Every now and then, The New York Times gives us an awesome new personal-finance tool. Back in 2007, they created an amazing rent vs. buy calculator, which they've diligently updated and maintained over the past fifteen years. A couple of weeks ago, they unveiled their where should you live? tool. [Warning: possible paywall, which is unfortunate.]

Here's how it works:

We created a quiz using data for almost 17,000 places across more than 30 metrics. Realtor.com shared housing prices with us; Yelp contributed tallies of restaurants, music venues and gay bars; and AccuWeather helped us collect statistics on temperature, sunshine and snowfall, to name just a few of our sources.

We want the quiz to be useful to anyone who’s thinking about moving — not just affluent, highly educated people who are working remotely because of the Covid pandemic. We’ve included data on affordability, jobs and abortion rights, which could be relevant to young people deciding where to start their careers. And we’ve quantified health care quality, snowfall and crime rates — criteria that might be top of mind for retirees.

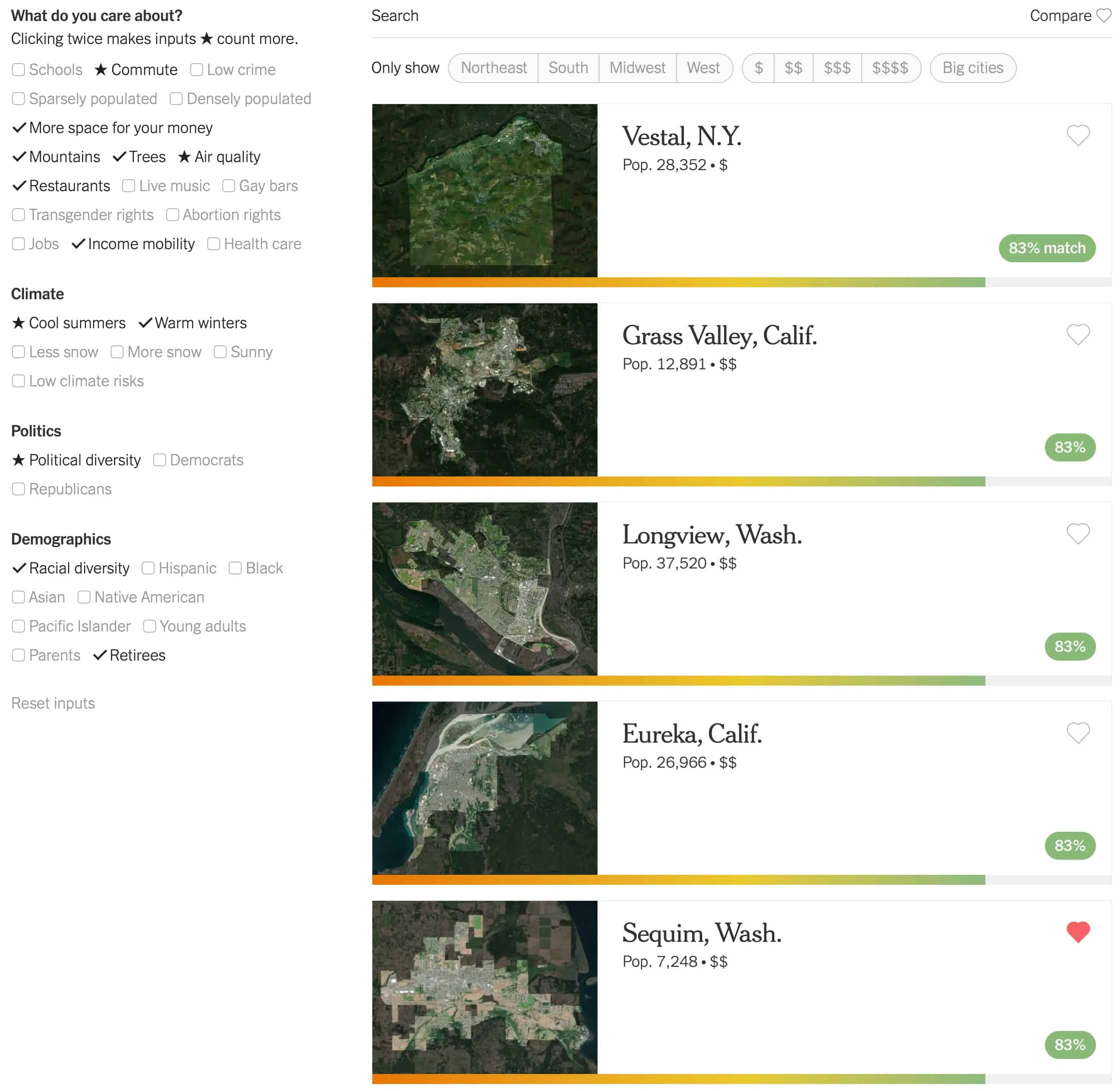

To use the tool, you select from 35 different factors that matter to most people, factors ranging from population density to climate to racial diversity to political affiliation. You can even emphasize the qualities that matter most to you. The tool tells you which American cities best match your preferences.

If you'd like, you can refine the results by specifying a region of the country (West, Midwest, South, or Northeast) and/or average cost of living.

Once you're satisfied with the search results, you can click on indvidual cities to get a detailed description of their demographics. If you like a place, you can “heart” it to save it as a favorite. Then, once you've finished, you can click “Compare &heart;” to view a table that places all of your favorite cities side by side.

Here, for instance, are the results of my own personal living preferences.

I don't know anything about my top match (Vestal, New York), but the rest of the results are pretty much spot-on. In order to get better matches for me, a tool like this would need to include some sort of stat to measure downtown vitality (it was important for me to find a city with a solid downtown instead of one where commerce clung to highways and freeways) and a stat to measure education level.

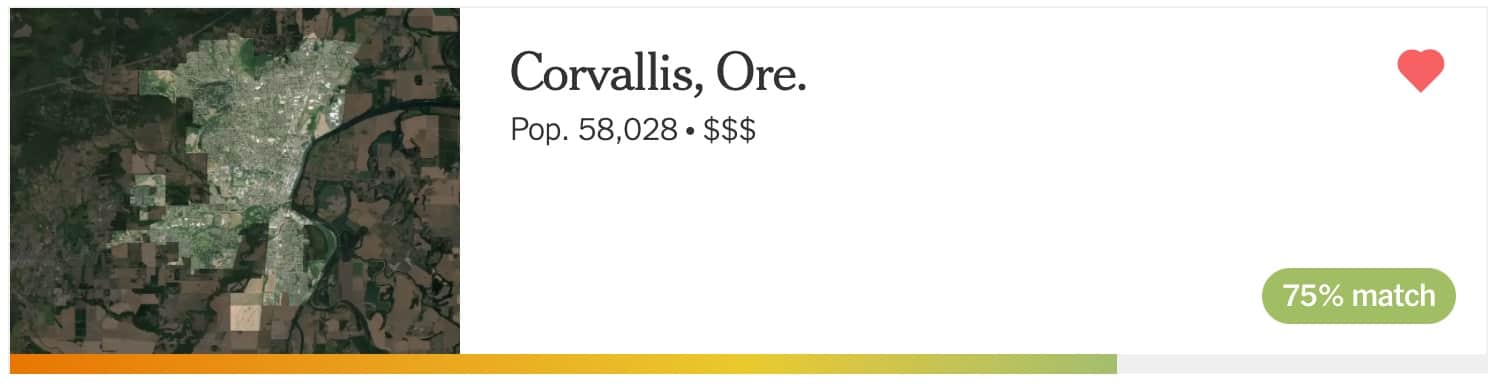

If this tool had existed when Kim and I were searching for new places to live last summer, we would have used it to help filter possible locations. As it is, we did a reasonable job picking a place to live. As you can see, Corvallis is a 75% match for my preferences.

And three out of the top ten results on my list — Sequim and Port Angeles in Washington, Florence in Oregon — were towns we considered seriously during our search. Two additional towns in my top ten (Grass Valley and Eureka in California) were on my list to look at, but Kim ruled them out because she doesn't want to live in California.

I realize that for most folks, this tool is just a fun diversion. Unless you're actually looking to make a move, there's nothing you can do with the results at the moment. Still, I think it's worth bookmarking for the next time you are trying to decide where to live.

If you'd like to see the raw data behind this tool, check out the piece that explains the methodology: “How we calculated where to live”.

[The TessMore Finance and the New York Times: Where should you live?]Get Rich Slowly https://ift.tt/3m1tyhr

Comments

Post a Comment

We will appreciate it, if you leave a comment.