a tool that aggregates all that information together. I use Personal Capital (see our Personal Capital review) because it has a good set of investing tools perfect for this.

Then, you just need to go into each account and adjust them accordingly.

Check your credit report for errors

As mentioned earlier, your credit score is very important and is based on information at the three credit bureaus (Experian, Equifax, and TransUnion). You want this information to be accurate and it might surprise you to learn that inaccuracies are common.

A few years ago, I checked my credit report and I had TWO Social Security Numbers (the two were identical except for one digit, a 6 was a 0). Credit reporting is a lot looser than you'd expect. It's voluntary, the bureaus accept all information, and it's up to you to tell them something is wrong. When you do, then it's up to the reporting company to prove what they said was true. If you never check, you could have incorrect information and it could affect your credit.

How do I do this? The Fair Credit Reporting Act lets you get a free copy of your report from each of the bureaus every 12 months, you just have to go to annualcreditreport.com to request it. If you start now, you'll have access to your report within minutes.

As a result of the pandemic (well, legislation in response to the pandemic), you can request your credit report every single week for free. This is the case through December 2023. Many years ago, I found a random phone number listed and had it removed (those fixes take just a minute or two).

Normally, when you can't get it every week, I use the Waterfall Method and stagger my reports every four months. This gives me a view into my report throughout the year. When you couple this with services like Credit Sesame, it almost acts like identify theft and credit error monitoring – except it's free.

Shred old financial documents

Old financial documents contain a lot of juicy personal information an identity thief would love. They're also annoying to keep organized, so chances are they're in a box labeled by the year in the hopes that you won't ever need it. Ultimately, keeping things neat means you can get to it when you need it and right now it's not cutting it.

Fortunately, there are a lot of documents you simply don't need anymore. There are those that, in very rare cases, you might need in the future. If throwing out financial documents makes you nervous, I have a way to declutter AND not have you break out in hives at the thought.

How do I do this? All the guides on shredding documents are unnecessarily complicated, my rules are very simple. Digitally scan everything, 1s and 0s are easy to store and it's convenient just in case… but you don't need the paper.

If it came from a government entity (federal, state, county, etc.), keep it for 7 years. Same goes for anything that supports a document filed with a government entity, like receipts for things in a tax return. Shred anything older (remember, you still have digital copies).

If you can retrieve a digital copy of a document right now (like credit card statements), you can shred the paper one.

That should cover 90% of the paper you have.

Bonus Tip: Look at all the shredded documents and consider going paperless for most of it. Chances are you didn't use any of it and this is a good reminder that getting them mailed to you was wasteful and time-consuming to deal with!

Comparison shop major fixed expenses

We all want to save money right? Now's a good time to shop around for any major fixed expenses you have, including but not limited to:

- Insurances – Health, Life, Disability, etc.

- Cable/Satellite TV, Internet, Landline Phone Service

- Cell Phone Provider

- Fitness / Social Clubs

- Utilities

- Loans, Credit Cards

- Satellite Radio, Spotify, Pandora

It's also a good time to consider canceling some of those services you won't use as much during the summer.

How do I do this? Shopping around for service can be a lot of fun – it gives you a chance to flex your negotiation muscles without much risk. What's the risk you threaten to cancel satellite radio and they let you? It's actually zero – because you can always sign up for service at the regular rate whenever you want. They will never NOT let you sign up for satellite radio.

My guide for how to negotiate your cable bill like a pro is a good framework for negotiating anything – check that out for a solid approach that has saved me thousands.

Opt out of data collection sites

We know consumer reporting agencies like credit bureaus collect information but there are also companies that collect your data for sale to other companies. They look up Linkedin records, match them with publicly available information from government sources, and they build profiles of you. If you've ever googled your own name, sometimes you'll see these sites trying to sell you a “background check” or some other BS.

By law, they have to remove you if you request it. It's just a pain but it's not difficult. You can pay a service like DeleteMe or manually do it yourself with their guide. I just used their guide to remove me and my wife from the more popular sites on the guide's list.

I don't think it's worth paying $20 a month for this service but the guide explains how to get removed from Spokeo, mylife, radaris, whitepages, intelius, and BeenVerified. They recommend a disposable email address, I use GuerrillaMail.com.

Bonus Tip: Unrelated to these sites but related to opting out, sign up for OptOutPrescreen.com so you stop getting mailers offering you credit or insurance. You have to do this every five years if you opted out electronically.

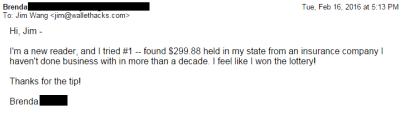

BONUS: Check MissingMoney.com

I said six but here's a seventh, pop over to MissingMoney.com and see if any new missing money has been recorded in the last year. Here's a more detailed explanation of what Missing Money is about.

What spring cleaning task are you going to tackle today?

The post Financial Spring Cleaning: 10 Quick Money Moves You Should Do Right Now appeared first on Best Wallet Hacks.

from Best Wallet Hacks https://ift.tt/TqmJfWN

Comments

Post a Comment

We will appreciate it, if you leave a comment.