Does silver have a place in your investment portfolio? Much like its first cousin, gold, silver has many detractors in the mainstream financial universe. The standard arguments are that it’s subject to wide price swings, doesn’t pay interest or dividends, and so there are better places to invest your money.

While the arguments against silver are valid, there are times when silver can be a solid investment – maybe even better than gold.

That’s why it’s good to know how to invest in silver, especially when the precious metal is rising in value. That may be the case right now, as you’ll understand better after reading this article.

Table of Contents

Why Invest in Silver?

Silver has a long history of being used as a monetary metal, even dating back to biblical times. It’s often been referred to as “the poor man’s gold” because it served a similar purpose among the lower classes that gold did for the wealthy.

That history doesn’t necessarily mean silver is a good investment today. But there are four substantial reasons why holding some silver in your portfolio may be a good idea.

1. Silver as an Inflation Hedge

As a commodity, silver has a tendency to rise in price during times of inflation, like the past few years.

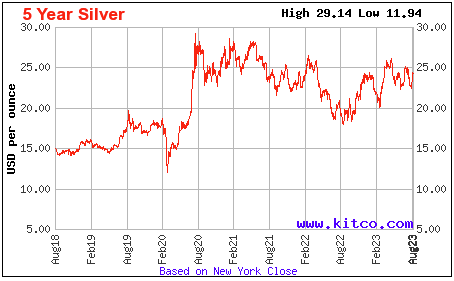

The screenshot below (from Kitco.com) shows the historical price of silver going back to August 2018. Notice that the price hovered around $18 early in 2020, just before the COVID-19 pandemic. It bounced up and down since but is currently sitting at about $24 – roughly 33% higher than it was early in 2020 when the current wave of inflation began.

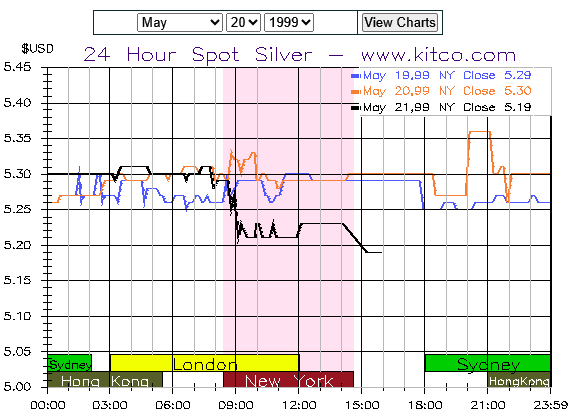

The longer-term chart below (also from Kitco.com) shows that the price of silver was hovering just above $5 an ounce in May of 1999. That means the current price of silver has increased by about 480% over the past 24 years.

It’s clear from the price action that silver has proven itself to be an effective hedge against inflation.

2. The Silver Supply Deficit

In addition to its desirability as a monetary asset, silver also has wide industrial applications. Silver is used to manufacture electronics and solar panels, so we’ve seen an increase in demand as the world gradually moves away from fossil fuels. Silver is also used in the production of jewelry, as well as held in coin and bar form for monetary purposes.

According to The Silver Institute, 2022 and 2023 have seen a shortage of silver production relative to global demand. Global production of silver in 2022 totaled 1,004.7 million ounces against a demand of 1,242.4 ounces.

The situation has been repeated thus far in 2023, with year-to-date production of 1024.9 million ounces of silver, versus demand of 1,167 million ounces. The supply deficit is expected to continue as industrial demand continues to grow.

3. Buy Silver for Investment Diversification

Silver represents a “hard asset” and offers diversification away from a portfolio comprised entirely of paper assets, like stocks and bonds. Even if you don’t invest in physical silver, holding the metal in an exchange-traded fund will increase your portfolio’s diversity.

4. The Gold/Silver Ratio

This may or may not be a relevant factor in the future direction of the price of silver, but silver advocates have long pointed to the change in the ratio of the price of gold to silver.

Until 1933, when gold was banned as a medium of exchange in the US, an ounce of gold was set at $20, while silver was valued at $1. That gave a gold/silver ratio of 20:1. By 1971, that ratio was reset at 35:1.

But based on today’s prices, with gold trading above $1,900 and silver at just about $24, the ratio has now expanded to roughly 80:1.

The theory is that if the ratio ever goes back to its historic norm of 20:1, the price of silver will quadruple even if gold goes nowhere.

Of course, that reversion to the historic norm could play out in a very different way. The price of gold could fall until it reaches a point where it returns to the 20:1 ratio without the price of silver moving at all.

That’s what makes this factor the least compelling of the four.

Factors that Affect the Price of Silver

Like every commodity or investment, there are big-picture forces that affect the price of silver.

Interest rates. “Safe assets,” like bonds, certificates of deposit, and U.S. Treasury securities, compete with investments that rely primarily on price growth. When interest rates rise, assets like silver tend to decline in value as investors seek predictable returns. Generally, declining interest rates will support rising silver prices, while rising rates could lower prices.

The state of the global economy. Silver is an international commodity, and its price will be closely correlated with the state of the global economy, and not just that of the U.S. If global economic growth is accelerating, demand for silver will rise. But if the global economy is declining, demand for silver will fall, taking the price down with it.

Industrial demand. Silver is a critical commodity in the production of batteries for electric cars. Given that the production of electric vehicles is a growth industry, that creates greater demand for silver.

Geopolitical issues. Most of the world’s silver is produced in non-western/non-industrialized countries. China and Russia are two of the largest suppliers. International conflicts, trade wars, civil unrest, or even natural disasters can cause at least a temporary shortage of silver.

Natural supply. The price of silver can be affected by changes in the world’s estimated amount of silver reserves. For example, discovering a large new source could lower the price. Conversely, the exhaustion of a large currently producing mine could raise the price of silver.

How to Invest in Silver

If you believe silver is worth investing in, you need to decide on the best way to do so. Silver can be held either in bullion form (physical bars or coins) or through paper assets, like stocks, ETFs, and futures contracts.

Silver Bullion

Bullion is a classic way to invest in silver since you’ll actually take possession of the metal. That can be done with either silver bars or silver coins. Either can be purchased through popular metals dealers, like Blanchard & Company, Goldline, or Kitco. You’ll have the option to store your silver with the company you purchase it from or to take possession of it yourself.

Different types of silver coins are available, but the most popular are officially minted coins, like the one-ounce American Eagle or the Canadian Maple Leaf. Each can be purchased for the price of a single ounce of silver plus a small markup for the dealer.

Alternatively, you can purchase bullion in bar form. Those can be in denominations of between 10- and 100-ounce silver bars. They will also be available for the price of their silver content plus a markup. But the markup will be less than it is for individual coins.

Numismatic coins. These are coins valued primarily because of their rarity rather than the bullion content. They are typically older coins, especially those minted before 1933 in the U.S. But they are valued because of their condition and rarity and do not represent true investments in silver.

Advantages:

- Bullion is a pure play on silver investing.

- Silver coins can be bought and sold locally with other individuals.

- Silver bullion has similar qualities to gold bullion, but at a fraction of the price – virtually anyone can afford to buy some silver.

- Like gold, silver is one of the few assets that isn’t simultaneously someone else’s liability (like bonds or even stocks)

Disadvantages:

- Dealer markups on individual coins can be as high as 8% to 10%

- There are additional costs for storage, whether you store it through the dealer or at home. In either case, it will need to be insured.

- While there is something of a private market for silver coins, they are somewhat illiquid.

- Silver bullion bars are even less liquid.

Silver Stocks

Siver stocks are a more indirect way to invest in silver. That’s because you’re buying shares of companies that produce silver but typically own very little.

Despite the importance of silver as an industrial commodity, there are relatively few companies concentrated in silver production alone. Many also mine and/or refine gold and other metals. To find silver stocks, do a web search using something similar to “best silver stocks” since the lineup of potential companies does change over time (and we are not in the business of recommending individual stock investments on this website).

If you do invest in silver stocks, be aware that they involve all the risks of owning silver, in addition to the typical market risk associated with stock investing. One of those risks is that the price of the stock can collapse even while the price of silver rises.

But that said, silver stocks may perform even better than silver during a bull run in the metal itself.

Advantages:

- Silver stocks can outperform silver, producing higher returns during silver bull markets or lower losses during silver bear markets.

- You can diversify between various silver companies.

Disadvantages:

- Silver stocks are not a direct way of owning silver itself.

- A silver company’s stock can collapse even while silver prices are rising.

- More speculative silver stocks are companies engaged in exploration, which could lead to unsuccessful searches

Silver Bullion Exchange Traded Funds (ETFs)

Instead of holding silver bullion physically, you can invest in it through an ETF. Such ETFs hold silver bullion at a central location, enabling you to purchase shares in those holdings.

Silver ETFs track the price of silver bullion and have the advantage of being more liquid than the metal itself. And since they are ETF shares, they can usually be purchased and sold through popular investment brokers commission-free.

Examples of silver bullion ETFs include abrdn Physical Silver Shares ETF (SIVR) and the iShares Silver Trust (SLV) (Author disclosure: I have invested in shares of SLV in the past).

Advantages:

- You’ll hold an investment in an equivalent amount of silver without needing to take possession of the metal itself.

- Shares in an ETF can be easily bought and sold.

- ETF shares are usually traded commission-free.

Disadvantages:

- Though you will be holding shares in a silver ETF, it’s not the same as holding the physical metal.

- ETFs have been known to liquidate. The Invesco DB Silver Fund (DBS) was liquidated on March 10, 2023.

Silver Futures

Silver futures are a way of making a bet on the price of silver without putting up a large amount of capital. Since futures involve a large amount of leverage, you can put up a small amount of money to purchase an option on the price of silver. You can either bet on a price increase or decline and still make money.

But the leverage involved in options also means you can lose more money than if you’re putting up a cash position. If the price of silver moves against your option, your entire position could be wiped out. Silver futures are more of a play on silver price action than on the metal itself.

Advantages:

- An opportunity to leverage a small amount of money for significant gains if your option position goes in your favor.

Disadvantages:

- Not really a play on silver itself, but on its price movements.

- Futures are not a long-term play.

- Your whole position can be wiped out if the option goes against you.

Where to Hold Your Silver Investments

We’ve already covered physical silver bullion coins and bars, which can be held either with the metals dealer where they are purchased or in your possession if that’s what you choose.

But if you’re going to invest in silver stocks, silver futures, or silver ETFs, you can do that through an investment brokerage account.

Examples include M1 Finance (which will also manage your investments for you), Ally Invest, and SoFi Invest. Each will enable you to open an account with no money, trade stocks and ETFs commission-free, and engage in self-directed trading.

Pros and Cons of Investing in Silver

Pros:

- Strong industrial demand indicates future solid price action.

- Represents a diversification away from a portfolio of paper assets.

- The price of silver generally rises in response to inflation.

- Silver has a long history as a monetary metal, which is unlikely to disappear in the future.

- It is less expensive than gold, making it suitable for small investors.

Cons:

- Often hyped up with predictions of dramatic price increases

- Silver bullion needs to be insured and protected, which can be costly.

- Silver does not generate cash flow, like interest or dividends.

- Prices can swing wildly in just a few days, making using leverage (margin) even more risky.

- The price of silver is heavily influenced by changes in the price of gold, which can distort the silver price either higher or lower.

Is Silver a Good Investment?

It’s not possible to know if silver, or any other investment, will be a good choice at this moment. There have been times in the past when silver has proven to be a highly profitable investment and others when it has either languished or even declined.

Because of the uncertainty surrounding this asset class, you should invest in it only with a small slice of your portfolio. Silver, like other commodities, is notorious for wide price swings. This has to do with all the forces that affect the price of silver, but it’s safe to say none of those will disappear in the future, despite the promising growth in industrial demand for the metal.

The post How to Invest in Silver: Everything You Need to Know appeared first on Best Wallet Hacks.

from Best Wallet Hacks https://ift.tt/Vy5kGSl

Comments

Post a Comment

We will appreciate it, if you leave a comment.