Last year I let Ownwell protest the property taxes on one of my rental properties. They were able to reduce my taxes by $233. This year I’m using them on both of my properties. Here’s my review of their service.

In short, Ownwell is a legit startup out of Austin that is making the property tax appeal process simple and hands-off for homeowners and investors. They charge a straight-forward 25% of what they save you. You can sign up at Ownwell.com using my link and get an extra $20.

Who is Ownwell?

Ownwell is a property tax negotiation service that helps homeowners in the US lower their property taxes. By utilizing a team of local, experienced negotiators, Ownwell helps homeowners navigate the property tax appeal process in their county. The platform claims to have saved homeowners thousands of dollars on their property taxes.

The way it works is simple. Users provide Ownwell with basic information about their property, including the property’s address and assessed value. An Ownwell representative will then assess the case and determine if they can save money. If they see the potential for savings, they will proceed with the appeal process on behalf of the homeowner.

Is Ownwell a Scam?

No. Ownwell is a legit company. They are based in Austin and currently have 42 employees on LinkedIn.

They were founded by Colton Pace. My friend John Egan interviewed Colton over at InnovationMap. Ownwell is a fast-growing, new company, but I can attest to its legitimacy. I used it successfully last year to protest my property taxes. See my screenshots below.

How Much Does Ownwell Charge?

Ownwell charges you 25% of what they save. There isn’t an upfront fee to use the service. And they don’t charge you anything if they can’t save you money (either they decide an appeal is not worth it, or they are unsuccessful in their appeal attempt).

As an example, if they are able to reduce your property taxes by $1,000, you would owe Ownwell $250 of that savings. Additionally, if you use my referral link to sign up with Ownwell, you get an additional $20 in savings.

In the above example, you would only owe $230 to Ownwell.

My Ownwell Experience

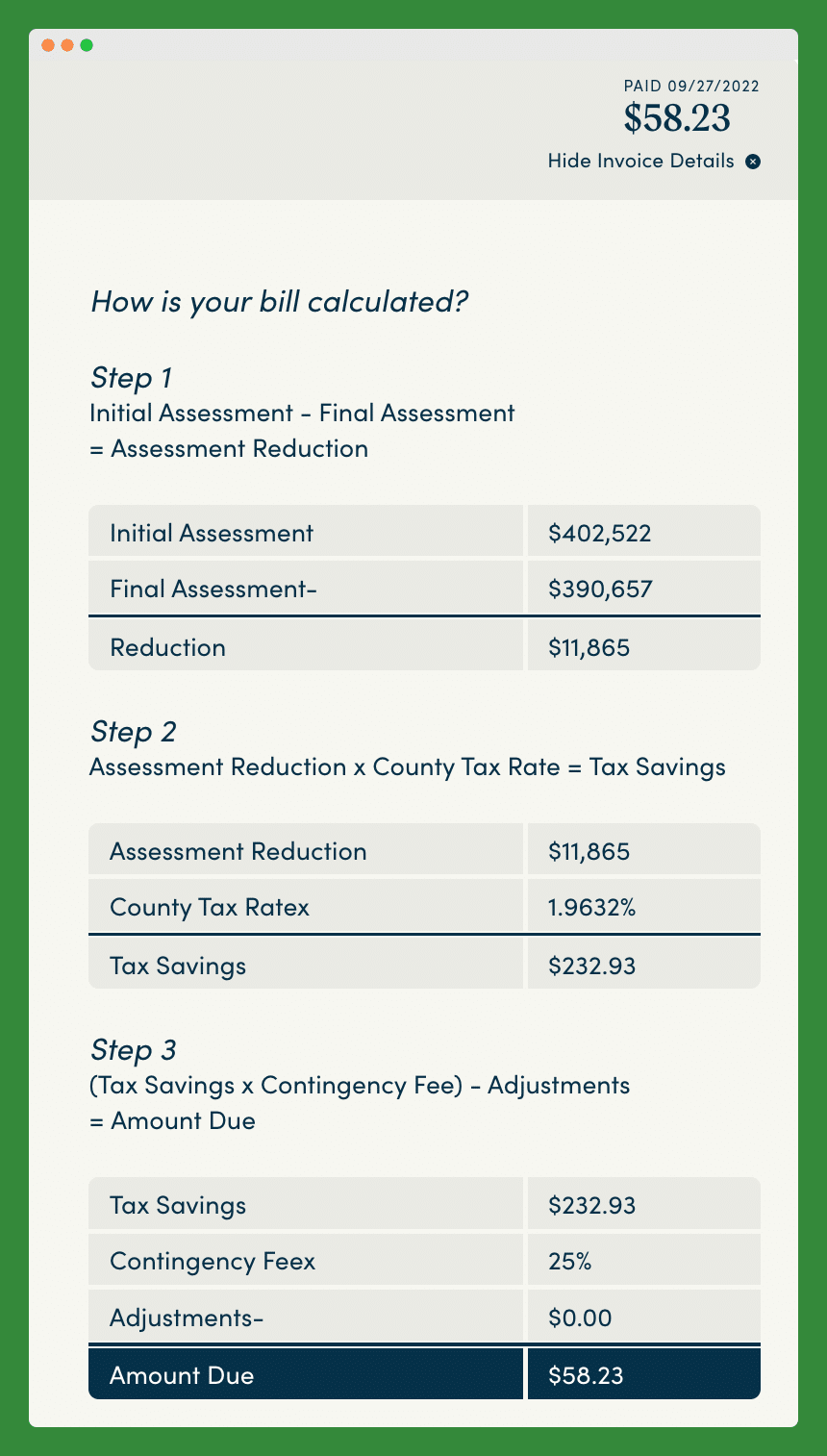

I used Ownwell to negotiate/appeal the property taxes on my rental property. Here are my numbers:

The County said my property was valued at $402,522. Ownwell went to work, and after an appeal, they established a new value of $390,657. That’s a reduction of $11,865.

The tax rate in my County is 1.9632%. Therefore, Ownwell reduced my property taxes by $233 ($11,865 x 1.9632%).

Once I was notified of my savings, Ownwell sent me an invoice for the 25% fee. I owed them $58.23.

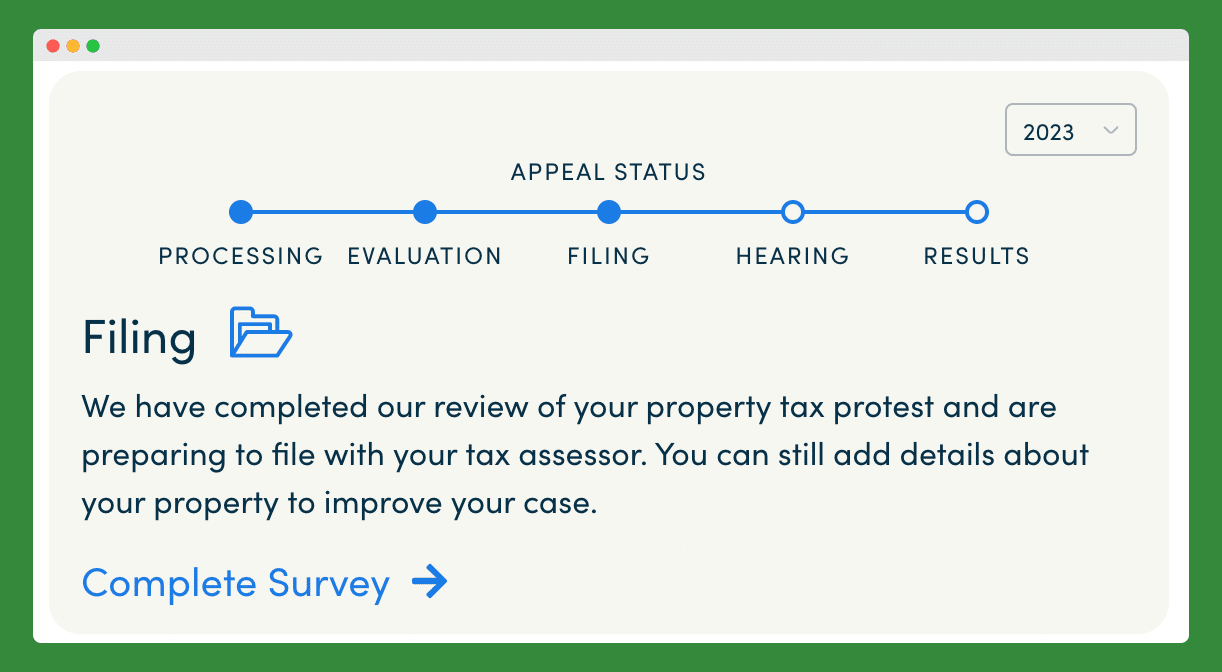

What to Expect Using Ownwell

Ownwell is simple and straightforward. Head to their website and submit your address. They will let you know quickly if they can help you.

Next, you will need to agree to work with them: letting them do your property tax appeal and charging you 25% of the savings.

Then, you wait. To improve your chances of a successful appeal, you can complete the property survey. They survey will collect additional information you might have that will help your case.

Finally, Ownwell has its hearing with the County and informs you of the decision.

Pros and Cons of Ownwell

Pros

Ownwell is very simple to deal with. Just go online and give them some basic info, wait for their response, and ultimately give them permission to work on your appeal. No phone calls. No back and forth. No hassle.

Ownwell works. Ownwell saved me $233. They claim to be able to help over 80% of their customers.

Ownwell help you year after year. Ownwell wants you as a customer for life and will be ready to appeal your property taxes the next year without you having to resubmit anything.

Cons

Ownwell is a new company. There will inevitably be some growing pains as they expand operations and move into new states.

Ownwell takes 25% of your savings. You could appeal your property taxes yourself and keep the 25% you are giving to Ownwell.

Who Should Use Ownwell

Homeowners and landlords who don’t want to bother with appealing their property taxes should both use Ownwell. It doesn’t cost anything to have them review your property tax situation. So there’s no harm in trying it.

Whether to negotiate your property taxes on your own or with the help of a service depends on your level of confidence and understanding of the tax appeal process. While negotiating your property taxes on your own can save you money on service fees, it could be overwhelming if are not familiar with the process.

And as someone who’s done their own appeal in the past, I’d use Ownwell every time going forward.

Using a professional service like Ownwell to advocate on your behalf might help you save time and reduce the stress that comes with navigating the appeal process.

They have a team of experts and resources at their disposal, which can be used to optimize the possibility of getting your taxes lowered.

That being said, it’s important to keep in mind that using a service like Ownwell is not a guarantee of a successful appeal or a reduction in property taxes. The assessment of property taxes is often complex, and factors such as property value, local tax laws, and the specifics of your appeal could all affect the outcome.

Ultimately, the decision on whether to negotiate your property taxes on your own or use a service like Ownwell should be based on your level of confidence in handling the appeal process and your understanding of the costs associated with each option.

FAQs

What’s Ownwell’s Phone Number?

They are in six states right now. Phone numbers are listed below:

Texas (512) 886-2282

Georgia (678) 890-0767

Florida (305) 901-2905

Washington (206) 395-8382

Illinois (312) 500-3131

California (310) 421-0191

How long does it take?

It takes several months to complete the entire process. Last year I applied with Ownwell in late April. I was informed of a successful appeal in September. Ownwell invoiced me on Sept 15th and I had a month to pay the invoice. Your timeline could vary.

Get started with Ownwell and save an additional $20 using my referral link.

The post Ownwell Review 2023: I Saved $233 in Property Taxes appeared first on Part-Time Money®.

from Part-Time Money® https://ift.tt/JPUWE29

Comments

Post a Comment

We will appreciate it, if you leave a comment.