If you could invest money in a financial asset that has the potential to grow significantly over time — knowing that it carries some level of risk — would you do it?

At its core, owning rental homes is similar to investing money in other financial accounts: You’re allocating funds to an asset with the goal of growing its value over time. Investing in real estate can be incredibly lucrative, notably generating over $430,000 in annual rental income for one 32-year-old investor.

While owning rental property can be profitable, its benefits come at a cost. Before you add “landlord” to your resume, it’s important to understand the risks, and knowing how to start investing in real estate is just the beginning.

Here, we’ll unpack the benefits of owning rental property, weigh the pros and cons, and highlight some of the key considerations that property owners should understand before diving in.

Key Takeaways

- Owning rental property can be profitable, but it comes with some downfalls.

- Some of the biggest risks of owning a rental property include extended vacancies and weathering an uncertain economy..

- To determine the return on investment (ROI) of a rental property, look to the two percent rule: If a property produces rent payments equal to two percent or more of your total investment, it passes the test.

- For estimating annual maintenance costs, use a square-footage model: Assume that for every square foot on the property, you will spend $1 each year.

Is Buying a Rental Property Worth It?

Is owning rental property profitable? It certainly can be. There are many benefits of owning rental homes, including the ability for the property to generate profit. Unlike a traditional investment strategy, owning rental property also comes with the ability to offer monthly passive income, as well as some potential tax deductions in April.

Owning rental homes, however, doesn’t come without a little effort and risk on your part, and weighing the pros and cons is the best way to determine whether buying rental property is worth it for you.

Pros of Owning Rental Property

Owning rental property comes with many potential benefits. Let’s take a closer look at some of the key ways your property can give your wallet a boost.

Monthly Passive Income

One of the biggest benefits of owning rental property is providing a stream of passive income each month. Passive income is a source of revenue that requires minimal effort to achieve without needing a second nine-to-five job. Examples include stock market investments, affiliate marketing commission, and rental property income, and you can use this income to pay down the principal on your mortgage — enabling your investment to pay for itself.

Appreciating Home Value

Generally speaking, home values tend to appreciate — or grow — over time. This is due to a variety of factors including improvements and updates, interest rates, the location of your home, amenities in the surrounding area, and tried-and-true supply and demand.

Tax Benefits as a Landlord

As a landlord, there are certain annual expenses that may qualify as tax deductions for rental property, including mortgage interest, property tax, operating expenses, depreciation, and repairs.

Cons of Owning Rental Property

Don’t be misled: Just because rental property is a form of passive income doesn’t mean it comes without some level of effort. In fact, one of the disadvantages of investing in rental property is that it requires a much more hands-on approach than traditional investments: managing maintenance needs, lining up renters, and deftly navigating unforeseen issues.

Rental Property Insurance

Any owner of rental property should secure landlord insurance, a policy that covers both the property and its contents. You may wonder, how much does landlord insurance cost? The sum varies dramatically depending on certain factors — such as the type of property, its geographic location, and the number of tenants and units — but the average cost of landlord insurance in the United States is around $1,288 annually — about 15 percent more than homeowner’s insurance due to the greater potential liability from residents and guests.

Maintenance Costs

As a landlord, be prepared for surprise out-of-pocket maintenance expenses for repairs and upkeep. For estimating maintenance costs, many landlords use a square-footage model as a general rule of thumb. In this model, you tally up the total square footage included on your property: individual units, common spaces, etc. Assume that for every square foot, you will spend $1 each year. For example, if your rental property features a total of 3,400 square feet, you should budget for roughly $3,400 in annual maintenance needs.

Vacancies

Inherent to owning rental homes and property is some level of risk. So what is the biggest risk in owning rental property? Extended vacancy is undoubtedly one of the biggest risks involved in investing in rental homes. If you can’t consistently rent your space month-to-month, you’re still responsible for paying the property’s expenses without generating income to offset the cost. However, as recently as May of 2022, rental vacancy rates were reported as low as 5.8 percent — not far from the historic low of 5 percent set in 1985.

Risks

Additional risks to consider include delinquent tenants and the threat of larger economic instability. Naturally, real estate is not recession-proof, and a period of weaker economic conditions directly impacts the full financial ecosystem. A downturn in the economy could lead to fewer tenants with access to disposable income. On the other hand, a recession could be a good time to buy a home as sale prices decrease.

Your perception of risk ultimately depends on your position as a renter, homebuyer, or financial readiness.

Types of Rental Property

There are many types of residential rental property to consider, and part of investing in real estate includes determining which type of property is right for you. Five key types of rental property include:

- Single-family homes

- Multi-family homes

- Apartment buildings

- Apartment complexes

- Condominiums

You may also consider taking on multiple types of properties to diversify your portfolio. Portfolio diversification ensures stability and predictability in your passive income, and includes changing up your rental properties’ geographic location and tenant mix, in addition to property type.

A common scenario is buying a second property as a vacation home and renting the property when it’s not in use to help offset the cost of financing multiple homes.

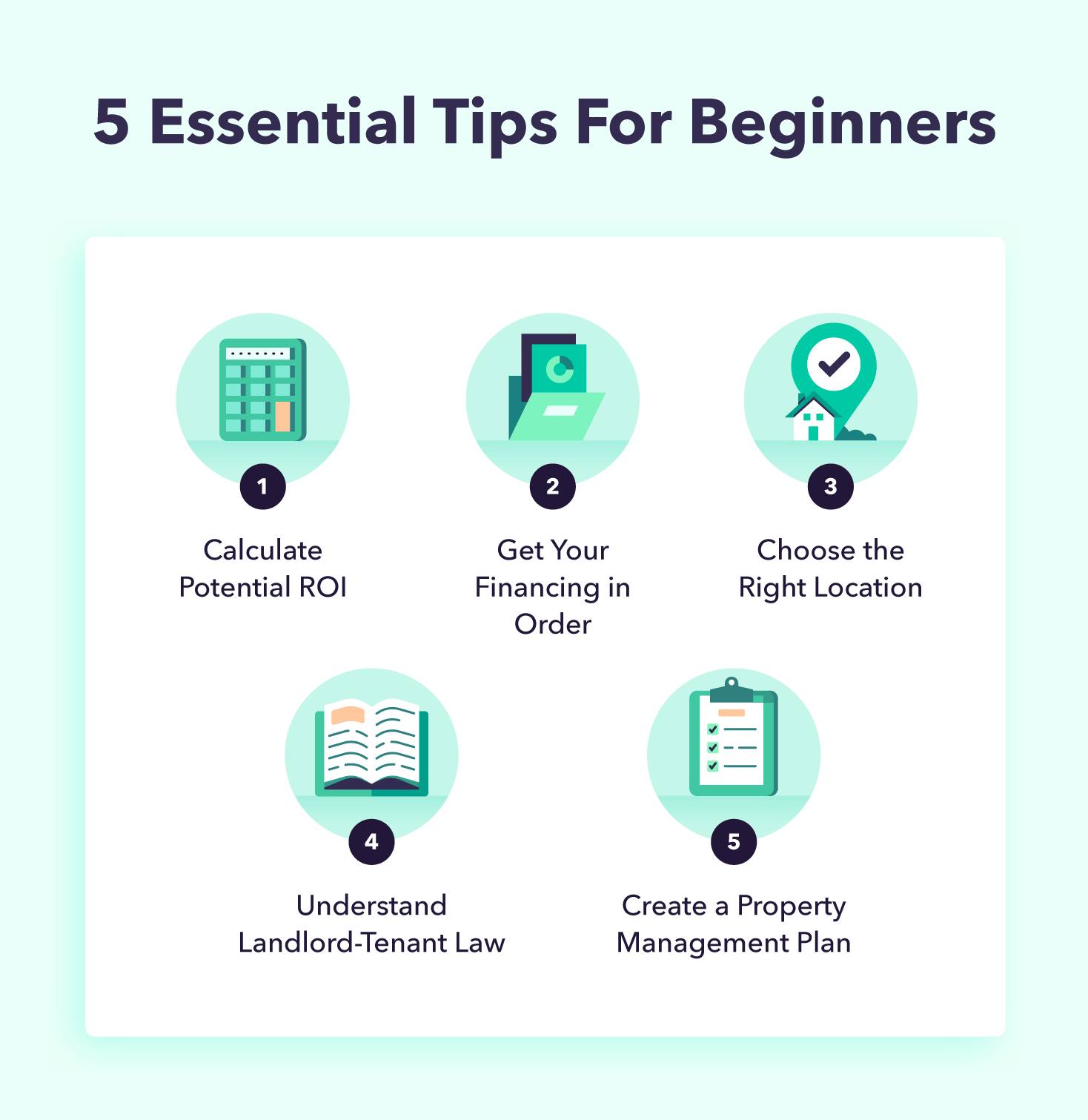

How To Buy Rental Property

The process of actually buying rental homes is not all that different from buying a house as a primary residence, including preparing for buyer expenses, getting pre-approved, and saving for your down payment. The difference lies in the research necessary to ensure your source of passive income actually provides a profit. Here’s how to set yourself up for success.

1. Calculate Potential ROI

Before you start searching for available properties, begin your process by conducting a cost-benefit analysis to understand if investing in real estate is the right fit for you. In outlining costs, be sure to consider maintenance fees, the cost of landlord insurance, property taxes, utilities, property manager salaries, and more.

To help gauge whether rental property could be a wise expenditure, many investors use the two percent rule in real estate. Its basic principle is that if a property has the ability to produce rent payments equal to two percent or more of your total investment, it is likely that the property will both cover your required expenses and produce positive income. In other words, it passes the test.

2. Get Your Financing In Order

- Start With the Basics

Start by asking a few foundational questions. Do you plan to purchase a home with cash, or will you take out a mortgage? Have you saved for a down payment, and how much will be required?

- Secure a Mortgage Loan

Unless you’re able to buy with cash, you’ll want to first shop around for the best mortgage loan, then work with your mortgage loan officer to begin the pre-approval process, which will determine your maximum budget for purchasing a property.

- Make a Down Payment on Rental Property

A sum of 20 percent down is commonly required for a down payment on investment property, but in many cases your down payment ultimately depends on your credit score.

For example, the Fannie Mae Eligibility Matrix indicates that you need a credit score of 640–699 for a loan with 25 percent down, a credit score of 700 for a down payment of less than 25 percent, and a credit score of 720 or more for just 15 percent down.

3. Choose the Right Location

The next step is to partner with a realtor to help you find the right property to fit your needs. The number one rule in knowing how to find investment properties: location, location, location. The best location for rental property will ultimately depend on the type of property you take on.

For example, is your rental property a vacation home with a waterfront destination, or is it an apartment building or multifamily home with dozens of tenants? Proximity to local amenities, waterfront access, and walking distance to public transportation are among the many considerations you’ll want to factor depending on your type of rental property.

4. Understand Landlord-Tenant Law

Landlord-tenant law is a combination of both common law and state statutes. As a landlord, you should familiarize yourself with basic tenants’ rights, eviction and security deposit considerations, and consult with your legal counsel to draft a lease template for your tenants.

5. Create a Property Management Plan

Next, have a plan in place for how you will manage and care for your real estate investment. How will you address basic property management needs? Will you hire a live-in superintendent, a property manager, a management company, or will you handle maintenance yourself?

Knowing how involved you want to be and whether you have room in your budget to hire someone will determine the plan you choose.

FAQs

Is Owning Rental Property Profitable?

Yes, owning rental property can be quite profitable by generating a source of passive income, offering potential tax deductions, and benefitting from appreciating home values over time.

What Is a Major Disadvantage of Owning Rental Property?

A major disadvantage of owning rental property is that it carries more responsibility and hands-on care than a traditional financial investment. As the owner, you are responsible for the property’s maintenance and care, securing tenants, landlord insurance, and navigating risks like extended vacancy and economic recession.

Is Buying Rental Property Worth It?

In the end, buying rental property can be quite profitable, but it’s important to do your own research to weigh the pros, cons, and potential ROI to determine whether it’s a good investment for your personal financial circumstances.

How Much Profit Should You Make from a Rental Property?

When investing in real estate, many use the two percent rule: If a property has the ability to produce rent payments equal to two percent or more of your total investment, it is likely that the property will both cover your required expenses and produce positive income.

What Is the Biggest Risk of Owning Rental property?

The biggest risks of owning rental property include extended vacancy, delinquent tenants, out-of-pocket emergency maintenance costs, and economic downturn (recession).

What Are the Advantages of Owning a Small Rental Property?

Owning rental property comes with a variety of benefits, including a monthly stream of passive income, appreciating home values over time, and a variety of potential tax deductions available to you.

What Are the Tax Advantages of Owning Rental Property?

A variety of rental expenses may qualify as potential tax deductions, including mortgage interest, property tax, operating expenses, depreciation, and repairs.

Remember, There’s No Crystal Ball

The post-pandemic era undoubtedly brought unprecedented conditions to the rental market, including driving massive demand for multi-family unit construction through the first half of 2022. In August 2022, however, asking rents dropped to 7.1 percent — down from 8.4 percent the previous month — a potential indication that the market may be cooling.

In the end, investing in real estate is like investing in any other financial asset: Determining whether it’s the right choice for you is all about weighing the risk against the reward, and navigating economic uncertainty, unforeseen issues, and inherent risks as they come.

Looking to monitor your investment income? Use our free investment calculator to set your goals and forecast growth over time.

The post Owning Rental Property: Pros, Cons & Tips for Beginners appeared first on MintLife Blog.

from MintLife Blog https://ift.tt/kOUcFTX

Comments

Post a Comment

We will appreciate it, if you leave a comment.