Real estate prices have skyrocketed in recent years, which means that down payments required to purchase a home have also risen substantially. If you’re like many would-be real estate investors, you may be stuck watching the action from the sidelines. But a real estate crowdfunding platform, Arrived Homes, provides the ability to invest in single-family properties with as little as $100.

If you’ve been looking to diversify your portfolio out of paper investments and into “hard assets,” Arrived Homes might be worth considering.

Table of Contents

What Is Arrived Homes?

Arrived Homes is a real estate crowdfunding platform where you participate in investments in single-family residential properties. The company started in Seattle, Washington, in June 2019. Arrived Homes enjoys an A+ rating with the Better Business Bureau, the highest on a scale of A+ to F.

Arrived Homes serves as a crowdfunded, online real estate investment marketplace. You can purchase shares in individual properties for as little as $100. They provide a list of current and previous properties, and you can choose from any that are currently available. The low barrier to entry means you can spread your investment across multiple properties without breaking the bank.

Arrived Homes procures potential investment properties through data-driven decision-making in collaboration with local real estate experts. The company strives to acquire high-quality properties in desirable neighborhoods. Individual properties must hold the prospect of rate return profiles, including stable cash dividends and long-term price appreciation potential.

The company fully vets each property investment. And though your investment can produce passive income through positive rental returns, the primary objective is long-term appreciation.

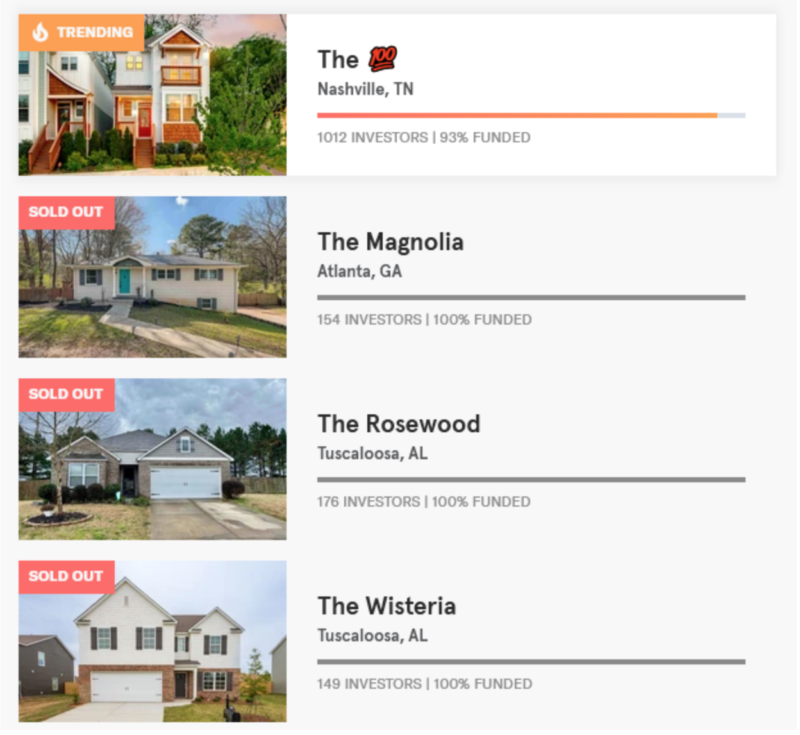

Properties offered for investments are primarily along the southern tier of the United States. The largest concentrations are in Georgia, Alabama, Tennessee, and the Carolinas.

As an investor, all you need to do is invest your money. Arrived Homes handles all the details, including property selection and acquisition, renovations, tenant and property management, and ultimately the sale of the investment.

Learn more about Arrived Homes

Arrived Homes Features

The following list of key features will help you decide if Arrived Homes is suitable for you. You can join other crowdfunded real estate platforms. Further down, I’ll cover some of the alternatives, like Fundrise, Roofstock, and Yieldstreet.

- Invest in single-family investment properties

- The minimum investment is between $100 and $20,000, depending upon the property.

- You don’t have to be an accredited investor to buy in.

- Open to individuals, specific entities, or (pending) self-directed IRA accounts (SDIRAs) that can accommodate alternative investments like direct property ownership.

- Income distributed quarterly

- Income reported via IRS Form 1099-DIV

- Early redemption is not permitted, but the company is working on a plan to accommodate early liquidations of shares at a future date.

- Phone and email customer support during business hours.

How Does Arrived Homes Work?

As mentioned earlier, Arrived Homes serves as an online real estate marketplace for investment properties. Arrived Homes, LLC sponsors the investments offered on the platform and sells shares through securities offerings under Regulation A of the Securities Act of 1933.

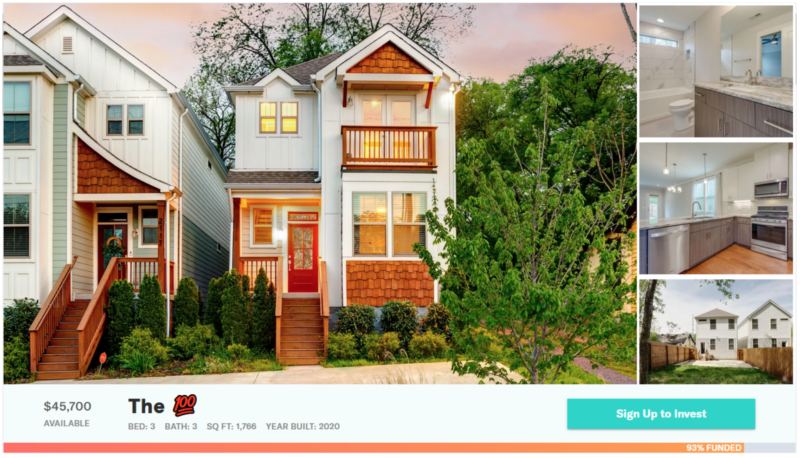

When I signed up for the platform, they were offering their 100th property investment. It was the only one still open to investing – they had already fully funded the other 99. That’s remarkable for a company in business for only about two years.

The property offered is located at 2119 Herman Street, Nashville, Tennessee.

The detail provided on the property was impressive. Arrived indicated the amount of the first dividend payment, the expected payment date(July 2022), and the first year dividend yield (3.6%).

The positive dividend yield itself is impressive. Finding properties with a positive cash flow is challenging in today’s high-cost real estate market. But once again, Arrived Homes concentrates their investment activities in areas of the country where they deem this outcome to be more likely.

In addition, Arrived carefully screens prospective tenants and rents properties with two-year leases. The combination creates increased rental income stability by reducing tenant turnover.

Arrived Returns

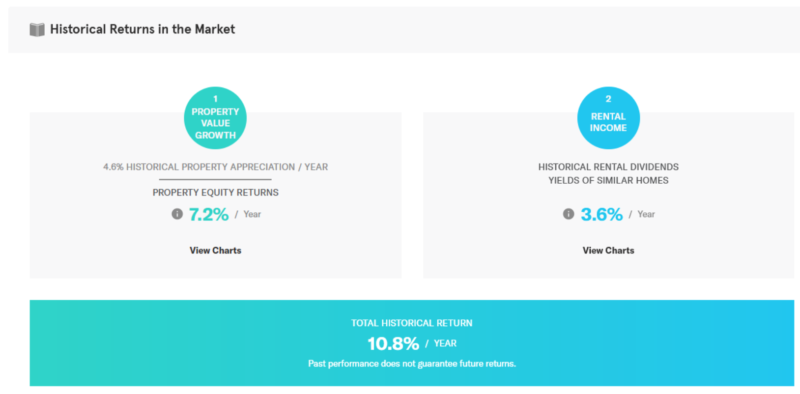

The above screenshot contains the annual dividend and the historical property appreciation. With a property equity return of 7.2% and an annual dividend of 3.6%, Arrived Homes expects this property to return 10.8% yearly if held until disposition.

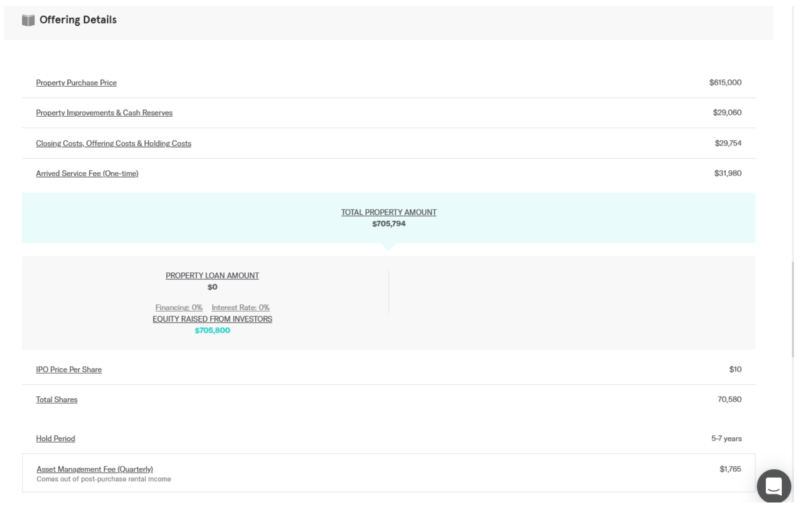

Next, Arrived Homes provides details of the offering. That includes the property’s purchase price, improvements, cash reserves, closing costs, offering costs and holding costs, and the one-time Arrived Homes service fee (covered below).

In the screenshot above, Arrived Homes discloses the price per share, which is $10, and the total shares offered (70,580).

The same table indicates the expected hold period of the property, which is between five and seven years. But also notice in the middle of the screenshot, Arrived will finance the investment entirely with equity raised from investors. That means no loan on the property, therefore no debt service or interest expense.

The company also discloses other details, including the use of the proceeds raised, the series overview, risk factors, and provides the offering circular.

Learn more about Arrived Homes

Arrived Homes vs. REITs

Though Arrived Homes is not a real estate investment trust, that’s the way they set up each property investment. That means each property will be structured and taxed as a Real Estate Investment Trust (REIT).

At least one purpose for this investment structure is to avoid the Unrelated Business Tax (UBIT) for investments held in self-directed IRA accounts.

Arrived Homes Pricing

The Arrived Homes online marketplace is free to use for browsing, investigating, and selecting properties you want to invest in.

Arrived Service Fee

Arrived Homes collects two fees on each investment – the first is the one-time Arrived Service Fee. Though they don’t indicate a specific percentage, I calculated it to be approximately 4.5% on the deal offered above ($31,980, divided by the initial equity raised of $705,800).

The Arrived Service Fee is the fee charged by Arrived Homes for acquiring the property and preparing it for investment. The result is included in your per share investment and does not represent an additional cost.

Asset Management Fee

The second fee is the Asset Management Fee – a quarterly fee based on the initial equity raised from investors. The fee is paid out of rental income from the property and covers the cost of managing the investment.

Once again, Arrived doesn’t provide a percentage for this fee. But a calculation based on the investment offered above indicates the fee to be about 1% of the initial equity raised ($705,800 X 1% = $7,060, divided by four quarters, equals $1,765 per quarter, the amount of the quarterly fee listed in the investment offer).

Agent Rebates

The company discloses a third fee, which investors do not pay. They refer to this as Agent Rebates. When Arrived Homes purchases a property from the original seller, they collect a real estate agent fee from the seller – also known as the Agent Rebate.

Learn more about Arrived Homes

How to Sign Up with Arrived Homes

To sign up with Arrived Homes, you must be a US citizen or resident and 18 years old. Unlike some real estate crowdfunding platforms, Arrived Homes doesn’t require you to be an accredited investor to participate.

Once again, Arrived Homes is free to sign up for browsing properties. You need to provide your full name and email address, and you can begin taking advantage of the platform.

Once you decide on a property, you’ll choose how much you want to invest. You will then review the contract terms and sign it if everything is agreeable.

You’ll need to link your bank account to Arrived Homes to fund your investment. But the same bank account can be the destination for the quarterly dividends earned on your investment. You can link only one bank account per Arrived Homes account.

Arrived Homes Pros & Cons

Pros:

- Opportunity to invest in real estate with as little as $100.

- Spread your investment across multiple properties for maximum diversification.

- You don’t need to be an accredited investor.

- Arrived designs investments to provide current income – a quarterly rental dividend – and long-term capital appreciation.

- Arrived Homes maintains a 2% cash reserve on each investment property to cover unexpected expenses or rental vacancies.

- Expected annualized returns on properties held to completion are greater than 10%.

- It’s an entirely passive investment.

Cons:

- A limited number of properties are available

- Low liquidity – average 5 to 7-year investment duration and no early redemptions

Learn more about Arrived Homes

Arrived Homes Alternatives

Roofstock

Roofstock works very similarly to Arrived Homes. It serves as an online real estate marketplace where you can invest in single-family rental properties. You can do this through direct investment (down payment) in a standalone property or shares in multiple properties. But be aware that Roofstock doesn’t provide direct property management – it connects you with property managers in your area. Our Roofstock review has more information.

Roofstock has investments for both accredited and nonaccredited investors. If you invest in individual property deals, Roofstock will require a down payment equal to 20% of the purchase price and cover any closing costs involved in the acquisition. It offers pre-vetted investment properties that you can take ownership of if that’s your preference.

Yieldstreet

Yieldstreet offers real estate investments, but you can also diversify beyond real estate on the platform. They can accommodate accredited and nonaccredited investors, allowing you to invest for income, growth, or both. Investments include real estate, structured notes, short-term notes, legal finance, venture capital, crypto, and other asset classes. It’s an excellent choice if you’re looking to diversify your portfolio on a single platform. The company claims a net annualized return of 9.71%. The minimum investment is between $1,000 and $5,000. Learn more in our Yieldstreet review.

Fundrise

Fundrise is the best choice in real estate crowdfunding platforms for beginners since you don’t need to be an accredited investor, and you can begin investing with as little as $10. Investors also love the diversified investment options Fundrise has to offer. For example, you can invest in their eREITs for just $10 and eventually trade up to more sophisticated investment choices. They offer five different plans, each with its mix of risk and reward. Check out our full Fundrise review for all of the details.

Learn more about Arrived Homes

Arrived Homes Review: Final Thoughts

Arrived Homes is an excellent choice if you feel spooked by the recent decline in the financial markets and would like to expand your portfolio to include a more stable asset class, like real estate. You don’t need to be an accredited investor – you can begin investing with as little as $100 and spread a small amount of money across multiple properties.

Though the company has only been in business for two years, they’ve already fully funded its first 99 investment offerings. That speaks volumes about the trust investors have in this organization.

The combination of net rental income – paid quarterly – and long-term capital appreciation can produce double-digit returns. That is a welcome addition to any portfolio.

The post Arrived Homes Review: Real Estate Crowdfunding for as Little as $100 appeared first on Best Wallet Hacks.

from Best Wallet Hacks https://ift.tt/BKFhg39

Comments

Post a Comment

We will appreciate it, if you leave a comment.