No one wants to see their investments take a dip, let alone a plummet. That’s what makes the dreaded bear market so troubling. In these markets, securities typically fall at least 20% in value and widespread pessimism abounds.

But for the savvy investor, bear markets are nothing to be afraid of. In fact, they may even be great opportunities to make some profit — if they use the right strategies.

Here are 10 clever bear market investing strategies that may help investors come out ahead in the end.

1. Wait It Out

When stocks begin to plummet during a bear market, it can be tempting to try and cut losses by selling. Some say that a great t investing strategy for long-term investors is to buy and hold, even during economic downturns.

In fact, recent research from Crestmont Research shows that S&P 500 returns over any 20-year period from 1919 to 2019 were positive. This means that anyone who invested in an S&P 500 index fund at any point between 1900 and 2000 made money, as long as they held for at least 20 years.

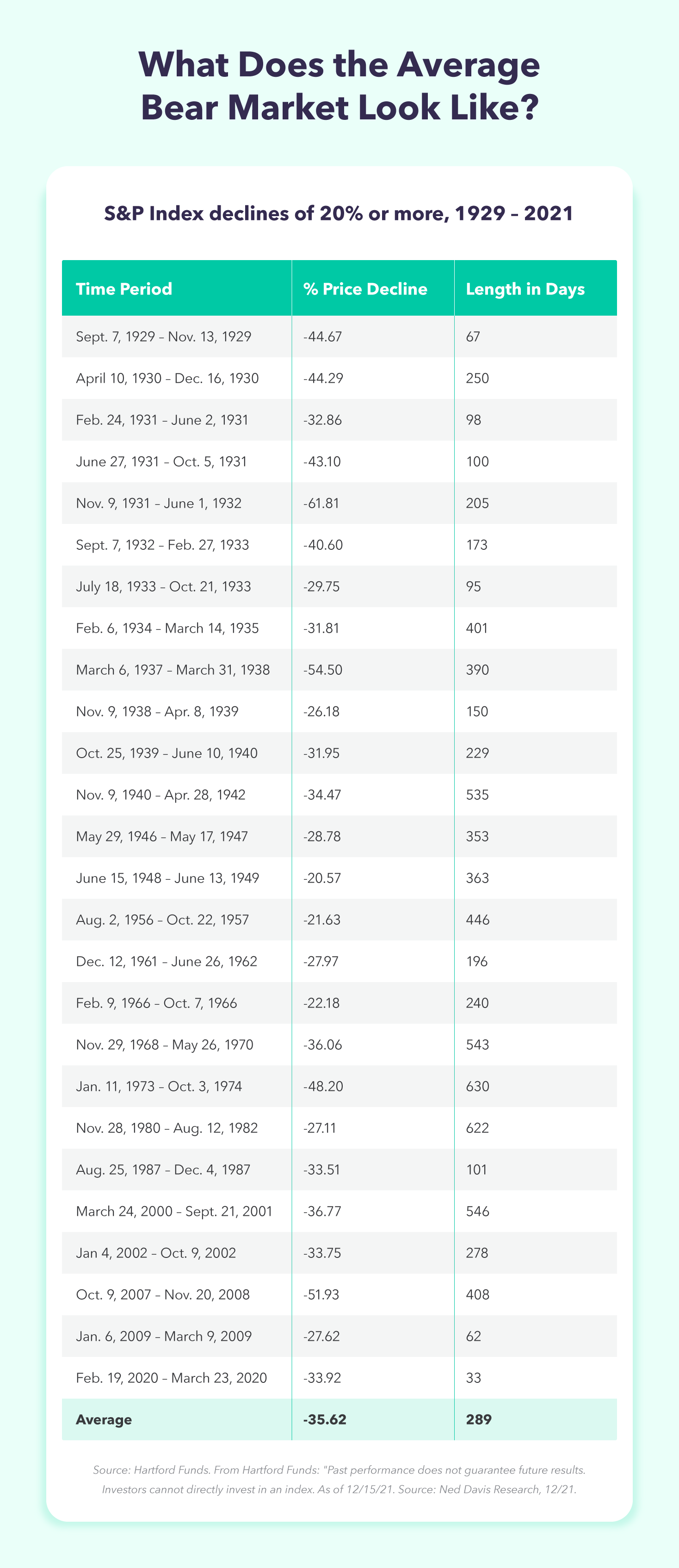

The important thing to remember here is that bear markets don’t last forever. On average, bear markets lose 36% on average over 9.6 months, and there have been 26 bear markets in the S&P 500 since 1928. In contrast, bull markets gain 114% on average over 2.7 years, and there have been 27 bull markets since 1928.

In short: When it doubt, wait it out. Bear markets don’t last forever, and those who stick it out can enjoy the upswing.

2. Hedge Your Bets With Dollar Cost Averaging

Since the stock market has historically bounced back, bear markets may be great opportunities for long-term investors to buy the dip. But when exactly should you buy? Let’s say one stock drops from $100 per share to $70 per share. It may seem like a good time to buy, but that stock could continue to drop until it bottoms out at $50 per share.

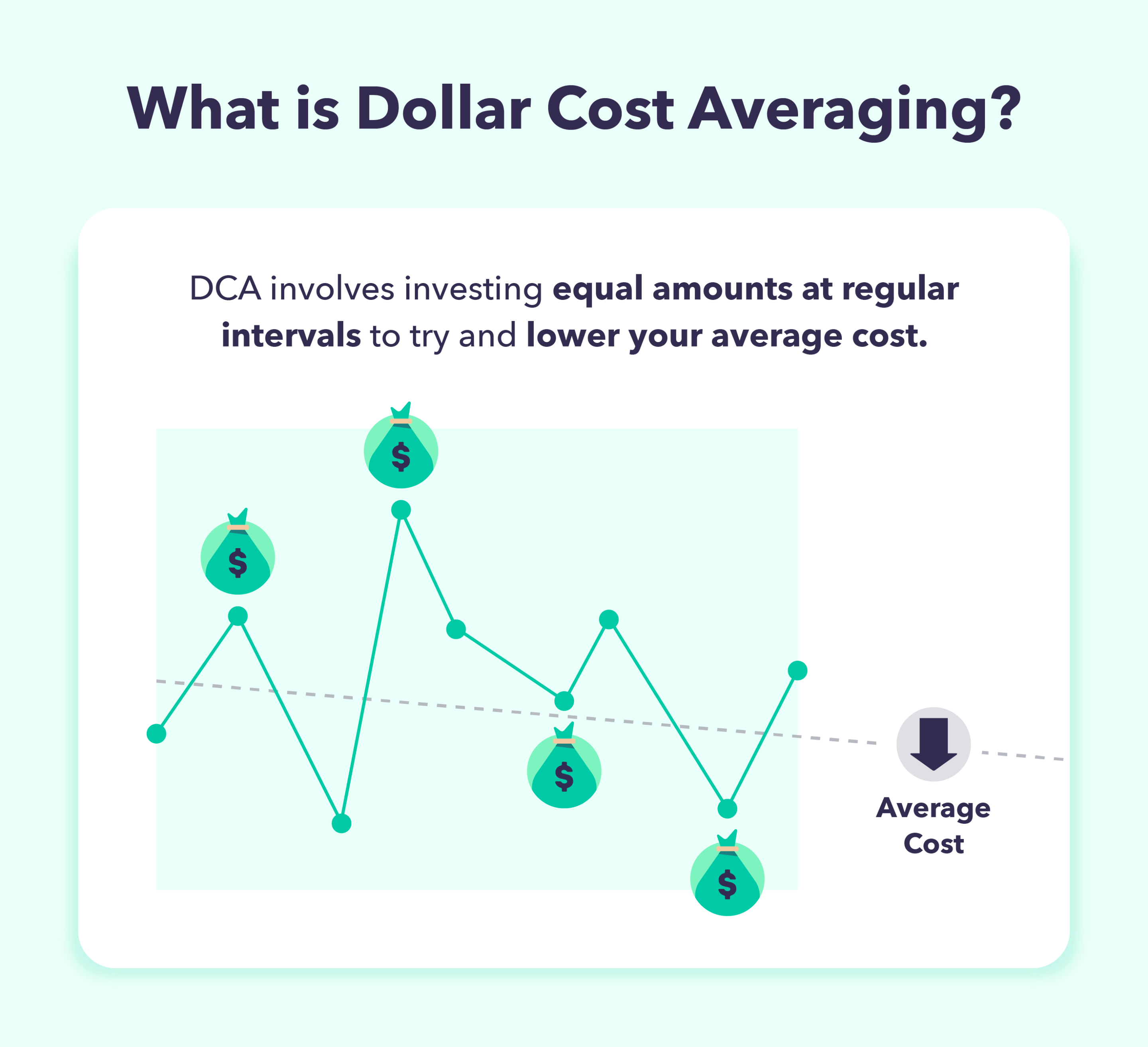

To hedge your bets, don’t try to time the market — consider using dollar cost averaging. This method seeks to lower the amount you pay for stocks with potentially less risk. To use this strategy, invest equal amounts of money into your favorite stocks at regular intervals.

By buying repeatedly at different times and prices, you could effectively average out your buy-in price. This could help you avoid buying too high so you can take advantage of a dropping market.

3. Diversify Your Funds

Diversifying your portfolio is typically a winning strategy whether it’s a bear or bull market. If you’ve ever heard the saying, “Don’t put all your eggs in one basket,” you’ll understand the purpose of diversification. By diversifying your portfolio, you may be increasing the chances that some of your investments will rise or remain steady as others fall. This can help you hedge your losses overall.

The four primary categories of a diversified portfolio are:

- Domestic stocks: Stocks may provide some of the highest rates of return in your portfolio. However, market volatility means stocks may also be riskier than other investment options.

- Bonds: Bonds provide lower rates of returns than stocks on average but are usually less volatile and, therefore, safer. Investing in bonds may help hedge your portfolio against the ups and downs of the stock market.

- Short-term investments: Some short-term investments are money market funds or short-term CDs (certificates of deposit). These are usually seen as conservative and safe investments, although they generally offer lower rates of returns.

- International stocks: Stocks outside the U.S. often perform differently than homeland stocks. This may provide some security in case of poor national stock performance.

4. Invest in Defensive Industries

Defensive industries are those that consumers tend to use even in hard times. Think necessities like shampoo or toothpaste. By investing in these recession-proof industries, you can add a stabilizing branch to your portfolio.

You can invest in individual stocks in defensive industries, or you can invest in index funds or exchange-traded funds. These funds hold shares in multiple companies, helping diversify your portfolio. For example, you can invest in a consumer staples fund to receive dividends from a variety of companies producing products considered essential.

5. Look for Bargains

Bear markets may cause even stocks like Disney to take a dip. Smart investors may see bear markets not as a setback, but an opportunity. Where there’s downturn, there’s also a better chance of finding a bargain.

Warren Buffet often buys during bear markets for this very reason. In fact, he once called the 2007 – 2008 bear market an “ideal period for investors.” Buffet knows that down markets create fear, which can lead to stock sell-offs at value prices.

This fear often comes exclusively from the market being down. In other words, when great companies are being sold at lower prices — not because there’s fear they won’t perform well in the future, but just because there’s fear in general. When the market inevitably bounces back, bargain purchases of no-brainer companies are likely to pay off as usual.

6. Buy Dividend Stocks

Another way to hedge against bear markets is to invest in stocks that pay dividends over those that do not. Data from Ned Davis Research shows that dividend stocks averaged an annual return of 9.5% from 1972 to 2012. This is compared to the average 1.6% returned annually by non-dividend paying stocks.

This difference may seem dramatic, but it makes sense. Stocks that issue dividends are usually profitable from year to year and time tested.

7. Buy Growth Stocks

While value stocks typically perform better than growth stocks, the reverse is true in a downturned economy. A report by Bank of America/Merrill Lynch tracked the performance of growth and value stocks over 90 years (1926 – 2015). Overall, value stocks outperformed growth stocks with returns of 17% versus 12.6%. However, in downturned economies, growth stocks proved to be the better performer.

8. Use Short Strategies

Falling market prices may provide unique opportunities to make gains in the short term. While not as safe as long term investing strategies, these short strategies can be attractive options to those willing to take the risk.

- Put options: Put options give holders the right to sell a stock or commodity at a predetermined price, called the strike price. They tend to increase in value when the underlying asset decreases in value.

- Inverse exchange-traded funds (ETFs): ETFs have an inverse relationship with major index funds like Nasdaq. When major index funds go down, ETFs go up. This may help investors hedge against market downturns.

- Short selling: Investors who expect a stock to decrease in value may try short selling. This involves borrowing stock shares, selling them at the current market price, and hoping to buy the shares back at a lower price when it’s time to return them, pocketing the difference.

9. Bet on the “Lipstick Effect”

The lipstick effect theorizes that in times of economic downturn, small luxury items like lipstick will increase in sales. The idea is that while consumers will be unable to afford larger luxury items, small items can increase spirits in down times.

While not a surefire bet, investors who have some extra cash may benefit from looking to cosmetic, beauty, skincare, or fragrance brands.

10. Go for the Gold

Gold has long been used as a great place to invest money. Its value tends to rise and fall with less volatility than the stock market. This makes it a great hedge against hard times. Investors who’d like to invest in gold have a few options:

- Purchase bullion

- Invest in gold-backed ETFs

- Invest in gold-mining stocks

Selling gold can be a quick way to raise cash. You may then reinvest this cash into dividend, growth, or defensive stocks to further prepare your portfolio for a bear market.

Bear Market Investing FAQ

Have other questions about investing during a bear market? Here are the answers to some commonly asked questions.

What Is the Best Strategy in a Bear Market?

A great strategy in a bear market (or any market) is to buy and hold stocks from major index funds like the S&P 500. Data from Crestmont Research shows that S&P 500 returns in any 20 year period from 1919 to 2019 were positive.

What Investments Do Well in a Bear Market?

Several investment options have proven track records in bear markets.

- Growth stocks: Based on a report from Bank of America/Merrill Lynch, growth stocks tend to outperform value stocks in economic downturns.

- Dividend stocks: Data from Ned Davis Research shows dividend stocks outperform stocks that don’t pay dividends, with annual returns averaging 9.5% compared to 1.6%.

- Defensive industry stocks: Defensive industries are basic necessities, such as shampoo or toothpaste. Consumers aren’t likely to stop using these basics, even in tough times.

How Do You Profit From a Bear Market?

There are a few ways you can try to profit from a bear market.

- Dollar cost averaging: This strategy takes advantage of falling prices by investing equal amounts at regular intervals. This seeks to reduce your average buy-in amount.

- Look for bargains: Even stocks like Disney may take a hit in bear markets. Consider scooping up these bargains and reap the rewards when the market bounces back.

- Short strategies: Short selling, put options or inverse exchange-traded funds (ETFs) are all ways to try and make money in the short term during a bear market.

How Do You Hedge Against a Bear Market?

A great way to hedge against a bear market is to diversify your portfolio. While stocks generally fall during a bear market, they don’t all fall. Having a diversified portfolio can increase your chances of having some winners to counterbalance the effects of losing stocks.

You may also hedge against a bear market by investing early on in growth stocks, dividend stocks, and defensive industry stocks. These stocks have proven track records of performing well during bear markets.

While bear markets may seem worrisome, they are nothing to be afraid of. By following bear market lessons and tracking your investments, you can work toward creating future financial success.

The post 10 Clever Bear Market Investing Strategies To Make Gains appeared first on MintLife Blog.

from MintLife Blog https://ift.tt/e8cDMFT

Comments

Post a Comment

We will appreciate it, if you leave a comment.