Securing a great savings account interest rate is one of the easiest ways to earn income on your cash deposits. However, with so many banks and savings accounts to choose from, the process can be time-consuming.

Raisin is a relatively new savings account platform that can simplify the research process because they partner with FDIC-insured banks, often regional and smaller ones, to offer high-interest rates on a variety of deposit products. The high-yield savings and CD rates you get through Raisin are often higher than what’s available to the general public on that bank’s website.

In this Raisin review, I analyze their offers, let you know how good the savings rates are, and if the platform is legit.

💡 SaveBetter is going through a rebranding and is changing their name to Raisin, the name of their parent company. Rather than being called SaveBetter by Raisin, they will simply go by Raisin. This is only going to be a rebranding name change, nothing about the service has changed. We will be updating this post with updated graphics, followed by naming and other changes.

Table of Contents

🔃Updated June 2023 with more information on how Raisin works, what happens if it or a partner bank fails, updated screenshots, the pooled deposit program, and other updated details plus news of the rebranding.

What is Raisin?

Raisin is an online platform that partners with over ten banks and credit unions to offer competitive rates on high-yield savings accounts, money market accounts, and CDs (certificates of deposit).

Raisin GmbH is Raisin’s parent company (founded 1973) and they’ve been doing this in Europe for years. Raisin works with approximately 400 banks in more than 30 countries. They only recently expanded into the United States with Raisin.

At Raisin, you will find banking offers from regional banks and mid-sized institutions that don’t appear in most savings account searches. As a result, you have more banking options to choose from and can earn a potentially better rate on your savings.

For instance, Raisin will let you open a high-interest account from Sallie Mae Bank, Ponce Bank, or The State Exchange Bank. You won’t see national names like Axos Bank, Capital One 360, or Discover Bank.

When you use Raisin, you might put your money with one bank but you don’t get a separate bank account. Your money is pooled with other Raisin customers at the bank in a custodial account. You won’t be able to transfer money into and out of the partner bank directly and you won’t get an account number at the bank, it has to go through Raisin.

Unfortunately, the platform doesn’t offer checking accounts or online bill pay services. So, you will only be able to open savings accounts, MMA, and CDs to maximize your cash reserves.

It’s not uncommon to use a separate bank for high-yield savings, so this limitation isn’t a deal-breaker for many.

How Does a Custodial Bank Account Work?

When you “open an account” with a partner bank through Raisin (such as Sallie Mae), you aren’t literally opening a new account at the partner bank. When you transfer funds from your existing bank to the new Raisin-linked account, you are transferring funds to a custodial account held by Lewis and Clark Bank.

You get FDIC or NCUA insurance through the partner bank (pass-through insurance), not Lewis and Clark Bank. Lewis and Clark Bank are the custodian bank. Your funds will not be in your name at the partner bank but there are legal records indicating how much you have there – you are fully insured by FDIC or NCUA insurance.

This means that you get $250,000 of coverage at each bank. If you open accounts at two partner banks, you get $250,000 from each bank for a total of $500,000 (though it’s still $250,000 at each bank, the amounts don’t pool together so you can’t get $300,000 at one and $200,000 at the other). Remember, the coverage isn’t from Raisin but the partner bank (not to belabor the point but this can get confusing).

This is the exact same mechanism used by many fintech companies who offer bank-like services but are themselves not a bank.

Also, this is how nearly all individual stock market holdings are managed. The shares of stock you “own” at any brokerage are not literally in your name. They’re held by a custodian who keeps track of who owns what (known as “street name). This makes it easier to transact on the shares.

Savings Account Promotions

The appeal of Raisin is that they’ve negotiated higher interest rates with their partner banks. You will usually see a lower rate if you go directly to the bank website.

Banks may use above-average rates to attract new customers that may not live within their local service area. For example, you can join a Florida-based community bank even if you live in California (you can complete the account opening process online).

If you currently bank with partner institutions, you can be eligible for better rates as they are available to all Raisin users. The only difference is that this account won’t show in your bank dashboard.

Additionally, these ongoing above-average rates are often superior to bank promotions, which usually offer a one-time cash bonus.

Who Can Use Raisin?

You must be 18 years old, live in the United States, and have a Social Security number (SSN) to open deposit accounts. It’s no different than the requirements of a regular bank account.

Best of all, you don’t need to create an account to compare the latest interest rate offers. They publish them on the website!

Who Should Use Raisin?

Consider using Raisin if you’re looking for the highest rates for savings accounts, term CDs, and no-penalty CDs. The offers can be better than those from well-known national banks, although you must be comfortable using a community bank with a smaller customer base.

Despite being online-only, the banking experience can be different than opening an account directly with a partner bank or credit union. You schedule deposits and withdrawals through your Raisin account instead of visiting the bank website that you may use for other services.

How Can Raisin Offer Such High Rates?

A typical commercial bank spends a LOT of money on advertising and marketing. I’m sure you’ve seen radio and TV ads for your local bank, not to mention magazine and print ads. Heck, M&T Bank pays $5 million a year to sponsor the Baltimore Raven’s stadium.

I’ve seen reports that they pay at least $400 in advertising fees for a personal bank account and twice that for a business account. This is why bank bonuses are often in the hundreds of dollars – they’d rather pay you than an advertising company. (and you’re happier when YOU get the money!)

But smaller regional banks can’t compete on that level so they partner with Raisin to increase their deposits. Instead of paying a big bonus, they just offer higher interest rates. They’re FDIC insured so this is a risk-free rate and often beats what you can get elsewhere.

Deposit Account Options

You can open these federally-insured savings products and earn passive income.

It’s currently possible to open an individual or joint account. The platform plans on offering IRA banking services in the future to minimize your taxable interest, but right now you can choose between:

- High-yield savings & money market accounts

- High-yield Certificates of Deposit

- No Penalty CDs

High-Yield Savings Accounts

You can open a high-yield savings account or a money market deposit account with a minimum $1 balance. This savings product is online only and typically permits up to six monthly withdrawals.

Consider this account if you don’t want your money locked up for several years or face potential early redemption policies as bank CDs require.

The interest rates are variable, but the Raisin offers can yield more than many of the best high-yield savings account rates.

High-Yield CDs

Now that we’re back in a rising rates environment, bank CDs are becoming an attractive option to earn attractive yields if you’re seeking a fixed income.

The rates are higher than an online savings account, but the investment term is usually from 9 months to 24 months. However, they do have an offer of a 60-month (5-year) CD, though it’s not the highest rate at the moment.

Unlike most CDs which require depositing at least $500 or $1,000, the minimum deposit is only $1 through Raisin.

This low minimum investment makes it easy to build a CD ladder and earns a higher yield on the cash you won’t need for immediate expenses.

Additionally, the rates are competitive with other platforms. As a quick example, you might earn 5.00% on a 12-month CD term through Raisin but only 2.75% directly from a bank.

The best CD rates fluctuate regularly, but you can usually get the best returns with an 18-month or 24-month term.

No-Penalty CDs

A no penalty CD can balance the benefits of high-yield savings accounts and traditional fixed-term CDs.

This product can earn a potentially higher interest rate than a savings account as you’re pledging your funds for a specific duration. However, you can usually make penalty-free withdrawals seven business days after account opening.

Most no-penalty CD terms are from 10 months to 17 months. Although some banks offer a 36-month term.

The rates are not as attractive as a term CD, and you should consider locking your money if you’re confident you won’t need to tap it. But if there’s a reasonable possibility that you will need the funds, consider this option or stick with a high-yield savings account for peace of mind.

What if a partner bank fails?

If you have cash at a partner bank and that bank fails, your money is still protected by FDIC insurance – as if you had your money in the bank directly.

The process for a bank failure is the same whether you have an account directly with the bank or through Raisin. Your funds would be frozen while the process resolved itself (often over a weekend) and your money would be returned to you or transferred to an acquiring bank.

What if Raisin fails?

Raisin isn’t a bank so there’s no risk that they would “fail,” but if Raisin goes bankrupt or otherwise no longer operates as a company – your money is still safe in an FDIC-insured bank.

If, in some rare situation, Raisin completely disappeared and all of its data were erased, the partner bank still has information about your account. Raisin shares a daily file with the partner bank that includes all customers’ positions and balances.

What are Raisin Fees?

There are zero fees for using Raisin. You keep 100% of your interest income. You also avoid the hidden fee of high minimum balance requirements since you only need to deposit $1 per account.

The only potential fee is an early redemption penalty for term CDs if you withdraw your funds before the CD maturity date – this is true at any bank. You can avoid this by opening a savings account or no penalty CD.

While you won’t pay a fee, Raisin makes money by collecting marketing fees from partner banks and credit unions. But since you often can get a higher interest rate than going to the bank directly, it’s a win win.

Raisin Partner Banks

As of May 2023, you can find offers from these banks and credit unions:

- Adda Bank, subsidiary of Bank 34 (FDIC Cert# 29087)

- Axiom Bank (FDIC Cert# 31390)

- Central Bank of Kansas City (FDIC Cert# 17009)

- Cloudbank 24/7, division of Third Coast Bank SSB (FDIC Cert #58716)

- Continental Bank (FDIC Cert# 57571)

- FVCbank (FDIC Cert# 58696)

- Hanover Bank (FDIC Cert# 58675)

- Idabel National Bank (FDIC Cert# 4241))

- Lemmata Savings Bank, subsidiary of California Bank of Commerce (FDIC Cert# 58583)

- Liberty Savings Bank (FDIC Cert# 32242)

- Mission Valley Bank (FDIC Cert# 57101)

- mph.bank, subsidiary of Liberty Savings Bank (FDIC Cert# 32242)

- Patriot Bank (FDIC Cert# 39928)

- Ponce Bank (FDIC Cert# 31189)

- Sallie Mae (FDIC Cert# 58177)

- The State Exchange Bank (FDIC Cert# 13551)

- Western Alliance Bank (FDIC Cert# 57512)

- Wex Bank (FDIC Cert# 34697)

These institutions typically provide brick-and-mortar banking services to personal and business accounts. Membership is open nationwide thanks to the Raisin relationship to improve your banking needs.

How Does Raisin Work?

The service acts as a middle man making it possible to open interest-bearing accounts with several banks but manage your balances with a single platform. You only interact with Raisin, but the partner bank holds your funds in a custodian account and pays interest.

If you like chasing yield and shifting your funds to the bank with the highest interest rate, this streamlined approach can make it easier to manage your accounts.

First, Create an Account

The first step is creating a Raisin account by providing your name, email address, and password. Once you open an account with a particular bank, you will submit the usual legal details to verify your identity.

Then Compare Offers

You can compare rates for these banking products:

- High-yield savings accounts

- Money market deposit accounts

- Term CDs

- No Penalty CDs

Tapping an offer lets you review the product terms and look at vital details such as the yield, minimum deposit, and withdrawal limits.

Link & Fund New Account

You will fund your Raisin accounts by linking an existing checking or savings account through the third-party app Yodlee or manually submitting your routing and account number.

If you opt to log into your account, make sure to turn off any adblocking extensions you may have for your browser. It will mess up the widget for logging in if you have an adblocker on.

All deposits take up to three business days to complete, and you begin earning interest when the bank custodian receives your deposit.

Managing Accounts

Managing your account is as intuitive as you think.

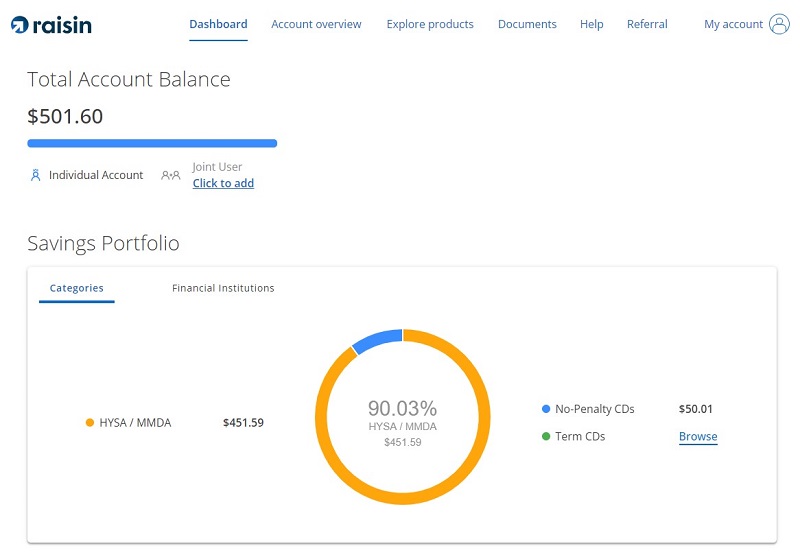

You can log into your Raisin account to view your current balance, interest rate, and earnings.

This dashboard also lets you schedule deposits or withdrawals. Your monthly statements and tax documents are in the “Documents” section.

Interest compounds daily and deposits monthly for your various accounts.

Transferring Funds

With Raisin, there is no “Raisin account.” When you transfer funds, they’re always between the partner bank’s account and your own externally linked account.

For example, when you open any new account, the funds have to come from the external account. You can’t transfer from another account within Raisin.

If you want to move funds from one Raisin partner bank to another, it has to go through your external account first.

Just One Year-End Tax Document (1099-INT)

Besides a higher interest rate, this is one of the best benefits of using Raisin – you only get a single Form 1099-INT at the end of the year!

If you chase rates from bank to bank, you’ll get a Form 1099-INT from every bank where you earned $10 or more in interest (though you still owe taxes on any interest you earn, even without a form).

With Raisin, you only receive one 1099-INT tax document, even if you have cash in multiple accounts!

Just one one form, despite dealing with multiple banks, means less paperwork when filing your taxes. This can save you a lot of time. You also avoid the annoying situation of forgetting to report a form and having to submit an amended return.

Is Raisin Legit?

Raisin is a legit platform to find the best savings account and bank CD interest rates. There are no service fees, and the minimum deposit is only $1.

You may be hesitant to use Raisin because it’s a relatively new technology company and not an actual bank. They are an extra layer between you and your money saved in a pooled account. However, it partners with FDIC-insured banks and NCUA-insured credit unions. You are fully insured.

Additionally, the savings account offers on Raisin are not advertised on the banking partner websites. This exclusivity can be a red flag for a potential scam as the interest rates sound “too good to be true.”

However, there are several customer reviews of accountholders depositing funds, earning interest, and making successful withdrawals to their linked funding account.

Raisin Pros and Cons

Here’s my list of positives and negatives of using Raisin to find a better bank account.

Pros

- Multiple account options and partner banks

- Above-average interest rates

- No service fees

- $1 minimum deposit

- One dashboard to manage several accounts

Cons

- No checking or online bill pay services

- They partner with smaller banks and credit unions with less name recognition

- Your account is in a pooled account at partner banks

- Personal banking only (no business accounts)

Alternatives to Raisin

Perhaps you would rather deal directly with the financial institution, or Raisin’s list of partners doesn’t interest you; there are other ways to secure a great savings rate. Here are a few Raisin alternatives to consider.

5% Savings Accounts

High-interest savings accounts that can help you earn approximately 5% interest. You will typically need to complete a specific number of transactions and maintain a minimum balance to earn the highest rate.

These platforms also provide checking accounts that you can use to pay bills and manage your day-to-day transactions.

UFB Premier Money Market – 4.81% APY

UFB Premier Money Market is offered by ufb Direct, which is a partner of Axos Bank. It’s technically a money market account, rather than a savings account, but offers a rate of 4.81% APY.

The benefit of this account, beyond the higher rate, is that you can pay your friends via peer-to-peer payments and your bills using Bill Pay. Most savings accounts don’t offer that, they have to use their checking account. This MMA also comes with a debit card too, so there’s some versatility here.

👉 Learn more about UFB Premier Money Market

Discover Bank

You can earn a cash bonus if you qualify for a Discover Bank promotion. It’s possible to receive the bonus after satisfying the deposit requirements. Discover Bank offers a competitive interest rate that may rival the Raisin offers. This online platform also provides rewards checking

Our in-depth review of Discover Online Savings Bank provides more details.

Ally Bank

Ally Bank offers high-yield savings accounts and CDs with competitive rates and an easy-to-use platform. You can also open interest-bearing checking accounts and tax-advantaged IRA savings accounts.

There may also be Ally Bank promotions worth considering.

Raisin FAQs

No, Raisin is a financial technology (FinTech) platform that partners with banks. However, you can deposit funds with federally-insured banks and credit unions. Up to $250,000 of balances are eligible for pass-through FDIC Insurance and NCUA Insurance.

These banks hold your money in a custodian account and award interest. While the banks store your wealth, Raisin manages deposits and withdrawals as requested.

Your deposits are protected with up to $250,000 in federal insurance – either FDIC for commercial banks or NCUA for credit unions. For data security, Raisin uses several practices, including Yodlee, to link to your bank accounts and guard your privacy. The platform is SOC 2 verified and uses external auditors to verify the security protocols to safeguard customer data.

You can contact Raisin from 9 am to 4 pm EST Monday-Friday when you have questions about banking services. Live chat and email support is also available to upload screenshots. An online knowledge library also answers commonly asked questions.

Raisin Review: Final Thoughts

Raisin is a unique platform that helps you enjoy some of the highest savings account and CD rates. In addition, you only have to deposit $1 and won’t encounter any service fees.

While banking with FDIC-insured banks, you may still spread out your savings and use better-known high-yield savings accounts to deal directly with the bank when you need help.

The post Raisin (SaveBetter) Review 2023: Is Raisin Legit? appeared first on Best Wallet Hacks.

from Best Wallet Hacks https://ift.tt/LUAZmXD

Comments

Post a Comment

We will appreciate it, if you leave a comment.