When you first start making money, there are a lot of tools and services you can pick from. The market is huge so there are a lot of companies competing to be your budgeting tool or your investment tool.

As your net worth grows, the number of tools and services begin to shrink. One big reason is because situations get more complex.

For example, new investors generally stick to the basics – robo-advisors and brokerages. Those link up nicely with tools like Personal Capital through Plaid.

As your investment universe expands, many platforms don’t integrate nicely. Some don’t have integrations at all.

That’s when a paid service and tool like Vyzer makes sense.

If you’re doing a lot of your money management by hand because there are no tools that integrate with the accounts you have – Vyzer may be the solution.

Table of Contents

Who is Vyzer?

Vyzer is a financial technology company based out of Netanya, Israel. Co-founded in 2020 by Tomer Salvi, Litan Yahav, and Guy Vamzu, Vyzer relies on third party account aggregator services (Plaid, Yodlee, Salt Edge and Zabo) to connect your accounts (read-only).

When it comes to data security, your data is encrypted at-rest and in-transit – it’s not end-to-end encrypted. End to end encryption would mean your data isn’t readable by the app that gets it – which would make it impossible to do some of the features Vyzer offers. They do require two-factor authentication.

I’ve spoken with Litan and I was fascinated by their origin story. Litan was part of a team (that included Vyzer co-founder Tomer Salvi) co-founded a technology company that captured 3D images of diamonds. They sold that to R2Net, the parent company of Blue Nile and James Allen.

From that, he started investing and realized how existing financial dashboard and management tools didn’t satisfy his needs. They are good for most people but once you reach a certain net worth, your investments don’t integrate nicely into existing tools.

As a result, he co-founded Vyzer. I was connected to Litan by a mutual friend who, after selling his company, was also looking for better tools as well.

Vyzer Features

Vyzer categories its major features as falling into one of three categories:

- Portfolio automations

- Cash flow planning

- Wealth management

Portfolio automations

When you have a lot of private investments, there aren’t many tools that integrate them into a nice dashboard. If you use Personal Capital, your tracking is completely manual because it’s not something that Plaid can pull in from other accounts.

For example, I have a few private investments that are managed through Carta. Carta is great except there is no way for me to pull that information from Carta into my Personal Capital account. Plaid doesn’t support it and so you have to track it manually.

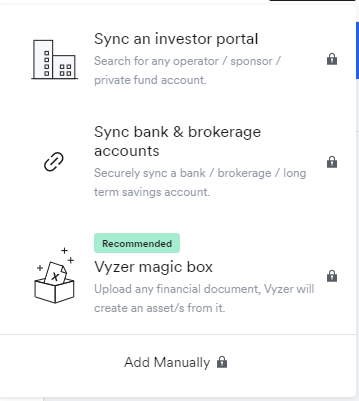

Vyzer offers three ways for you to connect an account:

- Sync an investor portal

- Sync bank & brokerage accounts

- Vyzer magic box

- (you can also manually add it)

The first two are done through third-party aggregator services Plaid, Yodlee, Salt Edge, and Zabo.

The Magic Box

The “magic box” feature is what differentiates Vyzer from all other services. It is also what justifies the monthly fee. With the Vyzer magic box, you upload documents and they create an asset from those documents. No other “online” service offers this. Right now, a human being will parse the document for you and create an asset and update it with subsequent uploaded documents.

Cash flow planning

When you have a W-2 income, cash flow planning is relatively straightforward. You’re paid on a regular basis and you know what to expect it.

As you layer on other cashflow producing assets, like dividend stocks or rental property or a note or fund, cash-flow planning becomes a little more complicated. It can prove difficult with other tools because other tools aren’t built to manage cash flow in this way.

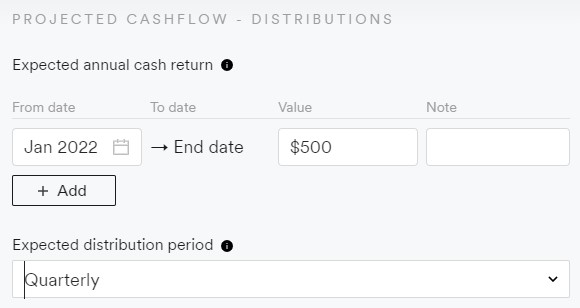

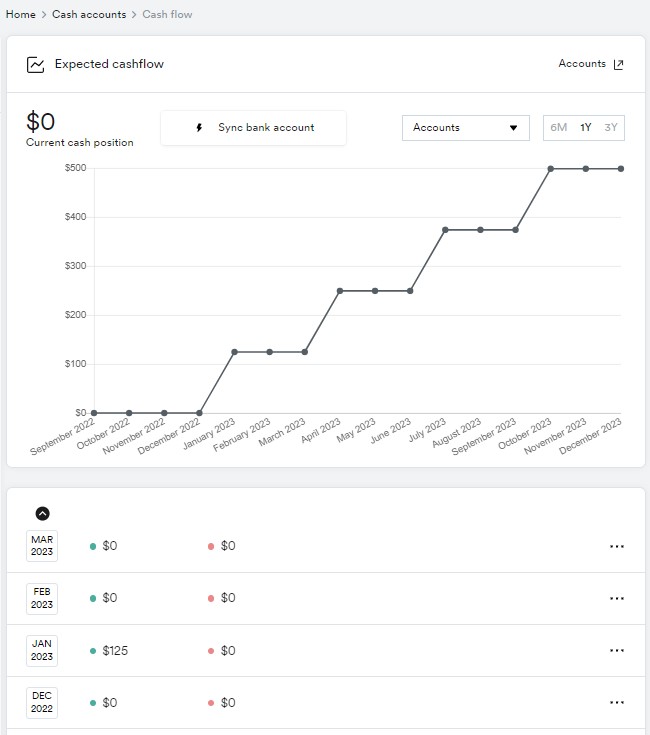

When you add new assets, which we’ll look at later on, you can add in projected cashflow distributions and Vyzer will keep track of them:

Wealth management

Vyzer monitor your assets and will keep you informed on a variety of events (or missed events). For example, if you have an asset with a distribution schedule, it’ll inform you if a distribution didn’t occur or if it was above or below your expected target value.

It will also analyze the investment and calculate whether the performance you’re getting meets, exceeds, or falls shorts of the expectations. Again, these are all based on the assumptions and figures you provide when you set up the asset.

Finally, you can two reports:

- Balance sheet – A list of all of your assets and liabilities to calculate a total net worth.

- General report – A list of all of your accounts.

In the future, there are plans to be able to generate a personal financial statement too.

Vyzer Pricing

Vyzer is not free because there’s quite a lot of manual work that goes on behind the scenes. It’s $99 per month when billed monthly and only $79 per month when billed annually ($948).

There is a 30 day free trial and a 90 day money back guarantee. I believe the 90 day guarantee exists so you can experience it’s features over the course of a quarter, which is the typical reporting cadence of many private investments.

Vyzer is more expensive than many of the tools we cover on WalletHacks.com. I think the price is justified given what you get for it AND if your situation warrants it.

Vyzer Sign Up Experience

The sign up experience is pretty fast – you create a login with a password and then ask three short questions.

- What are you invested in? Syndications, Real estate, Private equity, Public markets, Startups, Crypto, Hedge funds, Other

- Features and tools I’d love to use? Tracking cash distributions, Viewing investments by an entity, Capital call management, Target performance vs actual, Planning cash flow scenarios, Peer benchmarking

- Are you an accredited investor? Yes, not yet, I’m not sure

After those three quick questions, you’re shown a demo account that you can play with. This is all free.

What Assets Can Vyzer Track?

Vyzer tracks quite a few, as of this writing we have:

- Cash accounts – typical deposit accounts like checking, savings, money market, cash deposits and physical cash

- Real estate – All properties, from your home to rental properties to syndications

- Managed funds – private equity funds, real estate funds, hedge funds, venture capital and debt funds

- Private companies – ownership as shares, options, or a traditional non-public company

- Private loans – loans you track privately or through a peer-to-peer lending platform

- Brokerage accounts

- Long term savings – retirement savings, college funds, and “others”

- Crypto – coins/tokens as well as an exchange or wallet

- Other – collectibles, previous metals, vehicles, etc

- Loans

- Credit cards

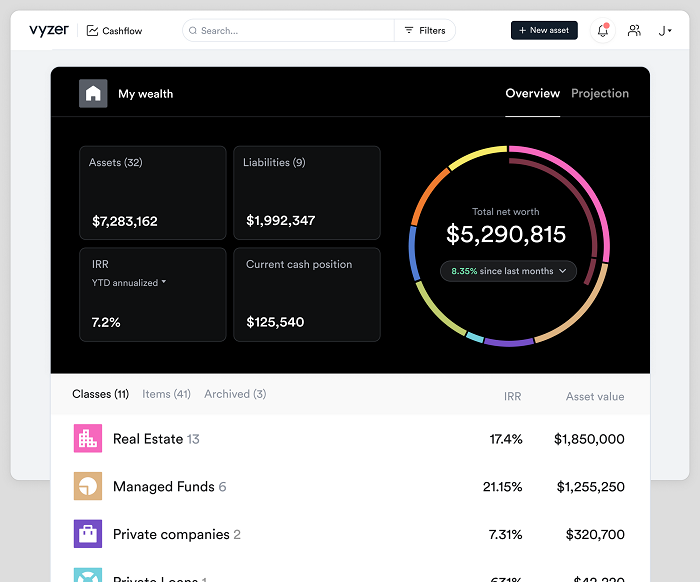

Net Worth Tracker Dashboard

Once you put all your assets in, your Net Worth Dashboard (which they call My Wealth) now has your total net worth, assets, liabilities, current cash position, as well as income.

If you categorize them properly, they will even give you a breakdown in percentages of where your money resides as well as a projection. The projections are all based on the assumptions you made when you created the asset.

Here’s a sample view of one with a lot of assets added:

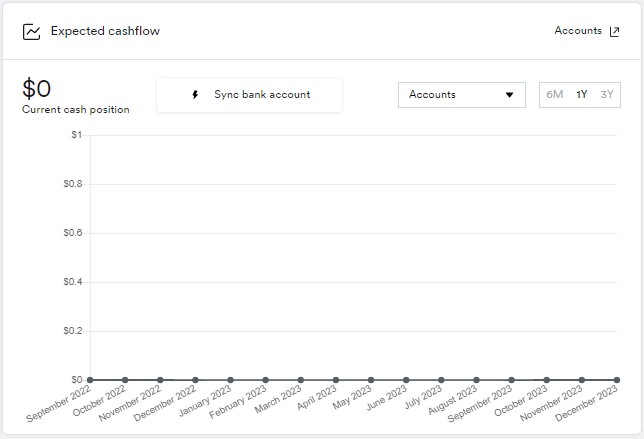

Cashflow Dashboard

The Cashflow dashboard is where you can see your current cash position, expected inflows, and expected outflows. Whenever you open the dashboard, it’ll ask you for your household W-2 income and monthly expenses.

You don’t have to enter this but it will ask each time unless you put in a number (you can put in $0 and it’ll stop asking). If you need to change this figure, you can do so by clicking “Household cost of living” in the lower left or go into your Profile -> Financial Settings.

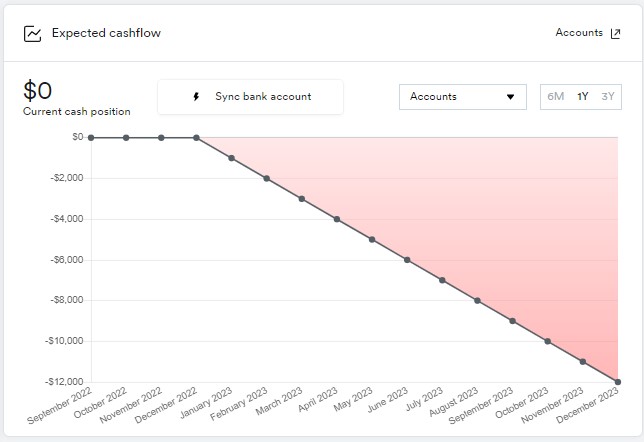

At first, the cashflow dashboard is pretty boring (unless you put in a W-2 income):

How to Add Assets

Vyzer will track a variety of different assets and this information includes everything you expect as well some some nice features to help with capital calls and cashflow projections.

Some assets are fairly simple to add. You can either link up your accounts and Vyzer will pull them in or you can add them in manually. When you select a brokerage that you can link, it’ll load up a login form from Plaid. You can opt to add it manually though.

Adding a Brokerage

A manual brokerage addition only has four “pages:”

General Information:

- Institution

- Account Name

- Current Balance

Projection:

- Expected annual performance %

- Expected monthly contribution

Performance:

- Account opening date

- Total investment

More Information:

- Holding Entity

- Notes

The expected monthly contribution will be included as an “expense” in cashflow projections.

Adding Real Estate

For example, if you create a New Rental Property, it’s a five “page” form that captures:

General Information:

- Sponsor / Operator

- Property Name

- Initial Investment (& Currency)

- Ownership Percentage (optional)

- Purchase Date

Projected Cashflow – Distributions:

- Expected Annual Cash Return – Start and End Dates, Values

- Expected Distribution Period – Monthly, Quarterly, or Annually

Capital Calls:

- Yes or No

- If Yes, you enter the Total Committed Capital plus the Call Dates

Projected Performance:

- Expected End Date

- Expected IRR %

- Expected Multiplier

More Info:

- Property Address

- Holding Entity

- Type – asset class of the property

- Notes

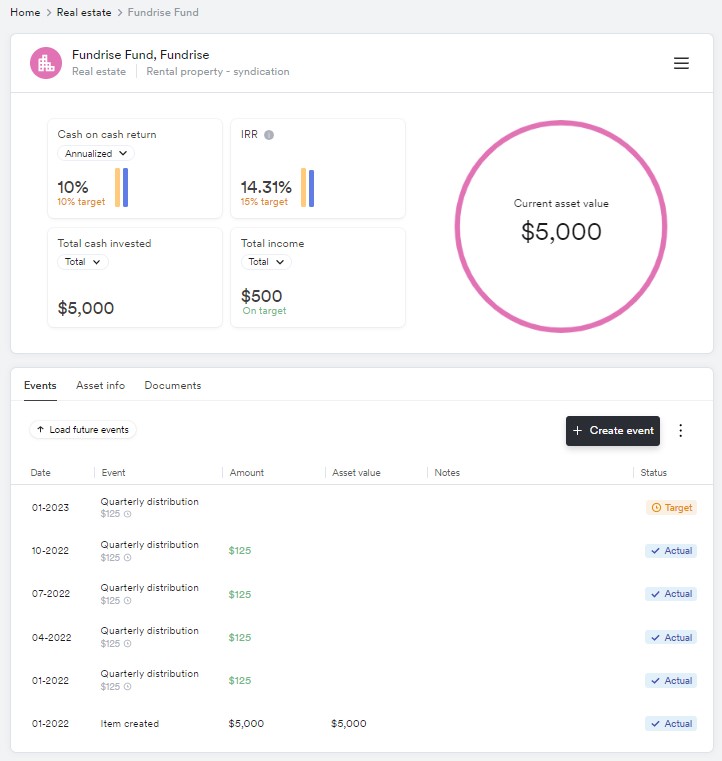

Afterwards, it creates this asset under Real Estate (the data in this screenshot is fabricated, I am not invested in a generically named Fundrise Fund):

After you create an asset, you can go back to the Cashflow dashboard and see it included in the Expected cashflow charts:

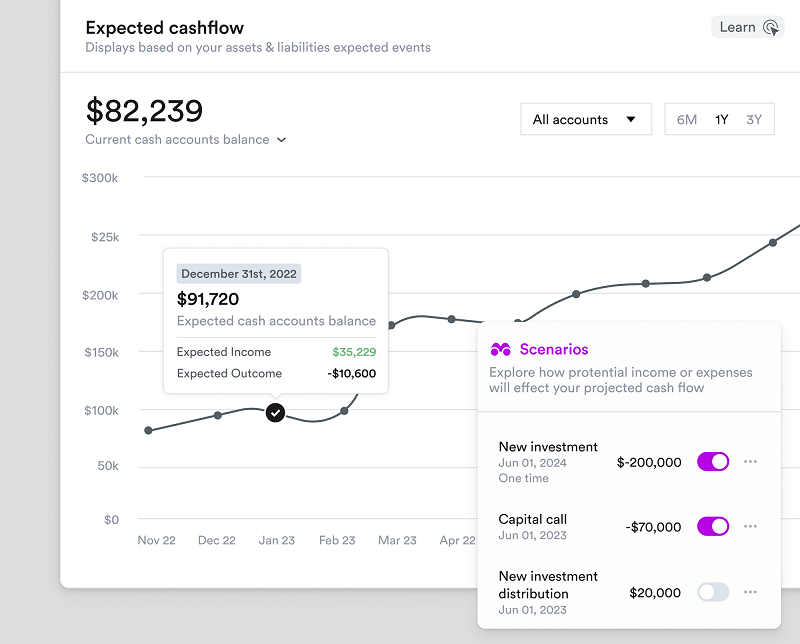

Here’s a sample one with a lot of different assets added, including scenarios they added:

Is Vyzer.co Worth It?

If you have a fairly standard collection of accounts and investments and haven’t had a problem with tools like Personal Capital, Vyzer is a improvement but you will have to decide if it’s $99 a month better (or $948 a year better).

If your accountant has a spreadsheet that tracks all the Form K-1s you receive each year and is frequently asking you where each one is, it might be a signal you can use Vyzer.

When you start investing in assets that don’t fit into a brokerage account, keeping them all organized is worth it. It’ll depend on your financial situation but I think Vyzer has done a good job satisfying a need that isn’t being filled right now.

Fortunately, there’s a 30-day free trial and a 90 day money back guarantee so you can see for yourself.

The post Vyzer Review 2022: Premium Investment Tracking, Cashflow & Planning Tool appeared first on Best Wallet Hacks.

from Best Wallet Hacks https://ift.tt/4rtyS9I

Comments

Post a Comment

We will appreciate it, if you leave a comment.