There are several ways to invest in crowdfunded real estate with $1,000 and get exposure to properties previously exclusive to wealthy investors. But a new platform adds transparency and simplicity to the investment process through tokenized real estate.

Eligible accredited investors can utilize HoneyBricks to invest in real estate using security tokens. But how does tokenized real estate work, and is HoneyBricks, which only launched in 2022, a trustworthy place to invest?

This HoneyBricks review fills in the essential details about this platform and lets you know how it might enhance your investment portfolio.

Table of Contents

What Is HoneyBricks?

HoneyBricks is a real estate investment platform for accredited investors. Unlike competing platforms which typically require investing at least $10,000 into private real estate deals, the minimum investment can be as low as $1,000.

Additionally, unlike your run-of-the-mill crowdfunded real estate platform, you use security tokens to invest in real estate instead of paper shares. Tokenized real estate appears to be the next investing trend, and this platform is an early adopter.

Unfortunately, HoneyBricks is a new platform currently recruiting its first investors (as of August 2022). Its first investment offerings will launch in October 2022. As a result, some will be apprehensive about investing too much until the platform can establish a track record of credible performance.

What Is Tokenized Real Estate?

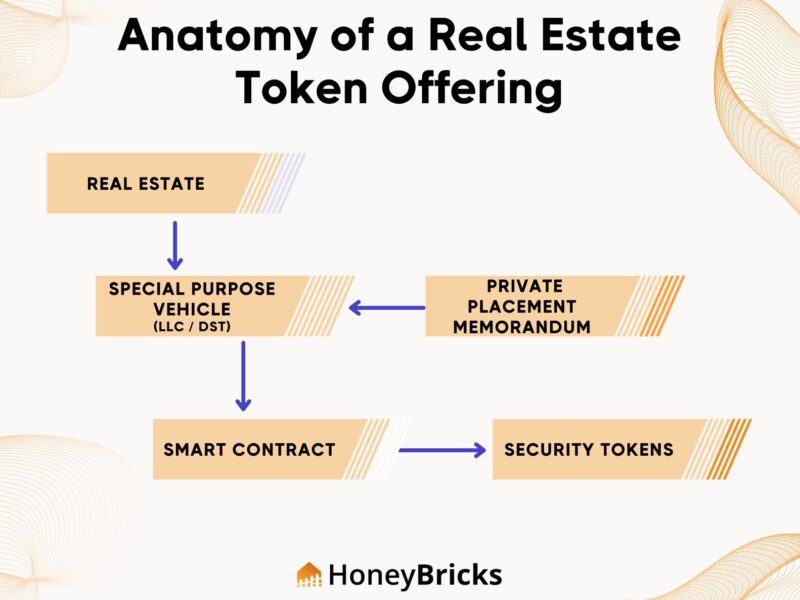

Through a real estate tokenization process, HoneyBricks turns real estate value into tokens stored on the blockchain, dividing them up into fractional values, enabling investors to own real estate digitally.

Blockchain technology is more secure than holding real estate shares in fiat currency and on paper.

It can also reduce the paperwork process to open a position and sell when that time comes. However, you purchase tokens instead of holding shares to have fractional ownership through an LLC.

HoneyBricks uses the Ethereum-based Polygon network to settle transactions using security tokens and stablecoins.

Unlike first-generation cryptocurrencies like Bitcoin and Ethereum, with extremely volatile trading prices, real estate tokens are a “second layer technology” with a consistent value tied to the property’s value and investment performance.

Additionally, tokenized ownership is regulated and authorized by the US Securities and Exchange Commission (SEC), similar to stock brokerages.

A security token provides transparency for the deal sponsor and investor. Sponsors can easily update investment values and minimize paperwork. Investors have an easier time validating their investment stake and can quickly sell their tokens to others.

Tokenized real estate can offer more opportunities to international investors who can exchange stablecoins instead of converting their funds into the local currency.

For example, when selling HoneyBricks tokens, all investors receive their distribution as the USDC stablecoin (USD Coin).

Minimum Investment Period

Two benefits of tokenized real estate are its short minimum investment period and extra liquidity. Current federal regulations require holding your tokens for at least 12 months.

After the 12-month holding period ends, you can instantly sell your tokens to other investors on a secondary market.

Not many crowdfunding platforms offer secondary trading. If they do, you may only be able to request redemptions quarterly, meaning it can take months to receive payment for your sold shares.

Like most platforms, holding for 3-5 years can provide superior returns as real estate is an alternative asset and isn’t a get-rich-quick investment idea.

Account Options

Currently, only taxable accounts are supported. However, self-directed IRAs may be able to participate in the future.

HoneyBricks Tax Treatment

You will invest in properties through an LLC, similar to crowdfunded investments. Therefore, you will receive a year-end K-1 tax form for each investment.

Who Can Invest?

Due to current federal laws, only US and non-US-accredited investors can invest through Honeybricks. Therefore, all deals are considered private placements.

You must satisfy one of these basic requirements:

- Have an annual income exceeding $200,000 ($300,000 for joint investors) for the previous two years

- Possess a liquid net worth exceeding $1,000,000, excluding your primary residence

The platform will verify your accreditation status during the onboarding process. If you don’t meet the requirements, here are several real estate crowdfunding platforms open to non-accredited investors.

HoneyBricks Fees

Investors will pay fees, and the amount differs by offering. As the platform is brand-new, a baseline is unavailable. However, similar services charge an annual management fee of approximately 1%, and additional transaction and property management expenses can apply.

Honeybricks also makes money by charging fees to sponsors.

If you cannot log into your custody wallet, you will pay an incidental fee to regain access to your HoneyBricks tokens. Unlike crypto investing, you can still access your tokens, but an additional fee applies to duplicate your tokens.

How HoneyBricks Works

Here is an overview of what the HoneyBricks investment process looks like for investors.

Investment Offerings

You can expect to invest in multifamily properties across US cities that satisfy preset investment criteria such as neighborhood scores, income history, and schooling data. Specifically in the nation’s 15 biggest.

This is a popular asset class for real estate crowdfunding platforms as they have multiple tenants to provide consistent income.

This type of property is an ideal offering for large numbers of investors with low minimum investments.

Four different deal structures will determine your potential portfolio yields.

| Investment Strategy | Risk Level | Potential Yield | Key Traits |

| Core | Conservative | 5-10% | Focuses on rental income, with limited growth from property appreciation |

| Core Plus | Moderate | 8-12% | Balances income with property appreciation |

| Value Add | Moderate Aggressive | 10-14% | Emphasizes capital growth but also earns rental income |

| Opportunistic | Aggressive | 12-16% | Mainly relies on property appreciation and earns minimal income. |

These investment strategies are similar to the debt-structured (Core) and equity-structured deals (Opportunistic) that most platforms offer.

Most of the investment offerings will fall under the Core Plus and Value Add strategies, according to HoneyBricks.

Member Dashboard

After establishing an account, your member dashboard will provide the following details:

- The total value of your real estate holdings

- Number of your current property positions

- Number of tokens for each property

- Year-to-date distributions to your custody wallet

Additional member-only features may also develop as the platform expands.

Receive Cryptocurrency Distributions

As you hold real estate tokens, you will receive your dividends and sold share proceeds as a stablecoin. Currently, all distributions are made through the USDC coin, but up to five additional coins will soon be supported.

Investment sponsors fund the distributions with US dollars (fiat currency). Then, HoneyBricks converts the fiat into USDC.

This distribution process may seem redundant if you plan to immediately exchange your stablecoins for fiat. However, this extra step is part of the tokenization process to maintain financial integrity.

Crypto-Backed Loans

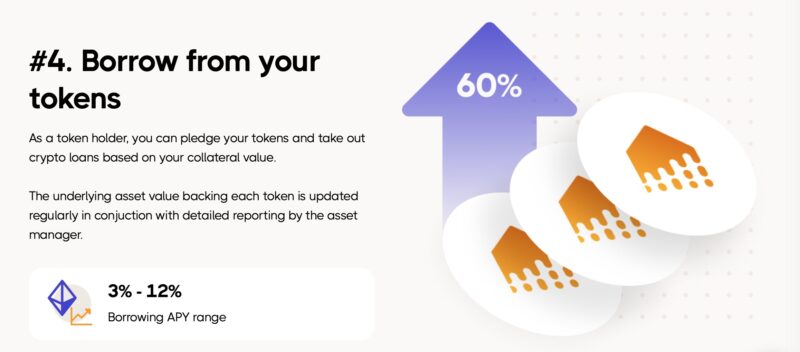

In comparison, most real estate investments lock in your investment principal until you redeem your shares. This platform allows you to use your HoneyBricks tokens as collateral for crypto loans.

The platform states your potential annual yield (APY) can be from 3% to 12%. This borrowing option might make sense if you can earn short-term gains while waiting for your real estate investment thesis to develop fully.

Secondary Trading Market

HoneyBricks will offer a secondary trading market where investors can trade tokens directly with other members. Of course, all investors must observe the federally-mandated 12-month holding period before redeeming tokens for cash or reinvesting in another project.

Learning Center

You can learn more about this investment method and general real estate investing through the learning center. Much of the content can help experienced real estate investors learn how to weave tokenization into their investment process.

HoneyBricks Pros and Cons

Below is a summary of the positives and negatives of investing with HoneyBricks.

Pros

- Invests in multifamily real estate

- Investment minimums as low as $1,000

- Tokenized real estate can streamline the investment process

- Multiple investment strategies

Cons

- New platform with a short track record

- Accredited investors only

- Must receive distributions as a stablecoin

- Individual offerings only

Alternatives to HoneyBricks

Here are some other investments platforms that offer similar real estate exposure as HoneyBricks. In the case of RealtyMogul and Fundrise, you don’t have to be an accredited investor to participate.

CrowdStreet

Accredited investors can invest in multifamily and commercial properties through CrowdStreet. Investment minimums start at $10,000, but you can invest in individual offerings and managed funds.

Investors with a big balance can be eligible for the Tailored Portfolios tool, which provides hands-on help and extra customization. Read our CrowdStreet review for more information.

RealtyMogul

RealtyMogul offers individual offers with a minimum investment of $10,000 or higher.

Non-accredited investors (and accredited investors) are welcome to invest in two REITs, each with a $5,000 minimum investment. One strategy focuses on growth and income (similar to Honeybricks Opportunistic and Core strategies, respectively). For more details, check out our RealtyMogul review.

Fundrise

You can dabble as little as $10 into Fundrise, which means this platform has one of the lowest investment minimums. Additionally, this platform is open to all investors, and you can begin getting exposure to specialized portfolio strategies with a $5,000 initial balance.

Accredited investors may enjoy the Premium investor service. With a minimum $100,000 initial investment, you can be invited to invest in exclusive funds and hands-on priority support.

Other platforms can be better if you invest in individual offerings instead of REITs. Get all the details in our Fundrise review.

HoneyBricks FAQs

Yes, HoneyBricks is a real way to invest in tokenized real estate for accredited investors. This investment method is regulated and approved by the SEC. The exchange platform allows investors to buy tokens directly from real estate sponsors.

Token-based real estate investing is a new concept but can be more transparent than traditional crowdfunding. The platform also makes it easy to redeem your tokens after the minimum 12-month holding period.

Despite just launching and opening to investors, its leadership team has invested a combined $5 billion in over 100 deals. In addition, the real estate advisors have worked with investment firms, including Blackstone and GE Capital.

You can receive dividend distributions and proceeds from sold tokens in your crypto wallet. As of August 2022, the platform issues all payments in USD Coin (USDC) but will expand the distribution options in the future.

Investors must use Ethereum-Virtual-Machine (EVM) compatible wallets to buy and store tokens. You’re also responsible for self-custody of your tokens, but the platform is working on offering a custody service and partnering with other trustworthy third-party services.

HoneyBricks seeks to invest in multifamily apartments in the 15 largest cities across the United States. An investor can make money from monthly rental income and appreciating property values.

The platform offers live chat and has an online help center with short articles.

HoneyBricks Review: Summary

HoneyBricks is an intriguing new platform that uses the latest smart contract technology to make real estate investing more transparent and affordable. It is one of the first services to offer tokenized real estate to eligible investors, which can help provide attractive investment options.

While this platform is only available to accredited investors, you can invest as little as $1,000 into individual properties when similar platforms require at least $10,000 per offering. But while HoneyBricks sounds promising, the big drawback is that they are entirely unproven, having just launched in 2022.

If HoneyBricks interests you but you’re reluctant to invest because of its brief history, I recommend you start by investing small amounts of money and comparing the platform’s performance to the established competition. Or, wait on the sidelines a little longer to see how things play out.

The post HoneyBricks Review: Tokenized Real Estate for Accredited Investors appeared first on Best Wallet Hacks.

from Best Wallet Hacks https://ift.tt/iz7kXlM

Comments

Post a Comment

We will appreciate it, if you leave a comment.