We’re all looking for ways to cut down on expenses — especially fixed expenses that lock us into a contracted bill month after month. One common way to spare your budget is to decrease your living expenses, including your house payment. Refinancing your loan could help cut down on your mortgage payments and could update your loan terms, saving you money. If you’re considering refinancing, you may ask, “How long does it take to refinance a house?”

Refinancing your home can be tedious, but it could help your budget in the long run. Luckily, we’re here to help by sharing the typical refinancing process and detailing how to make it as efficient as possible. Continue reading to learn more or use our menu below to jump to the section that interests you the most.

Whichever you choose, we’re happy to help.

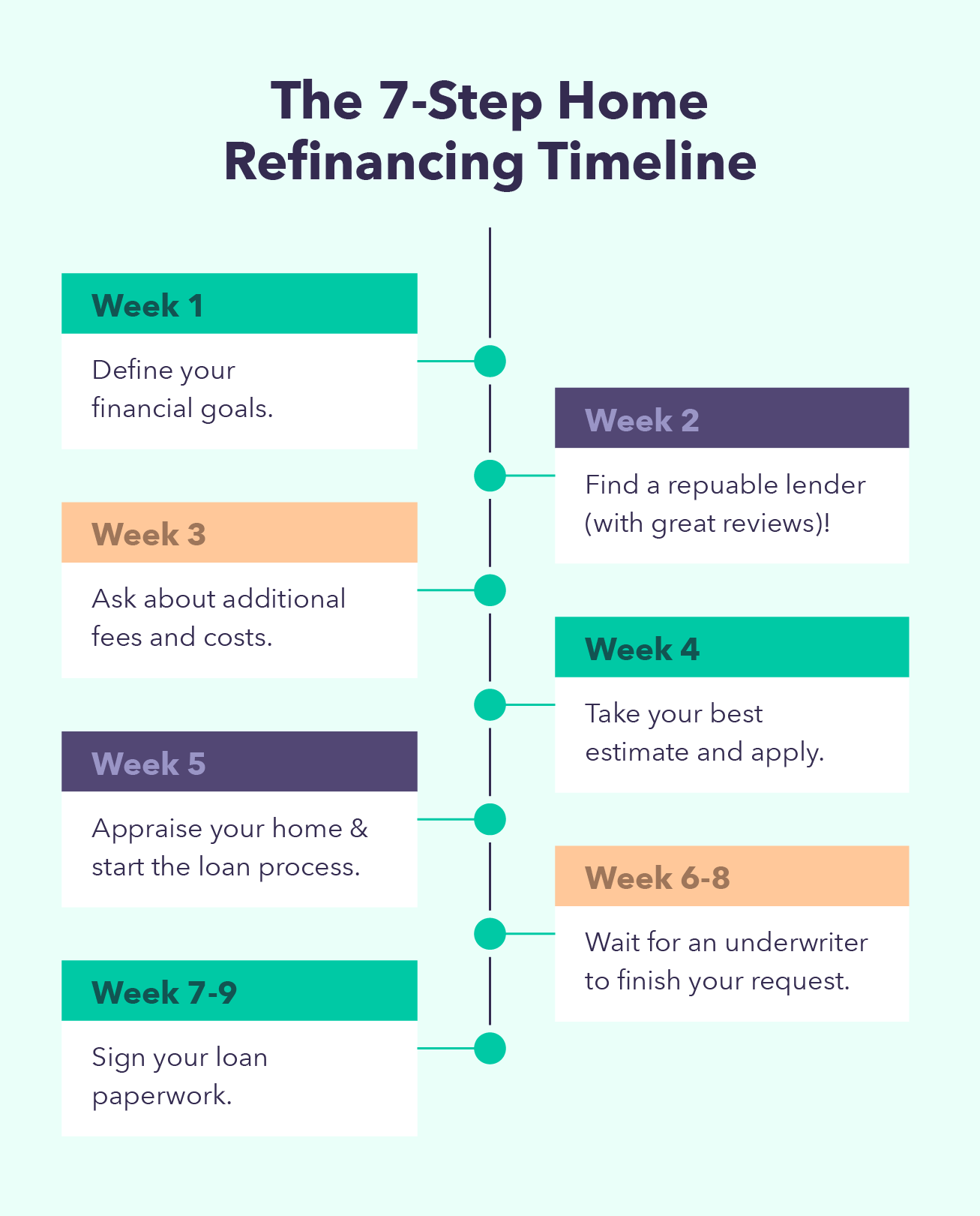

7 Steps To Refinance Your Home

Refinancing your mortgage has its positives and potential negatives. You could decrease your monthly mortgage payments, get a shorter loan period, or lock in a better interest rate. But you could also end up spending more on application fees or face prepayment penalties. Before speaking with a lender, research the refinancing process, requirements, and added costs that could affect your ideal result.

Step 1: Define Your Financial Goals

One of the first steps to refinance a house is asking yourself what you’d like to get out of a refinancing loan agreement. Do you want to shorten your loan term? Do you want to secure an interest rate lower than your current rate? Or do you want both? Determine your ideal end result, verify your investment choice, and seek a lender who supports your goals.

Step 2: Compare Lenders (And Reviews)

Ask around or search online to find the right lender for you and your goals. Pick out a few professionals you’d be interested in working with and ask them about their rates, terms, and requirements. To help narrow down your lender options, seek out reviews online or ask for referrals in your network to ensure you make the right choice.

Step 3: Double-Check for Additional Fees or Costs

Refinancing a loan can rack up a bill you may not be aware of until after you start the loan process. Attorney work, application, inspection, appraisal, and title searches are a few refinancing tasks that you could be charged for. To budget for these expenses, save a bit extra from each paycheck or assess your current savings account using our app. If you have enough saved, start inquiring about this loan. If you don’t, put extra cash into savings each month until you have enough to cover the extra charges.

Step 4: Apply for Your Best Loan Estimate

Once you’ve found the right loan for your financial goals, the next step is to fill out your application. To submit your application, you may have to provide proof of income, assets, debts, and other forms that complete your financial portfolio. The following documents may be helpful in the application process:

- Proof of income: This could include W-2 earnings statements, 1099-DIV income statements, federal tax returns for the last two years, bank statements for the last few months, and recent paycheck stubs.

- Proof of assets: Provide reports from your checking, savings, retirement, and other investment accounts.

- Proof or insurance: Provide evidence of your homeowners and title insurance.

- Debts statements: Provide statements of any debt accounts open, including student loans, credit cards, current home loan, auto loans, etc.

Step 5: Start the Loan Process and Appraise Your Home

Once you’re approved for your loan, it’s time to get your home inspected, appraised, and conduct a title search. To ensure you’re on track with your timeline, prepare all your documents ahead of time. Skip to our section below for more ways to speed up this process.

Step 6: Wait for Underwriters to Cross-Reference

Underwriters take it from here by double-checking your financial information to ensure everything is accurate before approving your loan. Your creditworthiness and debt-to-income ratio are generally the key factors underwriters will look at. Your property details, including when you bought your house and your home’s value, are a few other determining factors. This process may be the longest time constraint, taking a few days up to a few weeks.

Step 7: Close Your Loan to Lock In Your Interest Rate

Once your loan is approved and you’ve agreed upon your terms, it’s time to lock in your rate. This stage is commonly known to stretch your timeline as well. It can take your lawyer anywhere from one day to two months to settle your current loan and redeem your property. Keep in mind that this is typically where you pay the majority of your fees whether you’re approved or denied. These fees may include closing costs and application fees.

Ways To Speed Up Your Refinance Timeline

If refinancing your loan benefits your budget, you may be eager to get your new loan. Luckily, there are a few tricks to speed up this process:

- Round up your paperwork ahead of time: Just like you would gather your paperwork before heading to get a new driver’s license, do the same for your lender. Look up your state’s refinancing loan requirements and create a checklist of required documents.

- Double-check your credit: As most lenders require a credit score of 620 or higher, it may be the right time to check in on your score. Use our app to see your credit score, your credit history, and helpful tips to boost your ranking.

- Avoid taking on more debt: Your credit score is impacted by your debt. Maxing out your credit card could negatively impact your credit score and cost more in the long run. Focus on paying off debts and only spending your readily available money to improve credit utilization.

- Don’t apply for new credit: Inquiring about new debt opportunities could drop your credit score up to eight points. Next time you’re offered a new credit card or a deal on a car loan, take a few days to analyze the potential credit changes that could impact your refinanced mortgage.

- Do what you can to accommodate your appraiser and lender: You may run into a couple issues during this process, such as needing different paperwork or extra signatures. While life can get busy, do your best to make your appraiser’s and lender’s jobs easy. Doing so could speed up the process and earn you a better home loan in no time!

So, your answer to “How long does it take to refinance a home?” is 30 to 45 days on average. But remember that this can vary. Though the process takes time, it can be well worth it in the long run. Getting a lower interest rate and a shorter term length could lessen your payments going toward interest. Use our loan calculator to see what refinancing could do for your budget.

Refinance Time Frame FAQs

Take a look through some frequently asked questions regarding the average time to refinance a home.

Refinancing a home is often less complicated than the home-buying process.

Refinancing a home may lower your credit score initially, but you should see it bounce back within a couple of months.

Three factors that could keep you from refinancing your home include:

• Low credit score

• Insufficient income

• Low home appraisal

The income you need to have to qualify for a home refinance varies. However, lenders typically like to see a debt-to-income ratio of 43 percent of your pre-tax income.

Yes, refinancing a home is typically an easier process than purchasing a home.

Lenders generally like to see a credit score of 620 or higher.

The first step in refinancing your home is defining your financial goals.

The post How Long Does It Take To Refinance a House in 2022? (+ 5 Ways To Speed Up the Process) appeared first on MintLife Blog.

from MintLife Blog https://ift.tt/WLNtMVg

Comments

Post a Comment

We will appreciate it, if you leave a comment.