As your side hustle, freelance business, or e-commerce shop grows, you may need software to help you manage it. One popular solution is Square.

Once just a way to accept credit card payments with your phone, Square now offers a flexible suite of tools to run and grow your enterprise. Read on to discover how Square can help your business succeed.

What is Square?

Launched over ten years ago, Square is a globally-used business software. Square can work for companies of any size (including solopreneurs!) and in any industry. You can use Square for e-commerce, customer relationship management, employee management, banking, and more, depending on your needs.

How Does Square Work?

Square’s solution is customizable to your business. You can choose (and pay for) which components you need and skip the rest. Let’s take a look at some of Square’s main capabilities:

Online Selling

Square can make it easier to make money with an online store. The platform allows you to:

- Launch an e-commerce store with a custom domain quickly and easily.

- Accept credit and debit cards on your current website.

- Share a link, buy button, or QR code to sell your products and services.

- Sell in your store, on your website, and via social media.

- Give customers the option to pick up their purchases in-store.

- Offer shipping discounts and print shipping labels.

- Offer local delivery service.

- Schedule and advertise promotions.

- Sell gift cards.

- Create a loyalty program to reward frequent shoppers.

- Send targeted promotional campaigns.

- See your inventory levels synced across all of your sales channels.

- Integrate Square’s capabilities with WordPress, WooCommerce, Wix, and other software.

Plus, your customer can create an account and shop from their mobile device.

This feature is best for: E-commerce sellers. Try Square Online.

Invoicing

Square invoicing helps you win new business and get paid. The system lets you:

- Send contracts (that can be signed digitally), estimates, and invoices.

- Use invoice templates or create custom documents.

- Schedule recurring invoices and payment reminders.

- Batch invoices.

- Convert accepted estimates into invoices.

- Accept payment via credit card (can put cards on file), Apple Pay, Google Pay, ACH transfer, Square gift card, and Afterpay (a buy now, pay later app).

- Record cash and check payment transactions.

- Take payments online, in person, or over the phone.

- Collect deposits upfront.

- Send receipts to customers.

- Issue refunds.

- Accept tips.

- Apply discounts and taxes.

- Track contract, estimate, and invoice status from one dashboard.

- Manage customer relationships with a built-in directory.

- Run accounts receivable reports.

This feature is best for: Freelancers, side hustlers, and e-commerce shop owners that want to collect payments easily.

Appointment Scheduling

Square Appointments helps you automatically manage your work schedule. It comes with a free, customizable customer booking website so clients can claim the time slot that works best for them. You can also add a button or widget to the scheduling tool on your existing site.

Square Appointments works with Square Assistant, an automated messaging tool that lets customers confirm, cancel, and reschedule appointments 24/7. In addition, the system syncs with your Google calendar, so you don’t have to worry about double-booking a time slot. You can also use the tool to set recurring appointments or charge no-show or cancellation fees.

This feature is best for: Freelancers and side hustlers that meet with customers.

Marketing

With Square Marketing, you can drive website traffic and revenue via email and text. The platform lets you schedule one-time messages when you want to announce a new product, special promotion, or other news. You can also schedule automated messages to welcome new customers, remind shoppers about their abandoned carts, collect Google reviews, and more.

You can see how well your marketing campaigns perform on your dashboard and track metrics such as open and click-through rates. For more insights, like how much revenue each campaign brought in, you can run reports.

In addition, your sales data automatically segment your customers. That way, you can send targeted emails to each group.

This feature is best for: E-commerce shop owners who want to expand their reach.

Customer Relationship Management

The Square Customer Directory is a free customer relationship manager (CRM) that’s built into Square’s payment tools. Each time you make a sale, the Square Customer Directory automatically creates a customer profile. Don’t worry — the system merges data for repeat buyers to avoid profile duplication.

The CRM tool helps you learn more about your shoppers so you can send them personalized outreach and reward their loyalty. The platform also lets you filter your customers by several parameters, giving you even deeper insight.

This feature is best for: E-commerce sellers who want to enhance the customer experience and drive additional sales.

Employee Management

As your business grows, you may need to hire employees. Square’s Staff Solutions can help you:

- Schedule shifts.

- Track time worked.

- Process payroll.

- File payroll taxes.

- Offer employee benefits like health insurance and a 401k retirement plan.

This feature is best for: Full-time entrepreneurs building and growing their teams.

Banking

Square offers business checking and savings accounts, business debit cards, and business loans. That way, you can see and manage your company’s finances from one dashboard. Here are the highlights of each product:

Checking Account

With a Square checking account, you won’t need to:

- Make a minimum initial deposit.

- Maintain a minimum balance.

- Pay any account maintenance, overdraft, foreign transaction, or Square ATM fees.

Square also doesn’t check your credit when you open your account, and the signup process only takes two minutes.

You can sync your Square sales to your Square checking account and access those funds instantly. You can also deposit checks from your mobile device and transfer cash to your Square savings account for free.

Related Reading: The Best Free Online Business Checking Accounts

Debit Card

It’s easy to purchase what you need for your business when using your Square debit card. The card is linked to your Square checking account, and funds get automatically deducted whenever you shop.

Savings Account

Square’s savings account offers a significantly higher APY than traditional banks (check rates). You don’t need to maintain a minimum balance to earn that rate.

Plus, the software lets you put a designated percentage of your daily sales into your savings account. That way, you have the funds to pay taxes and invest in your business.

Important Note: The Square checking and savings accounts are FDIC insured up to $250,000.

Business Loan

When you need some extra capital, you may be able to take out a Square business loan. Square lends up to $250,000 to qualified borrowers, but your loan offer (if extended) will be based on your Square sales. In general, you’ll need to earn at least $10,000 yearly, have steady sales, and show evidence of business growth.

Applying for a Square business loan won’t impact your credit, and you’ll receive a decision quickly. If approved, funds will instantly be available in your Square checking account (the next business day is possible with an external bank account).

Square doesn’t charge interest. Instead, you’ll pay a flat fee based on your loan details. You’ll repay your loan automatically with an agreed-upon percentage of your Square sales. You must meet a minimum payment requirement every 60 days, and there are no prepayment penalties for paying off the loan early.

This feature is best for: Any business owner that wants to streamline their company’s finances.

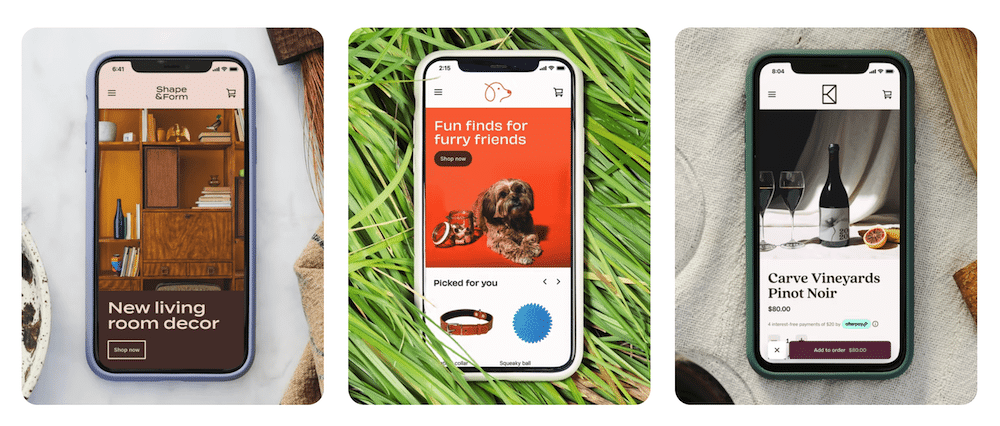

The Square App

Square offers a mobile app to help manage your business on the go. It lets you do things like:

- Accept payments with various Square credit card reader hardware or over the phone.

- Send customers invoices or QR codes.

- Track your sales.

- Communicate with your customers.

The well-rated app is available on Android and iOS. It’s free to download and use. You only pay payment processing fees when you make a sale.

If you want to get started with Square, your first move is to get the app. Then, decide which credit card reader hardware will work best for your business. We cover those options below.

Square Hardware

Square offers several types of hardware to process your sales:

| Hardware | Capabilities | Price |

|---|---|---|

| Free Square Reader | Accepts magstripe swipe credit card payments; Plugs into your Android or iOS mobile device | $0.00 |

| Upgraded Square Reader | Accepts contactless and chip credit card payments; Connects wirelessly to your Android or iOS mobile device | $49.00 |

| Square Stand | Allows you to plug your existing iPad into it to feel more like a point-of-sale (POS) terminal | $149 (payment plan is available) |

| Square Terminal | Accepts tap, dip, and swipe credit card payments; a portable credit card machine | $299 (payment plan is available) |

| Square Register | Functions as a fully-integrated POS system | $799 (payment plan is available) |

Related: 11 Side Hustles You Can Start Today with a Phone & Card Reader

Other Square Integrations and API

Square integrates with several popular business applications, including:

- Zapier

- WooCommerce

- Wix

- Linktree

- Acuity Scheduling

- Jotform

- LiveChat

In addition, Square offers developers free access to its application programming interface (API). That way, you can create custom solutions for your company that work with Square.

Square Pricing

You can start selling with Square for free. However, you’ll still need to remit payment processing fees as follows:

- In-person: 2.6% of the transaction + $0.10

- Online: 2.9% of the transaction + $0.30

- Manually entered: 3.5% of the transaction + $0.15

- Afterpay: 6% of the transaction + $0.30

If you want to add some of the advanced features discussed in this article, you’ll have to pay more.

Square offers specific, tiered plans for restaurants, retailers, and businesses needing an appointment scheduling solution. You can also add the tools you want a la carte.

Here’s a look at some of those costs:

| Tool | Price |

|---|---|

| Invoicing | Starting at $0/month $20/month for advanced features, like invoice customization |

| Email Marketing | Starting at $15/month for up to 500 customers |

| Text Marketing | Starting at $10/month + a fee for how many messages you send |

| Team Member Management | Starting at $0/month $35/month per location for advanced features, like shift swapping and managing time off requests |

| Payroll Processing | Starting at $35/month + $5 per paid team member |

Since Square’s pricing is complex and customizable, you’re encouraged to contact the company to create the right solution for your business.

Square Customer Service and Reputation

If you have a question or concern about Square, you can get the help you need by:

- Searching through the company’s library of informative articles and videos.

- Taking an in-app tutorial.

- Interacting with Square’s chatbot.

- Using the live online chat feature.

- Calling the Square Customer Success team (Monday to Friday, 6a-6p PST).

You can also engage with other software users in the Square Seller Community to learn from those with first-hand knowledge of the platform.

Square’s online reputation is mixed. They are A+ rated and accredited by the Better Business Bureau. However, the company received one out of five stars from customers and nearly 5,000 complaints in the last three years. To Square’s credit, the organization responded to every complaint.

On the other hand, Square is very well-reviewed on Trustpilot. The software company received 4.3 out of five stars across more than 3,700 reviews.

Pros and Cons of Square

Pros

- Customizable to your needs

- One-stop-shop to run and grow your business

- Integrates with many other applications

Cons

- Complex pricing structure

- Mixed online reputation

Common Questions About Square

What does Square do?

Square is a business software and payment processing company. It helps you make sales, manage your business finances, foster positive customer relationships, and more.

How much does Square cost per month?

Square’s per-month cost depends on your specific software configuration. It can range from free (apart from payment processing fees) to quite pricey if you opt for several of the platform’s tools.

Is Square free for businesses?

You can get started with Square for free. The company also offers 30-day free trials on paid plans.

What percentage fee does Square take?

Square’s fee percentage depends on how you accept payments. The fee structure starts at 2.6% for in-person credit card payments and goes up to 6% for Afterpay payments.

Should I use Square?

You may want to use Square if you’re a side hustler, freelancer, or e-commerce seller who wants to level up their business. However, you’re also encouraged to research other options, like the best self-employed accounting software.

The post What is Square and How Does it Work (for Side Hustlers)? appeared first on Part-Time Money®.

from Part-Time Money® https://ift.tt/uZpf7IL

Comments

Post a Comment

We will appreciate it, if you leave a comment.