We know that raising kids is expensive — but just how expensive is it?

According to a 2015 U.S. Department of Agriculture (USDA) study, the average cost of raising a child from birth until the age of 17 is $233,610. This estimate is based on a middle-income family of four and excludes any college costs. Taking into account the inflation in the economy, you can expect to spend $292,017 raising a child in 2022, or more considering child care expenses are rising rapidly.

A recent study done by the Brookings Institution for the Wall Street Journal found that due to unprecedented inflation rates, parents can expect to spend at least $300,000 raising a child born in 2015 until age 17.

While that may sound overwhelming, we’ve broken down eight major expenses for prospective parents to consider and provided some tips on how to prepare mentally and financially for your child’s future.

Costs of Raising a Child in 2022

Housing, food, and child care take up the largest percentage of children’s expenses. As they grow up, you can expect to pay for additional expenses like their hobbies, sports teams, or higher food costs for your growing teenager. The USDA estimates that parents can expect to pay between $15,438 and $17,375 a year raising a child in 2022, which can vary based on region and household income level.

Housing

Housing is the most expensive cost associated with raising a child, making up 29% of the total costs. Based on the USDA’s annual cost estimates, you’re looking at $4,981 going towards housing alone each year.

Where you choose to raise your family will impact the overall amount you spend on housing each year. Size, school districts, and location will all influence your expenses, and our Home Affordability Calculator can help you determine how much you can afford as a prospective parent. You’ll also need to consider the cost of homeowners insurance, mortgage payments, maintenance, and utilities.

Food

Food costs make up the second-largest expense to raise a child, at 18%. There are many factors that can influence this expense — choosing to eat healthier, purchasing formula for babies, your child’s age, eating at home versus eating out, and more — but on average you can expect to pay around $3,092 each year on food.

If you’re wondering how much you should spend on groceries and how to set a monthly budget, check out our grocery budget calculator to keep you on track and prevent your growing family from overspending each month.

Child Care & Education

With the cost of living consistently going up each year, parents are having to make tough decisions to cover the expenses. Investing in child care and education is not a choice for most, but more of a necessity. Coming in at 16% of the overall costs to raise a kid, parents can expect to pay at least $2,748 a year on child care and education.

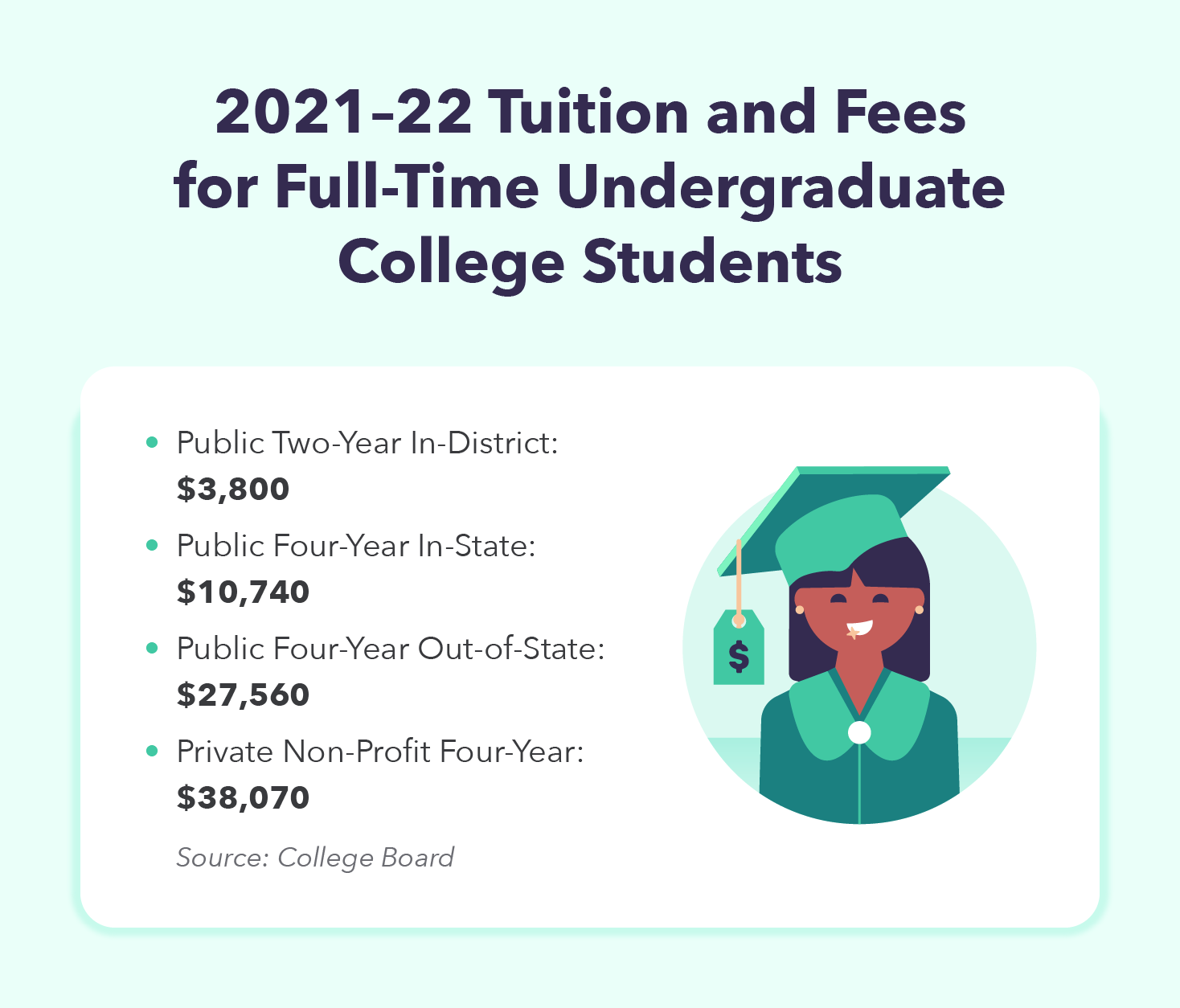

However, this yearly average cost does not include the expenses associated with your child attending college. College Board found that in the 2021-22 academic year, full-time undergraduate students paid $10,740 on average for in-state tuition and fees at a four-year public university and $27,560 on average for out-of-state.

Saving for college does not have to be intimidating. By starting a college fund early or involving your children in the process as they get older, you can eliminate the need for loans and avoid some of the debt associated with getting a college education.

Transportation

Transportation costs make up 15% of children’s expenses, and parents can expect to pay $2,576 on average each year. The bigger your family, the larger the vehicle you might need — adding car payments and vehicle maintenance expenses.

As your child ages and becomes a teenage driver, the transportation costs increase — these include driving school, driver’s license and permit fees, additional vehicles, car insurance, and added gas expenses.

Healthcare

Healthcare accounts for 9% of child-rearing expenses, including the out-of-pocket costs of premiums and deductibles paid throughout the years of raising a child. Parents can expect to pay about $1,546 each year on healthcare, with teenagers in general being the most expensive age.

This does not take into account the expenses “associated with pregnancy, childbirth, and postpartum care” which “average a total of $18,865,” according to a Kaiser Family Foundation study. Budgeting for a baby can feel overwhelming, but you can use our nine tips to set you and your child up for success and ensure you’re financially ready for a baby.

Clothing & Miscellaneous

Clothing and miscellaneous expenses like entertainment, toys, or haircuts account for 6% and 7% of total costs, respectively. So, parents can plan on spending at least $2,232 total each year. Again, these costs will vary based on location and the need for warmer clothing or the amount of money you’re willing to spend on extra luxuries like specialty electronics or family vacations.

The Bottom Line

Raising children is extremely rewarding and fulfilling, but it can get overwhelming when you start to add up the costs. By creating a monthly budget and using tools like the Mint app to track your financial goals, you can better plan for your child’s future and alleviate some of the financial stress of raising kids.

Sourcing:

- The average cost of raising a child. Expenditures on Children by Families, 2015 (January 2017)

- Inflation calculator. CPI Inflation Calculator (August 2022)

- Child care prices and inflation. Demanding Change: Repairing our Child Care System (March 2022)

- Cost to raise kids today. It Now Costs $300,000 to Raise a Child (August 2022)

- Costs associated with having a baby. Health costs associated with pregnancy, childbirth, and postpartum care (July 2022)

- Average cost of college tuition and fees. Trends in College Pricing and Student Aid 2021 (October 2021)

The post How Much Does it Cost To Raise a Child in 2022? Things for Prospective Parents To Consider appeared first on MintLife Blog.

from MintLife Blog https://ift.tt/5pLcKwt

Comments

Post a Comment

We will appreciate it, if you leave a comment.