Getting scammed for a loan is pretty common these days. Scammers or Fraudsters platforms take advantage of People who want to pay their educational expenses, bills, or make a big purchase by offering them a loan with terms that seem too good to be true.

Anyways, people still fall under their trap and even lose their savings. Loan Jam is one of many platforms on which people have some reservations as it is recently launched. Wondering whether it is one of the scams, or is it legit?

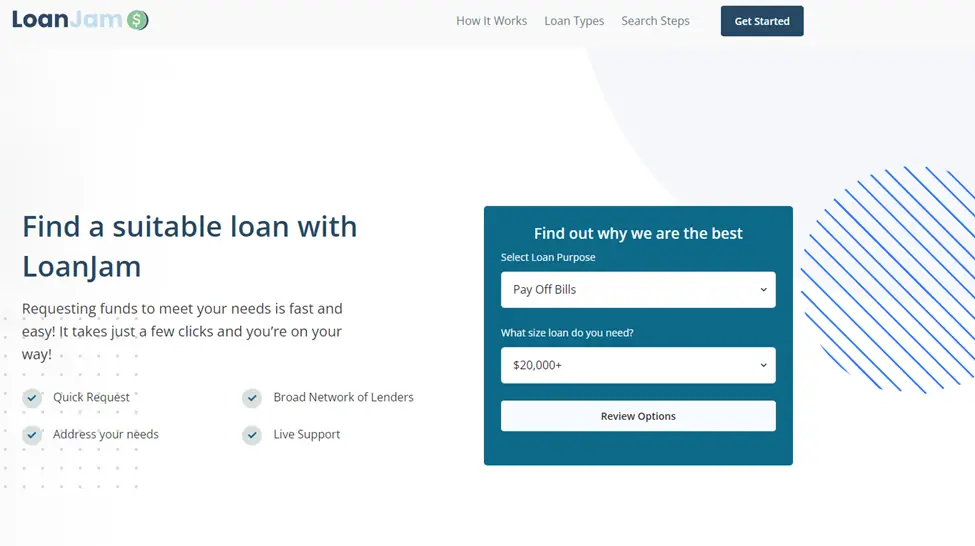

Loan Jam is indeed a legit loan service. It has listed 13 lenders who review your applications and then decide whether you are eligible or not. You should know that Loan Jam isn’t itself a loan lender. It merely provides a platform between you and your lender. So, you can try the Loan Jam service if you need a loan.

If you want to know about the application process and some crucial information that is necessary to know before you apply, then read on.

Loan Jam Service: Reviews And Process

Loan Jam is a credible service that has lenders providing you with a quote or a loan. It is relatively new, so many people are wary about it (which is understandable). I mean, when you search online, you don’t see any Loan Jam reviews as well. That is why I geared up and decided to know about this loan service.

After talking about those who have taken loans using this service and analyzing different authorities that are involved in it, it is safe to declare that the Loan Jam is legit.

Therefore, if you have to purchase a property, start a business, or pay your bills, then you can and should get a loan from Loan Jam.

Here are the four things that Loan Jam offers, which are increasing its reputation day by day.

- A broad range of lenders

- Quick application process

- Hits right where you need

- Live support

Let’s see some details.

Broad Range Of Lenders

There are 13 lenders listed on the Loan Jam; each offers its own plan. You can compare the plans and then decide from which lender you should apply for the loan.

It’s a great thing because you can then decide which plan is suitable for you, and you can fulfill it easily.

Quick Application Process

You will not need to fill out pages of online forms to apply at Loan Jam. The application filling process will take not more than two minutes at best.

The loan application process has three parts. These are:

- Input why you need a loan and how much

- Go through the streamlined details

- Get an offer and if it suits you, then accept it

That’s all.

Hits Right Where You Need

You can get a loan from 2,000$ to 100,000$. Any amount of dollars you want can be credited to you if you fulfill the requirements. If you want more than 100,00$, then Loan Jam is not for you.

Depending upon how much loan you want, the duration might be between six months to 144 months.

The longer the plan you choose, the more APR there will be. So, if you can, try to accept a shorter plan (preferably six months).

For example, you buy a loan of 10,000$, and you choose a plan in which you return the money in 36 months (3 years). The APR will be 4.89%, and you will have to pay 299$ per month. When you calculate the total money, the number you will get is 10,772$.

But if you choose the five-year return plan, then everything will change. The APR will then be 9.99%, and you will have to pay back 201.81$ every month. Long story short, the total amount you will return is 12,108$.

That is why I suggest going for the shorter plan if you can. But make sure you can also pay the money back every month. Paying it late will affect your credit score, which will affect your eligibility to get a loan again in the future.

One more thing there is to know is that the numbers won’t be the same in each state. Each state has its own rules and regulations when it comes to getting loans and paying them back. The APR, amount you want to borrow, and the repayment time are all different in each state.

Live Support

If you have any complaints or have just a question to ask, you can contact the customer service of Loan Jam. You will get live support from the company, and your issue will be addressed efficiently. So, is Loan Jam a scam or a legit loan service website? Yep, it’s definitely legit.

But make sure you read the terms and conditions carefully. If you agreed to any policy without reading it and later found out what it includes, then Live support can’t do much as you accepted the policy in the first place.

Critical Information You Should Take Before You Take a Loan Using Loan Jam Services

If you are thinking about getting a loan by using the Loan Jam platform, then I have some important information you should know.

Read Every Terms And Conditions Before Taking a Loan

Every lender offers different percentages of APR, which you can check out in their Policies. Some also include background checks while reports about your income tax report, Alimony, and child support might be compulsory. Failing to provide them will result in getting no credit.

Every Lender Has Different Requirements

You are not entitled to accept any lender’s policy. Suppose you don’t like it, then bid goodbye to that lender and don’t apply for the loan.

There will be a dozen more lenders available on the platform that will be happy to give you some money (if you fulfill their own criteria).

Note that every lender has different requirements. One lender may feel your application is acceptable, while others may feel it isn’t fit for a loan. So, You should buckle up and then apply to another lender if your application gets rejected.

You will also realize about different criteria needed by the lenders if you talk with one and then go to another and get information from him. Furthermore, if you have any questions, don’t hesitate to ask a lender. The more you clear things, the better it will be for everyone.

Credit Check Can Be Done

Loan Jam does not run a credit check; it is the lenders that might do this before they make a final decision.

Lenders usually request TransUnion, Equifax, and Experian to do this checkup. According to a source, this credit score is the biggest reason lenders reject your loan application. Yet, you should still apply even if you don’t have a good score.

Oh, another thing.

If you are ever late with your payments, then the lender may contact them, which will negatively impact your credit score.

Clearing Some Misconceptions About Loan Jam

Some people have complained about the Loan Jam because they are unclear about what this platform offers.

That is why I felt the need to address some of the misconceptions that will also make it clear to everyone that “it’s not Loan Jam’s fault” if anything goes wrong with you.

- Loan Jam is itself not a lender. It is a platform where you connect with different lenders and choose which lender’s plan suits you the best.

- Loan Jam cannot approve or reject any loan offer. It all depends on the lender’s decision after seeing your application and credit worthiness. Moreover, Loan Jam has also made it clear that just applying is not a guarantee that you will get a loan.

- Loan Jam does not have any influence on a lender regarding fees or any charges.

- Another thing you should know is that Loan Jam is not an agent/ broker and does not charge you any penny for its services.

- In addition, Loan Jam also has no influence on the money you get from the referrals. To know more, you should read the Policy before you mark the tick.

- Loan Jam is not responsible for any “issue” between you and the lender after you accept its terms and conditions. However, you should still contact customer support to see what can be done in a particular matter.

Concluding Thoughts

So, Is Loan Jam a Scam or a Legit Loan Service Website?

Yes, Loan Jam is legit, and you can get a loan using this platform. It itself isn’t a lender; rather, it has 13 lenders listed on the website.

Each of these lenders has its own set of criteria to grant loans. If you fulfill them and accept the policies, then you will get the money in no time. If you don’t, then you will face rejection.

So, why don’t you try out your luck here if you really need a loan?

The post Is Loan Jam a Scam or a Legit Loan Service Website? What Is Your Review? appeared first on CFAJournal.

from Finance Archives - CFAJournal https://ift.tt/B2xHrwZ

Comments

Post a Comment

We will appreciate it, if you leave a comment.