I'm a long-time vocal proponent of higher education. For me, it's personal. I was raised in a poor family with parents who had briefly attended college, but never with any real gusto. (I'm not sure my father had a plan. My mother studied home economics. Not kidding.)

My uncle got a math degree from a now-defunct community college, and his son (my cousin Duane) went to school back East. I'm not sure if he got a degree, though. (I'll ask him tomorrow when we get together to bake Christmas cookies!)

But from a young age, I knew that I wanted to go to college. I knew I was a smart kid, and I viewed college as a Way Out. It was an escape from the trailer house I grew up in, an escape from menial labor.

Too bad then that I squandered my college education. I entered Willamette University intending to be a religion major, but eventually ended up with a psychology degree — chased with an equally useless English minor.

My college degree hasn't really proved useful in my life. Well, I guess I apply both the psychology and English education in my career as a money writer, but I don't make direct use of the things that I learned. And that's the rub.

College degrees are valuable — but not if you choose the wrong one.

Although it's popular in some corners to bad-mouth college degrees, according to the U.S. Census Bureau your education has a greater impact on lifetime earning potential than any other demographic factor. Education matters more than age. Education matters more than race. Education matters more than gender. When it comes to making money, education matters most.

So, I'm always interested when I see knew reports and/or research regarding the value of college. In October, the Foundation for Research on Equal Opportunity (FREOPP) released an excellent report entitled “Is College Worth It? A Comprehensive Return-on-Investment Analysis”.

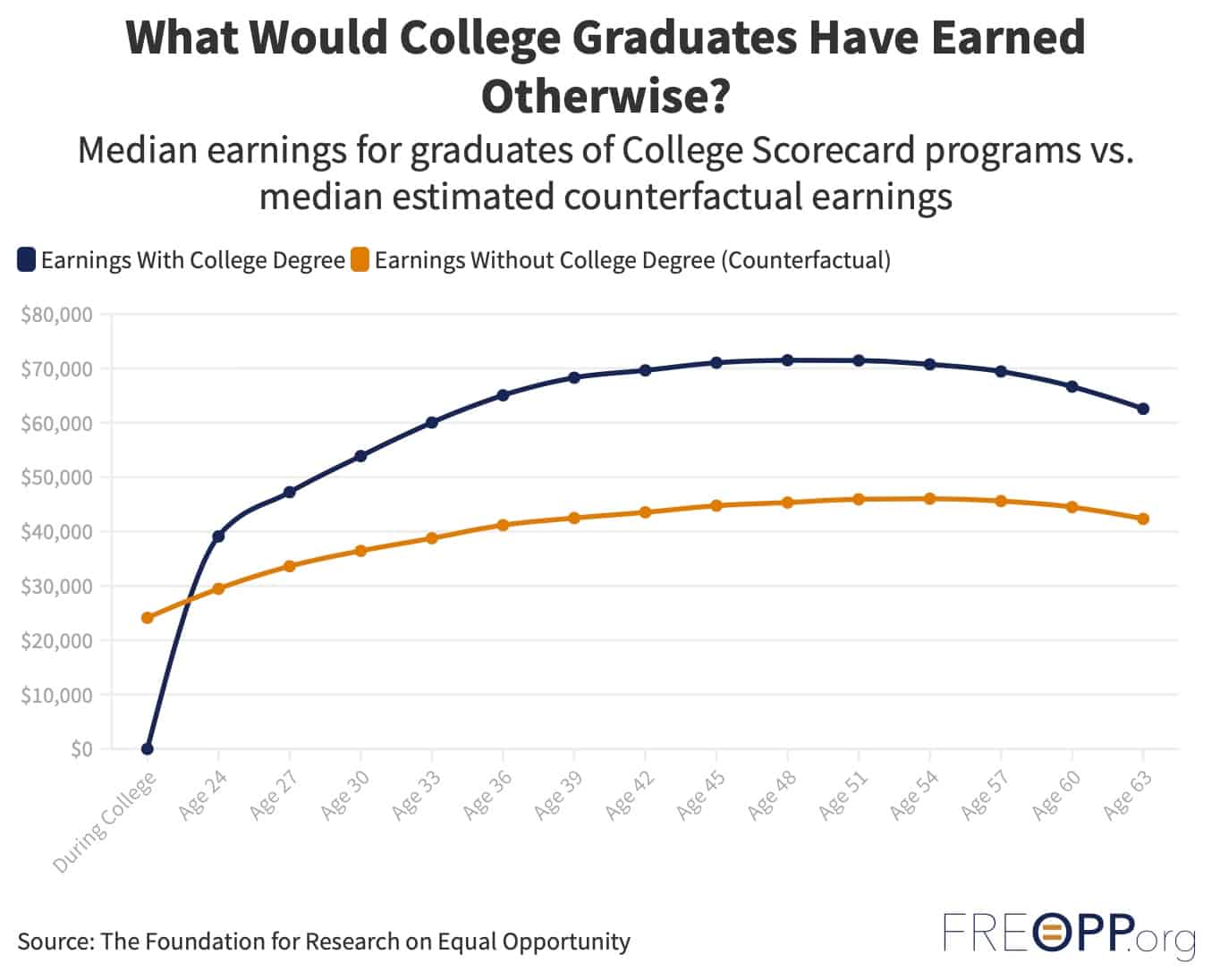

I like this report because it goes beyond averages. Sure, FREOPP says, the median bachelor's degree is worth $306,000 for students who graduate on time, but…

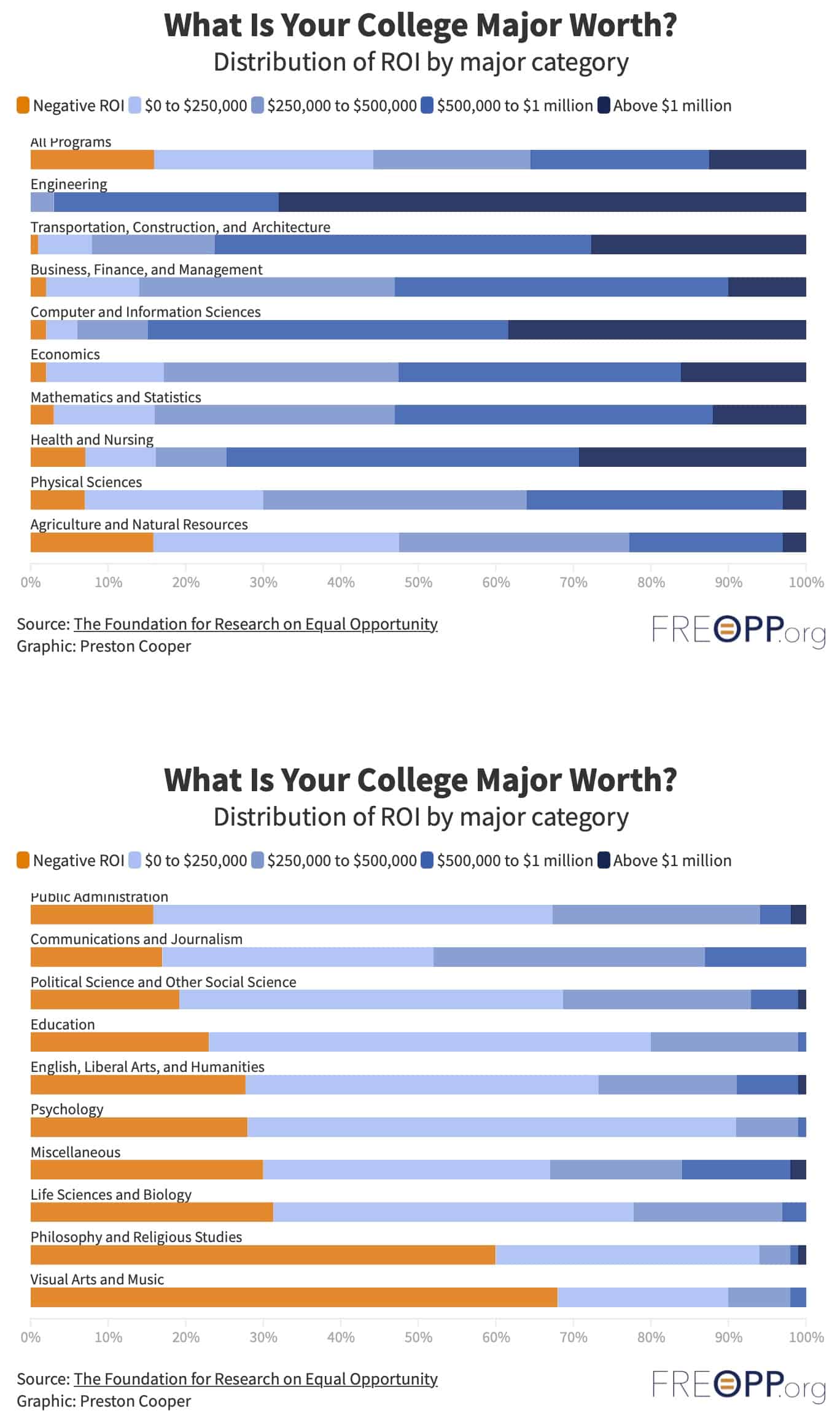

…the median conceals enormous variation. Some fields of study, including engineering, computer science, nursing, and economics, can produce returns of $1 million or more. Others, including art, music, religion, and psychology, often have a zero or even negative net financial value.

FREOPP argues that “the decision to attend college is less important than the choices that come next: which school to attend, and which subject to study.”

The analysis reveals that a student’s choice of program is perhaps the most important financial decision he or she will ever make. Most bachelor’s degree programs in engineering, computer science, economics, and nursing increase lifetime earnings by $500,000 or more, even after subtracting the costs of college. But most programs in fields such as art, music, philosophy, religion, and psychology leave students financially worse off than if they had never gone to college at all.

Differences in ROI between programs can amount to millions of dollars.

The FREOPP report — which is very long — includes plenty of interactive stats and charts and graphs. Readers acan compare the value of college majors, expected earnings, and more.

The FREOPP report echoes some of the findings of Georgetown University's 2015 report on “The Economic Value of College Majors”. The Georgetown study found that engineering majors earned a median starting income of $50,000 per year. Folks with an art degree started with annual salaries of around $28,000. And high-school graduates who didn't go to college? Well, they had average starting salaries of $22,000 per year.

The bottom line? FREOPP says there are three main messages to draw from their report.

- First, major is the most important factor when predicting the return-on-investment for a college education. Degree subject accounts for half almost half of ROI variation alone.

- Second, elite colleges can pay off, but not always. FREOPP found that there is a weak correlation between the cost of a school and how much a degree from that school is worth. But, as with majors, there's plenty of variation. A film degree from Harvard is likely to be worth less than an engineering degree from a “no name” university.

- Finally, there are a lot of bachelor's degrees that don't make sense from a financial perspective. You might want an art degree or a religion degree for other reasons, and you might be fulfilled with those degrees, but they're poor choices when viewed through the lens of money.

Here's what I always say when I write about this subject: The more you learn, the more you earn. And it's true. No, a college degree isn't a guarantee that you'll earn more, but it never has been. But, generally speaking, the more formal education you have, the more money you'll make during your lifetime. This report only reinforces that conclusion.

[“Is College Worth It? A Comprehensive Return-on-Investment Analysis” at Foundation for Research on Equal Opportunity]

Get Rich Slowly https://ift.tt/3E1gfnC

Comments

Post a Comment

We will appreciate it, if you leave a comment.