As an investment, farmland has offered attractive historical investment returns with low volatility. It’s also become more alluring during inflationary times when stocks and bonds are more likely to struggle.

Until a few years ago, it was difficult to invest directly in farms because of several entry barriers. The only option was to parcel the family farm to other farmers in the community or be wealthy enough to purchase a large farm tract.

These days, accredited investors can gain exposure to farming through AcreTrader and FarmTogether. These crowdfunded investment platforms make it easy for individuals to invest their dollars in farms across the United States.

While either platform can add farmland investing to your investment portfolio, you may find one of the two to be a better fit for your investment strategy and budget. This AcreTrader vs. FarmTogether comparison highlights the vital differences between each platform and helps you choose the better service for your investment goals.

Table of Contents

What Is AcreTrader?

AcreTrader began in 2018 with headquarters in Fayetteville, Arkansas. Founder Carter Malloy grew up in a farming family with a professional financial services background. Other members of the senior leadership team come from farming families too.

This platform is only open to accredited investors with an annual income exceeding $200,000 ($300,000 for joint investors) for the last two years or a minimum $1 million liquid net worth. Non-citizens that legally reside are eligible to invest as well.

Note: For transparency, FarmTogether has similar investor requirements, but real estate investing for non-accredited investors is possible through other platforms.

Qualified investors can invest in individual farmland and timberland offerings as a multi-year investment (5-10 years) without a secondary market to redeem their shares early.

Technically, the investors must hold their shares for at least one year. Afterward, the platform states it’s possible to sell a partial or complete position early to other AcreTrader investors, but there isn’t a secondary exchange. Please read our full AcreTrader review for more.

How AcreTrader Works

After verifying your accreditation status, you can begin committing funds to open offerings. The platform seeks to offer up to two new open investments per week.

Each offering has several research tools that you can review before deciding to invest:

- A property description

- Farm map

- Financial assumptions (i.e., total estimated costs and income potential)

- Soil map

- Articles of organization and subscription agreement

- AcreTrader Score (summary of property advantages and risks)

There is also a 30-minute webinar and a live Q&A session that you can watch when the offering initially opens.

If you decide to invest, you will need enough cash to satisfy the investment minimum, and you can commit additional funds if desired. Each share represents 1/10 of an acre, so buying ten shares means your ownership stake is a full acre through an LLC or Partnership entity.

You hold your shares until AcreTrader decides to close the investment and sell the property to another buyer. So far, there have been three successful exits (September 2022).

How Investors Can Make Money Through AcreTrader

Investors can earn investment income from the following sources:

- Rent: Farmers pay cash rent at the start of the season, and it isn’t contingent on yields

- Appreciation: Rising land values can increase the total investment return if the parcel sells for a profit.

- Crop Income: Investors may receive a portion of the cash flow from the annual harvest.

Rental income and property appreciation are the primary income streams.

AcreTrader projects a non-levered annual cash yield from 3% to 5%, but that rate can be up to 9% IRR when estimating property appreciation.

This rate is lower than the historical average 12% annual yield for farmland due to depressed commodity prices and the fact that AcreTrader maintains conservative investment projections due to several variable economic factors.

Investors have had as high as 15% annual returns on its successful exits. As a result, it’s possible to earn more than the projected yield that rivals the average stock market return but with potentially less volatility.

AcreTrader distributed all investment earnings (i.e., rental income and cash flow) as a single-year distribution in December.

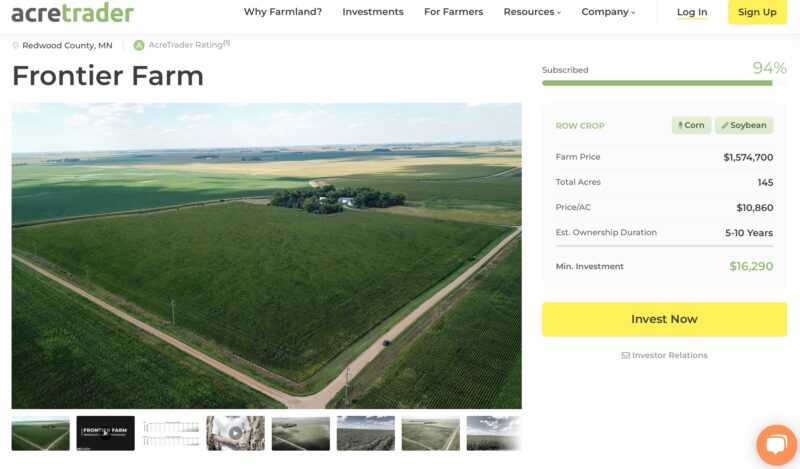

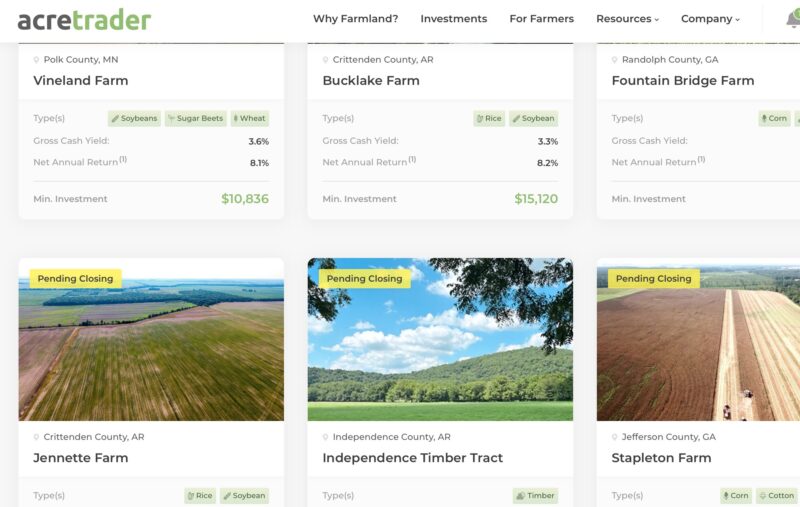

Investment Offerings

Acretrader only offers individual properties that you hold for an estimated five to 10 years. However, the platform states they may offer evergreen funds in the future that invest in multiple projects and can be potentially held for longer than a decade.

You will find investment offerings for these crop types:

- Row crops (corn, cotton, potatoes, soybeans, etc.)

- Permanent crops (almonds, oranges, etc.)

- Timberland

The platform introduced timberland offerings in 2022, a unique offering with challenging entry barriers for average investors. However, it can be a high-yield alternative investment that competes with farmland.

Most of the offerings are for row crops and timberland. For permanent crop investments, FarmTogether tends to be the more consistent option.

These offerings are located across the United States, allowing you to invest in the cooler northern climates and the Great Plain, which serve as “America’s Breadbasket.” You can also buy plots in the southeastern United States, where warm-weather crops grow and the growing season is longer.

AcreTrader Minimum Investment

The minimum investment differs by offering but usually falls between $10,000 and $20,000. The cost per acre determines the share price, with the offering requiring you to buy the equivalent of 1-2 acres in shares.

You can invest through a taxable account or a self-directed IRA.

AcreTrader Fees

An annual 0.75% annual servicing fee is withheld from all investment distributions. Your investment gains are still subject to federal and state taxes when you file your income tax return.

The only other fee most investors will encounter is a 5% selling fee when your shares are sold.

Unlike some platforms, AcreTrader doesn’t collect carried interest from upside property appreciation.

AcreTrader Pros and Cons

Pros

- Farming and timber investment options

- Extensive research material

- Properties across the United States

- No carried interest on property upside potential

Cons

- One investment distribution per year

- Potentially high investment minimum

- No evergreen funds

- Accredited investors only

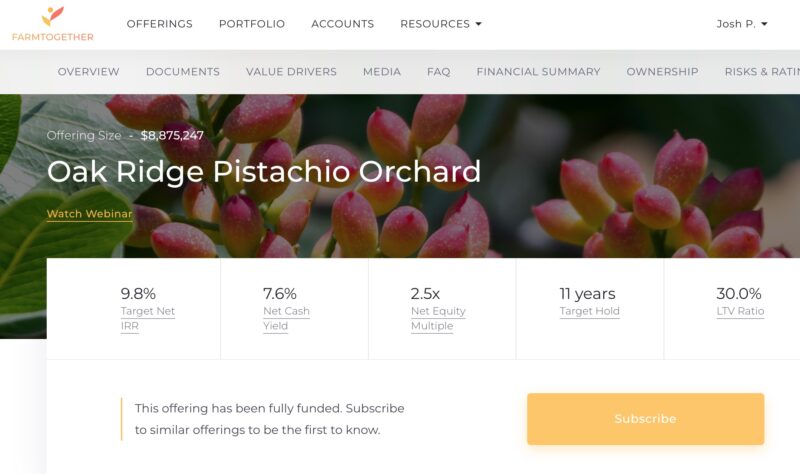

What is FarmTogether?

FarmTogether started in 2017 – its leadership team has experience with agricultural investing and a combined experience managing $1.2 billion in related investments.

The platform offers individual crowdfunded offerings and diversified evergreen funds. However, the investment minimums for the managed funds are relatively high at $100,000 versus a minimum of $15,000 for individual properties.

This platform is only open to accredited investors. However, international investors from FATF Countries can also invest if they satisfy the accreditation requirements.

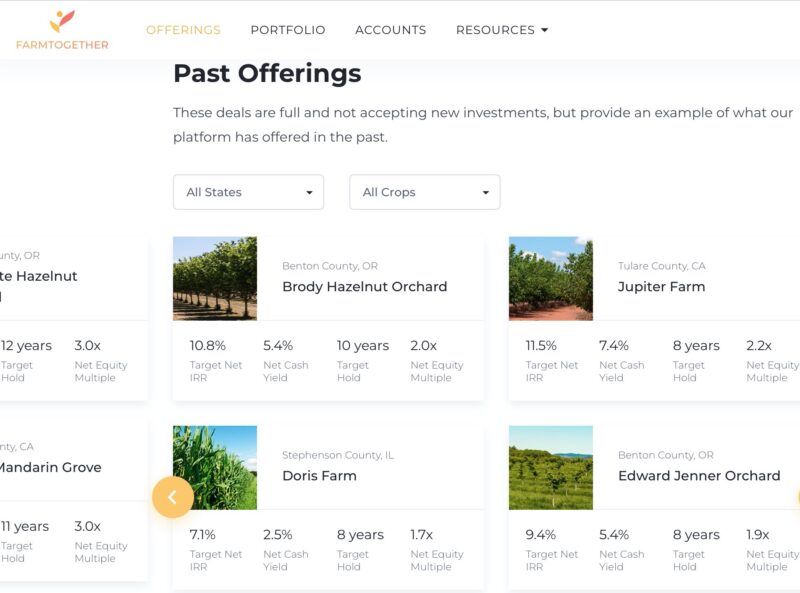

Investors can anticipate one new offering per month, so there won’t be as many investment opportunities. However, the offerings are typically for permanent crops, while AcreTrader currently emphasizes row crops and timberland.

Additionally, its evergreen funds are worth a look if you have the capital, as you will be continually investing through the platform. There isn’t a secondary market to trade your shares early. Read our FarmTogether review for more details.

How FarmTogether Works

Investors can invest in individual projects (crowdfunding) or an evergreen fund (Farmland Fund). Either option has an LLC structure, and there are no REITs.

Bespoke offerings and 1031 exchanges are available if you can invest at least $1 million.

There isn’t a secondary trading platform and the minimum holding period varies for individual offerings. Still, it can be as low as two years for the farmland fund before you can request quarterly distributions.

For most crowdfunding offerings, the average target holding period is 8 to 12 years. This is a little longer as FarmTogether favors permanent orchards, which can require more time to reach peak production.

As you research a particular investment, the offering page provides these details:

- Property overview

- Operator overview

- Crop background

- Potential returns and fees

- Value drivers (why FarmTogether is investing in the property)

- Underwriting risks and rating

- Investment Deep Dive pre-launch informational webinar

How Investors Can Make Money Through FarmTogether

Investors agreement can earn investment income from:

- Annual rent payments

- Crop income

- Property price appreciation

The income structure can vary by agreement but lease payments are the primary income stream. In addition, crop income cash flow and property appreciation also play a pivotal role.

FarmTogether projects a target cash yield from 2% to 9% for crowdfunded offerings and a target net IRR from 6% to 13%. These potential returns are typically more aggressive than AcreTrader as FarmTogether is more likely to use leverage to provide better returns during good years.

Lease payouts can distribute quarterly, semi-annually, or annually, depending on the offering terms.

Investment Offerings

The majority of the FarmTogether investment offerings are for permanent crops, such as:

- Almonds

- Apples

- Mandarins

- Pecans

- Pistachios

Most of the properties are located in California, Oregon, and Washington.

There are also a handful of permanent orchards in Oklahoma, plus row crops in the Midwest. But, unfortunately, there is no timberland investing.

Crowdfunded Farmland Offerings

Individual properties are generally open for funding once a month. You will have fractional ownership in a farm growing row crops or permanent crops.

The estimated holding period is typically from eight to 12 years. The minimum holding period per federal regulations is one year before you can request early redemption. There isn’t a secondary exchange so you will need to contact the investing platform to request a sale.

The minimum investment starts at $15,000.

Sustainable Farmland Fund

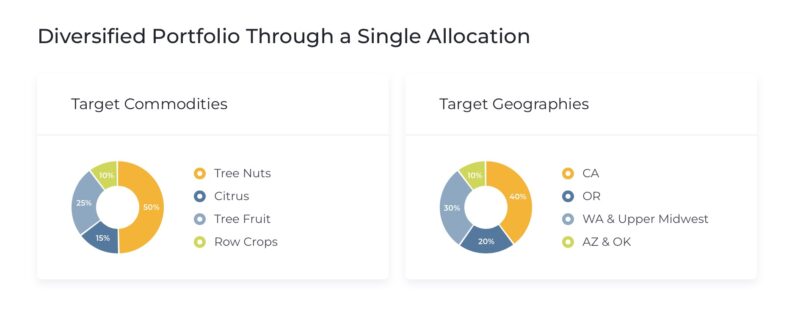

If you prefer investing in multiple properties with a single investment, the Sustainable Farmland Fund can be a better opportunity.

The fund invests in permanent and row crops across the US. Most of the fund’s asset allocation is in tree nuts (40%) and the California geographic region (40%).

The fund holdings are similar yet different from individual offerings to prevent overlapping properties.

So, for example, you might get exposure to an almond orchard. To avoid overlapping properties, the fund may invest in a separate farm from what’s available to individuals through crowdfunding.

This investment vehicle has a minimum two-year holding. Next, you can request quarterly redemptions but may only be able to redeem part of your shares.

Unfortunately, the minimum investment is $100,000, which can be challenging to afford.

Bespoke Offerings

Once you have $1 million to invest at a time, FarmTogether offers customized bespoke portfolios. As a result, it’s possible to be the sole owner of a farm with row crops or permanent crops.

1031 Exchange

You may be able to exchange a currently-owned investment property worth at least $1 million. The platform may offer fractional or sole ownership in your new holding.

FarmTogether Minimum Investment

The minimum investment depends on the investment product:

- Crowdfunded Farmland (single properties): $15,000

- Sustainable Farmland Fund: $100,000 (Class A) and $1 million (Class I)

- Sole Ownership Bespoke: $1 million (row crops) and $3 million (permanent crops)

- 1031 Exchange: $1 million

It’s possible to invest through taxable or tax-advantaged self-directed IRA accounts.

FarmTogether Fees

The investment fees depend on the product offering, and investors must review the offering documents to preview the upfront and ongoing costs.

There are two fees that FarmTogether charges all investors:

- Annual Management Fee: 1% to 2%

- Net Operating Income: Up to 5%

- Selling Fee: Up to 1%

There may also be upfront fees that do not pass through the minimum initial investment.

FarmTogether Pros and Cons

Pros

- Individual offerings, funds, and customized portfolios

- Invest in row crops and permanent crops

- Short holding period (2 years) for the farmland fund

Cons

- Potentially high annual service fees

- High investment minimum for managed fund

- Most offerings are for permanent crops

AcreTrader vs. FarmTogether: Who Wins?

Either platform can help you successfully invest in agriculture. Meanwhile, noticeable differences may motivate you to choose a particular service to join first.

When AcreTrader is Better

AcreTrader wins the comparison if you want to invest mainly in row crops and timberland. Being able to expect at least one new offering per week instead of FarmTogether’s once-a-month frequency also provides more investment options.

AcreTrader’s published fees can also be lower as their annual management fee is only 0.75% (versus 1% or higher with FarmTogether), and they are less likely to retain a portion of the yearly crop income.

When FarmTogether is Better

Consider FarmTogether if you desire more access to permanent crops or can meet the investment minimums for the managed funds or bespoke offerings.

While AcreTrader offers more individual offerings, FarmTogether is the better option for managed funds and customization if you have a high-value portfolio.

However, the potentially higher platform fees and only having one new offering per month are the two most significant frustration factors.

AcreTrader vs. FarmTogether: Summary

There are many things to like about AcreTrader and FarmTogether. Both platforms make farmland investing easy through fractional ownership.

The investment minimums are comparable for individual offerings on either platform. AcreTrader tends to be better for single properties as their offering frequency can launch at least one weekly deal. You can also invest in timberland, which is another desirable commodity.

However, FarmTogether provides more customization if you can invest $100,000 or more, allowing you to effectively allocate your capital.

The post AcreTrader vs. FarmTogether: Which Farmland Investing Platform is Better? appeared first on Best Wallet Hacks.

from Best Wallet Hacks https://ift.tt/Q2wXZeR

Comments

Post a Comment

We will appreciate it, if you leave a comment.