![Do You Need to File Taxes? [Minimum Income to File Taxes] Do You Need to File Taxes? [Minimum Income to File Taxes]](https://ptmoney.com/wp-content/uploads/2012/04/Do-You-Need-to-File-Taxes_-Minimum-Income-to-File-Taxes-min.jpg)

It’s that time of year when people begin wondering whether they need to file a federal income tax return.

When in doubt, I say go ahead and file! (Your 2022 tax returns are due on April 18, 2023, and we recommend TurboTax because it’s 100% free to file for most people).

But, when making a decision this important, you probably want some hard numbers, so I’m going to give them to you.

Here’s the quick answer: If you are single, under the age of 65, not claimed as a dependent, and made less than $12,950 in 2022 from your W-2 job you may not have to file. This number goes up to $13,850 for 2023 income (for you advanced planners).

Unfortunately, however, nothing is that simple when it comes to taxes. The minimum income to file taxes isn’t just a straightforward number that you can compare your income to make an easy decision. In fact, there are so many factors at play that the IRS created a questionnaire to help you determine whether you need to file (more on that later).

Also, keep in mind if you had taxes withheld from your paycheck, or qualify for tax credits, you will need to file to receive your refund. So, even if you may qualify to skip filing a return, you’ll probably want to do so anyway.

Featured Partners

Turbotax is America's #1 tax software. Answer simple, non-taxy questions. Start for free.

A low-cost tax preparation software that has special services for the self-employed and active military members.

Do it right. Do it for free.® E-file directly to the IRS. Start your free return today!

The IRS Interactive Tax Assistant

There are a series of questions you should answer to help you determine the minimum income amount that applies to you. Let’s start with the IRS questionnaire found on their “do you need to file” page. This questionnaire is provided through the IRS interactive tax assistant (ITA), which is a remarkably easy-to-use program found on the IRS website.

The questions are designed to help you determine whether you need to file a federal tax return and if you need to adjust your Form W-4 to eliminate tax withholding.

The IRS has stated that they want to help eliminate wasted time and money from returns that are filed when they don’t need to be. I recommend that you take them up on that offer and work through the questions.

According to the IRS website, answering these questions should take you no longer than 10-15 minutes. This is certainly worth your time, especially if it saves the time it would take you to file or if it saves you from having money withheld unnecessarily.

Cases When You’ll Have to File

Even if you didn’t have much income, you may still have to file taxes if any of the following circumstances apply:

- You had Federal taxes withheld from your pension and/or wages for 2022 and wish to get a refund back

- Are you entitled to the Earned Income Tax Credit for 2022

- You received unemployment income

- You were self-employed with earnings of more than $400

- You sold your home

- You owe any special tax on a qualified retirement plan (including an IRA or a Health Savings Account [HSA]) You may owe tax if you:

- Received an early distribution from a qualified plan

- Made excess contributions to your IRA or HSA

- Were born before July 1, 1949, and you did not take the required minimum distribution from your qualified retirement plan

- Received a distribution in the excess of $160,000 from a qualified retirement plan

- You owe Social Security and Medicare tax on unreported tip income

- You will be subject to the Alternative Minimum Tax (AMT)

- You earned $108.28 or more from a tax-exempt church or church-controlled organization

- You received an advance payment on the Premium Tax Credit

- You signed up for health insurance through a Marketplace

- You received distributions from a health savings account or medical savings account

- You claimed a first-time homebuyer credit on a previous return

If any of the above circumstances apply to you then you should file a federal tax return regardless of your earnings.

Most of us with a small business or side hustle will need to file since self-employment income of more than $400 is one of the minimum requirements.

If you have confirmed that none of these circumstances apply to you, then you might be able to avoid filing.

Income Maximums

The next question you need to ask is whether someone else can claim you as a dependent. If you are not a dependent and you’re under 65 years of age, then you won’t need to file taxes unless your income exceeds the following amount:

(These numbers have been updated for the 2022 tax year)

- $12,950 (single filer),

- $19,400 (head of household),

- $25,900 (married filing jointly),

- $25,900 (qualifying widower with dependent child).

For filers age 65 and older, the income numbers are slightly higher for some filing types. See the IRS questionnaire for more information on this.

Note that if you are married filing separately, the IRS requires you to file a return if you’ve had an income of more than $5, no matter how old you are.

Dependents May Have to File

If you are a dependent of another taxpayer, then you follow a different set of rules. (Learn more about what qualifies someone as a dependent on this IRS webpage.)

The rules determining whether a dependent needs to file a tax return are somewhat complicated, but I’ll try my best to keep it simple. Dependents who are under 65 and have unearned income (i.e. interest income) over $1,100, or earned income (i.e. wages) over the standard deduction of $12,950, must file a tax return.

That part’s pretty easy. Here’s where it gets more complex: If you received both earned and unearned income in 2022, you must file a return if your combined income adds up to more than the larger of (1) $1,100 or (2) total earned income (up to $12,950) plus $350.

For example, 18-year-old Danielle is claimed as a dependent by her parents. In 2022, she received $200 in unearned income from taxable interest from an investment and also earned $4,050 from her part-time job at the library. Danielle’s unearned income and earned income each fall below the individual thresholds. Her total income of $4,250 is also less than her earned income plus $350 ($4,050 + $350 = $4,400). Since all three of these factors apply, Danielle does not have to file a 2022 tax return.

Still confused? Understandable. Basically, if you are a dependent and have both earned and unearned income you have to file a tax return if your total income was more than $1,100 and your unearned income was more than $350.

Let’s take a look back at Danielle. If she earned $400 (instead of $200) from her investments this would bring her total income up to $4,450. In this case, she would have to file a tax return because her total income would be greater than her earned income plus $350 ($4,400).

Related: Where to Get Your Taxes Done (The 3 Best Places and Prices)

How to File a Free Return

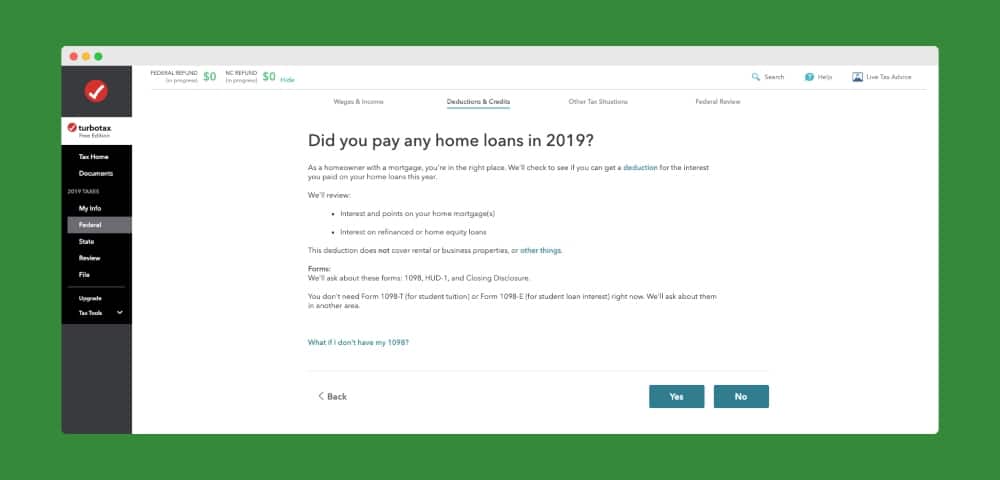

If you aren’t sure if you need to file then you probably should. And being able to file for free with TurboTax makes it a no brainer. You’re able to file a return using the Free Edition if you have simple tax situations. According to TurboTax, simple tax situations can include:

- W-2 income

- Limited interest and dividend income

- A standard deduction

- Earned Income Tax Credit (EIC)

- Child tax credits

You’re not eligible to use the free edition in situations like itemizing your deductions, business, or 1099-MISC income, rental property income or when taking a student loan interest deduction.

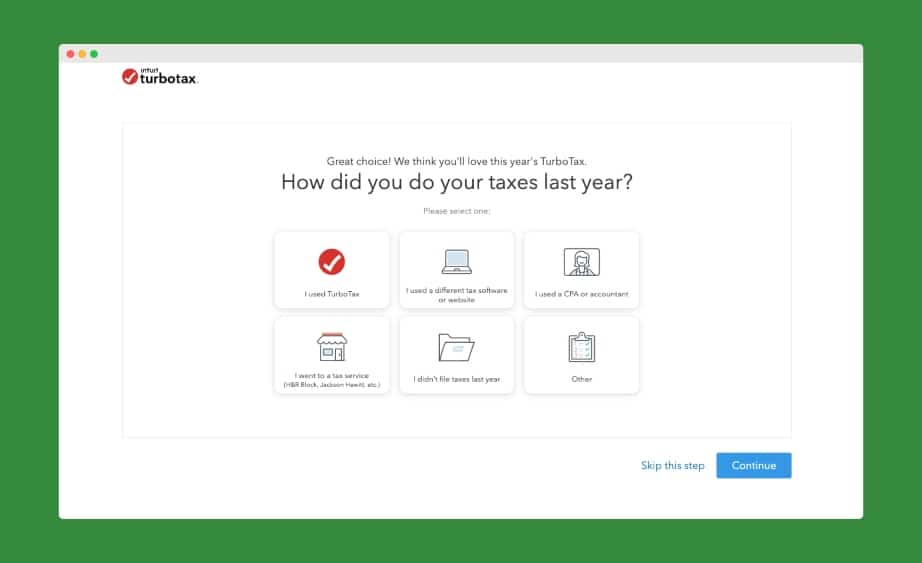

Before you start, get all of your paperwork gathered. If you have them, you’ll need things like your W-2, 1099-INT, 1099-DIV, or social security information. To determine if you need to file a return using TurboTax, begin by answer a few questions.

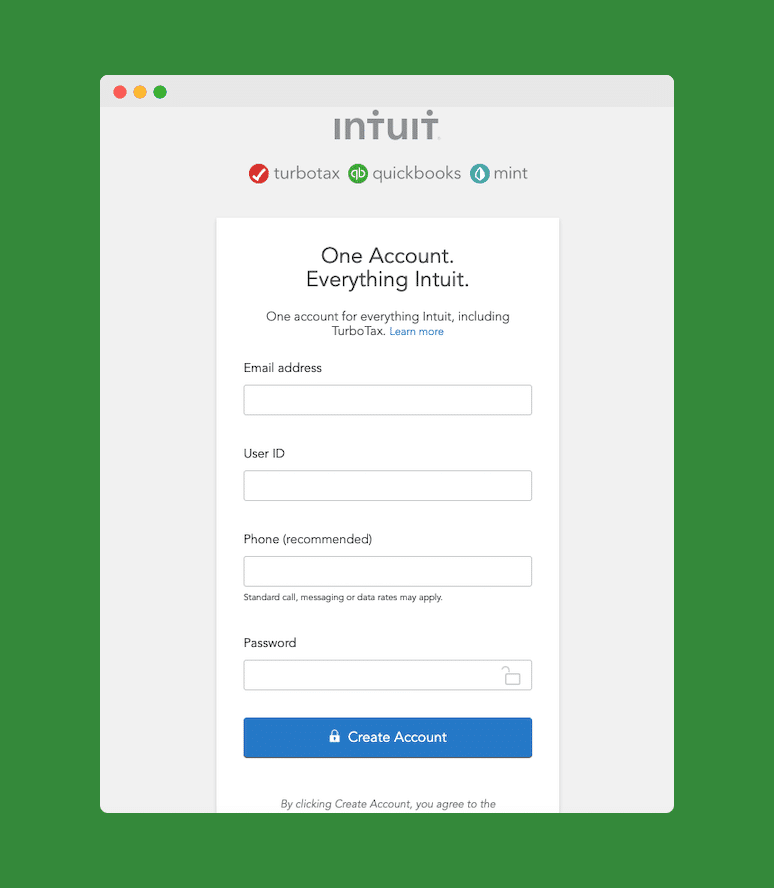

After that, you’ll be prompted to create a TurboTax account with Intuit. If you already have an Intuit account for Quickbooks or Mint, you can use the same login to have one account for all of their services.

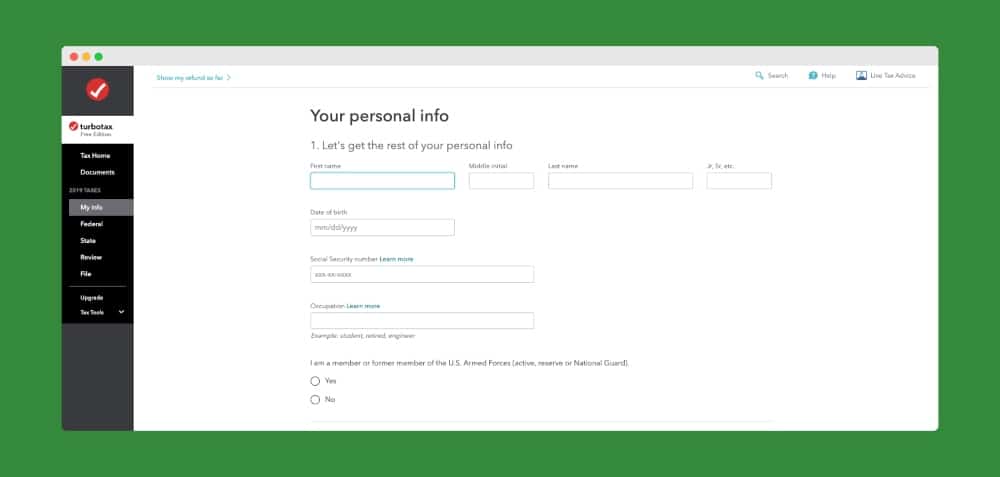

Once your account is set up, next, you’ll add more details on your personal information to help personalize questions they ask you to complete your return.

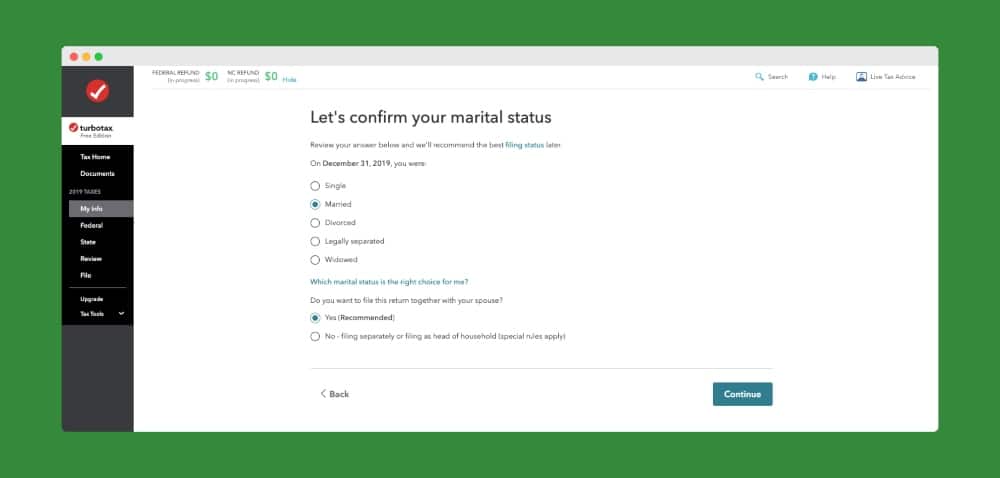

Up next, they’ll ask other questions like your marital status, mailing address, and if anyone else can claim you as a dependant. TurboTax asked questions based on your response to previous questions. So the steps you experience will be unique to your current situation.

The TurboTax software will walk you through the steps to determine if you need to file a return based on your responses to questions.

After adding your personal information, you’ll be prompted to add your “Wage and Income” information. In this section, you’ll input income that applies to you. Possible information to enter will be:

- Wages and salaries

- Self-employment income

- Unemployment income

- Interest and dividends

- Investment income

- Retirement plans and social security

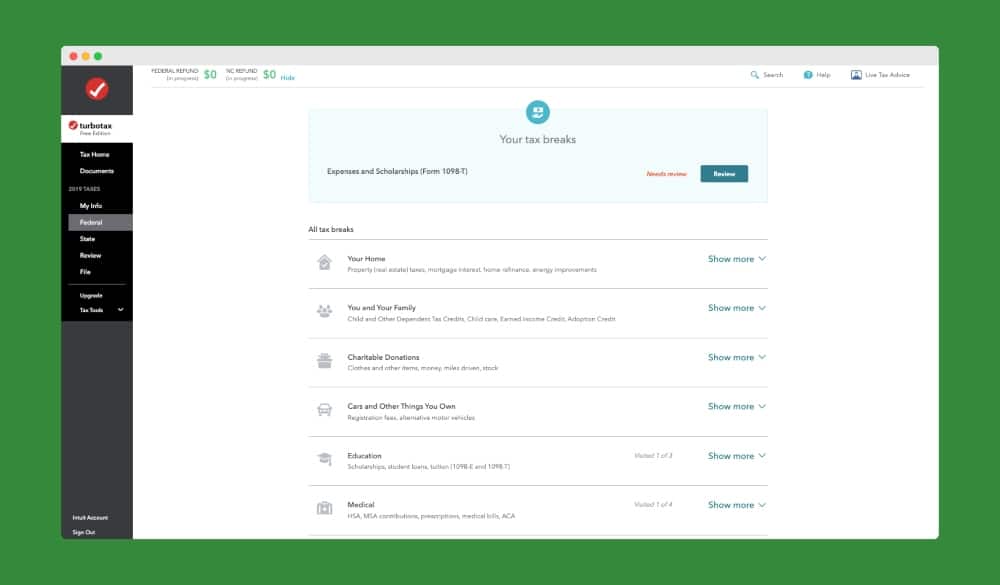

Once you input your income details, the next step is adding your “Deductions and Credits” or your tax breaks. Deductions are things that can lower your taxable income, while tax credits can reduce the amount of tax due. Here are some examples:

- Property tax

- Mortgage interest

- Dependant and child tax credit

- Earned income credit

- Charitable donation

- Medical expenses

If you aren’t sure what deductions or credits you qualify for, don’t worry, they walk you through by asking the right questions.

TurboTax helps you through each area of deductions and credits to ensure you get all the tax breaks you qualify for. It’s worth taking the time to go through each section to get the most financial benefit.

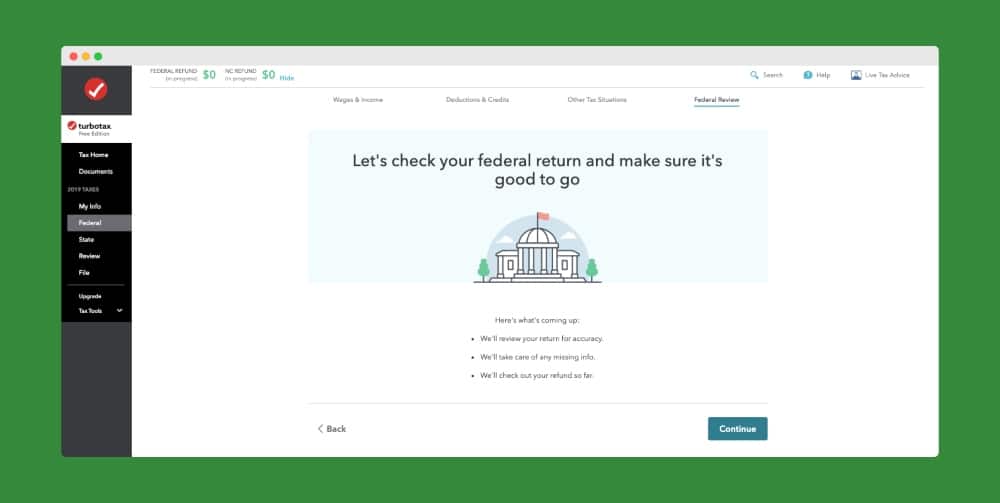

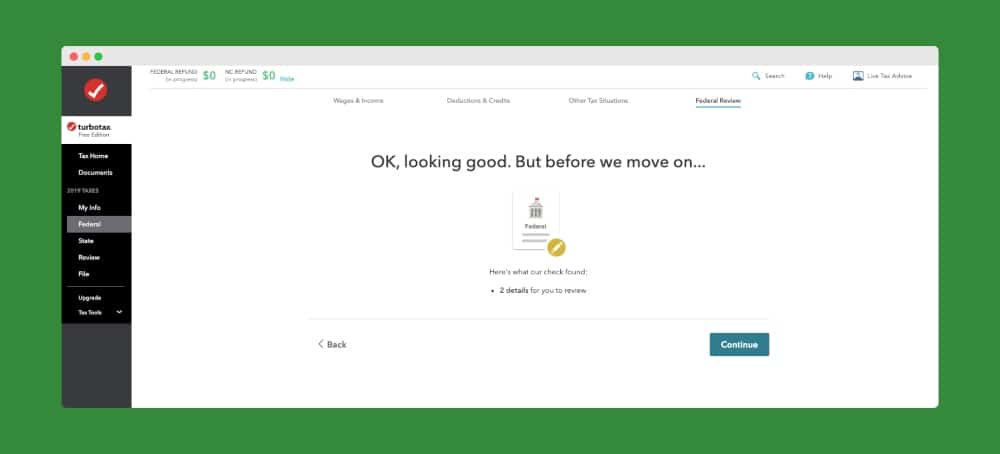

After completing your personal information, income, tax breaks, and any other tax situations, it will be time to review your federal return.

If there are any problems, the software will direct you to the areas that need a second look or additional information to file your return.

Now that your federal return is complete and reviewed, TurboTax gives you the option to pull your federal return information into your state return. The process for completing your state return is the same as your federal. The software takes you step-by-step through your income and tax breaks specific to your state.

Upon wrapping up your state return, it’s time for one final review of everything. If you are owed a return, TurboTax will need additional information on how you would like to receive your federal and state refunds. You’ll also need to sign your return before TurboTax submits it to the IRS.

A bonus to doing a tax return with TurboTax is, you may get money back you wouldn’t know about if you didn’t take the time to do a return. An expected return can be a financial windfall to put towards your financial goals.

The Bottom Line

If your income is in the lower range and you are just not sure what to do, you can always start to complete a federal tax return through a free filing service like the one TurboTax offers. Their software should help you determine whether filing is necessary based on your specific circumstances.

Check out: Three Ways to File Your Taxes for Free

Always, I repeat, ALWAYS file a return if you had taxes withheld from your paycheck or if you suspect you might qualify for a refundable tax credit, like the child tax credit, education credits, etc. (Learn more about tax credits here)

In this case, it’s your money and you should get it back from Uncle Sam!

What about you? Did you earn enough to file?

The post What is the Minimum Income to File Taxes? [Updated for 2023] appeared first on Part-Time Money®.

from Part-Time Money® https://ift.tt/E3FTaQO

Comments

Post a Comment

We will appreciate it, if you leave a comment.