There comes a time in your financial life where you wonder if what you’re doing supports your long term goals. We all know saving money is important. We all understand investing is important.

I reached that point a few years before I wanted to buy a house.

I’d been aggressively saving towards my 401(k) and Roth IRA – both are good things. But if my goal was to save towards a house in 3-5 years, having that money “stuck” in retirement accounts wasn’t right for my goals.

I never met with a financial planner or even thought about the term “financial plan,” but I should have. Instead, I just did some messy math on some scrap paper and pulled back my 401(k) contributions.

We wouldn’t start working with a fee-only financial planner later on – that’s when I saw how structure and rigor could’ve helped. Both give you the confidence that you’re doing the right thing and also something easy to follow.

Juggling various short-term and long-term financial goals or just knowing if you’re saving enough can be challenging – that’s why people use financial plans. There comes a time when we all need a second opinion to improve our odds of financial success.

This is where an online financial planning programs like Fortunately can help. They’ll let you create a free personalized financial plan in as little as ten minutes, help you visualize your goals, adjust, and receive expert advice.

But can a self-serve platform replace a real-life human advisor? In this Fortunately review, I’ll cover the key features, pros and cons, and let you know who the app is best suited for.

Table of Contents

What is Fortunately?

Fortunately is a self-directed online financial planning service that analyzes your current financial situation to help you generate a personalized plan.

Fortunately’s main objective is to ensure you’re saving correctly for retirement while taking into account your short-term and long-term goals.

Fortunately can make recommendations for the following:

- Investment asset allocation

- Tax optimization

- Monthly investment and savings contributions

- Excess cash reserves

- Saving for future goals (i.e., college tuition, buying a house, etc.)

- Retirement spending

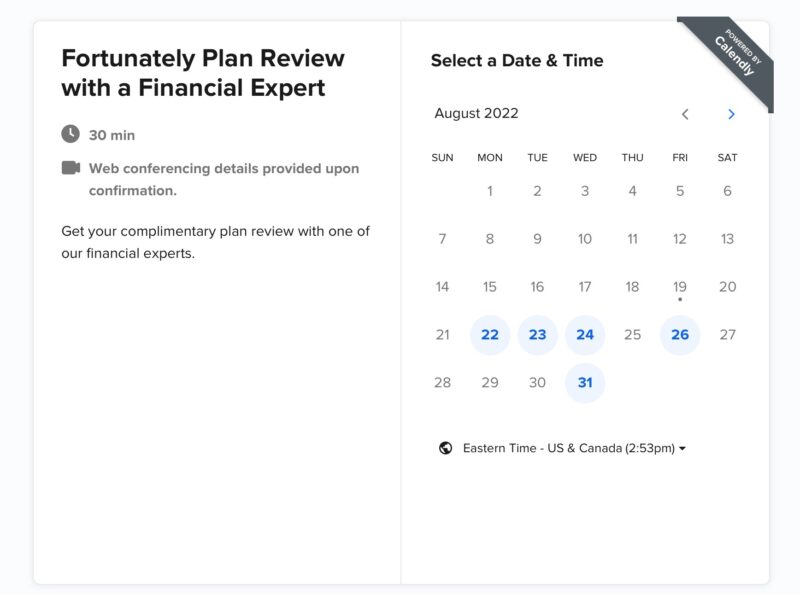

You can schedule calls with financial advisors for extra hands-on guidance with your plan, but otherwise, Fortunately is self-directed with personalized suggestions to increase your savings rate. The company does plan to offer managed services soon.

Who Is Fortunately Best For?

Fortunately is for someone who would like a financial plan and on-going guidance without hiring a full-time advisor. In my opinion, it’s best suited for young professionals or anyone with a family and some time before they plan to retire.

Fortunately can help you save and invest more efficiently to improve your long-term net worth and achieve your short-term goals instead of focusing on a single purpose like retirement or paying off debt. It does not have any budgeting capabilities.

For example, you might receive a recommendation to invest more each month and reduce the amount you deposit into savings. The service can also make recommendations for each financial account you have to optimize its productivity for achieving your goal.

Who Isn’t Suited for Fortunately?

While we wish Fortunately worked for everybody, it’s less effective in certain situations.

Other platforms may be a better fit if the following apply:

- You need a monthly budget to avoid overspending (try Mint or You Need a Budget)

- You just want to track your finances without significant planning assistance (try Personal Capital or many Personal Capital alternatives)

- You want someone to take your money and invest it based on your goals (try a roboadvisor)

- Help to pay off high-interest debt (again, Mint or YNAB can help)

- You are retiring soon and want to test different scenarios (try NewRetirement)

- Have unique financial circumstances that may need a full-time financial advisor

This app is best those building or evaluating their financial plan and looking to make decisions about financial tradeoffs – comparing near term priorities vs. anticipated retirement goals.

How Much Does Fortunately Cost? (Pricing & Fees)

Fortunately is free for the first 30 days. Most similar offerings only give a 14 day (or less in many cases) trial, so being able to explore for a whole month is significant.

Then, you pay $5 per month or $50 annually (which is a $10 savings over monthly payment). Your membership lets you use the financial planning software and schedule calls with an advisor.

Compare this with some fee-only financial and the cost is almost negligible. Fee-only financial planners and advisors typically charge several hundred dollars an hour. While that may sound expensive, it’s cheaper than those who charge based on assets under management (never my preference).

You can also get a free financial evaluation but won’t be able to save your data unless you upgrade to a paid plan. The company plans to roll out automated money management as an optional add-on in the future.

How Fortunately Works

Let’s take a closer look at Fortunately’s key features, which you can use to plan for the future and visualize your financial progress.

Personalized Planning

It takes approximately 10-15 minutes to answer several basic questions to structure your personalized financial plan. Of course, you can always fine-tune your plan later on by adjusting your account balances and goals.

The topics include:

- Age

- Marriage status

- Current annual income

- 401k eligibility and contribution amounts

- Financial account balances (brokerage, IRA, and cash accounts)

- Housing costs (rent and own)

- Monthly living expenses

- Monthly savings rate

- Upcoming life goals (i.e., buying a home, large purchases, child care, paying for college)

- Planned retirement age and estimated retirement spending

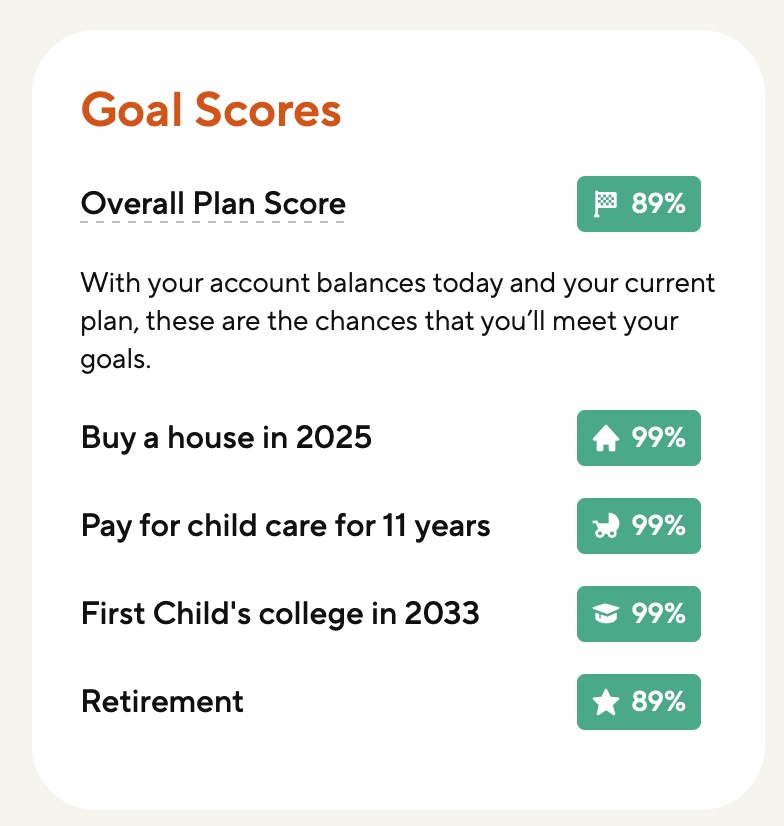

After answering these questions, Fortunately runs your details through a Monte Carlo simulation for various optimistic and pessimistic scenarios to receive an overall plan score.

Ideally, you want a score above 80%, indicating that your current savings plan surpasses most simulations.

What’s nice is that these planning tools are free. You will need a paid subscription to track your progress, make dynamic adjustments, and receive ongoing support.

Forecasting Assumptions

While there are many ways you can customize your plan, several standard assumptions apply to all simulations.

Some of them include:

- A life expectancy of 100 years

- Do not model Social Security benefits or state and local taxes

- Doesn’t include advanced tax credits and deductions (i.e., itemized returns, capital losses, mortgage interest deduction, child tax credit)

- Average historical investment returns (i.e., 8.45% for stocks and 4.63% for bonds)

While you may not live to see 100 years on Earth, this conservative assumption helps prevent under-saving for retirement.

Additionally, you won’t get bogged down in the variable details that are difficult to model. As a result, allowing you to quickly make a plan and receive an accurate assessment at your current savings rate.

Plan for Multiple Life Goals

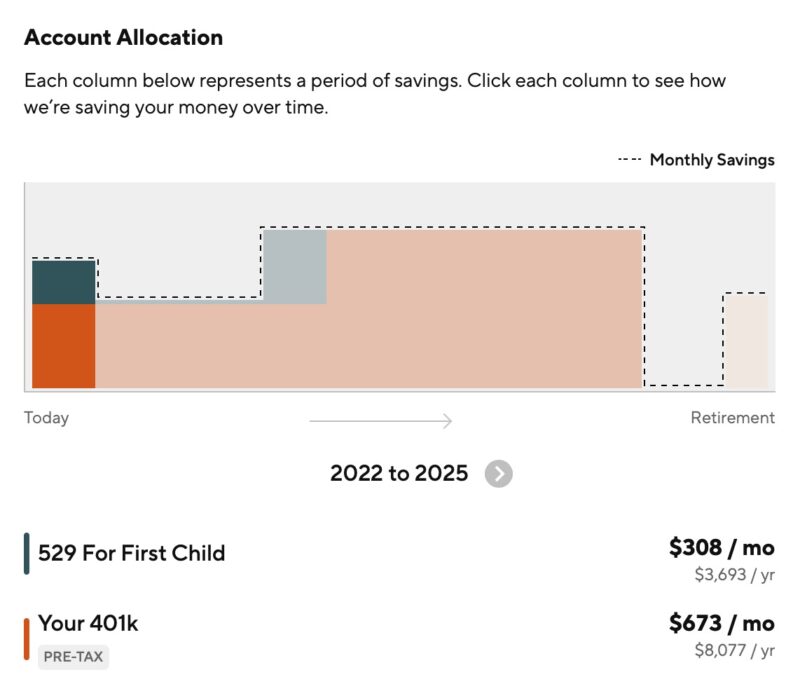

You can incorporate multiple savings goals for one-time or monthly expenses into your plan that are a significant portion of your monthly budget.

For example, you can allocate your monthly childcare costs, and the remaining years before you won’t need this service. Another example is your monthly 529 contribution or savings for a home down payment.

After creating your savings target and deadline, the interactive planner displays the milestones on your financial projection timeline. You will also see how much money you can save each month before and after reaching the goal.

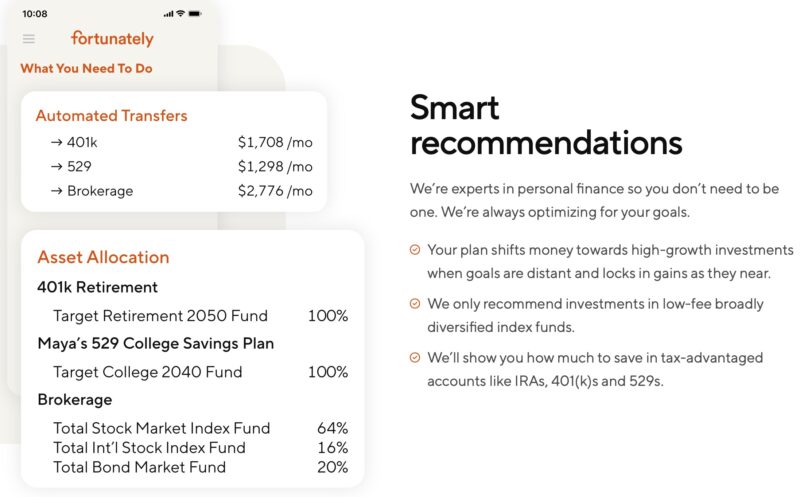

Smart Recommendations

You will receive several personalized recommendations that can improve your savings and investment strategies.

For example, one initial recommendation can be making a one-time transfer from your cash reserves to an investment account. Doing so can still allocate enough cash for unplanned expenses while having more opportunities to earn passive income from long-term investments.

Investment Strategy

Using the three-fund portfolio strategy, the service will recommend an asset mix for your brokerage account, 401k, IRA, and 529 plans.

This strategy uses tax-advantaged and cost-efficient index funds and target date retirement funds instead of trying to outperform the market through individual stocks and active mutual funds.

You can also preview the future asset allocation predictions to determine how you will rebalance your stock and bond ratio.

Fortunately doesn’t yet offer managed portfolios so you are responsible for buying the recommended positions and manually rebalancing your portfolio as necessary.

Constant Monitoring

You can link your financial accounts to view your real-time balances in the dashboard. The service uses the third-party app Plaid for read-only access to your accounts while safeguarding your data.

Syncing your accounts makes tracking your net worth and personalized plan progress easier.

Schedule an Expert Call

One of the most valuable benefits for paid users is scheduling online sessions with the financial expert team. You can choose an open slot on the calendar and discuss your plan with an advisor with a complimentary 30-minute web conference.

This perk is the sweet spot between one-time advice packages and hiring an advisor if you just need a little hands-on help.

Insights

Going beyond personalized planning, all users can read free informational articles covering financial topics like investing and managing a mortgage.

These articles provide additional value, but the goal planning tools are the best option.

Fortunately Pros and Cons

Pros

- Personalized suggestions

- Access to financial experts

- Can link financial accounts

- 30-day free trial

- Affordable pricing ($5/month or $50/year)

Cons

- Not for complex situations or making a monthly budget

- Cannot customize certain assumptions

- The free plan doesn’t save information

- No managed accounts (yet)

Fortunately Alternatives

Fortunately is more than capable of handling the foundational components of your financial plan, but there are other alternatives if you feel this it isn’t a good fit.

Here are a couple of Fortunately alternatives to consider, including a more costly alternative, which is to bypass the self-directed route and hire a human advisor.

NewRetirement

Consider NewRetirement if you want a comprehensive near-retirement planner and forecaster. Like Fortunately, you have an interactive planner that can project your future net worth and retirement income and run your retirement strategy through Monte Carlo simulations. It also has a 14-day free trial and several tiers of service, the lowest of which is $120 a year.

The NewRetirement service has more customization options as you can budget for specific budget categories and add optimistic and pessimistic assumptions. NewRetirement is aimed at those who are nearing or extensively planning their retirement – including forecasting various scenarios like downsizing or moving to a lower cost of living area.

One-time financial advisor sessions are also available but the cost is higher.

Read our NewRetirement review for more full details.

Personal Capital

Personal Capital is better if you want a completely free net worth tracker. The service offers several retirement planner and investment portfolio analyzer features that can evaluate your current strategy.

However, the retirement planning tools do not provide the same customization to plan for multiple lifetime goals and project your future cash flow. It’s a much lighter version of any of the tools mentioned in this review, but it’s also free.

Additionally, you must enroll in their managed investment service ($100,000 minimum) for financial advisor access. There’s no way to pay for it directly.

For more information, check out our Personal Capital review.

Hire a Financial Advisor

If you have a complex financial situation or own several different types of assets, your best option may be in hiring a financial advisor. An advisor can also manage your investments and provide a personalized action plan.

Unfortunately, your advisory fees will be significantly higher than Fortunately’s flat pricing.

In addition, those fees can increase as your assets under management get bigger. For these reasons, you must do the proper research to ensure you’re hiring the right person.

Fortunately FAQs

Fortunately can be beneficial if you need help estimating the financial impact of your life goals and determining how much to save and invest. You can also receive similar personalized insights as hiring an advisor but at a substantially lower cost.

The service won’t sell your personal information or account data. Additionally, you can connect your financial accounts with Plaid and Auth0, which encrypts your information and doesn’t provide access to your sensitive account details. This is the industry standard for financial tools of this type.

Email support is available for basic account questions, and there are FAQs. You can also schedule web conferences with financial experts to review your plan and create action steps.

Creating a basic plan and connecting your banking and investment accounts is easy. Making plan adjustments and scheduling financial expert calls are also simple. Comprehending the recommended steps and projections are also user-friendly. However, as the platform is relatively new, it may not offer as many in-depth features as other planning tools, which some users may find limiting.

Final Thoughts

Fortunately makes it easier to save for immediate financial priorities while staying on track with your retirement goals. It lets you quickly adjust and predict how the changes will impact your monthly savings and future net worth.

If you’re unsure, remember that it’s free to start and there’s a 30-day free trial if you want to link accounts and save your plan. That is plenty of time to determine if Fortunately is the right tool for you. It doesn’t matter if I think it’s good or bad, it’s only good if you can use it! (and if it can give you a plan that you can follow)

The post Fortunately Review 2022: A Financial Plan for $10/Month? appeared first on Best Wallet Hacks.

from Best Wallet Hacks https://ift.tt/vVNAayQ

Comments

Post a Comment

We will appreciate it, if you leave a comment.