Looking for a way to track your net worth and optimize your savings strategy?

Playbook can help you optimize your taxes and build a personalized financial plan to help achieve your financial goals.

But unlike other personal finance apps, Playbook targets high-income subscribers who earn six figures and already have a solid grasp of their budget.

But how does it all work, and can Playbook add value? There is a monthly fee, after all.

In this Playbook review, I’ll show you how this financial planning app can help high-earners improve their net worth tracking and investment strategies. I’ll also let you know its limitations as I see them.

Table of Contents

What Is Playbook?

Playbook is a fintech company with headquarters in San Francisco. The platform’s primary mission is to help households earning at least $100,000 annually to accomplish the following goals:

- Reduce their tax liability

- Make a customized net worth plan

- Enroll in automated investment portfolios

You can use Playbook to quickly look for ways to reduce your taxable income, estimate your net worth, and create savings goals.

For a complete experience, you can also enroll in their robo-advisor investment platform that invests in cost-efficient index funds based on risk tolerance.

Unfortunately, this service doesn’t offer hands-on financial advisor access like other wealth management programs. The lack of this feature is a bummer given the $19 monthly fee to use Playbook.

You also won’t be able to make a monthly household budget that can prevent overspending within a specific category. But let’s face the truth, most high-income families don’t have the same financial challenges as typical households that don’t have much disposable income and are more likely to live paycheck to paycheck.

How Playbook Works

You can build a personalized Playbook financial plan by following a few simple steps – the first being to sync your banking and investment accounts to Playbook. Here’s how it works:

Link Accounts

After joining Playbook, you can link your banking and investment accounts through Plaid, a third-party service that most finance apps use to read your current account balances. The service connects to most institutions and uses bank-level security to protect your data.

Enter Income and Expenses

You will also enter these numerical figures to estimate your free income and future net worth:

- Annual household income (i.e., you, your spouse, and supplement income)

- Total monthly expenses

- Estimated annual taxes

- Monthly 401(k) match and employer matching contributions

- Tax filing status

This basic financial profile is the foundation of your personalized plan.

Designate Financial Priorities

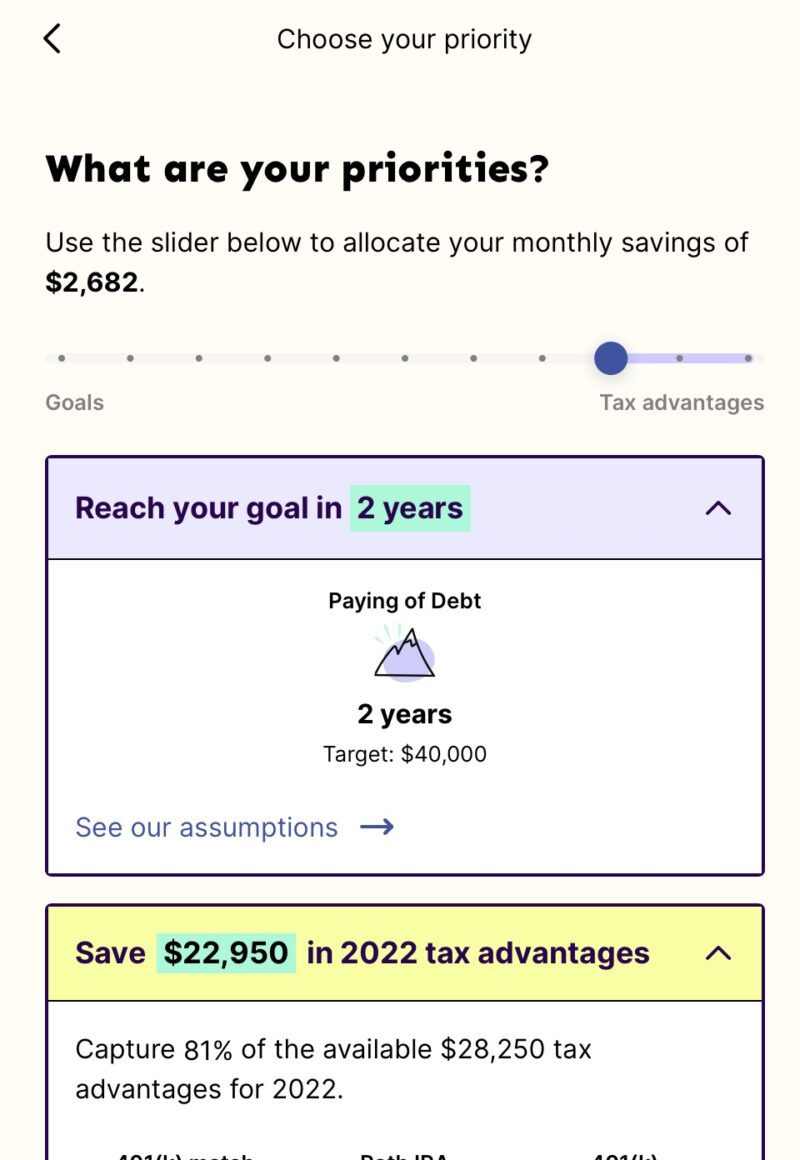

After creating your financial profile to estimate your take-home pay and monthly living expenses, you can start prioritizing your future goals.

First, Playbook will determine if you have sufficient cash reserves for an emergency fund. The platform recommends having six months of resources with two months in a savings account and the remaining four months in a brokerage account with more growth potential.

You can also create long-term savings goals such as saving for a wedding, a new home, or getting out of debt.

After creating your initial goals, you can decide whether to prioritize tax savings or squirrel away money for your savings targets. The interactive tool estimates your potential tax savings and goal achievement date on the same screen.

Life is about compromises, and this tool is one way that Playbook can help balance your short-term and long-term goals to achieve financial freedom at the opportune time.

Passive Income Investing

Along with making a financial plan, you can use Playbook to build a customized passive investing portfolio of stock and bond index ETFs. Most of the investment offerings are Vanguard funds.

As a reminder, this service is optional but is part of your membership fee. The investment methodology is similar to most robo-advisors as your asset allocation depends on risk tolerance.

You cannot add individual stocks to your Playbook portfolio, so you’ll need to keep a separate account to actively invest in stocks and ETFs.

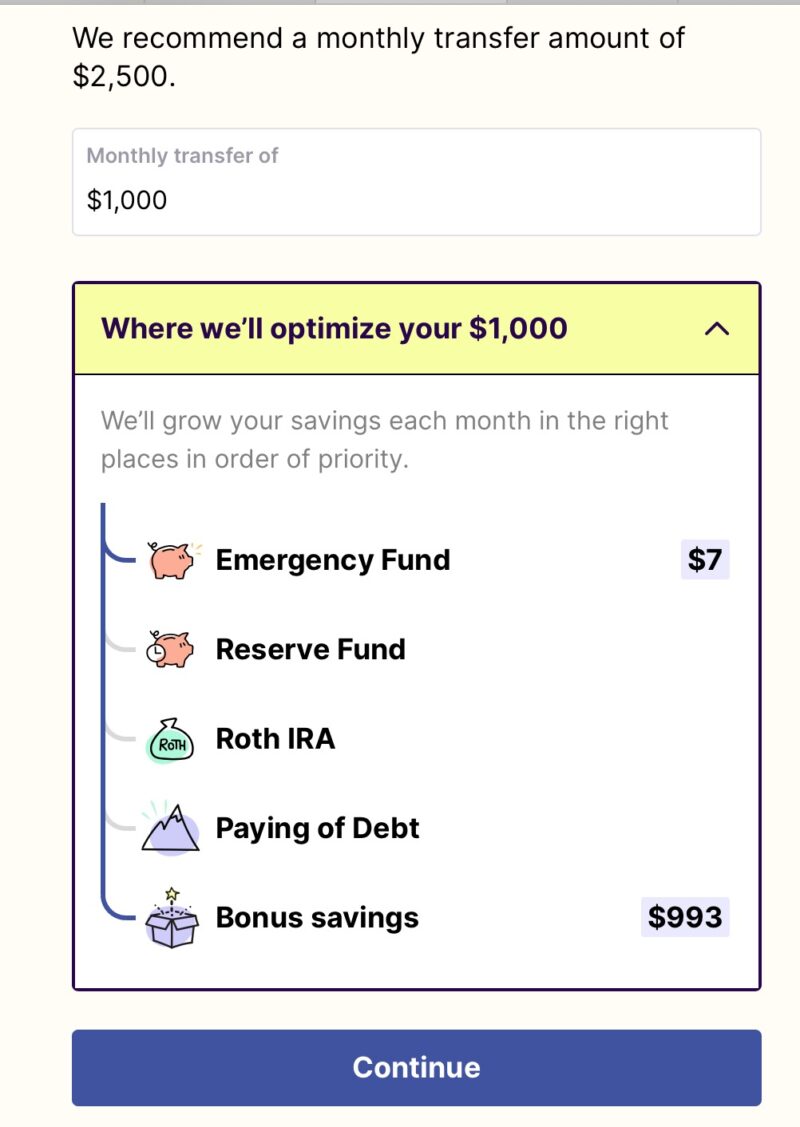

Monthly Transfers

After everything looks good on paper, the final step is activating your plan. The enduring value of Playbook is that the service will coordinate monthly transfers to your savings and investment accounts.

You can schedule the transfer amount and transfer date for one day each month. After each transfer, your dashboard updates with the latest savings progress.

It’s possible to adjust your plan as necessary if your priorities or circumstances change.

Playbook Pricing

Playbook is free for the first 30 days and costs $19 monthly.

This fee is all-inclusive, and you won’t pay an annual advisory fee or assets under management fee (AUM) if you enroll in their investment plans. The ETF expense ratios are withheld from your investment returns, but all investing apps pass these fees onto investors.

You can easily cancel your subscription by sending an email request through your member dashboard.

Who Is Playbook Best Suited For?

Playbook provides basic financial planning advice to help you optimize your taxes and manage your savings and investment accounts. The platform is low maintenance and makes it easy to automate your finances.

To maximize its value, your annual household income should exceed $100,000, and you should own a couple of investment accounts, including a 401(k). W-2 income is preferable to self-employment income, which can add complexity.

This brings me to the drawbacks of using Playbook.

Who Shouldn’t Use Playbook

People with complex tax situations such as being self-employed or eligible for special tax deductions may find it difficult to relate to the basic advice.

Also, as the tool is self-guided, other platforms are better if you prefer hands-on help from a financial advisor. Human advisors are more expensive, but the additional cost can be worth it for many high-income earners.

Best Playbook Financial App Features

Your membership benefits include the following financial planning and investing tools.

Tax Optimization

Playbook prominently advertises that they will legally look for ways to reduce your annual tax bill. First, you list your tax filing status (single or married, filing jointly), and the app analyzes your financial accounts and income to make a tax savings plan.

In most cases, it will encourage you to maximize these tax-advantaged accounts:

Unfortunately, the tax planning tool doesn’t consider your number of dependents or itemizable tax deductions. Instead, it focuses on ways to reduce your taxes this year while using the funds to build your net worth simultaneously.

Net Worth Calculator

You can connect your banking and investment account to calculate your liquid net worth. The app uses standard assumptions such as your monthly savings rate to project your future net worth.

The platform can also predict your future net worth if you utilize their suggestions to improve your tax situation and prioritize specific savings goals.

The accuracy of these projections may not be known until later down the road. For example, being unable to adjust the assumptions such as earning supplemental income, adjusting your day job salary, planned retirement age, average stock market return, and providing for dependents.

This net worth estimate doesn’t offer a Monte Carlo simulator to test your savings strategy against various optimistic and pessimistic scenarios. Perhaps it will be a future feature as the platform grows to become an in-depth retirement planner.

Personalized Financial Plan

You can create your wealth planning plan in less than an hour as this platform doesn’t require as many details as some platforms.

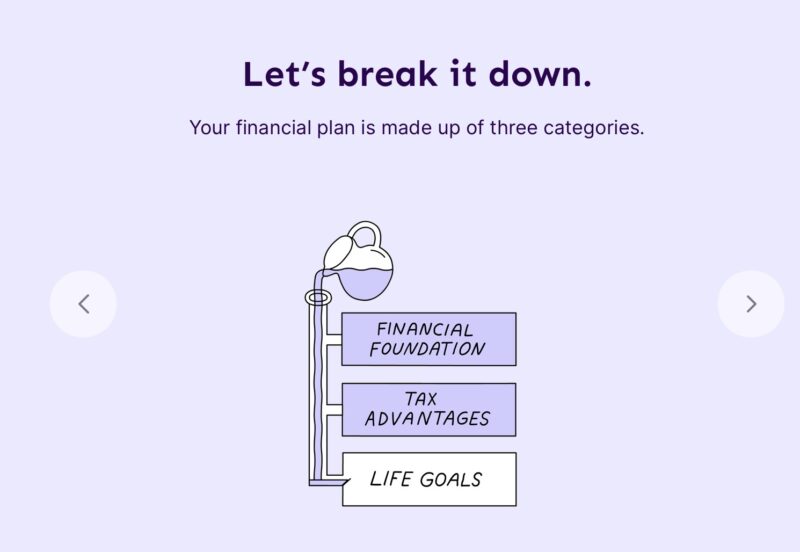

Playbook will present planning opportunities for three different areas:

- Financial foundation

- Tax advantages

- Life goals

The app prioritizes your immediate financial situation to ensure you have enough cash to cover several months of living expenses if you stop earning an income.

After that, the app can help present different ways to gain the most positive benefits from saving and investing your take-home pay.

Lazy Portfolios

Playbook may recommend opening a tax-advantaged investment account to save money and earn passive income.

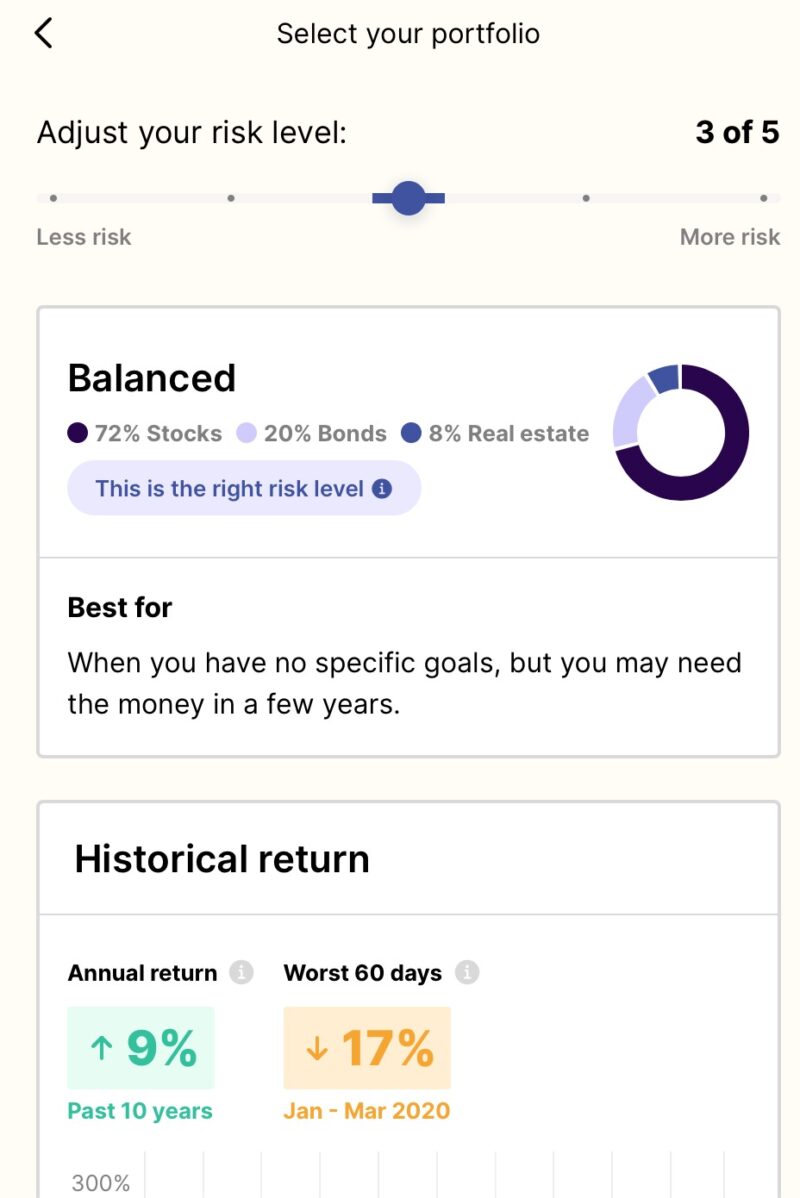

The setup process is easy as you choose your risk tolerance level (i.e., conservative, balanced, aggressive), and the investment platform will purchase the corresponding percentage of stocks, bonds, and real estate funds.

Portfolio rebalancing is automatic, and you can contribute new money monthly. In addition, it’s possible to create multiple accounts for various objectives.

Balance Protection

The balance protection feature can help prevent over-drafting your linked checking account to fund your scheduled monthly transfers. In addition, you can designate your safety cushion to initiate a partial transfer to your various Playbook-tracked goals.

Playbook App Pros and Cons

Pros

- Personalized advice to save money and reduce income taxes

- Monthly transfers to savings and investment accounts

- Passive investment accounts

- Connects to your financial accounts

Cons

- No access to a human advisor

- Cannot customize assumptions

- Minimal retirement planning tools

- $19 monthly fee (after the 30-day free trial)

Alternatives to Playbook

The following Playbook alternatives have many of the same features as Playbook and some different ones too. For example, Personal Capital and NewRetirement offer access to a human advisor. Kubera tracks your net worth but lacks key features, like investment tracking and financial calculators. Let’s take a closer look at each one.

Personal Capital

Personal Capital provides a free net worth tracker, investment portfolio analyzer, and basic budgeting tools. These services can overlap Playbook in several areas but lack automated monthly transfers.

Its net worth tracking tools can be more robust as you can add manual accounts and the value of tangible assets like your house, investment property, or vehicle.

If you have at least $100,000 in investable assets, you can enroll in the wealth management service for an additional charge (starts at 0.79% per year). The best benefits include a managed investment portfolio and financial advisor access. Learn more in our Personal Capital review.

NewRetirement

Consider NewRetirement if you want an in-depth retirement plan that lets you customize your risk assumptions. The platform also offers a retirement simulator to test the strength of your retirement strategy.

A free version is sufficient to see if you’re on the right track. However, you must upgrade to a paid plan ($120 per year and up) to have customization features and access one-on-one financial planner sessions.

Check out our NewRetirement review for more details.

Kubera

Kubera specializes in tracking your net worth. You can sync financial accounts and add manual entries. Additionally, the service can store your essential documents, simplifying estate planning.

However, this service doesn’t offer investment services or financial calculators like Playbook. The service also costs $15 monthly or $150 annually. Find out more in our Kubera review.

Playbook FAQs

No, the Playbook financial app doesn’t let you receive advice from a credentialed financial advisor.

The self-paced platform only offers saving and investment options for specific topics such as an emergency fund, Roth IRA, and identifying tax savings within your linked accounts.

You can contact Playbook by email for technical support and platform navigation questions. The average response time is 1-2 hours on weekdays. Unfortunately, the support team is credentialed but won’t provide personalized advice.

A mobile app will be available in late 2022 for Android and Apple devices. If you don’t use the app, the website is mobile-friendly and easy to navigate from a phone or tablet.

Playbook Review: Final Thoughts

Playbook can be an affordable wealth planning tool for high-income households seeking basic advice to improve their savings and investment practices. It can help you identify tax savings opportunities and make a plan to save for specific goals.

The automated monthly transfers can also be convenient and make Playbook worth using if you don’t want to micromanage your finances.

This platform isn’t ideal for people with complex situations or who need a financial advisor. Other platforms are better if you primarily want to plan for retirement instead of estimating your financial freedom date.

The post Playbook Review: Financial Advice for High-Income Earners appeared first on Best Wallet Hacks.

from Best Wallet Hacks https://ift.tt/s5eh4JB

Comments

Post a Comment

We will appreciate it, if you leave a comment.