The Vanguard S&P 500 ETF (VOO) and the Vanguard Total Stock Market ETF (VTI) are two of America’s largest and most popular investment funds. They’re also among our top-rated Vanguard funds here at Wallet Hacks. Not only are they a hit with individual investors, but both are commonly included in top robo-advisor portfolios. Each ETF represents the general US stock market in a portfolio. But in a head-to-head comparison (VOO vs. VTI), is one better than the other?

It can be a difficult decision because not only are the two funds similar in so many respects but they’re both provided by the same fund family – Vanguard.

The major differences between the two mega-funds boil down to seemingly small details that might make all the difference. Let’s drill down on the two funds and see which one might work better for you.

Table of Contents

VOO vs. VTI – How Each Works

Management of both the Vanguard S&P 500 ETF(VOO) and the Vanguard Total Stock Market ETF (VTI) are similar, which is no surprise given that they’re both managed within the Vanguard family.

VOO is an index-based ETF that tracks the S&P 500 Index, as the name implies. The fund holds positions in approximately 500 of the most prominent publicly-traded companies in the US. But it also means the fund overall is more narrowly focused than VTI since it excludes both medium and small-cap stocks.

VTI tracks the performance of the CRSP US Total Market Index, which represents nearly the entire US stock market – encompassing large, mid, and small-cap companies. Like the VOO, VTI is a passively managed, index-based fund.

VOO vs. VTI – A Direct Comparison

For further comparison, let’s take a closer look at three elements of these two Vanguard stalwarts: Portfolio Breakdown, Fund Data, and Performance History:

Portfolio Breakdown

VOO has over $850 billion total net assets and holds stock in more than 500 companies. The largest sector compositions include information technology (29.2%), healthcare (13.3%), consumer discretionary (12.5%), financials (10.7%), and communication services (10.1%).

The ten largest holdings in the fund, which represent just over 30% of total net assets, include:

- Apple

- Microsoft Corp.

- Alphabet Inc. (Google)

- Amazon.com Inc.

- Tesla Inc.

- Meta Platforms, Inc. (Facebook)

- Nvidia Corp.

- Berkshire Hathaway Inc.

- UnitedHealth Group Inc.

- 10.J.P. Morgan Chase & Co.

VTI has about $1.4 trillion total net assets, with more than 4,000 stocks. The largest sector compositions include technology (29%), consumer discretionary (16%), healthcare, 12.8%), industrials (12.8%), and financials (10.9%).

The ten most significant holdings in the fund, which represent just over 25% of total net assets, include the following companies:

- 11.Apple

- 12.Microsoft Corp.

- 13.Alphabet Inc. (Google)

- 14.Amazon.com Inc.

- 15.Tesla Inc.

- 16.Meta Platforms, Inc. (Facebook)

- 17.Nvidia Corp.

- 18.Berkshire Hathaway Inc.

- 19.UnitedHealth Group Inc.

- 20.J.P. Morgan Chase & Co.

Fund Data

The table below gives a side-by-side comparison of the basic features of both the VOO and the VTI:

| Fund / Feature | VOO | VTI |

| Asset Class | Domestic stock – general | Domestic stock – general |

| Category | Large blend | Large blend |

| When Launched | 09/07/2010 | 5/24/2001 |

| Expense Ratio | 0.03% | 0.03% |

| Market price (as of 2/2/2022) | $420.42 | $230.06 |

| 30-day SEC Yield | N/A | 1.22% |

| Total Net Assets | $856.1 billion | $1.4 trillion |

| Number of Stocks | 507 | 4,139 |

| Dividend Distributions | Quarterly | Quarterly |

Performance History

Surprisingly, a close look at the average annual returns of the two funds in recent years yields little insight into the difference between the two. Most of that difference, which favors VOO, has occurred in the past year.

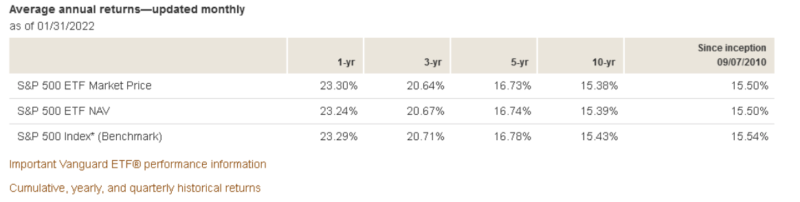

VOO:

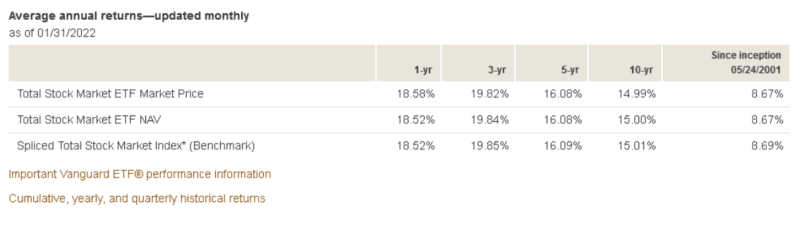

VTI:

In comparing the returns between the two funds, VOO has easily outperformed VTI in the one year ending January 31. And though VOO also comes out on top in the three-year, five-year, and 10-year comparisons, the difference between the two funds is very slight. The performance advantage of the VOO over the three multi-year terms is likely due to the more robust performance in the most recent year.

It’s also worth noting that VOO outperformed the VTI for the most recent year is because large-cap stocks outperformed medium and small-cap stocks by a margin of as much as 13%. It was simply a market that favored large-cap stocks.

Translation: Just because the S&P 500 outperformed the broader market in 2021 doesn’t mean it will always be the case. In some years, mid-cap stocks – especially small-cap stocks – have led the pack, placing the advantage in favor of VTI in future years.

It would be best if you discarded returns since inception. VTI launched in May 2001, right in the middle of the Dot-com bust. That also means that it was around through the 2008 stock market meltdown. The experience of one-and-a-half bear markets lowered VTI’s returns since inception.

By contrast, Vanguard launched VOO in the middle of 2010, which means it conveniently missed both bear markets.

Related Post: VTSAX vs. VTI: Which Will Get You to FIRE Faster?

VOO vs. VTI – Is One Better than the Other?

Given the popularity of both funds, each one is a winner. Deciding which one will work best for you depends on what you’re hoping the fund will do.

VOO is a much more narrowly focused fund, investing only in the 500 largest publicly-traded companies in the US. Stocks in those companies have done extraordinarily well in the current bull market that began in 2009. For many investors, large caps have been the go-to stocks. In particular, the S&P 500 – and thus VOO – easily outperformed the broader market in 2021.

But that doesn’t mean that performance is a permanent feature. That one-year performance has skewed the fund’s 3, 5, and ten-year performances ahead of the broader market. If market leadership were to shift from large-cap to mid or small-cap stocks, the situation could reverse.

That’s where VTI could be the better choice. It also includes all the companies in the S&P 500 index, so you won’t be missing out if that group continues to lead. But if leadership shifts to smaller companies, the VTI will likely outperform the VOO.

If you’re evaluating the two funds, you might also be concerned about company concentrations. While the top 10 holdings of VTI make up 25% of the fund’s total value, the top 10 of the VOO exceed 30%. That kind of concentration means that if just two or three stocks go on a long, slow downward trajectory, the performance of the entire fund will be negatively affected.

Such a high concentration has become typical of funds in recent years. But if it concerns you, VTI may be the better choice.

But overall, both these funds have been performing well for years, so you can’t make a wrong choice either way.

Comments

Post a Comment

We will appreciate it, if you leave a comment.