Whether you like flashy sports cars or practical minivans, shopping around for cars can feel like a fresh start. The problem is, most people can’t afford to pay out of pocket. So how do you explore car loan options to help turn your motorized dreams into reality? Understanding all your financing options and how you can get the most bang for your buck will save you headaches—and debt—down the road.

To get started, check out our car loan calculator below to estimate your monthly auto loan payment.

This auto loan calculator approximates monthly payments, total interest, and the total cost of the car based on car price, loan term, and interest rate. Use the calculator to compare how different loan terms and interest rates may affect your monthly payments to ultimately find a car loan that fits your budget.

How To Use the Car Loan Calculator

Here’s an explanation of each input on the car loan calculator.

- Car price: The total price you will pay for the car. To estimate this, take the sticker price and subtract any savings from negotiations. You may need to include additional fees as well.

- Loan term: The time, measured in months, that you have to pay off the auto loan. The longer the loan term, the more you will end up paying in interest. Auto loan terms are usually in increments of 12 months.

- Trade-in: The trade-in value of your current car.

- Down payment: The amount you pay upfront toward the car at the time of purchase.

- Cash rebate: A discount given by the manufacturer that is deducted from the purchase price of the car.

- Interest rate: The percentage you pay to borrow money for the car. If you are preapproved for a loan and offered an interest rate, enter that percentage. Interest for car loans is influenced by credit score. You can view average auto loan interest rates by credit score below.

| Credit Score | Average Loan Rate (new car) | Average Loan Rate (used car) |

|---|---|---|

| Superprime (781-850) | 2.47% | 3.61% |

| Prime (661-780) | 3.51% | 5.38% |

| Nonprime (601-660) | 6.07% | 9.80% |

| Subprime (501-600) | 9.41% | 15.96% |

| Deep Subprime (300-500) | 12.53% | 19.87% |

Note that this car loan calculator’s results are only an estimate and do not include state and local taxes, registration fees, or documentation fees. To get a fuller picture of what you’ll pay for a new car, contact your dealership for information on additional fees.

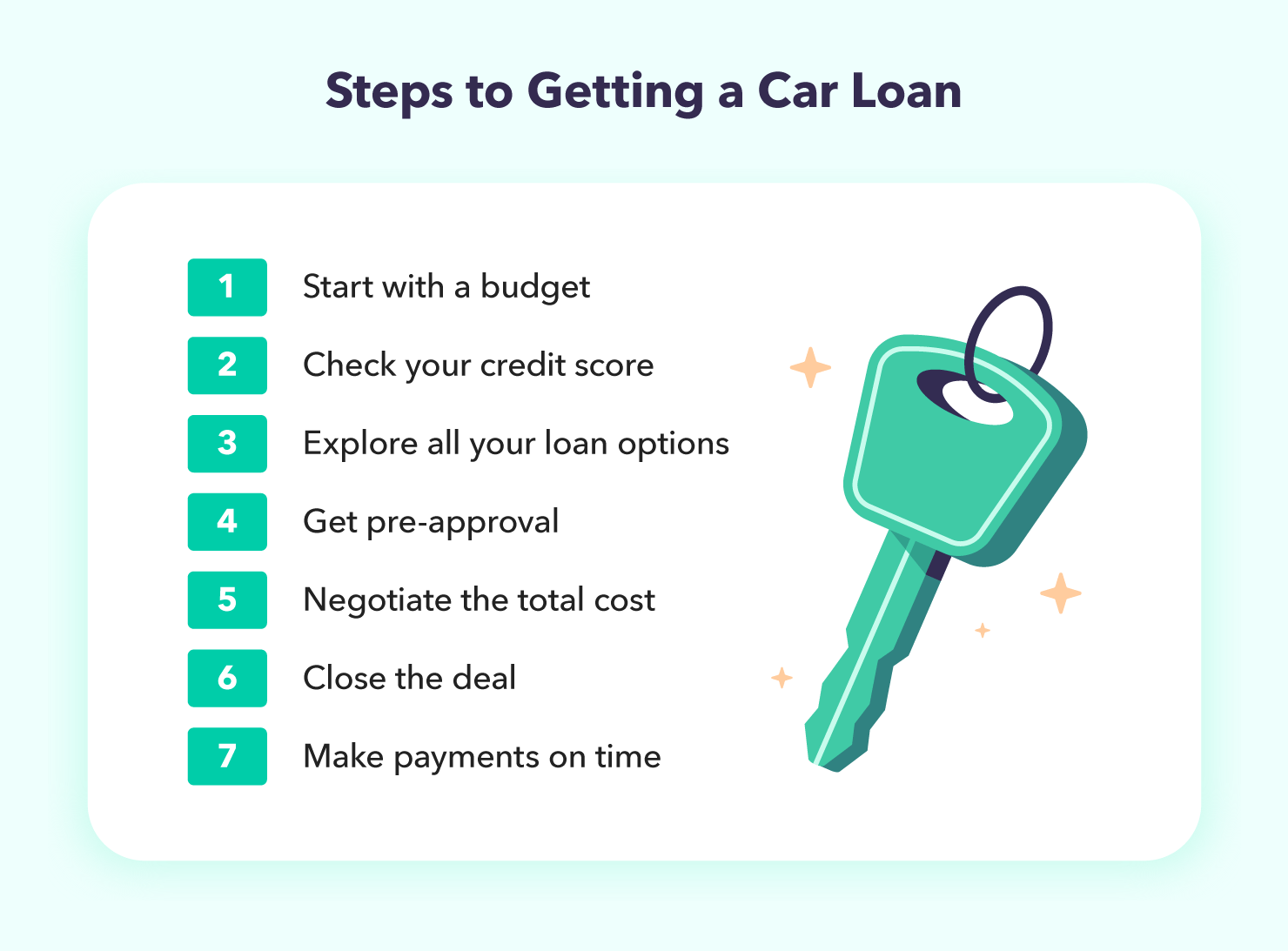

How To Get a Car Loan

So, how do you get a car loan to help turn your motorized dreams into reality?

Throughout the financing process, remember that you’re shopping for two different products: the car and the car loan. Before setting foot in a dealership, take the time to weigh all your options so you feel 100 percent certain that investing in a new car is the best decision for your financial health as a whole. Once you’re ready, use the steps below to get a car loan.

1. Set a Budget for Your Auto Loan

If you don’t have a monthly budget, it’s time to create one. Assess all the monthly debt payments you currently have—such as rent, student loans, and credit card bills—and then figure out how much you’ll be able to afford on a monthly car payment.

Your car payment calculations should include not only the amount paid back to the lender, but also gas, insurance, and maintenance fees. If you come up with a number that won’t work with your income, consider saving for a larger down payment so you won’t have to take out a large car loan.

2. Check Your Credit Score

Request a copy of your free credit report to determine how your score will affect the loan shopping process. When doling out the best rates, lenders look for a score of 760 or higher and will give you a better deal the higher your score. Payment history, debt-to-income ratio, and the history of your credit lines all affect that magic three-digit number.

Start by fixing any inaccuracies you find on your report that are dragging down your score. Within a month or two, you should see the mistakes removed, which may make your number rise. If you aren’t in a rush to purchase the car, work on bringing your score up to help you get more favorable loans when it does come time to apply.

If you don’t have the time or ability to raise your credit score before purchasing the car, you could find a co-signer for the loan. Consider asking a parent, friend, or family member with a good score to co-sign. It’s important to remember that the co-signer is responsible for paying back the loan if you’re unable to make the monthly payments, and the credit score of both you and the co-signer will be affected by late or missed payments.

3. Explore Your Auto Loan Options

There are two main ways to get a car loan: direct lending and dealership financing. After picking out the car you want to buy, consider which option makes the most sense for you.

Direct Lending

Direct lending entails receiving a loan from a bank, credit union, or online lender. You’ll agree on the amount of the loan and the finance charge, or interest rate, that you’ll pay on the loan. Some things to note about receiving direct lending:

- Banks often offer competitive interest rates but are more exclusive about who they offer a loan to. It is more likely you will need to have a good or excellent credit score to obtain a desirable loan from a bank. You don’t usually have to be a member at the bank to apply for an auto loan or get pre-approval.

- Credit unions may have an easier loan application process and lower interest rates. However, you must be a member to apply for a loan.

- Online lending websites often contact several lenders at the same time so you can easily obtain and compare competing loan offers. Just like a bank or credit union, you will determine the terms of the loan with the lender. Make sure to always do background research on each lender to ensure they aren’t predatory.

Dealership Financing

Some dealerships offer on-site financing, which means you agree on the loan amount and interest rate with the dealer. Here are some things to keep in mind:

- The dealer will gather all your information and send it to one or more prospective auto lenders, who will then give the dealer a “buy rate.” This could be higher than the interest rate you negotiate because it could include a compensation fee for the dealer handling your loan.

- Because you are treating the dealership as a one-stop shop for all your car needs, you might be offered special deals or rebates that include low interest rates.

4. Get Pre-Approval for Your Car Loan

Whichever financing option you decide to pursue, don’t just take the first loan offer that comes your way. Take the time to shop around and get competing rates through the pre-approval process. This entails asking multiple lenders to look at your credit report and draft up the loan amount and interest rate they’d be willing to offer you.

Pre-approval may give you more bargaining power with a dealership than if you went in without a financing plan. You also might be able to hunt down the best deals because lenders are competing for your business. Remember, just because you receive pre-approval from a lender doesn’t mean you have to take their offer.

5. Negotiate Auto Loan Offers

Once you’ve found a lender that you want to finance your car loan, consider negotiating the final deal. This includes:

- Length of the loan: Typically, a shorter loan will have higher monthly payments but lower interest rates. A longer loan will have smaller monthly payments and higher interest rates.

- APR and interest rate: Depending on your pre-approval offers, you might be able to negotiate for a lower interest rate. This means you’ll pay the lender less to borrow the money over the length of the loan.

- Additional add-ons:Extended warranties or additional insurancecan raise the total cost of the loan.

- Special offers or discounts: If you’re getting your loan through a dealership, use the negotiation process to ask about any manufacturer rebates that could get you a lower price on the car, therefore reducing the amount of money you need to borrow.

6. Close the Deal on Your Car Loan

Before driving off into the sunset, make sure to tie up any loose ends that could impact your car loan. Per the federal Truth in Lending Act, lenders are required to provide you with important information about your agreement so you can verify all the terms match what you discussed.

Sign all paperwork before taking your new car home, and make sure you have multiple ways to contact your lender if you ever have any questions.

7. Make Auto Loan Payments on Time

Finally, be sure to make your car loan payments on time. Whether you make monthly payments online or by mail, they will be discussed during the negotiation process. You must make payments on time every month to avoid severe late fees or repossession of your brand new set of wheels. You can likely set up automatic payments to ensure they get paid on time.

If you think you might be late on a payment, contact your lender immediately to discuss the possibility of adjusting your payment plan. While most of the original terms you negotiate will likely stay the same, you may be able to make a delayed payment. But if you consistently default on your payments, the lender is allowed to repossess your car, sell it, and use the money to pay off your remaining debt.

FAQs

Here, we’ll answer commonly-asked questions about car loans and payments.

How Much Should My Car Payment Be?

It’s recommended to spend less than 10 percent of your take-home pay on your car payment. However, you will also need to factor in car insurance, gas, your existing debt, cost of living in your area, and other factors to determine your car payment.

Is it Smart To Do A 72-Month Car Loan?

72-month car loans are becoming more common, but keep in mind that taking out a long-term car loan can mean you end up paying more money than the car is worth (also called an “upside-down” loan). A 72-month car loan may allow you low monthly payments, but extending the loan term will increase the amount of interest you pay. A loan term that is 60 months or fewer may be better.

What is a Good APR for a Car Loan?

If you have good credit, you can get a good APR for a car loan. According to Experian, the average loan rates for a superprime credit score of 781–850 are 2.47 percent for a new car and 3.61 percent for a used car. The average auto loan rates for a prime credit score of 661-780 are 3.51 percent for a new car and 5.38 percent for a used car.

How Much Does it Cost To Finance a Car?

This depends on the car price, loan term, interest rate, and other fees. Use our car loan calculator above to estimate your monthly payments, total interest paid, and the total price of the car.

How Do You Lower Your Car Payment?

Here are several ways to lower your car payment:

- Pay a larger down payment: If you pay more upfront, you can lower your monthly payments over the life of the loan.

- Refinance your loan: Refinancing is taking out a new loan to get a better deal. If your credit score or financial circumstances have improved, you may be able to get a lower interest rate and thus pay less on your monthly payments.

- Speak with your lender: Keep your lender in the loop and see if you can work with them to find a short-term solution if you are having trouble making your monthly payments.

- Trade in your car: Trade in your car for something cheaper with lower monthly payments. Make sure to research the car’s trade-in value first.

Will Trading In My Car Affect an Auto Loan?

If you plan to trade in your current car before purchasing a new one, it could lower the total cost of your car loan. The credit or cash you receive from the trade-in can be put to use as a down payment, thus reducing the amount you need to borrow from a lender. Before trading in, just make sure you know whether the total amount you still owe on your car is less than what it’s worth. Carrying an old auto loan onto a new auto loan may raise your interest rates and limit your options for the best deals.

How Do You Get a Car Loan With Bad Credit?

Despite many lenders being wary of borrowers with poor credit scores, there are still options available to obtain a car loan. If you have bad credit, lenders may still offer you a loan—but likely at a higher price. Interest rates and additional fees skyrocket for borrowers with less-than-ideal credit scores, and it may dig you into a deeper hole of debt than you started with. However, paying off existing debt, finding a co-signer, or saving for a larger down payment are all ways to help offset bad credit.

Despite its complexities, getting a car loan can be a straightforward process if you make a strategic plan. Assess your current financial health, loan shop, use a car loan calculator, and negotiate a deal that suits your needs. Consider using the Mint app to set a budget and start saving. In no time you’ll be able to hit the streets with a shiny new toy and feel confident in your abilities to manage debt.

The post Car Loan Calculator appeared first on MintLife Blog.

from MintLife Blog https://ift.tt/OISdpL5

Comments

Post a Comment

We will appreciate it, if you leave a comment.