In 2003, I graduated Carnegie Mellon University with about $35,000 in student loan debt. It was a mix of federal mostly subsidized and a small percentage of unsubsidized loans. If my memory is correct, it was mostly Stafford loans with a small Perkins loan mixed in.

The interest rate was low and servicing the debt wasn’t a problem because my expenses were low.

Back then, a year of Carnegie Mellon cost around $30,000. Graduating with just $35,000 in debt isn’t a testament to my ability, I had plenty of help from financial aid and my parents. Graduating with a loan of about 30% of my college costs seemed reasonable.

Today, a year at Carnegie Mellon is around $77,500.

That puts the four year bill at $310,000.

(that’s more than what we paid for our first townhome!)

And what if you graduated with 30% of that in student loans?

That’s $93,000!

I can’t even begin to wrap my head around a near six figure student loan debt but that’s what many students face. I was lucky to graduate with only $35,000 in debt.

My alma mater has an endowment of around $3 billion, according to their most recent financial report (page 20). Folks often point to endowments whenever they talk about the cost of college. Harvard’s endowment is over $50 billion and it costs approximately $76,000 per year to attend that hallowed institution.

While I don’t know the ins and outs of university finances, I do raise an eyebrow when I see an endowment of $3 billion (and certainly when you see one with over $50 billion) and the price of college. I wonder if there’s room to reduce the cost of tuition… but let’s put that aside for now.

What if you could snap your finger and make college free – would we want to?

Let’s have a fun thought experiment and run through some pros and cons. 🙂

Table of Contents

Before we get into Pros and Cons for this thought experiment, let’s make a few non-trivial assumptions:

- The only thing we’re changing about college is that it is now free. Everything else is being held the same – same quality of education, same number of schools, same number of students, etc.

- We won’t discuss how we make it free, that’s too big of a problem. We’re just going to look at whether it should be free. (for our purposes, let’s just say Warren Buffett decided to pay for it!)

- We’re expanding the idea of “college” to include any post-secondary education. This increase the trades, culinary school, certifications, etc.

Let’s get into it!

Pro: Reduces Student Loan Debt

This is the biggest and clearest reason for making college free – it would eliminate student loans.

I think this is an obvious result of making college free and not one anyone would dispute. 🤣

Pro: Increases Access to College

While you still have to get accepted into prestigious universities, it would increase access to college because many people don’t go (or even consider it) because of cost.

That said, it would also increase competition. The pool of applicants would go up and since schools can’t take more students, the competition would naturally go up too.

This would increase access to college for some and decrease it for others. It’s not always about academic fit or financial means though, colleges accept folks for a variety of reasons but the applicant pool would certainly increase.

Pro: Increases Focus in College

A lot of students have to take part-time jobs to help pay for college. As a result, you’re taking someone who is paying thousands of dollars to go to school and diverting their focus away from academics for many hours a week… just to work a job.

You want students to be focused on education and learning, not working to help pay for college.

Pro: Free to Pursue Any Major

The absence of student loans means you won’t have the classic situation of a liberal arts major with six figure debt. We need people in liberal arts, it’s what helps make our society better.

But liberal arts graduates don’t have the same career prospects as those with more lucrative degrees. This is only a problem because of the high cost of college. If college were free, students would be free to pursue any major – even the ones with lower paying jobs after graduation.

Sure, an engineer may graduate and make more but at least the art history major could earn their, likely, lower salary without carving out a huge junk for student loan payments.

Con: People Do Not Value Free

If you get something for free, you don’t value it as much as if you paid for it.

There are a variety of reasons for this but the main one is that when you pay for something, you have given up something tangible for it – your money. Free college will still cost you time but we don’t value our time as much as we value our money.

If school gets difficult, it’s easier to walk away when you aren’t saddled with the cost. If you pay $30,000 for something, anything, you’re going to value it more than if you paid zero. It’s human nature.

And college is difficult. The premier schools are extremely difficult.

People already quit school after they’ve paid. Imagine if it were free… quitting without any financial repercussions, would make that decision so much easier.

Con: It May Devalue Some College Degrees

If college were free, it could devalue some of them.

The prestigious schools will always be prestigious. They are competitive and people know it.

But what about lesser known schools? The smaller universities that don’t have name recognition outside of their alumni and their local region?

Right now, you can take some courses from Harvard for free. It’s one of many free learning resources online but how many people would give you credit for taking those classes. It’s unclear but I suspect the answer is not everyone.

Con: Those Unfit for College Would Attend

In this case, “unfit” doesn’t mean that they’re not smart enough or anything like that – I simply mean that going to college is not the best choice for them (fit goes both ways!).

Not everyone should go to college but our education system seems to elevate college above all other institutions. If someone wants to become a Master Electrician, there’s little reason they should spend four years at a private college. They should go to a trade school and/or begin an apprenticeship.

We still put college on a pedestal (though it’s a shorter one nowadays) and so a Con is that a kid who would rather be doing something else might be urged to college. At least with college being free, they wouldn’t be saddled with debt!

My Conclusion

I don’t think college should be free. Not exactly a hot take, since “free college” would be exceptionally difficult to implement.

I think that if you make college free, students won’t take it as seriously. They need to have some skin in the game. We all know that kid in college who took a few extra years to graduate… they (or someone close to them) was footing bill those extra years.

College should be cheaper though. Average student loan debt in 2021 was $37,338.

There isn’t a single reason why it’s that expensive… there are a lot of reasons. Inflation, increased amenities, less state funding, etc.

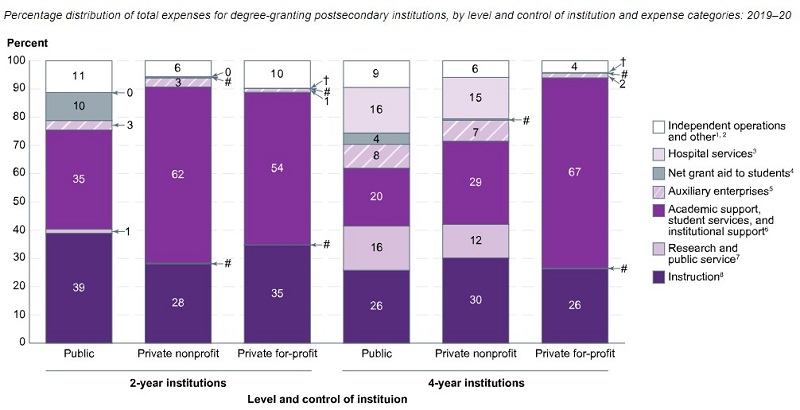

But this chart, from the National Center for Education Statistics, is eye-opening:

At private 4-year for-profit universities, 67% of total expenses goes towards “Academic support, student services, and institutional support.” Only 26% goes towards instruction. Even at private nonprofits, it’s 29% (instruction is 30%).

Maybe that’s an area to take a look at. 🙂

Do you think college should be free? Why or why not?

The post Should College Be Free? appeared first on Best Wallet Hacks.

from Best Wallet Hacks https://ift.tt/PZLwUmy

Comments

Post a Comment

We will appreciate it, if you leave a comment.