If you’re like me, you have a lot of competing priorities for your time.

There’s only so much time in the day and if you aren’t careful, it’s easy to spend too much time on things that seem urgent and important but are neither.

This is especially problematic when it comes to your money because there are a lot of things that demand your attention, and often your guilt, but they usually don’t move the needle.

Today, I’m going to share a framework for thinking about the tasks you have and how you should be prioritizing and handle them.

Table of Contents

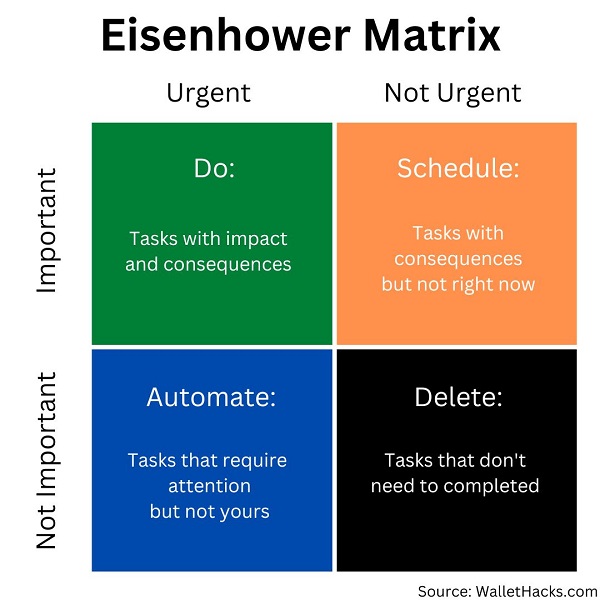

Urgent and Important Matrix

Before we get into some examples, we need a framework to help us understand what requires our attention. This framework is known as the Eisenhower Principle.

The Eisenhower Principle separates tasks into four quadrants:

I like this framework because it’s a filter by which you can establish your priorities.

A list of tasks is simply that – a list. If you were to prioritize them, it could be a subjective ordering based on something other than importance and urgency. With this framework, importance and urgency are the two key factors to consider when prioritizing tasks.

More to the point, once you’ve batched each task into one of these four buckets, you also have a plan of attack. To commend your attention right now, a task must be both important and urgent. If it’s just important or just urgent, it can wait.

If it’s neither important nor urgent, it’s subject to review – do you even need to do it? Perhaps not because it’s unimportant.

Note there’s no consideration of how long something takes. This framework is important but not complete. Once you’ve put all of your tasks into these quadrants, you still have to prioritize tasks within these categories. That’s when other considerations come into play – like time to complete, cost to complete, relative importance and impact, etc.

But as long as this is the first filter, you’re in good shape.

OK – let’s talk about some examples to cement this.

1. Not Important, Not Urgent Tasks

“Fixing” Your Morning Coffee / Avocado Toast

You’ve probably heard this before – if you didn’t spend $4 each morning on your coffee, you’d have $1,460 more each year to invest. If you invested it in the stock market at 8% a year, you’ll be a millionaire by … blah blah blah.

Once they slammed coffee, next came avocado toast. You get the idea.

While $1460 a year would be great in your pocket, “fixing” this problem comes at a great cost in terms of time, attention, and mental energy.

It’s not urgent because the daily cost is relatively small. It’s not important because you have to spend a lot of time (getting the coffee, getting a coffee maker, getting filters, setting it up each night, drinking it each day, getting to-go cups, etc) to get those savings.

Alternatively, that time could be spent elsewhere that earns you more than $4 a day.

Also, the upside is capped at $4 a day.

Checking Your Stock Portfolio

How often do you check your stock portfolio?

When I first started investing (dot come bubble period), I was checking it all the time. I had set up portfolios in Google Finance and was refreshing them all the time. I was checking Yahoo! Finance for news. I was reading up on everything with these dot com companies because there was news all the time.

It was exciting because there was always an update. Refresh Yahoo! Finance, and boom – dopamine hit from more news.

It felt urgent because there was always news. Something was happening and some stock was making big moves.

The most recent Reddit r/wallstreetbets pump of Gamestop brought back some memories. One second Gamestop was nearing bankruptcy and the next it was going to the moon! 🚀🚀🚀

This is a prime example of doing something that is both not important and not urgent. It might seem important (I need to be in the know!) and urgent (there’s always news, I have to know it immediately!), but the reality is it has no bearing on your finances.

You are unlikely to take action (in fact you should NOT take action) and so this is just time wasted. Unless you treat it as entertainment, this is a task to delete.

2. Not Important, Urgent Tasks

Not important but urgent tasks are the worst because humans are creatures who do NOT thrive under a sense of urgency – the urgency almost lends a bit of importance to an otherwise meaningless task.

In many versions of this matrix, the automate box usually says delegate. But many of these tasks are very personal and delegation might not be feasible – that’s why I reframed it to automate instead of delegate.

Updating Your Monthly Net Worth

I have a monthly ritual in which I record our family’s net worth in a spreadsheet. For years, I used to log into every account and manually record the numbers. It’s urgent (must be done at the end of the month) and relatively important (we should know our finances!), but not really that important.

Knowing that number is more vanity than actionable.

This is a task that is ripe for automation, right? I semi-automated it with a tool.

So instead of logging into each account, I have them all linked in Personal Capital and I log into one place to collect almost all the numbers.

Paying Credit Card Bills

Credit card bills are the epitome of not important yet urgent tasks.

They aren’t important in the sense that you get a better outcome when you complete them. Anyone can pay a credit card bill and the result is the same – it’s paid. (it would be nice if random people paid your bill though!)

It is, however, urgent when due. Miss a payment and the fees are ridiculous.

The solution is to automate this. We have all of our credit card bills on autopay. The linked checking account has free overdraft protection from an associated savings account.

To solve the problem of potential unauthorized charges, we get transaction notifications for any transaction over $0. This way we never have to review the statements for errors.

I haven’t paid a credit card bill in years and we haven’t missed a payment in years either.

3. Important, Not Urgent Tasks

These are often the most difficult tasks to deal with because we know these are important but the lack of urgency means it’s easy for us to delay them a little bit longer.

Rebalancing Your Asset Allocation

Rebalancing your asset allocation is an important task that most people do not consider urgent – because there’s no obvious difference between doing it today and tomorrow. We may tell ourselves we want to rebalance every six months or every year, but when that time comes there’s no magic deadline that makes it clear we must do it.

But it’s still important – if we want 80% stocks and 20% bonds today, we certainly want it in a year. If one outperforms the other, we want to readjust.

To solve this problem, it’s best to schedule all similar tasks for some date in the future when you’ll knock them all out at once.

Since you’ll want to rebalance each year, it’s probably best to find other important, not urgent tasks to schedule around this one!

Improving Yourself

This is the king of important but not urgent tasks. Whether it’s taking up a new hobby, learning a new skill, or otherwise improving some aspect of yourself, doing something that makes you a better human is an important yet not urgent task.

To bring this back to money, this could be something like pursuing a new skill or certification that makes you a more valuable employee. For example, if you’re in IT, there are a million different technical certifications that can help you earn more at your job (or find a new job that pays better).

It could also be something as simple as improving your fitness. This can have all-around benefits for your life, money and otherwise, that you can take with you into old age.

These are important but lack the urgency that might make you think more about them.

4. Important, Urgent Tasks

Finally, the most obvious of quadrants – the important and urgent tasks are those you have to deal with right now.

Dealing with a financial emergency

I’ve been fortunate in that I’ve been in just one car accident as a driver. When it happened, a red Dodge Durango ran a red light and hit my Celica at a 45-degree angle. It was a slow accident so I escaped physically unscathed but my car was totaled.

The challenge with financial emergencies is that they are important and urgent but also a surprise. One moment you’re driving from one office building to another, the next moment you’re getting your car towed and a rental car.

But an emergency is a situation where the preparation happens ahead of time. I’ve often written about having an emergency plan and an emergency fund. The fund has the money but the plan outlines what you will do in the event of an emergency. It’s prepared when you’re calm, which is the best time to build plans.

Saving for retirement

I’m using “saving for retirement” as a catch-all for investing in general. When we think about savings goals, retirement is often the “big one” with a long time horizon.

We know it’s important but we rarely believe it’s urgent. Is there a difference between saving today vs. saving tomorrow? What’s one day?

One day matters for two reasons:

- Rarely is it just one day – one day can easily because 10 or 50 or 500.

- The day you are losing isn’t today, it’s the day before you need the money.

When you delay your savings for one day, you don’t lose today. You’re losing that last day your money would’ve been invested before you started taking withdrawals. If you’re going to invest for 20 years, that’s 7300 days of investing. You’re not giving up Day 1, you’re giving up the fact that Day 1 will have been invested for 7300 days.

That’s a lot of money.

That’s real urgency.

The post Eisenhower Matrix: How to Spend Your Financial Time appeared first on Best Wallet Hacks.

from Best Wallet Hacks https://ift.tt/gIc3TVo

Comments

Post a Comment

We will appreciate it, if you leave a comment.