If you are a regular T.J. Maxx customer or shop at one of their popular subsidiaries – including Marshalls, HomeGoods, HomeSense, and Sierra – you may be interested in the T.J. Maxx Credit Card, also known as the TJX Rewards credit card. It works at the many thousands of stores within the T.J. Maxx family.

The T.J. Maxx Credit Card pays rewards of up to 5% of your purchases at company stores. They also pay a small bonus on your first purchase using the card. You can redeem your rewards within 48 hours of earning them.

It’s an excellent rewards credit card opportunity for anyone who is a regular shopper within the T.J. Maxx family, which includes some of America’s most popular retailers.

Table of Contents

About the T.J. Maxx Credit Card

T.J. Maxx is the leading off-price apparel and home fashion retailer in the U.S., operating thousands of stores under that name, and several partner brands. As a result, the T.J. Maxx Credit Card, commonly known as the TJX Rewards credit card, is one of the most valuable store credit cards offered anywhere.

The T.J. Maxx Rewards Credit Card is a MasterCard issued by Synchrony Bank. It will earn 5% rewards when you shop at any store within the T.J. Maxx family using the card. You also get 10% off your first purchase when you open an account.

How T.J. Maxx Credit Card Works

The T.J. Maxx Credit Card works on a point system. You’ll earn five points for every dollar spent at T.J. Maxx, Marshalls, HomeGoods, HomeSense, and Sierra.

When you sign up for the card, you’ll also need to open an account with T.J. Maxx. By linking the card with your account, you’ll receive Rewards Certificates at the purchase points, and those rewards will become available within 48 hours of completing your purchase.

You can apply Rewards Certificates automatically when you checkout. You can also do it manually, by hand keying the CSC number of the Rewards Certificates you want to redeem.

When T.J. Maxx approves your card, you’ll get a welcome bonus of 10% off your first purchase. Be careful, however, since the coupon will only be redeemable for purchases on the T.J. Maxx website if you sign up for the credit card online.

Card benefits also include special discounts, like private shopping events and discounts on select merchandise. You’ll be alerted to these events through exclusive shopping invites.

T.J. Maxx Credit Card Fees & Interest Rate

T.J. Maxx Credit Card webpage does not disclose fees and interest rates. But based on the Synchrony Bank/T.J. Maxx Credit Card disclosure, the APR for the interest rate is the prime rate, plus 23.74%. Based on the Wall Street Journal prime rate of 3.25%, the APR on the T.J. Maxx Credit Card should be 26.99%.

T.J. Maxx doesn’t indicate an annual fee, but they will charge you up to $38 for late payments.

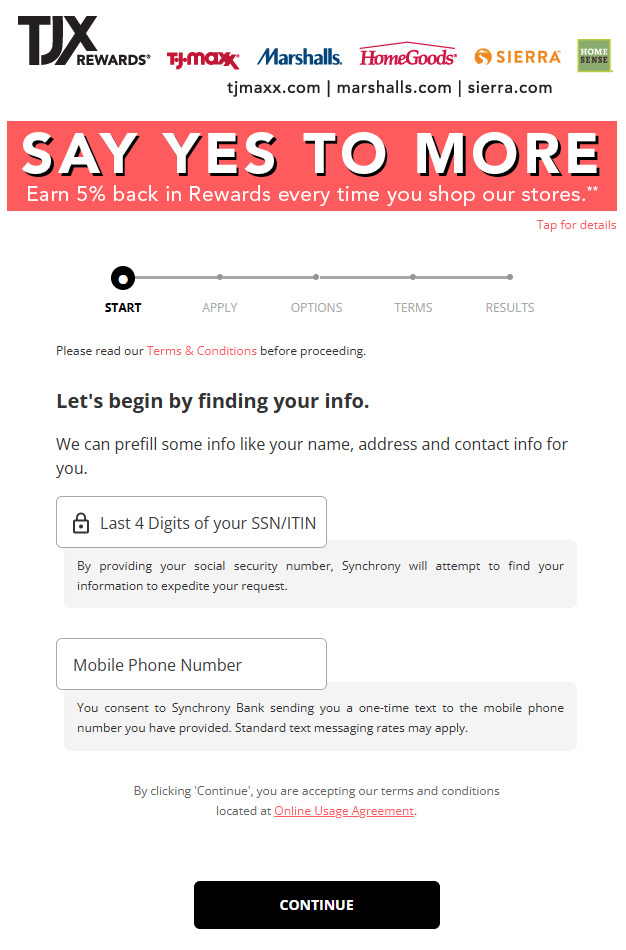

How to Sign Up for the T.J. Maxx Credit Card

You can sign up for the T.J. Maxx Credit Card from a desktop or mobile device. You’ll start by entering the last four digits of your Social Security number and your mobile phone number.

Once you sign up for the credit card, you’ll also need to create a tjmaxx.com account. You can then link your credit card account to access your Rewards Certificates digitally. The rewards will be available at checkout at any T.J. Maxx store, and rewards certificates are available within 48 hours.

T.J. Maxx Credit Card vs. Regular Rewards Cards

One of the fundamental limitations with the T.J. Maxx Credit Card – or any merchant credit card, for that matter – is that rewards will apply only when you shop with the sponsoring merchant.

T.J. Maxx is a bit stronger than most merchants in this regard. After all, rewards accumulate from all merchants in the T.J. Maxx family, including Marshalls, HomeGoods, HomeSense, and Sierra.

But if you’re looking for a credit card that pays rewards on purchases with just about any merchant, here are a few cards worth considering:

Chase Freedom Unlimited

Chase Freedom Unlimited is one of Chase’s premier cash back credit cards. It currently offers 5% on travel purchases through Chase Ultimate Rewards, 3% at drug stores and dining, plus 1.5% cash back on all other purchases. And for the first year, you can earn 5% cash back on up to $6,000 in gas station purchases.

Chase Freedom Unlimited is one of Chase’s premier cash back credit cards. It currently offers 5% on travel purchases through Chase Ultimate Rewards, 3% at drug stores and dining, plus 1.5% cash back on all other purchases. And for the first year, you can earn 5% cash back on up to $6,000 in gas station purchases.

In addition to generous rewards, Chase Freedom Unlimited is also offering a up to $300 cash back with an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year). The annual fee is $0 (hard to beat that!) and your cash back rewards never expire.

👉 Learn more about the Chase Freedom Unlimited

Capital One SavorOne Cash Rewards

The Capital One SavorOne Cash Rewards card made our list of the best cash back credit cards, and for good reason. It features 3% Cash Back on dining, entertainment, popular streaming services and grocery stores (excluding superstores like Walmart and Target), plus 1% Cash Back on all other purchases. You can redeem rewards through a statement credit, a check mailed to you, or even applied to online purchases through PayPal.

The Capital One SavorOne Cash Rewards card made our list of the best cash back credit cards, and for good reason. It features 3% Cash Back on dining, entertainment, popular streaming services and grocery stores (excluding superstores like Walmart and Target), plus 1% Cash Back on all other purchases. You can redeem rewards through a statement credit, a check mailed to you, or even applied to online purchases through PayPal.

Capital One SavorOne Cash Rewards also offers a $200 Cash Back after you spend $500 on purchases in the first three months. Meanwhile, annual fee of $0 and no foreign transaction fees on purchases made outside the U.S.

Blue Cash Preferred® Card from American Express

Blue Cash Preferred Card from American Express has a great welcome bonus – $350 statement credit after you spend $3,000 in purchases in the first 6 months. Terms Apply.

Blue Cash Preferred Card from American Express has a great welcome bonus – $350 statement credit after you spend $3,000 in purchases in the first 6 months. Terms Apply.

It also has great cashback rewards – 6% on U.S. supermarkets on up to $6,000 per year in purchases (then 1%), 3% Cash Back at U.S. gas stations and on transit (including taxis/rideshare, parking, tolls, trains, buses and more). Finally, 1% Cash Back on other purchases. You earn cash back in Reward dollars that you can redeem as a statement credit.

If you like to travel, this is one of the few credit cards that still offers car rental loss and damage insurance. Their Global Assist Hotline provides emergency assistance and coordination services on a 24/7 basis when you travel lease 100 miles from home.

$95, .

👉 Learn more about the Blue Cash Preferred from American Express

T.J. Maxx Credit Card Pros & Cons

Pros:

- Earn 5% cash back shopping at any one of the five store chains in the T.J. Maxx family.

- Get a 10% discount on your first purchase.

- Rewards are redeemable within 48 hours of earning them.

- No annual fee indicated

Cons:

- Rewards can only be earned and redeemed on purchases made at stores within the T.J. Maxx retail family.

- The interest rate is higher than general-purpose rewards cards, even if you have good or excellent credit.

Should You Sign Up for the T.J. Maxx Credit Card?

You should consider signing up for the T.J. Maxx Credit Card if you are a regular customer at T.J. Maxx, Marshalls, HomeGoods, HomeSense, and Sierra. The card will allow you to earn 5% rewards for purchases at any store within the five brands.

But if you’re not a regular shopper within the T.J. Maxx family, or if you’re looking for a general-purpose rewards card, you are better off using one of the alternatives listed above.

The key limitation of the T.J. Maxx Credit Card is that the rewards are good only within the T.J. Maxx family of stores. If you don’t do most of your spending there, you’ll be better off with a different rewards card.

The T.J. Maxx Credit Card is best suited for the company’s most loyal customers, to be used as a secondary rewards card when shopping at T.J. Maxx. Everyone else should look elsewhere.

The post T.J. Maxx Credit Card Review: Earn TJX Rewards of Up to 5% appeared first on Best Wallet Hacks.

from Best Wallet Hacks https://ift.tt/R2HEwop

Comments

Post a Comment

We will appreciate it, if you leave a comment.