With the holidays coming up, you’re probably thinking about what you might want to give that special someone. Or that special little someone.

We share a few money related ideas that might help you find the perfect gift.

These gifts are all in some way related to money – this could be actual money (as is the first suggestion) or something that can help you become better with your money. These may be books, planners, guides, etc.

We hope you find something great below and let us know if you get anyone anything from this list!

Table of Contents

How About Cash?

I’m Chinese (surprise!) and for all important occasions, but especially birthdays and Chinese New Year, our family gives cash. The best gift is always cash.

Brand new crisp bills in a red envelope like this one. So crisp that the bills stick together and are hard to get apart.

For various reasons, I know some people don’t like giving cash (it’s tacky? not sentimental?) but I urge you to give it a try. It’s a little like giving someone a wallet but making sure you stick a dollar inside because gifting an empty wallet is bad luck. Giving a gift card they won’t use is bad luck!

If giving money makes you feel a little uncomfortable, let me assure you that no one is ever uncomfortable receiving cash.

Contribute to a 529

If you want to give a gift to a littler someone, consider making a deposit into their or their child’s 529 plan!

If you aren’t familiar with 529 plans, we consider it one of the best ways to save for college for a variety of reasons. One of the best reasons is that anyone can contribute to a 529 plans and if the beneficiary doesn’t need it, you can always change it to someone else.

The only thing you have to keep in mind are gift taxes but unless you intend to give more than $15,000 a year, you have nothing to worry about (that’s the limit before taxes come into play). If you do plan on giving more than that, you’ll want to review the gift tax rules but there are ways to structure it so you don’t need to worry about taxes. (if this is you, look up the five-year gift tax average rule)

Give Stock

My friend Jessica suggested that one could gift shares of stock. It’s similar to contributing to a 529 from a gift tax perspective but gets a little trickier when you talk about minors. If they have a custodial investment account, you can just contribute to that account. Otherwise, you need to open one up for them.

If you want to give stock that you don’t already own, Stockpile is a company that makes it easy to give someone stock. You simply buy a gift card and they redeem it on the Stockpile site.

Alternatively, you can go with a service like EarlyBird, which is designed for parents to help get their children investing. EarlyBird is a Registered Investment Advisor and offers fixed portfolios with fees of $1 per month per child. They also charge a $2 processing fee per gift.

Need an Amazing Home Planner?

Need a planner for 2022 or know someone who does? I want to recommend one from my friend Laurie from the Passionate Penny Pincher.

If you already love checklists and planners, check out the home planner and see for yourself.

If you don’t know much about them, they’re basically a guide for your day, week, and year; packaged into a beautiful notebook. The pictures are really thorough (as is the planner) to give you a sense of what is included.

Here’s how Laurie describes them:

This is NOT your traditional planner. The Home Planner is a game changer for busy families because of the pre-made checklists!

Each checklist is designed to add MORE time and LESS work to an already busy day. Easily check off those daily tasks along with any weekly tasks that may not be at the top of the priority list. When was the last time you organized the stack of cookbooks on top of the fridge or developed the pictures on your phone? The checklist will make sure you don’t forget.

Along with the weekly checklists, there are also seasonal checklists to help throughout the year. Whether you need a list for vacation planning, hosting guests, or yard maintenance, these checklists are perfect to make sure your bases are covered. For unique recurring tasks in your home – seasonal or personal – add them to the monthly checklist page so that you don’t forget.

There are physical as well as digital versions of the planner – plus she has several other home planning products worth checking out.

Laurie is running a Semi-Annual Sale from now until November 21st where you can get a discount using these Passionate Penny Pincher coupon codes:

- TURKEY for $10 off $50

- THANKS for $25 off $100+

- GIVING for $50 off $200+

Family Emergency Binder

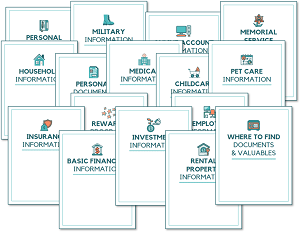

Everyone needs an “In-Case-of Emergency” binder for their money and their life but starting one can be a little daunting. We provide a guide to making your own ICE binder but if you want a series of templates you can just fill out, I recommend checking out Chelsea Brennan’s Family Emergency Binder.

This 16-section template covers pretty much everything from personal information to insurance to medical to childcare.

Do you have pets? There’s a section for that.

Rental property? Yep, it’s in there.

There’s even a memorial service template – something you probably didn’t think about.

Get it for $39.

For a limited time, you can get the Family Emergency Binder on a flash drive.

It costs the same as the digital version and you get:

- A setup walkthrough video from me and PDF setup guide

- A complete fillable Family Emergency Binder, with options for different family structures.

- Detailed folder system by binder section to make finding paperwork quick and easy

- Family Emergency Binder keychain so the drive doesn’t get lost!

- A gift box that safely holds the flash drive in an elastic loop, so it’s safe in transit

Send a Statement (Card)

My friend Stefanie O’Connell Rodriquez is the host of Real Simple Magazine’s podcast Money Confidential and founder of Statement Cards.

If you want to celebrate and recognize an important woman (or women!) in your life but the cards at the store just don’t work, consider doing it with a Statement Card.

The cards are well-designed, strong (100 lb card stock!), and filled with empowering messages guaranteed to make her smile – just see them for yourself.

A Few Amazing Books

Last but not least, books can be a good gift if done correctly. It’s a little like exercise equipment, you have to know your recipient really well so you don’t end up getting them a paperweight.

I want to share a few books that I think won’t become paperweights:

Stacked: Your Super-Serious Guide to Modern Money Management by Joe Saul-Sehy and Emily Guy Birken – I haven’t seen this book but I know both authors and I have a sneaking suspicion that this book will be both entertaining and educational in a way that will get the reader better with their money.

Wallet Activism: How to Use Every Dollar You Spend, Earn, and Save as a Force for Change by Tanja Hester – This book I have seen and looked through (I haven’t read it in its entirety) but if you care about where your money is going and the full cost of the things you buy, Tanja’s book will open your eyes to the various second order effects of your spending.

Fire the Haters by Jillian Johnsrud – If you or someone you know is a creator, whether it’s blogging, Youtube, Instagram, etc; and want to learn how to navigate that world, get them a copy of Jillian’s book. Whether it’s your inner critic or an external one, Jillian shows you a way forward through the noise so you can shine.

A Cat’s Guide To Money: Everything You Need to Know to Master your Purrsonal Finances, Explained by Cats by Lillian Karabaic – I know nothing about this book other than it looks super cute and my friend Stephonee recommended it.

A Money Workbook for Couples

If you thought managing money for yourself was tough, wait until you enter a relationship! Do you share finances? Do you keep it separate? Who has debt? What are you going to do about it? How do you organize your finances to reach your goals?

These are all tough questions but my friend Kara (founder of Bravely Go) has just the workbook for you – First Comes Love, Then Comes Money. It’s a downloadable workbook that help you navigate those challenges. It won’t give you the answers but it’ll help you know which questions to ask.

Some Personal Finance Swag & Gear

Finally, if you’re looking for some personal finance themed swag – clothes, hats, bags, etc. – to give out as gifts, some of my friends have stores with great looking stuff:

- Grownup Gear

- Her First 100K Merch

- PFSwagger (a round up of a bunch of stores)

- The Finance Bar

Finally, if you have any great ideas for a money related gift that I should include on this list, tell me in the comments or email me!

This post on TessMore Finance: Best Money Gifts for 2021: A Personal Finance Holiday Gift Guide was also published on Best Wallet Hacks.

Best Wallet Hacks https://ift.tt/3clqyr9

Comments

Post a Comment

We will appreciate it, if you leave a comment.