If you’re familiar with Microsoft Money, Money in Excel may interest you. The upgraded version of Microsoft Money enables you to keep track of transactions, create budgets, and establish and work toward reaching your financial goals. This Money in Excel review covers everything you need to know, from features to pricing to Money in Excel alternatives.

Table of Contents

What Is Money in Excel?

Money in Excel is a financial management tool – in workbook form – from Microsoft that works within Microsoft Excel. It enables you to connect your financial accounts to Excel, where you can view and manage your accounts in one place. It also provides personalized insights into your monthly spending patterns to help you accomplish your financial goals.

Money in Excel was designed to replace Microsoft Money, which has been around for over a decade. Microsoft has incorporated changes and upgrades within the new plan, designed to make Money in Excel a more efficient and pleasant experience than Microsoft Money.

Money in Excel works with Microsoft 365. When you sign up for 365, you’ll gain access to more than 1,000 premium templates, high-quality images, icons, and fonts. That will allow you to fully customize the Money in Excel workbook.

You can use custom charts – or build your own – to help you better track and manage your money.

They have plans available for both personal and business use.

What Does Money in Excel Do?

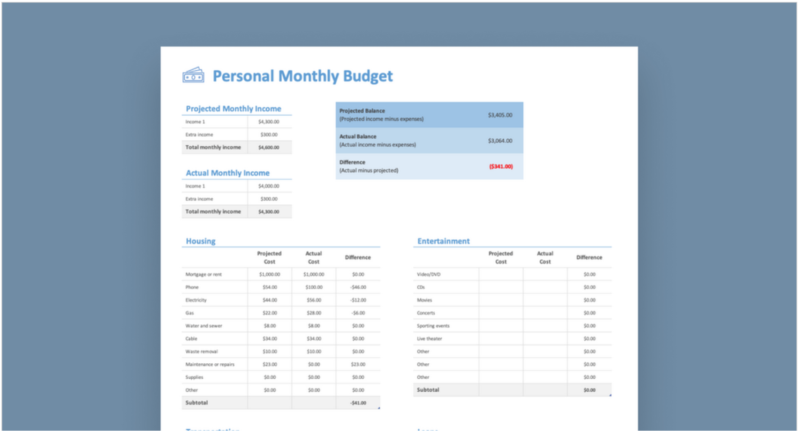

Not only is Money in Excel designed for financial management, but you can customize it for specific budgeting plans – a personal or family budget or custom budgets for monthly college expenses, a wedding budget tracker, or even a vacation budget.

For example, the wedding budget template enables you to budget for the reception, music, apparel, decorations, and other wedding-related expenses. That will allow you to track your progress toward reaching your budgetary goals for the big event.

You should be aware that Money in Excel Personal and Family are currently available only to US subscribers. It’s also recommended primarily for desktop use since the mobile experience is “currently limited.” For example, though you can view the app from your mobile device, you can’t add transactions, capture changes, or access the Money in Excel pane.

Money in Excel requires a minimum of Windows 10 or macOS Catalina, and either Excel Version, 2008 or later, or Excel for Mac, 16.40 or later.

How Does Money in Excel Work?

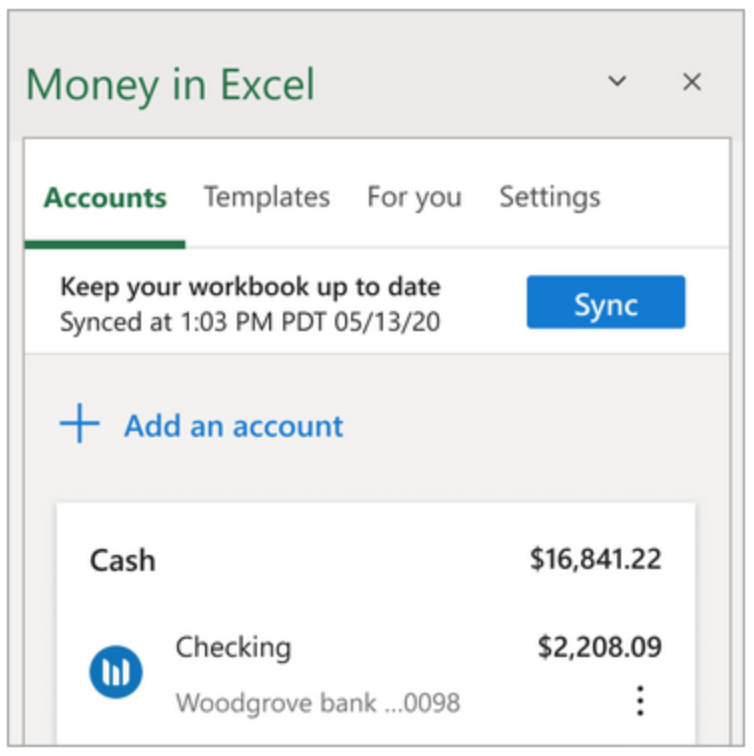

Once you’ve downloaded the workbook and chosen (or created) your customized template, you can begin adding accounts. The process is simple and offers you two options.

- From the Accounts tab, choose to Add an account, or

- Choose Settings, then select Add an account.

The program will import transactions from the past 30 days when you add an account. Those transactions will appear in your transaction feed within a few minutes of adding the accounts.

You can remove accounts by selecting the Accounts tab, “Edit bank institutions,” and Edit next to the institution you want to remove. Once you do, you can hit “Delete all accounts” to remove the accounts you want to eliminate.

Synchronization. Unlike most budgeting apps, Money in Excel does not provide automatic account synchronization. But you can update account balances, import transactions, and save changes across your workbook and spending emails by selecting Sync from the Accounts tab. The Sync Bar will keep track of the last time Money in Excel synced the workbook to your data.

Money in Excel sharing. You can choose to share your Money in Excel file with other parties. If so, they’ll be able to open the file and see the contents in your spreadsheets. However, they won’t be able to access your Money in Excel pane to view account balances or load new transactions. Meanwhile, Money in Excel will not sync any changes they make to your spreadsheets.

You can only share your Money in Excel information with other Money in Excel users connected to your Microsoft account.

Money in Excel Security

To ensure your financial information remains private and that you are the only one accessing your workbook, Money in Excel will ask to verify your identity each time you open the workbook.

Microsoft has partnered with Plaid to provide connections to your financial accounts with your permission. Plaid connects with over 10,000 financial institutions and powers other apps, including Betterment, Acorns, Chime, Venmo, and Wise.

Plaid will have access to account balances, transaction history, and associated account information, but not your Microsoft 365 login credentials.

Meanwhile, Microsoft will not sell or trade your data, and they collect information only to help you with your personal financial needs. Data is stored within the United States using Microsoft’s Azure cloud services.

Money in Excel Pricing

Money in Excel is free if you already have a Microsoft 365 subscription. You can download Money in Excel from Microsoft 365. If you don’t already have Microsoft 365, you can sign up for a subscription, taking advantage of one of three different plans:

Microsoft 365 Personal – designed for a single user and comes with 1 TB of cloud storage to backup files and photos. It’s available with both monthly and annual premiums.

Microsoft 365 Family – can be used by up to six people and includes up to 6 TB of cloud storage. It’s available with both monthly and annual premiums.

Office Home & Student 2021 – designed for a single user and comes with 1 TB of cloud storage to backup files and photos. Available for a one-time fee.

The pricing for the three plans is as follows:

Microsoft 365 Personal and Family include Teams, advanced security for email and files, and ongoing technical support. Either plan is available for Windows, macOS, iOS, and Android devices. (Outlook, Word, Excel, PowerPoint, and OneNote are premium editions.)

Office Home & Student 2021 offers only the Classic versions of Outlook, Word, Excel, PowerPoint, and OneNote.

Money in Excel Pros and Cons

Pros

- Ideal for fans of spreadsheet budgeting

- Free for existing Microsoft 365 subscribers

- Share spreadsheets with other users on your account

- Manual account syncing available through partnership with Plaid

Cons

- Mobile app has limited functionality

- No automatic sync available

- Limited to US users

- Must pay for a Microsoft 365 subscription to access

Money in Excel Alternatives

Money in Excel is one of many budgeting and financial management tools available, and it’s not the only one that’s free.

Tiller is a powerful budgeting tool that automates your budgeting spreadsheets, saving you time. If you prefer to budget with spreadsheets, there’s a good chance you will love Tiller. When it first launched, Tiller only worked with Google Sheets but they’ve since expanded to include Microsoft Excel. Tiller is free for the first 30-days, then it’s $79 yearly ($6.58/month). There is no obligation and you can cancel at any time.

Personal Capital provides its free financial dashboard. You can connect your various financial accounts and take advantage of budgeting and financial management. That includes a retirement planner and a fee analyzer to help you reach your retirement goals.

If you have at least $100,000 to invest, you can also take advantage of Personal Capital’s Wealth Management plan. It’s a premium service that offers complete investment portfolio management.

Mint is a free budgeting software and one of the most popular. It includes budgeting and bill tracking, but it also comes with free credit monitoring. It’s a perfect choice if you’re looking for a free and comprehensive budgeting system and want to track your credit score regularly.

Though it isn’t a free budgeting app, EveryDollar is a premium service that will also give you access to Dave Ramsey’s Financial Peace University. The budgeting app makes full use of Dave Ramsey’s financial principles.

Specifically, EveryDollar follows Dave Ramsey’s 7 Baby Steps:

- Save $1,000 for a “starter” emergency fund.

- Use the “debt snowball” (a Dave Ramsey concept) to pay off debt.

- And 3-to-6 month living expenses to fully fund your emergency fund.

- Save 15% of your income for retirement.

- Start a college fund for your children.

- Pay off your mortgage ahead of schedule.

- Build wealth and give, which includes faith-based tithing and giving to charities.

If you’re looking for a more comprehensive financial management plan and are willing to pay a modest fee, EveryDollar may be better than Money in Excel.

The Bottom Line on Money in Excel

If Money in Excel interests you, you can get started here. Remember that if you are a Microsoft 365 subscriber and looking for a financial management workbook or budgeting tool, you can add Money in Excel at no additional cost. It offers features commonly found in other budgeting and financial management apps to help you control your finances and reach your financial goals.

Once your accounts are included in Money in Excel you can update your transactions and spreadsheets by syncing your activity regularly. That’ll allow you to see your entire financial life within the Money in Excel workbook and make the moves necessary to keep your finances moving in the right direction.

The post Money in Excel Review: Meet the New Microsoft Money appeared first on Best Wallet Hacks.

from Best Wallet Hacks https://ift.tt/tOHfDXw

Comments

Post a Comment

We will appreciate it, if you leave a comment.