Are you caught in the trap of not being able to get a credit card because you don’t have credit? Or maybe your credit history isn’t the greatest, and you need someone who will give you a chance?

Building credit without a credit card is possible, but secured credit cards can help you reestablish your credit while offering the convenience of owning a credit card. But not all secured credit cards are equal. The fees and flexibility differ between products, so you have to do your research before settling on one specific card.

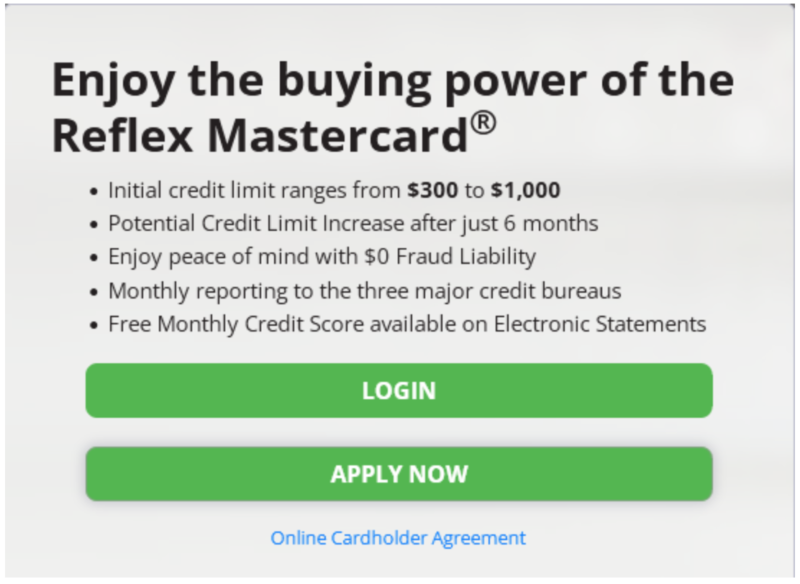

The Reflex Mastercard is a secured credit card designed for those trying to build or rebuild their credit. It’s easy to qualify for, and you gain access to several Mastercard benefits.

But how does it work, and can it compete with other top cards from Capital One, Indigo, or Chime? I cover all of this and more in this Reflex Mastercard review.

Table of Contents

What Is Reflex Mastercard?

The Reflex Mastercard is being offered by Continental Finance Company, one of the leading providers of credit cards for borrowers with less-than-perfect credit. The company is based in Wilmington, Delaware, and was founded in 2005. Continental is accredited by the Better Business Bureau, rating A on a scale of A+ to F.

Continental Finance Company has provided more than 2.6 million credit cards since it began, specializing in borrowers overlooked by traditional credit card issuers. They make credit cards available to consumers with poor credit, fair credit, or even limited credit.

The Reflex Mastercard is a secured credit card issued by Celtic Bank, a nationwide small-business lender and a residential construction lender, founded in 2001 and based in Salt Lake City, Utah.

The Reflex Mastercard is not only offered for those with impaired credit but also includes a potentially generous credit limit, with a credit limit increase in as little as six months (though the “fine print” specifically states 12 months). And since your payment history is reported by all three major credit bureaus – Experian, Equifax, and TransUnion – your on-time payments will help you to build a good credit reference with all three.

Reflex Mastercard Features & Fees

What is it? A credit card for consumers with poor credit or limited credit

Credit limit: $300 to $1,000

Cash back rewards: Not offered

Mobile app: Available for iOS and Android devices through the Continental Finance Company mobile app

Customer service: Available by toll-free phone or through the online banking service

Interest rate: 29.99% APR that will vary based on the Prime Rate

APR for cash advances: 29.99%

Payment due date: At least 25 days after the billing cycle closing date

Annual fee: $125 the first year, then $96 annually after that

Maintenance fee: $120 annually, charged at $10 per month; the monthly maintenance fee does not apply for the first 12 months after opening your account

Additional card: One-time fee of $30

Cash advance fee: The greater of 5% of the amount of each advance, or $5 (this fee is not charged for the first 12 months after opening your account; also, be aware that no cash advances are permitted for the first 95 days)

Foreign transaction fee: 3% of transaction amount (this fee is not charged for the first 12 months after opening your account)

Late payment fee: The lesser of $28 or the minimum monthly payment for the first late payment, then up to $39 for subsequent late payments

Return fee: The lesser of $28 or the minimum monthly payment for the first late payment, then up to $39 for subsequent late payments

Learn more about Reflex Mastercard

Reflex Mastercard Benefits

The Reflex Mastercard can be used for online purchases and at any of the millions of merchants and vendors worldwide that accept MasterCard. You’ll also be eligible to take cash advances against your credit line 95 days after opening your account.

If your account is approved, your initial credit limit will be between $300 and $1,000. But you should be aware that the annual fee of $125 will be immediately charged against your credit limit. If that credit limit is $500, applying the annual fee will reduce the remaining credit limit to $375, typical for this credit card type.

Credit limit increases. Your account will be reviewed after it is been open for at least 12 months for acceptance for a credit limit increase. Though the amount of the credit limit increase will vary, the maximum credit limit possible with the card is $2,000 overall. You’ll be required to increase your security deposit to cover the credit limit increase.

Online banking. You can enroll in online banking, receive online statements, make payments, and view recent transactions, previous statements, payment history, current balance, and credit information. Online banking is available on both the website and the mobile app.

Credit reporting. Your payment history will be reported to all three major credit bureaus, allowing you to build a positive credit reference with each bureau.

Free credit score. You’ll receive your monthly credit score if you sign up to receive electronic statements. The score provided is the Vantage 3.0 score from Experian, which is the typical score provided by free score providers.

Learn more about Reflex Mastercard

How the Reflex Mastercard Security Deposit Works

You must post a security deposit equal to your credit limit. Should you fail to make your scheduled payment on your credit line or otherwise default on the account, the security deposit will be used by the lender to satisfy any deficiency, up to the amount of the deposit (you’ll then be responsible for any additional unsatisfied balances).

You will not be able to withdraw from the deposit account as long as it secures your credit line. You’ll have the option to make additional deposits into your security deposit account to increase your credit limit to a maximum of $2,000.

However, the credit limit will not be increased after supplying the additional deposit until the account has been open for at least 90 days and at least three on-time minimum payments have been made. The security deposit will be held in an FDIC/NCUA insured account and will be non-interest-bearing.

How to Apply for a Reflex Mastercard

To apply for the Reflex Mastercard, you must be a US resident over 18 (or 19 in Alabama) and have an active checking account or debit card.

The application can be completed directly on the website. You’ll be asked to provide the following information:

- Your full name.

- Home address (no post office boxes).

- Email address.

- Social Security number.

- Total monthly income.

- The primary source of monthly income.

- Primary and secondary phone numbers.

- Your date of birth.

You’ll also be asked if you intend to use the card for cash advances or if you would like an additional card.

The amount of both your credit limit and your security deposit will be determined at the time of approval. You’ll receive a letter apprising you of both shortly after approval. The letter will specify the method of payment for the security deposit, which will be required to activate your credit limit.

Setting up a linked bank account to make your monthly payments or even an automatic draft will be possible.

Reflex Mastercard Pros & Cons

Pros:

- Designed specifically for those with poor, fair, or limited credit.

- Allows you to spend wherever Mastercard is accepted.

- Reports your payment history to all three major credit bureaus

- A monthly credit score is available with online statements

Cons:

- Higher fees than many of its competitors.

- Requires a security deposit equal to the credit limit.

- The $125 annual fee is steep.

- The security deposit is held in a non-interest-bearing savings account.

Learn more about Reflex Mastercard

Reflex Mastercard Alternatives

At this point, you’ve probably come to the conclusion that the Reflex Mastercard is a really expensive way to establish or build credit.

For some, it may be the only option.

For others, one of the alternatives below may be a better choice.

But exactly which will be the best choice will depend on your credit situation. Some cards will work best for you if you have no credit, while others will be better if you have fair credit rather than poor credit.

Chime Credit Builder Visa Card

The Chime Credit Builder Visa card is a secured Visa card, but you don’t need a security deposit to qualify, providing you can set up an eligible direct deposit of $200 or more in your Chome Spend account.

When you use your Chime Visa, Chime places a hold on the funds in your secured account. They report your payment history to the three major credit bureaus, helping you build or rebuild your credit. There is no interest charged and no monthly or annual fee. While there is no rewards program, you can’t ask for much more from a credit builder card. Learn more about Chime in our full review.

Chime is a financial technology company, not a bank. Banking services provided by The Bancorp Bank or Stride Bank, N.A., Members FDIC. The Chime Visa® Debit Card is issued by The Bancorp Bank or Stride Bank pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa debit cards are accepted. Please see back of your Card for its issuing bank.

Self Visa Credit Card

Self is a credit builder platform like Chime. Their primary product is an installment loan that lets customers build a positive payment history at an affordable cost. The loan terms range between 12 and 24 months, and payments are reported to the three main credit bureaus. Your payments are sent to a Certificate of Deposit in your name, which is used to secure the loan.

If you have a Self Credit Builder Account, you can apply for a Self Visa Credit card without a credit check. The minimum credit limit is $100, but you can increase the limit as the balance on your Self CD grows. Learn more in our Self Credit Builder Review.

Jasper Cash Back Mastercard

Jasper Cash Back Mastercard is an unsecured credit card designed for consumers with limited credit history. It will not be an option if you have a poor credit history. But if you qualify, they’ll provide a credit limit of up to $15,000 with no annual fee. The interest rate is a very reasonable 15.74% to 25.24% APR, and you can earn 1% cash back rewards.

Capital One Platinum Secured Mastercard

Capital One Platinum Secured Mastercard is a credit card that, like Reflex Mastercard, does require a security deposit. The initial credit line will be $200, and the deposit will be $49, $99, or $200, depending on your credit. However, you can increase your credit line by increasing your deposit to a maximum of $1,000. And if you use your card responsibly and make your payments on time, your deposit can be refundable.

The current interest rate is 26.99% APR, and there’s no annual fee. Much like Reflex, you will be eligible for a credit line increase after just six months of on-time payments.

OpenSky Secured Credit Card

OpenSky Secured Credit Card is a Visa card designed for consumers with either no credit or poor credit. That’s because the company does not run a credit check when you apply. Like the other cards on this list, it can be used to build or rebuild your credit rating. A refundable security deposit is required, ranging from $200 to as much as $3,000 (but be aware the deposit will only be returned after you close your account).

The current interest rate is 17.64% APR, and there is a $35 annual fee. OpenSky reports all three major credit bureaus

Indigo Platinum Mastercard

The Indigo Platinum Mastercard shares many similarities to the Reflex Mastercard. Still, while it’s not the lowest-cost option available, its fees are lower than the Reflex Mastercard. The maximum annual fee is $99 (and could be lower, depending on your credit history), and unlike the Reflex card, it doesn’t charge a monthly maintenance fee. The purchase APR is also lower (24.9% vs. 29.99%). Neither card offers cash back rewards. Check out our Indigo Platinum Mastercard review for more information.

Learn more about Reflex Mastercard

Should You Sign Up for the Reflex Mastercard?

Reflex Mastercard is an option if you are looking to build or rebuild your credit, but that doesn’t mean there aren’t better options.

In my view, its major disadvantage is that the Reflex Mastercard is more expensive than competing cards. For example, the APR of 29.99% is at the top of the interest rate range. So is the $125 annual fee for the first year, not to mention the $10 monthly maintenance fee that kicks in after the first 12 months. For my money, the Capital One Platinum Secured Mastercard mentioned above offers far more value, as does Chime.

But fees aside, this card will allow you to build or rebuild your credit. And that’s the whole purpose of any credit card in this category. Since Reflex reports your payments to all three major credit bureaus, you’ll build a good credit reference with timely payments.

The post Reflex Mastercard Review: Better Credit for a Price appeared first on Best Wallet Hacks.

from Best Wallet Hacks https://ift.tt/IxS4twE

Comments

Post a Comment

We will appreciate it, if you leave a comment.