The term “cost of living” refers to the amount of money that’s necessary to cover essential living costs in a given time and location. Living expenses such as housing, food, utilities, transportation, and health care all vary based on time and place and are factored into cost of living.

If you plan on moving to a new city or are just curious about what it might cost to live somewhere else, use the cost of living calculator below to see the difference we’d expect between your current location and your desired one.

Additionally, the calculator will let you know whether it’s likely you’d be able to maintain your standard of living based on your income. If your current salary just won’t cut it, take charge of your financial future and try out our tips to negotiate a potential cost of living adjustment.

Cost of Living Calculator

Average Cost of Living in the U.S.

Based on our index, the average U.S. cost of living equals 100. This means that if an area’s cost of living is on par with the national average, its cost of living index (COLI) is 100. Cities that are in line with or closest to the average cost of living in the U.S. are as follows:

- Yuma, AZ (COLI of 99.9)

- Ogden, UT (COLI of 99.9)

- Pierre, SD (COLI of 100.2)

- Orlando, FL (COLI of 100.2)

If a city has a COLI above 100, that means it is a certain percentage over the national average. In other words, it could be considered a more expensive city to live in.

- Los Angeles, CA has a COLI of 148. This means that the cost of living in Los Angeles is 48 percent higher than the national average.

When a city has a COLI below 100, that means it is a certain percentage below the national average cost of living. In other words, it could be considered a more affordable city to live in.

- Amarillo, TX has a COLI of 81.5. This means that the cost of living in Amarillo is 18.5 percent lower than the national average.

What Is the National Cost of Living?

Although the average cost of living index is equal to 100, this number can be confusing to interpret. To put this in perspective, we’ll use the median necessary living wage for Yuma, AZ, which has a COLI that is in line with the U.S. average of 100, as an example.

The median necessary living wage is similar to cost of living because it’s the estimated income needed to meet basic living expenses in a given place and time. By using Yuma’s living wage as a reference point, we can illustrate what kind of salary and wage it may take to meet the average cost of living in the country. We’ve also listed the median necessary living wage for the nation to put into perspective how the average cost of living compares.

Median necessary living wage in Yuma, AZ:

- $74,740 per year, pre-tax for a family of four (two working adults)

- $17.97 per hour, per working adult in a family of four

Median necessary living wage in the U.S.:

- $68,808 per year, pre-tax for a family of four (two working adults)

- $16.54 per hour, per working adult in a family of four

Highest Cost of Living Cities in the U.S.

Cost of living is useful when comparing the costs of cities and finding out the highest and lowest cost areas to live. The city with the highest cost of living is New York (Manhattan), NY, with an index of 239.3. Check out the table below to see which other cities top the nation for highest cost of living.

| Top 10 Highest Cost of Living Cities in the U.S. | |

|---|---|

| City | Cost of Living Index (COLI) |

| 1. New York City (Manhattan), NY | 239.3 |

| 2. San Francisco, CA | 186.4 |

| 3. Honolulu, HI | 185.6 |

| 4. New York City (Brooklyn), NY | 172.6 |

| 5. Washington, D.C. | 154.4 |

| 6. Oakland, CA | 152.8 |

| 7. Orange County, CA | 151.9 |

| 8. Seattle, WA | 149.9 |

| 9. Boston, MA | 148.6 |

| 10. Los Angeles, CA | 148 |

6 Tips for Negotiating a Cost of Living Adjustment

Some employers offer a cost of living adjustment to workers who need to move to an area with a higher cost of living to complete their job responsibilities. These adjustments typically come as an increase in your pay and are meant to account for elevated living costs.

A good time to consider negotiating a cost of living adjustment is when you’re relocating for work and can’t afford the same basic living expenses in the new location.

The cost of living adjustment will help expand your budget to cover expenses such as housing, food, and transportation. Check out the tips below to help you successfully negotiate a cost of living adjustment.

1. Leverage the Data

First, use a salary tool to see how your current income compares to the market average for your position and area. You can get comprehensive salary data from Mint or try using the Bureau of Labor Statistics’s data on wages, compensation, and benefits. Checking to see if your salary is competitive for your area can help you decide if it’s worthwhile to negotiate.

If you’ve decided to negotiate an adjustment, it’s important to use data to justify your ask. Dig into the data on the national cost of living adjustment through the Social Security Administration, as well as the Consumer Price Index. Information based on Social Security adjustments plus the rising costs of living expenses like food and housing will help backup your request.

2. Demonstrate Your Value

Demonstrating your worth as an employee is a crucial part of negotiating any aspect of your compensation. Be prepared to provide evidence of your impact at work by quantifying your achievements when possible.

For example, if you work in sales, you could highlight your value by providing metrics on the number of leads closed or the total profit driven for the company. This shows your employer that your value justifies your increase in pay.

3. Get Your Timing Right

Timing is important when asking for a cost of living adjustment. If you’re relocating for work in the near future, it’s wise to ask before moving. Additionally, give yourself and your employer adequate time to prepare for the discussion and set up a meeting to negotiate.

4. Approach It With Confidence

When entering into any negotiation, confidence is key. Practice what you’ll say so that you can deliver your cost of living argument confidently. This helps demonstrate to your employer that you’ve done the research and know your worth, and it may make it more likely for them to accept your request.

5. Be Collaborative

Research shows that being cooperative in a negotiation results in better outcomes for both sides. Approach your negotiation in a collaborative way and let your employer know that you’re willing to work with them. This way, both parties can come to a solution that will satisfy everyone.

6. Express Gratitude

Whether or not you’re successful at negotiating a cost of living adjustment, it’s good practice to express your gratitude. Try following up with a thank you email that briefly summarizes what you discussed.

If you obtained the adjustment you asked for, it’s good to ask for it to be confirmed in writing as well. On the other hand, if you didn’t get the adjustment, it shows that you’re professional and gives you the opportunity to move forward.

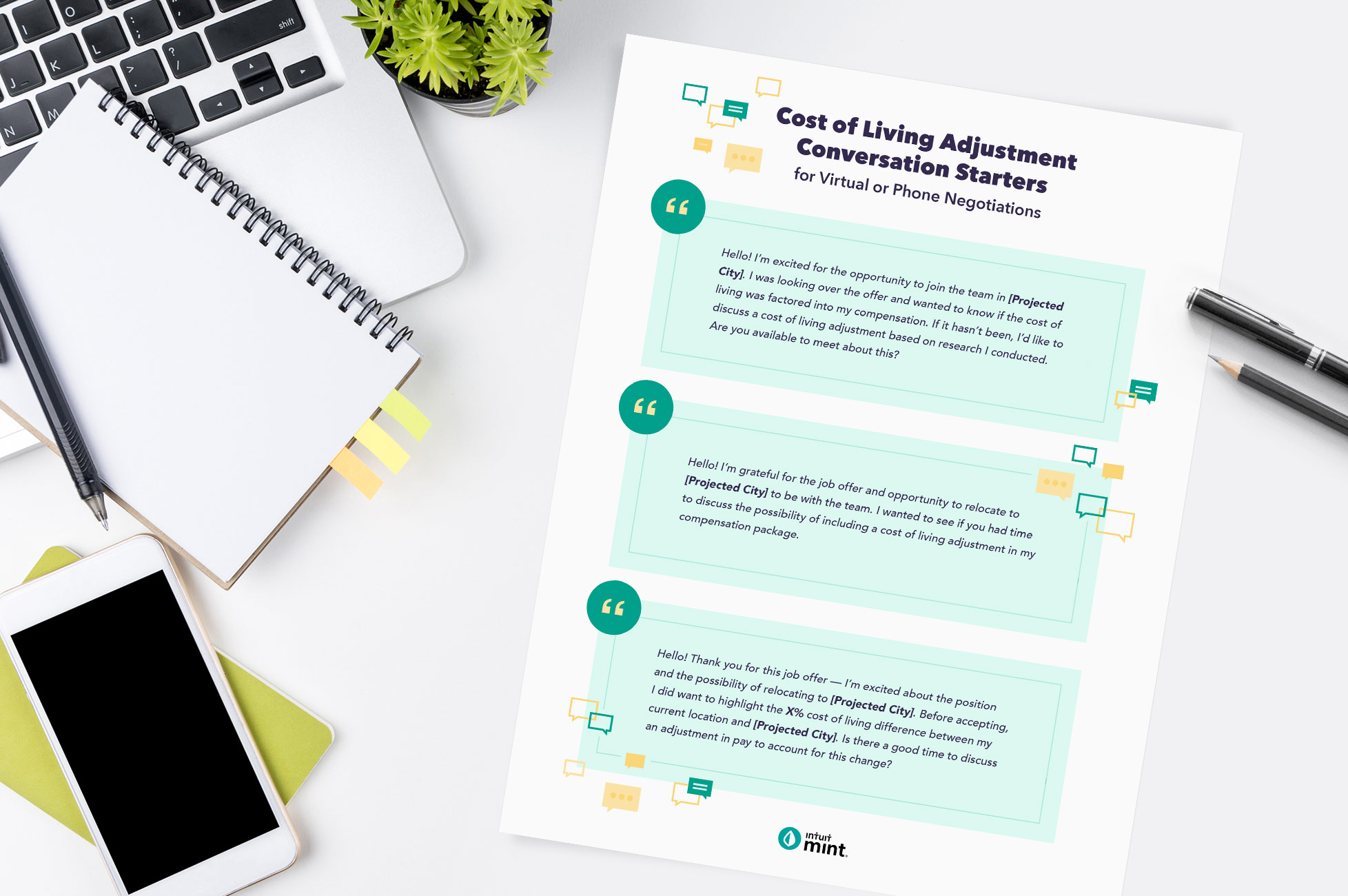

Negotiating any part of your compensation, whether it’s a raise or cost of living adjustment, can be a daunting task. If you want to negotiate but don’t know how, try out these conversation starters to help you open the discussion for a cost of living adjustment.

Cost of living varies depending on your time and location. Whether you’re relocating across the country or just a couple hours away, it’s wise to think about whether you can maintain your standard of living in a new place.

Use this cost of living calculator to compare two cities in the U.S. and help think through whether your current budget will still work for you. If it doesn’t work, consider asking for a cost of living adjustment to boost your budget for expenses like groceries, housing, and transportation. Once you move, readjust your budget categories in your Mint app to help keep your finances on track.

About This Calculator:

To calculate cost of living, C2ER’s 2021 Cost of Living Index (COLI) is used to compare costs of living for 294 urban areas in the United States. Keep in mind these are estimates, and we can’t make any guarantees about your actual costs.

Sources: Living Wage MIT | COLI

This post on TessMore Finance: Cost of Living Calculator + Tips to Negotiate a Cost of Living Adjustment was also published on MintLife Blog.

MintLife Blog https://ift.tt/3x7ZTb0

Comments

Post a Comment

We will appreciate it, if you leave a comment.