Wouldn’t it be nice if you never had to mow your own lawn? Or shovel snow from your driveway? How about having a swimming pool you didn’t need to maintain?

Living in a homeowners association (HOA) can sometimes provide these benefits and more. However, you will usually need to pay an HOA fee. With that said, what are HOA fees exactly, and what do they cover?

Here’s what you need to know.

What Is a Homeowners Association (HOA)?

A homeowners association (HOA) is an organization that makes and enforces rules within a residential community. These communities can be subdivisions, condominium buildings, or other planned communities.

While HOA governing boards are run by a select group of volunteers, HOA memberships are mandatory for all residents living within the community. This means when someone moves in, they automatically become a member of the HOA and must pay HOA dues — meaning monthly, quarterly, or annual fees. Prospective homeowners should keep these fees in mind when budgeting to buy a home.

What Are HOA Fees?

HOA fees are regular payments that community residents must pay to the association — and condominium residents may pay similar fees to condominium associations. The association then uses these fees to help maintain community grounds, homes, or amenities.

HOA fees are independent of mortgage payments or real estate taxes. This means residents in an HOA community must always pay their dues, even if they paid off their mortgage.

What Do HOA Fees Cover?

What HOA fees cover will vary from community to community. If you live in an HOA community or plan to move into one, you can always check your HOA’s governing documents — usually the Conditions and Restrictions document (CC&Rs) — to see what your HOA covers.

If you’re wondering what HOA fees are used for, here are some examples of what HOA fees may cover.

- Snow removal

- Trash removal

- Landscaping and ground maintenance

- Maintaining amenities, like a community pool or garden

- Utilities for common areas

- Pest control for common areas

- Association insurance

Depending on what their governing documents state, some HOAs also contribute a portion of collected fees to a community reserve fund. Reserve funds help cover unexpected expenses as they arise, such as repairing a burst pipe in the community clubhouse. They can also go toward large, planned projects such as replacing roofs in the community.

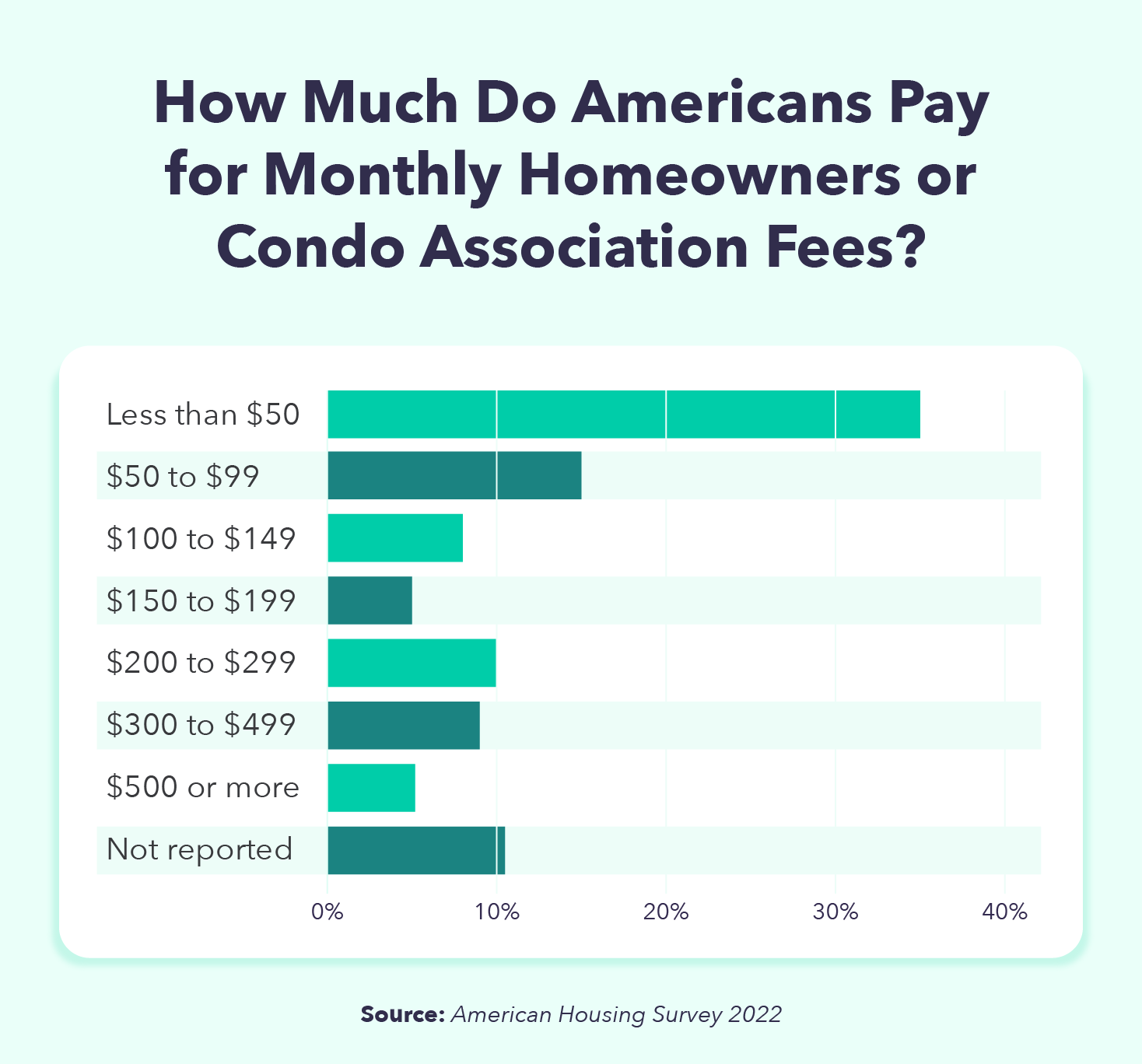

How Much Are HOA Fees?

According to the latest U.S. census data, the average homeownership or condominium association fee is $191 per month. However, fees vary widely depending on location, home size, and what services the HOA covers.

For example, census data shows that an HOA community in California will likely charge more than one in Alabama. Additionally, larger homes tend to pay less in monthly fees than smaller homes, when speaking in terms of square footage.

Here’s a breakdown of the nation’s average HOA fees (including condominium association fees):

Something to keep in mind is that HOAs may be able to raise fees every year. If this concerns you, ask your HOA contact or real estate agent for a copy of the HOA’s governing documents. These documents outline your rights in the community as well as how the HOA runs — including whether the HOA can raise fees in the future.

Will I Need To Pay Additional Fees?

In addition to your monthly, quarterly, or annual HOA dues, you may also need to pay special assessment fees or fines. These aren’t regular payments but may pop up from time to time.

Special Assessments

HOAs should have reserve funds to cover planned or unplanned maintenance or repairs. However, when reserve funds fall short, the HOA may be able to impose special assessments to cover the remaining balance.

For example, if the community plans to replace the clubhouse roof but the cost exceeds what’s in the reserve funds, the HOA may be able to charge residents the difference.

This power depends on what the HOA governing documents state. Some HOAs require a community vote to exercise this power, others don’t. Check your community’s governing documents to see how your HOA may operate when it comes to special assessments.

Fines

HOAs don’t just make community rules — they also enforce them. One common enforcement tactic is imposing fines on residents who break community rules. This means if you paint your home the wrong color or fail to clean up after your dog per community rules, you may have to pay for it.

What Happens When HOA Fees Are Not Paid?

Homeowners who don’t pay their HOA fees may incur late payment fees or interest. Access to community amenities — like the pool or clubhouse — could also be restricted. If missing payments continue, the HOA may even be able to foreclose on the property.

If you’re unable to make your monthly payments, contact your HOA board or management company. They may be able to create a payment plan or some other accommodation for you.

Questions To Ask Before Buying into an HOA

If you’re considering buying a home within an HOA, remember you’re not just buying a home — you’re also joining a community. You should understand how community rules, finances, and management may affect you.

Here are some questions you should know the answers to before moving in.

- How much do HOA fees cost?

- What amenities and services do fees cover? What isn’t covered?

- Does the HOA have authority to raise dues in the future?

- Does the HOA have authority to charge special assessments?

You can ask your HOA contact to provide you with the minutes of past HOA meetings, which can show you any past fee increases or rule changes. HOAs are required to have these documents available for residents to view. You should also receive a copy of the community’s Covenants, Conditions, and Restrictions (CC&Rs) which outline current community rules.

Knowing the answers to these questions can help you determine whether moving in is within your budget. You can also use the “advanced” menu on Mint’s home affordability calculator to see how HOA fees could affect your overall monthly payment.

FAQ About HOA Fees

Have additional questions about HOA fees? Here are answers to some of the most commonly asked questions.

Do All Condos Have HOA Fees?

Condominiums almost always have HOA fees. In rare cases, associations may become inactive, insolvent, or lose control to a majority homeowner so they no longer collect fees.

While no fees sounds like a positive, it’s important to remember that without a governing body maintaining the condominium building, repairs may not happen. This can decrease the value of units within the building.

Are HOA Fees Tax Deductible?

If you purchase property within an HOA as your primary residence, you cannot deduct any monthly or quarterly fees on your tax return. However, if you purchase and use the property as a rental, you can deduct HOA fees as a business expense.

What Do HOA Fees Not Cover?

What HOA fees cover varies from community to community. In general, fees cover common areas — like a clubhouse — and do not cover your private property. This means you’ll be responsible for your own mortgage, home insurance, repairs, and maintenance.

So what are HOA fees? They are regular payments residents within a community must make to the governing association. They typically cover community amenities and services, like a pool or snow removal. They usually will not cover costs associated with your private property, like home insurance.

If you’re moving into an HOA and don’t yet have insurance, browse rates from our trusted home insurance partners.

Sourcing

- Census data on the average monthly homeowner or condominium association fees. American Housing Survey (Sept. 2022).

- HOA meeting minutes. What To Include In Your HOA Meeting Minutes (April 2022).

The post What Are Homeowners Association (HOA) Fees and What Do They Cover? appeared first on MintLife Blog.

from MintLife Blog https://ift.tt/6ONpMGb

Comments

Post a Comment

We will appreciate it, if you leave a comment.