Today I thought I’d share a few of my spreadsheets to help you stay on top of your finances. They’re oldies but goodies.

These sheets will hopefully add to your overall financial organization efforts. I’ve provided a brief explanation about each one and links to download the sheets (no email address required!).

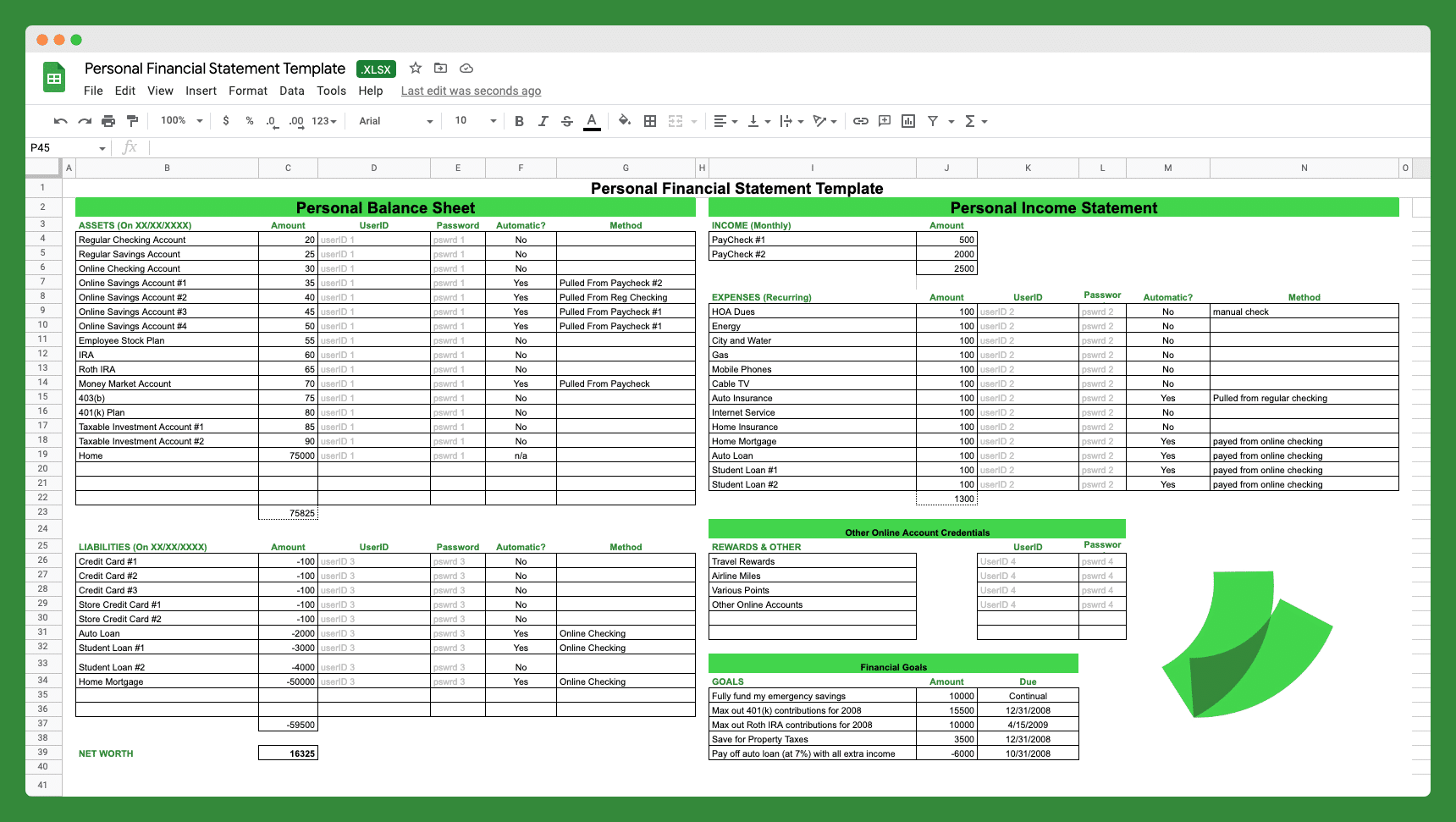

1. Personal Financial Statement Template

First up is my all-in-one, dashboard-style spreadsheet called the personal financial statement template.

This sheet puts all your personal financial information in one simple, printable spreadsheet. Here’s what’s included:

- Personal Balance Sheet: This is simply a listing of all your assets and liabilities. It totals up to give you your net worth.

- Personal Income Statement: This includes your income and all your recurring expenses. While this isn’t a full-blown budget, it will help you visualize what you “have to” pay each month.

- Financial Goals: It’s important to keep your financial goals in mind when viewing net worth and income vs. expense. This spreadsheet keeps the big picture in mind.

- Online Log-in Credentials: If you’re worried about security, you don’t have to use this section, but I like to have all of my log-in information in one spot so that my wife could pick up the pieces if something happened to me.

This sheet will help you:

1. See your entire personal finance situation all in one spot. To make the most of your finances, you must know precisely where you are starting. This sheet will give you that view.

2. Help a loved one in case something happens to you. If you’re the one source of financial knowledge for your family, you need this sheet or something like it stored away safely if something happens to you so that your family can take control of your finances.

To learn more about this spreadsheet and to download it, visit Steal My Personal Financial Statement Template [Free Excel Download]

2. Monthly Expense Tracker

Up next is the monthly expense tracker. Some might call this a bill tracker template. This sheet will help you avoid late payments and overdrafts by tracking all of your monthly recurring expenses and showing you how they will affect your balance at different times in the month.

![]()

This sheet includes a rolling calendar of recurring monthly expenses and income, as well as your total available balance projected out for 30 days or more.

More on how this spreadsheet will help you:

- Avoid Late Payments: Since you list out your monthly recurring expenses by payment due date, you’ll be able to reference which bill is coming due at what date quickly

- Prevent Bank Over-Drafts: Since the sheet contains a running balance, you’ll be able to roughly predict what your balance will be at various points in the month. This gives you a bit of warning so you can shift some money around from a different account and avoid an overdraft.

To learn more about this spreadsheet and to download it, visit Steal My Monthly Expense Tracker (Free Excel Download)

Did you enjoy that expense tracker excel template? Up next, we tackle debt.

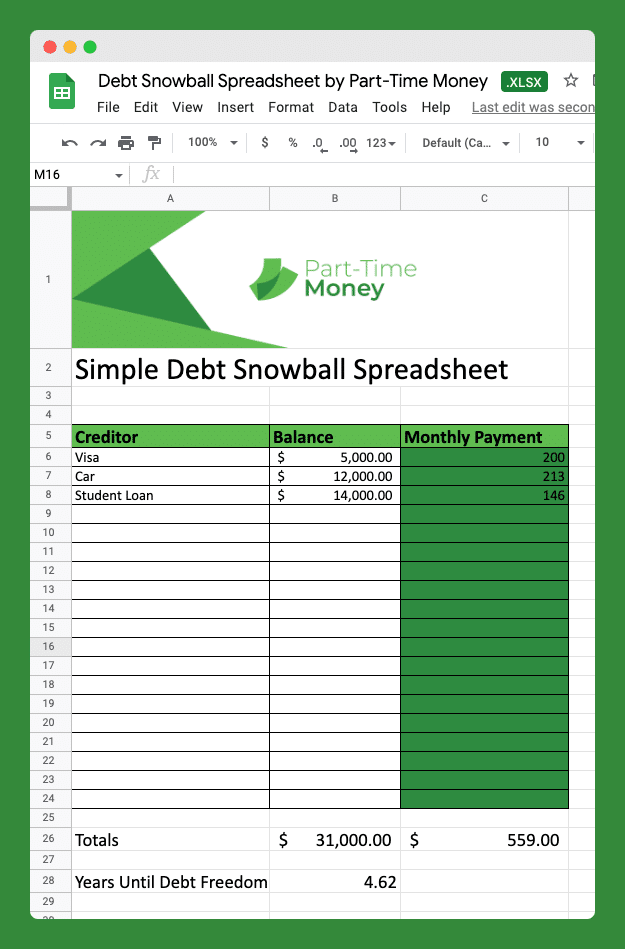

3. Debt Snowball Spreadsheet

When you are drowning in debt, it can feel like the process will last forever. For most people, the time it takes to get out of debt is much shorter than they think.

I put together this simple Debt Snowball spreadsheet so I could list all my debts, put them in order from largest to smallest, and get a rough estimate of how much time till I was debt-free.

This sheet does not count interest into the time, but people who get focused on paying off debt tend to find extra money to make their debt go away in about two-thirds the time this spreadsheet lists.

Download: Direct Download

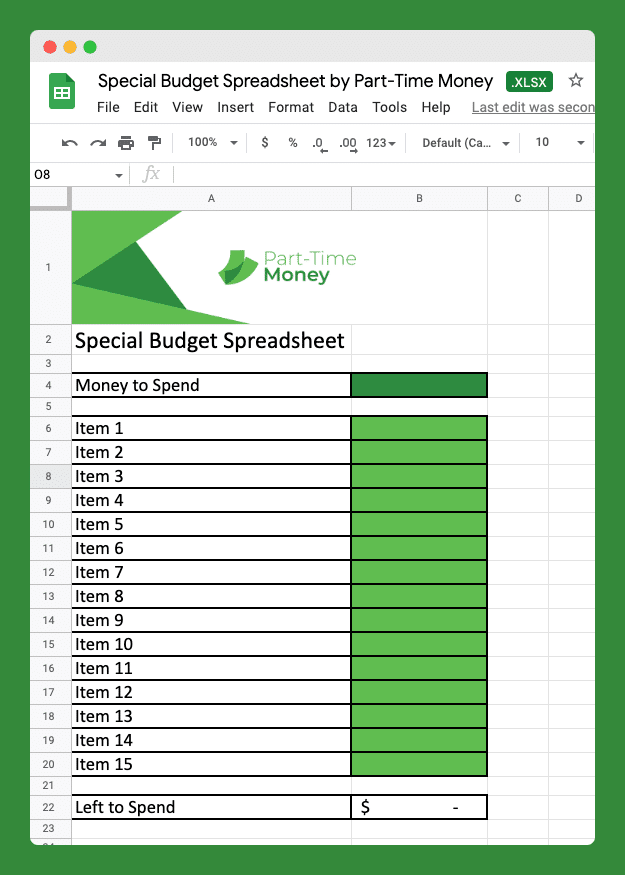

4. Special Budget Spreadsheet

Sometimes you want to budget money that doesn’t fit exactly into your monthly budget. This could be a lump sum of money you weren’t expecting or money you will use on a vacation that is sitting in savings.

The special budget spreadsheet allows you to plan this money out without clogging up your normal budget. It is also a great starter budget for kids who don’t need all the features that household budget spreadsheets give you.

Download: Direct Download

Did you like the special budget tracking template? Next, we will tackle credit card organization.

5. Credit Card Tracking Spreadsheet

There are many reasons for having multiple credit cards. One reason is that closing them can temporarily hurt your credit score.

Whether you are using all your open credit card accounts or not, it is important to know all of your accounts, check in on them from time to time, and move any debt around to the lowest interest rates. Maybe you have your own business like me and need to track your business vs personal cards.

Not only does it have fields for the cards, but it also gives you places to keep track of fees, rewards, and special privileges your credit cards provide you.

To learn more about this spreadsheet and to download it, visit Steal My Simple Credit Card Tracking Spreadsheet [Free Download]

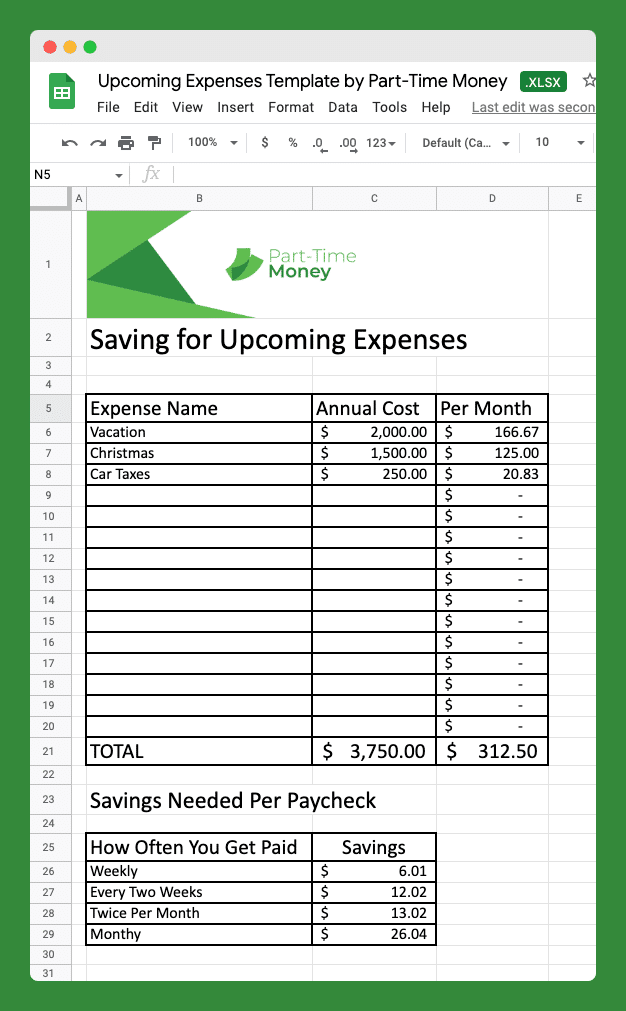

6. Upcoming Expenses Spreadsheet

One of the more challenging things for people to budget is expenses that only happen once or twice a year. We get tunnel vision and pretend those expenses aren’t coming, and then WHAM they wreck our monthly budget.

If you’re just starting a business, maybe it’s taxes. Maybe all those tax deductions don’t end up panning out and you’re stuck with a big tax bill.

We need to save some money each month for these expenses to prevent this from happening, but how much?

The Upcoming Expenses spreadsheet allows you to list all your non-monthly but known expenses. It calculates how much you need to put into savings each month to keep them from making one or two months a year extremely uncomfortable.

Download: Direct Download

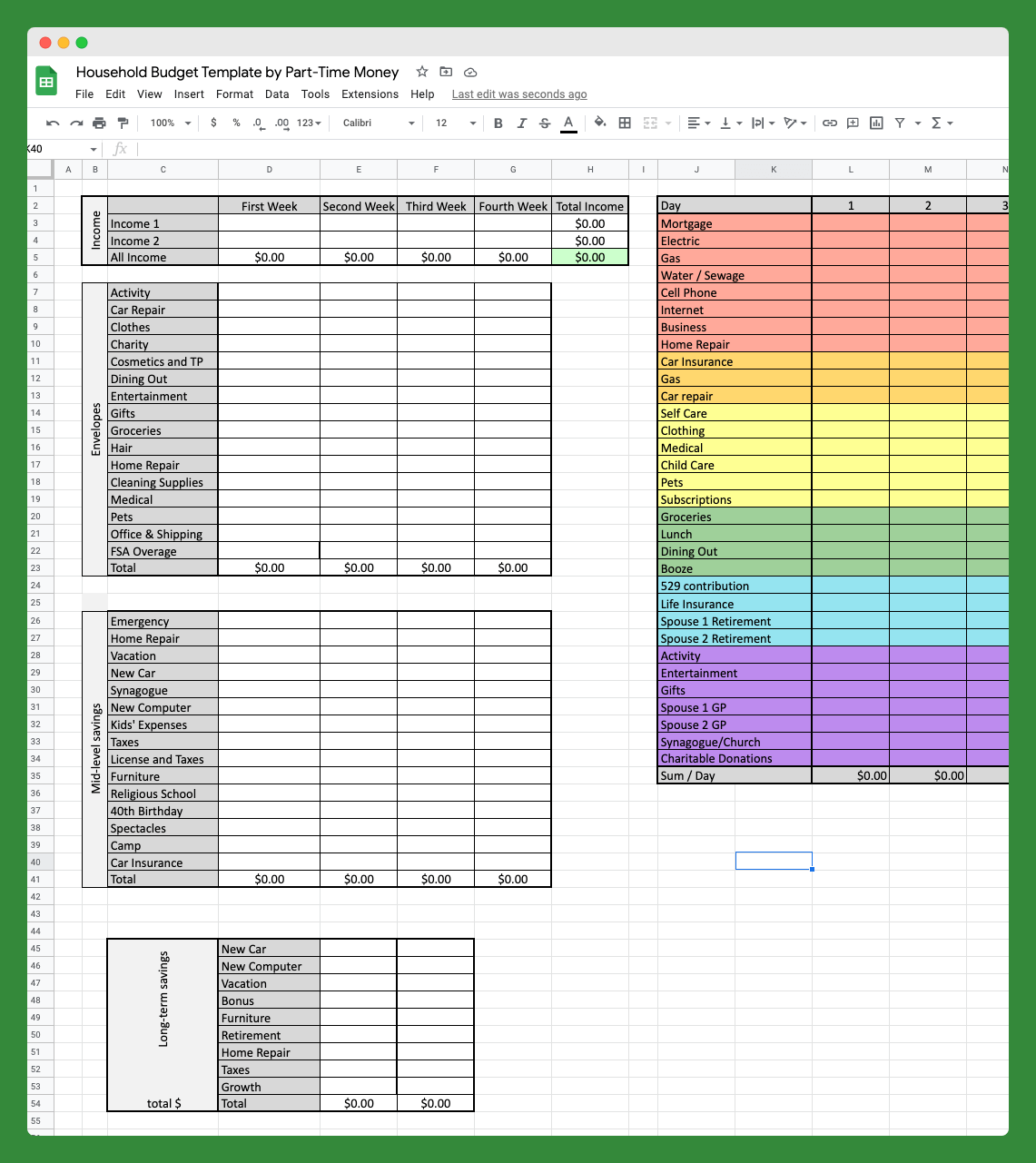

7. Household Budget Spreadsheet

The last spreadsheet on our list is a big one. It was designed by our editor, Emily, as a complete budgeting system for her household. It includes income tracking, savings goal progress, investment tracking, and finally, expense tracking.

It’s really the most comprehensive spreadsheet on our list here. So if you want everything under one roof, this is probably the best one for you.

According to Emily, this sheet takes her about two hours per week to maintain. That’s a lot, she admits. But she enjoys the detail and it’s helped her reach her family’s financial goals.

To learn more about this spreadsheet and to download it, visit Steal My Household Budget Template (Free Excel Download)

More Resources

These free excel templates are a great place to start. But maybe you want a more sophisticated resource to help you budget, track, and achieve your financial goals. Here are the best that I know of:

- The Best Personal Finance Budget Software

- Empower (Net Worth Tracker) Review

- YNAB: A Principles-Based, Powerful Budgeting Tool

While the sheets are by no means perfect, they’ve all helped me at times. Hopefully, you can add them to your financial tool belt and make some use of them too. If you have any questions or suggestions about the sheets, feel free to use the comments below.

What other templates do you need? Maybe a combined expenses and income excel template?

Maybe something for business, like a job cost tracking spreadsheet or business expense tracker template? Business expenses and business income are definitely things you need to track.

Especially when you are first starting out and don’t have access to a profit and loss statement generated by accounting software.

The post 7 Free Spreadsheets and Templates for Budgeting, Expense Tracking, and More appeared first on Part-Time Money®.

from Part-Time Money® https://ift.tt/kuBP5hT

Comments

Post a Comment

We will appreciate it, if you leave a comment.