Yes, an income statement is the same as profit and loss statement. These terms are used interchangeably. Traditionally, this statement was referred to as an income statement. However, companies and businesses have been using the terms profit and loss more frequently in recent times.

Background

There are numerous success factors for businesses, among which efficient and effective management of finances takes utmost importance. Financial statements are the primary tools businesses use for financial management, planning and forecasting.

There are three main components of financial statements; balance sheet, cash flow, and income statement, which show a firm’s financial position and performance at a specific point or period of time. By analyzing the financial standing of a business, managers can make better decisions about budgets, assets, investments and expenditures. Moreover, the shareholders, banks and other stakeholders decide whether to invest in a company or not by looking at its financial statements. Additional detail is provided below about one of the components financial statements, i.e., income statement.

What is an Income statement?

The income statement is a components of financial statement that shows the revenues and expenditures of a firm and helps to calculate the net profit or loss over a period of time. The income statement analysis helps management in better strategy formulation and evaluation. It allows a firm to cut non-profitable expenditures and increase investments in profitable projects. Other names of the income statement are the Profit and Loss statement, statement of operation, statement of financial result or income, or earnings statement.

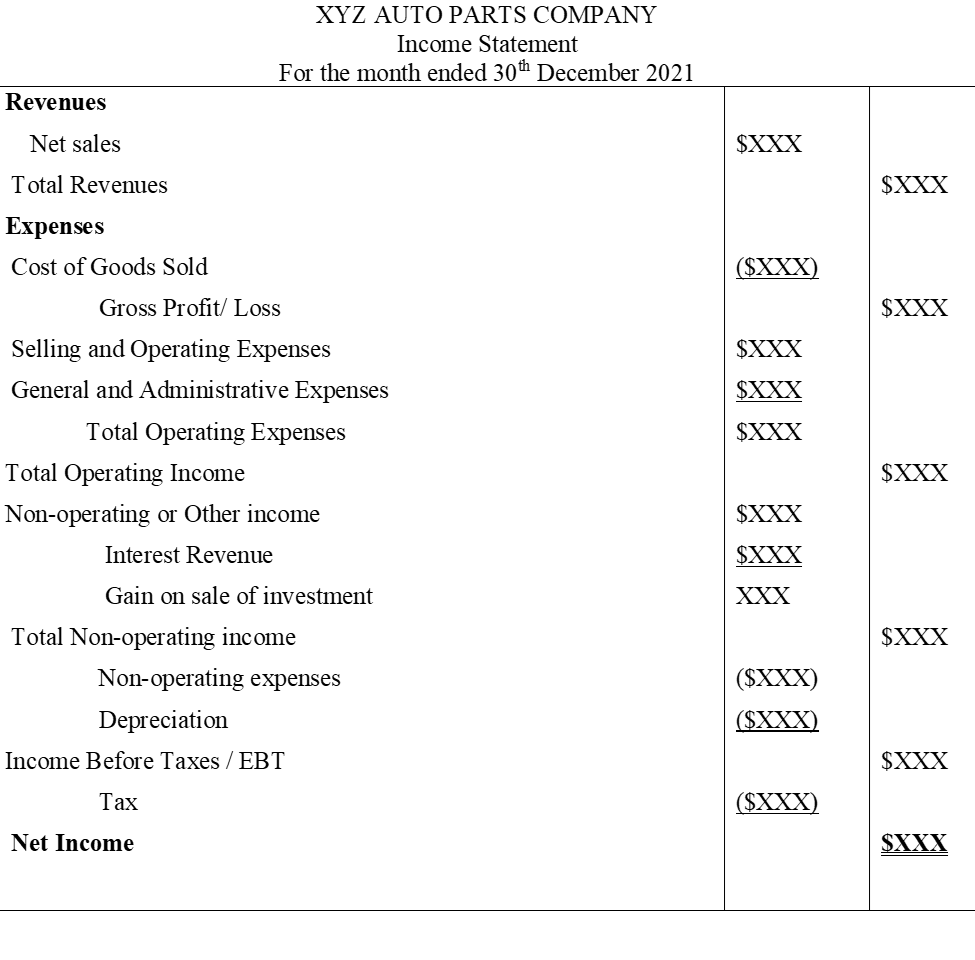

How to make an Income Statement?

Major Components of Income Statement

Following are the essential components that make up the income statement.

· Revenue/ Sales:

Revenue is the income from sales of a product or service. Revenue is of two types; operating and non-operating. Operating revenues are obtained from primary activities of a business like assembling and production or trading. While non-operating revenues come from secondary activities of a sale like delivery of the car to the customer.

· Expenses:

This part of the income statement pertains to the costs that the business must cover in order to generate revenue. Common types of expenses are depreciation expenses, wages, electricity bills etc. Similar to revenues, a company’s expenses can be categorized into two main types that are operating and non-operating expenses. The expenses incurred to perform the primary business activities are known as operating expenses. For example, the salaries of factory workers. On the other hand, the costs incurred to perform the secondary business activities, which are indirectly related to the business, are known as non-operating expenses—for example, interest on debt and payment to lawyers for resolving legal affairs.

· Cost of Goods Sold (COGS):

COGS refers to the cost incurred to produce goods to be sold. It includes direct costs like direct labor and raw materials but not indirect costs like factory overhead. It is similar to operating expense but it is listed as a separate component on the income statement. Operating expense includes all other direct expenses, excluding COGS.

· Gross Profit / Loss:

Subtracting COGS from net sales gives gross profit/loss for the period.

Gross Profit = Net sales – COGS.

Net sales is the amount gained from selling goods, while COGS is the cost incurred for manufacturing those goods. If the cost of goods sold is less than the net sales, then the business has made a gross profit, but if the cost incurred to produce goods is greater than the income by those goods, then there is a gross loss.

· Depreciation:

Depreciation refers to the gradual wear and tear of assets over time. The long-term asset’s cost is distributed over the span of its useful lifetime. This amount is a non-cash transaction and serves the purpose of showing a reduction in the equipment’s value because of its use. This is recorded in the income statement as well.

· Earnings before Tax (EBT):

It is calculated by deducting the expenses of the business from the revenues. The obtained amount is then subjected to Tax.

EBT = Revenues – Expenses (before tax)

· Net Income:

Net income is calculated by subtracting total expenses (including Tax) from total revenues. If the total revenues exceed the total expenses, then the company has made a net profit, but if the total expenses exceed the revenues, then the company has made a net loss.

Income statement and P&L statement:

Three terms are used interchangeably in accounting; income statement, profit, and loss statement and profit and loss accounts. There is practically no difference between a profit and loss statement and an income statement. P&L is just another name for an income statement because it shows net profits and losses.

What is a Profit and Loss Account?

The Profit and Loss Account is a T-account made at the end of the year to show the company’s annual expenses and gross profit. The expenses and Tax are then deduced from the gross profit to calculate the company’s net profit at the end of the year. This net profit/loss figure should be the same as the one shown on the income statement. The profit/loss is then distributed among the shareholders.

Main features of Income statement and P&L

Following are some of the main features related to income statements and P&L.

- It provides financial information regarding the firm’s revenues, expenses, profits, and losses, which is a primary factor for business performance evaluation. In addition to this, it’s about evaluation of financial and operational performance.

- Income statement or P&L are made for specific periods of time. For instance, it may be for the month, quarter, year, etc.

- It gives net profit/loss as output with a detailed breakup. Hence, it’s easy to trace movement and how revenue is converted into profit/loss.

- It helps to assess the financial health of the business. For instance, if there is a profit at the end of the financial statement, it’s said to be a financially viable company and can be valued in multiples depending on the business strength.

Conclusion

Income statement and profit and loss statement are used interchangeably. There is no such difference in these terms, and both can be used in place of another. It’s one of the main components presented in the financial statement. Further, it’s more about the financial evaluation of the business performance in terms of operational and non-operational activities.

It’s prepared in a specific format that helps track revenue and expenses. In addition to this, it enables us to trace how revenue is converted into profit or loss depending on the size of expenses.

Different line items are presented in the income statement that presents inflow and outflow of economic benefits and help to analyze specific period-wise performance.

Frequently asked questions

What does it mean by accuracy and completeness of profit and loss statement?

Accuracy of profit and loss statement means that transactions recorded in the income statement are free from misstatement. In other words, there is as such no error in the profit and loss statement.

On the other hand, completeness refers to the concept that all transactions pertaining to business have been recorded in the financial statement. In other words, management has not hidden any of the transactions and line items.

How do external auditors review income statement?

Generally, external auditors perform analytical and substantive procedures on the income statement. The analytical procedure is about comparing breakup, trend analysis and concluding if balances are stated reasonably.

For instance, if there is a significant increase in fuel expense, it must be backed by some logical ground like increase in business activity. On the other hand, the substantive procedure is a test performed to get conclusive evidence on transactions. For instance, auditors may check the invoice, goods dispatched notes, and payment receipt to assess the accuracy of revenue.

What is the statement of comprehensive income?

Statement of comprehensive income contains unrealized revenue and expenses along with profit or loss from the income statement. It’s prepared and presented to enhance user understanding of the financial statement.

Is there any impact of income statement on the balance sheet of business?

Yes, profit or loss reported at the end of the income statement is adjusted in the business’s balance sheet. If there is profit at the end of the income statement, it increases equity balance. On the other hand, if there is a loss at the end of the income statement, it decreases the equity.

Comments

Post a Comment

We will appreciate it, if you leave a comment.