Investment advisors often recommend holding a large part of your stock portfolio in the S&P 500 index, and for a good reason. The index has been steadily outperforming the rest of the market for over a decade.

The easiest way to hold the S&P 500 is through index funds. Since they are designed to match the index’s performance closely, they represent the best way to take advantage of the S&P 500 with virtually any amount of money.

Two of the top S&P 500 index funds are the Vanguard S&P 500 ETF (VOO) and the SPDR S&P 500 ETF Trust (SPY). Both funds perform a similar function, so which one should you buy?

The differences between the two exchange-traded funds are very slight. Either will get the job done if you’re looking to match the performance of the S&P 500. But it might come down to personal preference for which you may choose.

Table of Contents

VOO vs. SPY: How Each One Works

Vanguard S&P 500 ETF (VOO) and the SPDR S&P 500 ETF Trust (SPY) are designed with the same goal in mind – to track the performance of the S&P 500 index, which comprises the 500 largest publicly traded companies in the United States. You’ll benefit from the stock performance of the top companies in the country. And since the index covers all major industries, you’ll be diversified across multiple sectors. International stocks, of course, aren’t included in the S&P 500 as it’s the U.S. only.

Each fund is issued by a major fund family. VOO belongs to the very popular Vanguard organization, while SPY is part of State Street Global Advisors (SSGA). Each represents one of the most prominent fund families globally, giving you the ability to hold multiple funds under the same roof. And because they’re so popular, they’re available from nearly any broker in the industry.

VOO vs. SPY: The Direct Comparison

The Basics

The table below provides a side-by-side comparison of the basic features of VOO and SPY. As you’ll notice, there are more similarities than differences between the two ETFs.

| Fund / Feature | VOO | SPY |

| Asset Class | Domestic Stock – General | Domestic Stock – General |

| Category | Large Blend | Large Blend |

| When Launched | 09/07/2010 | 01/22/1993 |

| Expense Ratio | 0.03% | 0.0945% |

| Market Price (as of 5/25/2022) | $365.20 | $397.37 |

| 52-week High / Low Price | $358.04 / $439.25 | $380.54 / $479.98 |

| Total Net Assets | $760.1 billion | $358.7 billion |

| Number of Stocks | 505 | 505 |

| Dividend Distribution | Quarterly | Quarterly |

Portfolios

The industry distribution of the VOO is as follows: information technology (27.4%), healthcare (14.2%), consumer discretionary (11.5%), financials (10.9%), and communication services (8.6%).

Here are the top ten holdings of VOO:

- Apple Inc.

- Microsoft Corp

- Alphabet Inc.

- Amazon.com Inc.

- Tesla Inc.

- Berkshire Hathaway Inc.

- UnitedHealth Group Inc.

- Johnson & Johnson

- NVIDIA Corp.

- Meta Platforms Inc.

The industry allocation of SPY is as follows: information technology (26.87%), healthcare (14.81%), financials (11.20%), consumer discretionary (10.36%), and communication services (8.97%). This distribution roughly parallels VOO, though it isn’t identical.

Below, SPY’s top ten holdings represent 29.0% of the overall net assets of the fund:

- Apple Inc.

- Microsoft Corp

- Amazon.com Inc.

- Alphabet Inc., Class A

- Alphabet Inc., Class B

- Berkshire Hathaway Inc.

- Tesla Inc.

- Johnson & Johnson

- UnitedHealth Group Inc.

- Meta Platforms Inc.

The main differences in holdings are that SPY breaks out two classes of Alphabet and that VOO includes NVIDIA, while SPY doesn’t (SPY likely includes NVIDIA outside its top 10 holdings.)

Otherwise, as you can see from the summary table above, each fund holds an identical 505 stocks and tracks the performance of the S&P 500 index.

Fund Performance

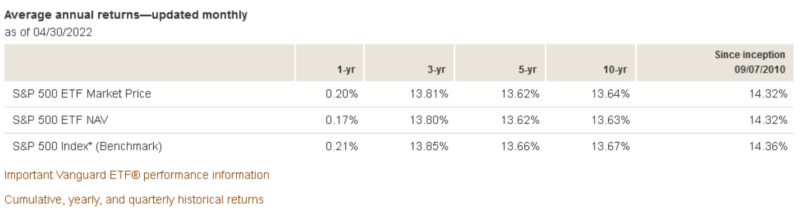

Below are screenshots of the 1-year, 3-year, 5-year, 10-year, and since inception performances of both funds (through April 30, 2022), according to Vanguard and SSGA.

VOO:

SPY:

If we could overlay the two screenshots, the performance for each period would be almost identical. Let’s do a side-by-side comparison using a table:

| Fund / Performance Period | VOO | SPY |

| 1-Year | 0.20% | 0.11% |

| 3-Year | 13.81% | 13.69% |

| 5-Year | 13.62% | 13.50% |

| 10-Year | 13.64% | 13.52% |

| Since Inception (inception date) | 14.32% (since 09/07/2010) | 9.99% (since 01/22/1993) |

While the performances for virtually every interval are nearly identical, the VOO slightly outperforms the SPY. For the 1-year timeframe, VOO has a performance advantage of 0.09% and 0.12% for the 3-year, 5-year, and 10-year intervals.

Much of this can be explained by the difference in the expense ratio for each fund. While VOO has an expense ratio of 0.03%, SPY is 0.0945%. That means VOO has an annual advantage of 0.0645% on the expense ratio, which makes up slightly more than half the difference in annual performance.

(Though the average annual return since inception overwhelmingly favors VOO – by 4.33% per year – you can ignore this difference.

Having been launched in 1993, SPY fully experienced the Dot-com bust of 2000 – 2002 and the Financial Meltdown of 2007 – 2009. The VOO was not in existence for either of those bear markets.)

VOO vs. SPY: Is One Better than the Other?

Usually, when comparing two funds that perform the same function, the differences between the two funds are insignificant and more personal preference than anything else.

You can say this of the VOO and the SPY to a certain degree. Each is tied to the S&P 500 index, holds 505 stocks, and maintains nearly matching industry sector allocations. And as S&P 500 index-based funds, neither have any significant exposure to international markets.

VOO vs SPY: And the Winner is…

If I have to pick a winner, it would be VOO, based purely on performance.

The performance is higher for the most recent 12 months, but there’s a consistent 0.12% performance advantage over the most recent 3-year, 5-year, and 10-year time frames.

That kind of performance edge can make a difference when you hold a fund in your portfolio for over 20 or 30 years. And since the S&P 500 is so popular among investors, that’s what you should expect to do. Depending on your portfolio size, a small performance advantage can add up to thousands of dollars over the years.

Investors seem to share that sentiment. Even though SPY has been around for about 17 years longer than VOO, VOO nonetheless has twice the volume of assets under management as SPY.

Some of it has to do with the lower management expense ratio of the VOO, But even when you discount for the MER, VOO still has a slight performance advantage over SPY. To find out how VOO stacks up against a total stock market ETF, check out our VOO vs. VTI comparison.

The post VOO vs. SPY: Which S&P 500 ETF is Best for Your Portfolio? appeared first on Best Wallet Hacks.

from Best Wallet Hacks https://ift.tt/yeXKCha

Comments

Post a Comment

We will appreciate it, if you leave a comment.