Near the end of 2023, Mint announced that they were closing up shop by March of 2024.

For years, I’d used Mint in my early to mid-twenties to help me manage spending. Budgeting is a key component of responsible money management and Mint made it super easy.

Over the years, I focused more on investing and wealth building (but still keeping a budget, just not spending as much time on it) and turned to other tools as I “matured” financially.

I was still surprised when I got the email that Mint decided to shut down and migrate folks over to Credit Karma.

I’ve long been a fan of Credit Karma because they offered legitimately free credit scores. You can to contend with the advertisements but I was OK with that, companies need to make money so they can continue to offer free products and services. It’s how Mint kept the lights on… until, I suppose, it wasn’t doing well enough.

The big question for many users was where would they go? Mint suggested Credit Karma, their sister brand/company, but I was a little skeptical. Since Mint was founded and acquired by Intuit, a lot of Mint alternatives are available.

You have a lot of options.

But one option that should be considered is making that migration. If it’s seamless and offers the same services as Mint, it seems like a no brainer especially since Credit Karma is free.

I finally got the email from Mint that I can now migrate to Credit Karma – and it was pretty easy.

Table of Contents

How to Migrate from Mint to Credit Karma

You can’t migrate until you get an email (or log into your account and see the option) from Intuit.

I received an email with the SUBJECT: You can now move your Mint history to Credit Karma.

First things first, DOWNLOAD YOUR TRANSACTIONS! (here are the instructions)

Once you migrate, they shut down your Mint account and you can no longer get access to it. You want to download your transactions in case Credit Karma isn’t a good fit and you want to import that data to another app.

Next, click the orange button in the email and you’ll get prompted to log into Credit Karma.

Click this obvious button:

Once you click, you’ll be shown a modal pop up with what you’ll get and another, small, warning that once you migrate, you lose Mint forever. Click with trepidation. 🙂

You’ll be prompted to log into Credit Karma:

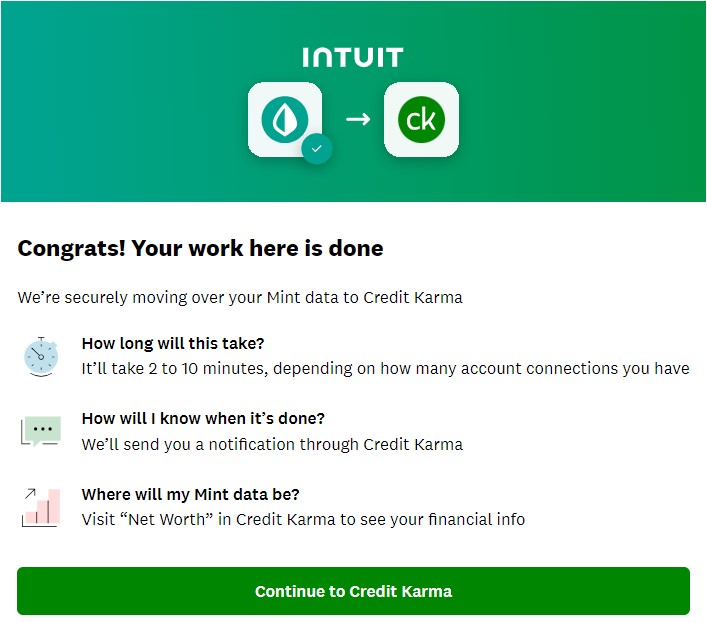

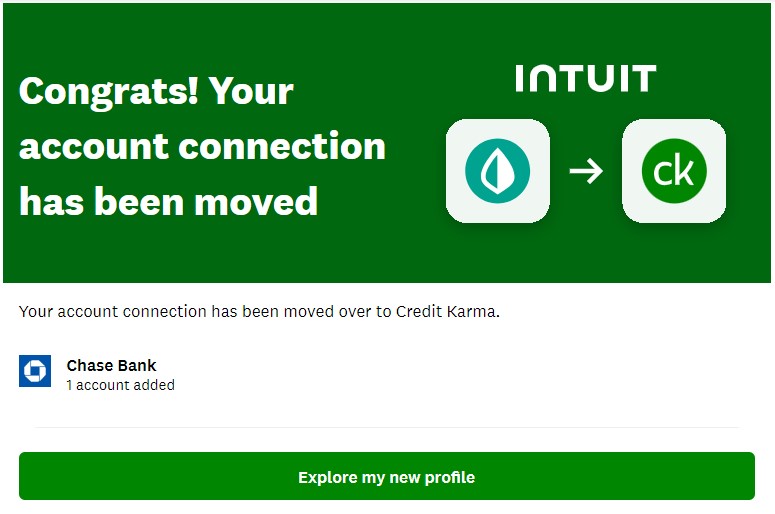

And in a few minutes, boom you get this happy screen:

Mint Features in Credit Karma

I would not go as far as to call Credit Karma a budgeting tool.

As of December 22nd, I don’t see many Mint features within Credit Karma (outside of what existed before the Mint closure announcement). You pretty much just have the Net Worth tools that Credit Karma announced earlier in 2023.

There’s some very light budgeting tools, like categorization of your spending and a look at cash flow, but it’s pretty basic stuff right now.

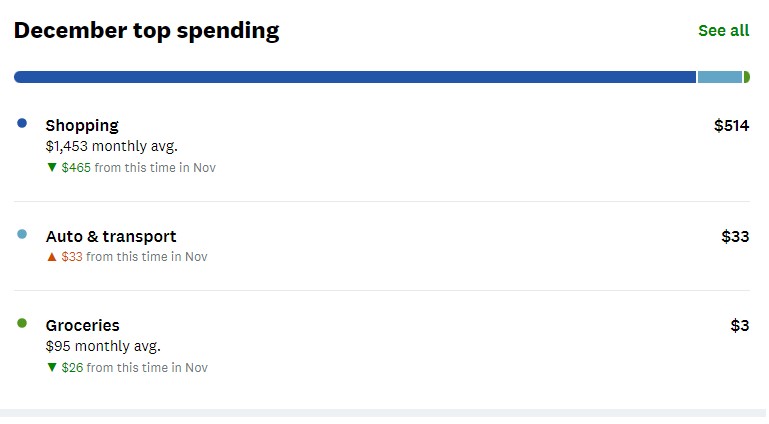

For example, here’s what they show as my “December top spending:”

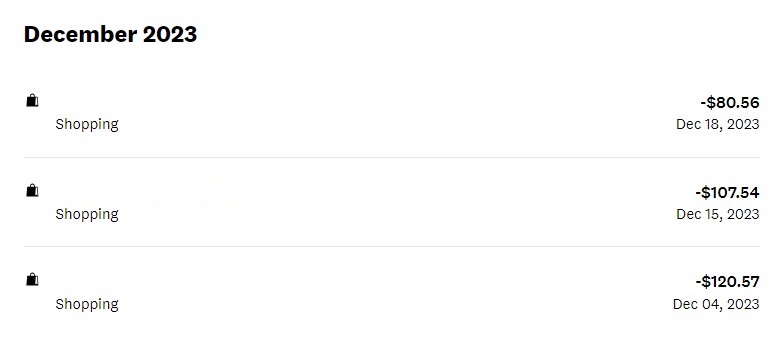

You can click through to “Shopping” and see a list of my expenses:

You can edit the expense and change the category to one of 26 other categories, but that’s it. You can’t split anything, so you that charge at the gas station is all gas, even if you spent a little in the food mart.

You can’t rename or add expense categories. You can’t rename the expense to something more readable either, it’s just whatever appears on the credit card statement.

Credit Karma is Not Mint (Yet?)

It’s still early (Mint doesn’t shut down until March 2024) but don’t migrate to Credit Karma if you think it’s going to give you the Mint experience.

It’s not.

It’s very very far from Mint and so if you migrate now, you will be in for a shock.

I think it will take a few months for various features to get pulled into Mint (if Intuit is serious about Credit Karma being a Mint successor) but if this is its final form, you need to look elsewhere.

Mint Alternatives

If you don’t want to wait or want to get a head start, here are some good Mint alternatives. You can always migrate later and many of the alternatives are offering promotions for Mint escapees.

If you’ve graduated from budgeting, my vote goes to Empower Personal Dashboard (formerly Personal Capital) because they offer some light budgeting tools (better than what Credit Karma offers right now) but a rich suite of investment and wealth building tools. Our Empower review goes into greater detail.

Simplifi by Quicken is very similar to Mint and might be one of the more popular options for those looking to move. The big difference is that it’s not free, the normal price is $4 a month but they’re running promotions right now for folks making a switch. There’s a 30-day money back guarantee so you can try it out to see if it works for you.

The post Migrating from Mint to Credit Karma: It Was Not Good appeared first on Best Wallet Hacks.

from Best Wallet Hacks https://ift.tt/Do04TF3

Comments

Post a Comment

We will appreciate it, if you leave a comment.