I didn’t really develop a full-fledged financial plan until I was well into my 30s. I waited too long.

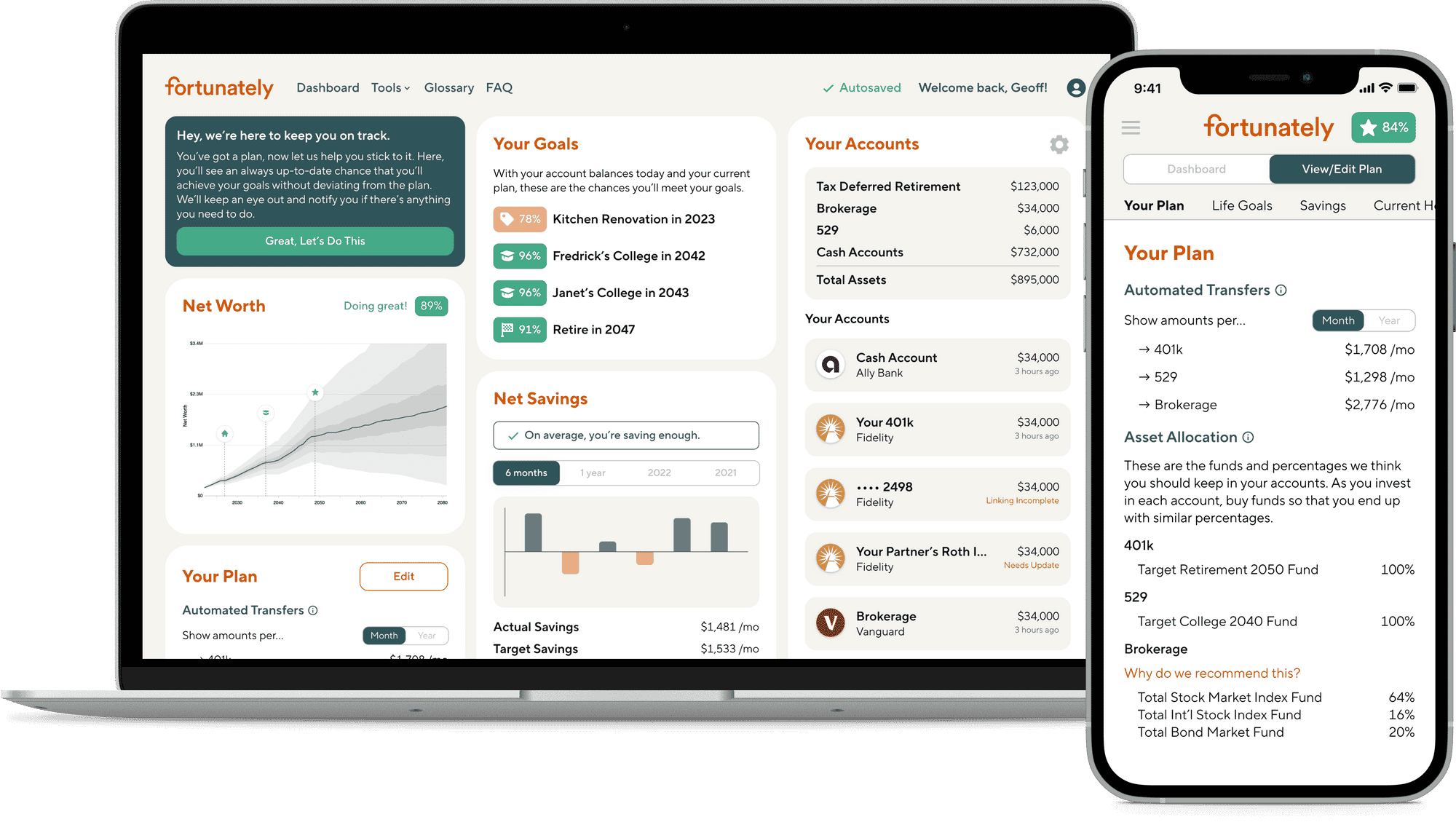

Many people avoid getting help with financial planning despite its importance because it seems complicated or overwhelming. This is the issue that “Fortunately,” the financial planning software, tries to address.

Fortunately is a platform that tries to “keep your financial future on-course, despite life’s unpredictability”. Whether you need to plan for retirement or simply want to save for a rainy day, Fortunately strives to get your finances in order. Here’s what you need to know about this new, up-and-coming financial planning tool.

The Challenges of Financial Planning

Planning your financial future can be tough, to say the least. And with half of Americans predicted not to have enough money for retirement, you’re not alone in feeling anxious about your prospects. Now, more than ever, it is important to start saving early and often for your retirement.

No doubt, it can be tricky knowing where to start. Do you focus on paying off debt first, or should you start investing for retirement? How much should you be putting away each month? Can you afford your dream home?

When it comes to our finances, we all want to feel like we’re in control. But life can be unpredictable, and things happen beyond the expected.

How Fortunately Answers These Challenges

Fortunately’s self-directed planning service looks at your entire financial situation to help you create a personalized plan. The app’s reports show whether you’re on track to reach your financial goals. It also offers recommendations on how to improve your financial health.

You can also use Fortunately to determine the best investment allocation for you and get insights into your financial habits. It can help you save for retirement, college, weddings, and other big goals, or just plan for unexpected balloon payments and make the most of your money.

Their key features make monitoring your finances more manageable. Here’s what you’ll get with Fortunately.

1. Fortunately Gives You a Personalized Financial Plan

You can get a basic personalized financial plan tailored to your situation in just a few minutes – 5-10 depending on your situation. Fortunately will ask questions about your age, current annual income, spending, existing savings, and upcoming life goals to determine the basic structure of your plan — whether you should have more allocated to stock or bonds.

You can also fine-tune your strategy by linking your financial accounts, setting up automated transfers, and adjusting your goals to see the big picture.

2. Plan With Life Goals

Their goal-based planning feature is very good. You can set up multiple short-term goals, like saving for a car, or long-term, like retirement. For each goal, you can set a target date and amount and track your progress over time.

The app even makes recommendations on what you can afford, given your circumstances.

3. Smart Recommendations

In addition to goal-based recommendations, Fortunately will also give you personalized tips on improving your financial health. The platform shows you the probabilities of success and failure so you can optimize your finances accordingly.

4. Investment Strategy

Their investment strategy feature will also help you determine the best way to invest your money, whether you’re looking for growth or income.

5. Forecasting and Visualization

One of the most helpful features of Fortunately is their forecasting and visualization tool. This feature shows you how your current financial situation will affect your future, so you can plan accordingly.

Their forecasting tool takes into account your existing assets and liabilities and your current saving rate. Using past, real-world information, it then projects your investments into the future to show you how your financial situation might change over time.

6. Guides and Resources

Fortunately is a helpful tool for anyone looking to get their finances in order. Like most platforms today, they also have free resources (blog and podcast), or you can schedule a call (chat or Zoom) with one of their consultants to help review your plan.

Using Math to Improve Your Chances

Can you fund your goal, given how much you save and your lifestyle? That is the all-important question that Fortunately shows visually. Instead of giving a definite “yes” or “no,” the platform shows you probabilities of success or failure.

The exact way they do this is proprietary, of course, but it seems they apply Monte Carlos simulations, testing thousands of possible futures using “decades of real data.” This is the same technique used by actuaries, so it makes sense that the founders of Fortunately have math and economics degrees, with the CEO having actuarial experience.

But the key takeaway is that these are all just probabilities — no one knows for sure. Anyone planning to use the app should take all forecasts carefully and proceed with caution.

In any case, proceeding with caution applies whether you’re using an app or an in-person financial advisor.

Signing Up with Fortunately

I signed up for Fortunately and recorded it to share with you.

In the video, you will see that all it takes to sign up and get some basic recommendations is to provide your email address (and create an account) and answer about 5-10 minutes worth of questions (depending on your situation).

At the end you will be presented with an opportunity to sign up for Fortunately’s on-going service: $5/month, starting with a 30 day free trial.

The Pros and Cons of Fortunately

Fortunately is an excellent tool for anyone who wants to take control of their financial future. If you’re looking for a simple way to see a snapshot of where you’re headed, then Fortunately is a wonderful option.

Of course, it might not be the best fit for everyone. For instance, if you’re looking for a more hands-off approach to financial planning — or if you’re not comfortable sharing your financial information with an app — and you don’t mind paying extra, then an in-personal financial advisor might better suit you.

Pros

- It is offered at an affordable $5 a month with a 30-day free trial. In-person financial advisors can charge hundreds to thousands of dollars.

- The probabilities of meeting your goals are presented in a visually appealing chart.

- Get personalized recommendations and suggestions based on your unique situation. (This is in contrast to the generic recommendations from free online sources.)

- You have access to financial experts. While these are likely limited to basic and generic recommendations, the overall direction is still helpful for starters.

- There is the ability to link your accounts to one platform and set up automated transfers.

- Their business model does not rely on selling your data, nor is your information stored in Fortunately’s servers. (Alternative free resources typically earn by selling your data.)

- The platform has a user-friendly interface that’s perfect for starting families.

Cons

- The platform’s self-directed planning style might not be for some people.

- While the platform accounts for various scenarios and probabilities, it can fail under extremely complex situations.

- The projections are only just probabilities, which may be misinterpreted by beginners.

Fortunately is Just a Tool

Fortunately is good for most people because it gives a general sense of your financial situation. While it isn’t the end-all-be-all solution to financial planning and securing your retirement or other goals, it was never designed to be one — or at least its current iteration isn’t.

Instead, it is a tool that guides its users in the right direction. And like all tools, it has no value without valuable input from the user. Its probabilities, while extremely helpful for planning purposes, should be interpreted as they are — mere probabilities.

Nevertheless, knowing you’re headed down an unsustainable path is enough of a nudge for most people. The low-dollar commitment to getting started helps, too. For those reasons, I’m on board.

The post Fortunately Review 2022 | Build a Solid Financial Plan for $5 a Month appeared first on Part-Time Money®.

from Part-Time Money® https://ift.tt/6DpJFyu

Comments

Post a Comment

We will appreciate it, if you leave a comment.